On platform risk:

Smart contract platforms have seemingly found PMF with DeFi over the last year. App devs are flocking to said platforms in hopes of launching the next COMP, UNI, SNX, etc. and cashing out life-changing money after a few months of work.

Too good to be true? 🧵

Smart contract platforms have seemingly found PMF with DeFi over the last year. App devs are flocking to said platforms in hopes of launching the next COMP, UNI, SNX, etc. and cashing out life-changing money after a few months of work.

Too good to be true? 🧵

The canonical platform risk case study is Facebook vs. Zynga. Zynga built a $10B company on Facebook's platform, until March 2011 when Facebook cut off Zynga's access to their APIs and cratered their business.

venturebeat.com/2016/06/30/fac…

venturebeat.com/2016/06/30/fac…

Ethereum's narrative from 2014-2018 was that it existed to fix this problem.

A "world computer" running "unstoppable code" where nobody could pull the rug out from under you like Facebook did to Zynga.

Inspiring stuff! Have they lived up to it?

consensys.net/blog/news/prog…

A "world computer" running "unstoppable code" where nobody could pull the rug out from under you like Facebook did to Zynga.

Inspiring stuff! Have they lived up to it?

consensys.net/blog/news/prog…

Unequivocally no. A culture of scheduled hard forks and consistent tinkering with the EVM makes backwards compatibility impossible. As an example, Aragon had to rewrite their entire business in 2019.

coindesk.com/markets/2019/0…

coindesk.com/markets/2019/0…

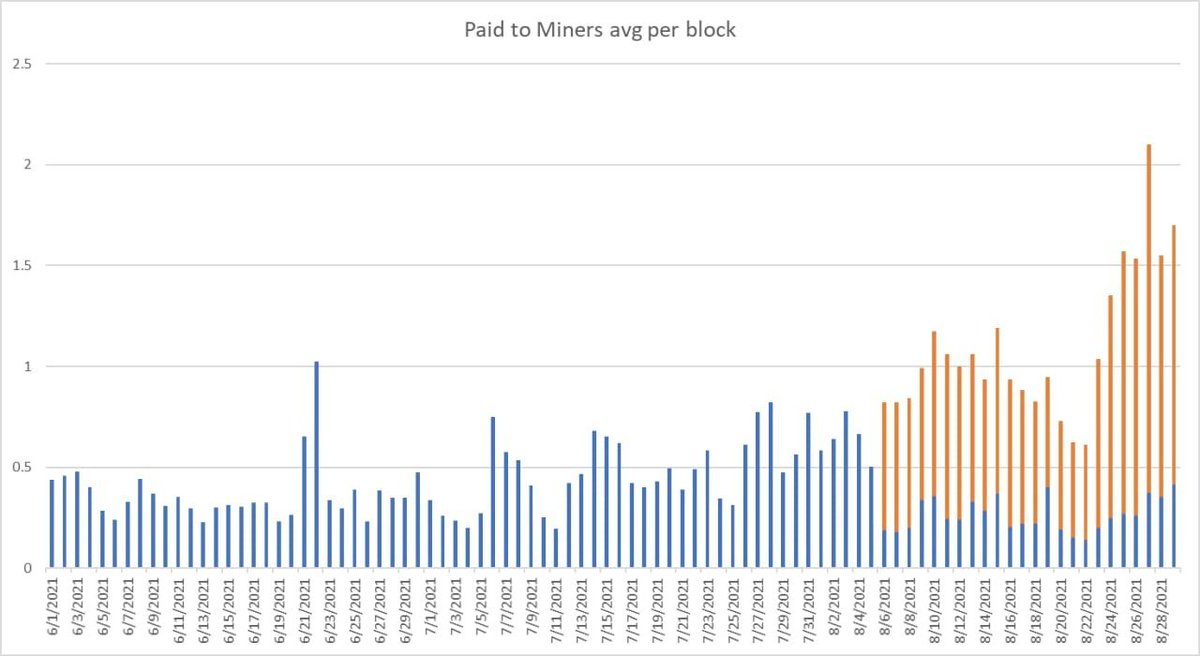

DeFi's rise brought consistent demand for Ethereum's blockspace, generating enormous fees for miners, which is great!

...unless you're a smart contract developer looking to deploy a new contract and you don't have $10k to spare. Or a small time trader. Or a retail transactor.

...unless you're a smart contract developer looking to deploy a new contract and you don't have $10k to spare. Or a small time trader. Or a retail transactor.

So how did the community react to this new found PMF? They ensured all smart contracts deployed on-chain could still function in a high fee environment right? Holding up the social contract?

No, they poured gas on the fire with EIP-1559 to pump their bags.

PLATFORM. RISK.

No, they poured gas on the fire with EIP-1559 to pump their bags.

PLATFORM. RISK.

Now the solution is to deploy new applications not on the base layer but on experimental L2s (or new blockchains entirely) with incredibly different security and liveness assumptions, not to mention new development environments entirely.

sports.yahoo.com/layer-2-platfo…

sports.yahoo.com/layer-2-platfo…

Why would these new blockchains avoid the same platform risk that Ethereum incurred?

Are they more decentralized? No.

As they get exponentially more popular will fees not go up? No.

Past is prologue. Platform risk exists. Especially platform risk from holders vs. transactors.

Are they more decentralized? No.

As they get exponentially more popular will fees not go up? No.

Past is prologue. Platform risk exists. Especially platform risk from holders vs. transactors.

#Bitcoin moves slower, but prioritizes NOT introducing platform risk extremely highly.

Example: RBF-by-default. Many Core Devs want to push RBF-by-default which would break the ability to accept zero-conf on-chain txs, which maybe only @bitrefill does.

Example: RBF-by-default. Many Core Devs want to push RBF-by-default which would break the ability to accept zero-conf on-chain txs, which maybe only @bitrefill does.

https://twitter.com/BitcoinErrorLog/status/1435221825429061641?s=20

My sense is that Core Devs will not move forward with RBF-by-default until @bitrefill is satisfied enough with LN as an alternative that removing zero-conf on-chain txs as an option is acceptable.

What a difference from Aragon on Ethereum!

What a difference from Aragon on Ethereum!

I have had many discussions with publicly traded companies, experienced entrepreneurs looking to start new businesses, fintechs evaluating "crypto", etc.

They all recognize and appreciate #Bitcoin's lack of Platform Risk as a key differentiator.

We're on the right track.

They all recognize and appreciate #Bitcoin's lack of Platform Risk as a key differentiator.

We're on the right track.

Immediate FUD I anticipate: "Bitcoin doesn't have smart contracts you can't build anything on it wahhhh!"

Check the mailing list. Covenants are coming. I've been incredibly encouraged by Core Dev focus on enabling "pooled liquidity" on-chain.

lists.linuxfoundation.org/pipermail/bitc…

Check the mailing list. Covenants are coming. I've been incredibly encouraged by Core Dev focus on enabling "pooled liquidity" on-chain.

lists.linuxfoundation.org/pipermail/bitc…

The brainpower behind this could light up 1000 suns: @ajtowns, @JeremyRubin, @roasbeef, @TheBlueMatt, @ffstls, Antoine Riard, and many others.

They will take their time. They will do it right. Soon ™️ we will have "pooled liquidity" on #Bitcoin without introducing Platform Risk.

They will take their time. They will do it right. Soon ™️ we will have "pooled liquidity" on #Bitcoin without introducing Platform Risk.

In the meantime, it is up to us to create an incredible Developer Experience for building on #Bitcoin and the #LightningNetwork ⚡️: docs, GUIs, libraries, SDKs, examples, communities, hackathons, conferences. @kycjelly, @D_plus__plus, et al are leading the way here, MOAR!!!

I have no doubt that the tradeoffs the #Bitcoin is making wrt taking care not to introduce Platform Risk are the right ones. We already know the playbook for the faster moving chains: get devs, get killer app, see fees go up, burn & pump, gg.

#Bitcoin's built different. LFG 🚀

#Bitcoin's built different. LFG 🚀

Other incredible #Bitcoin DevEx tools:

@lightningpolar by @jamaljsr

Balance of Satoshis by @alexbosworth: github.com/alexbosworth/b…

LSAT Playground by @BuckPerley: lsat-playground.bucko.vercel.app

Sapio Studio by @JeremyRubin: learn.sapio-lang.org

More from @lightning soon 😈

@lightningpolar by @jamaljsr

Balance of Satoshis by @alexbosworth: github.com/alexbosworth/b…

LSAT Playground by @BuckPerley: lsat-playground.bucko.vercel.app

Sapio Studio by @JeremyRubin: learn.sapio-lang.org

More from @lightning soon 😈

• • •

Missing some Tweet in this thread? You can try to

force a refresh