𝗠𝘂𝗹𝘁𝗶𝗽𝗹𝗲 𝘀𝗲𝗰𝘁𝗼𝗿 𝘄𝗮𝘁𝗰𝗵𝗹𝗶𝘀𝘁 𝗼𝗻 𝗧𝗿𝗮𝗱𝗶𝗻𝗴𝘃𝗶𝗲𝘄 𝘂𝘀𝗶𝗻𝗴 𝘁𝗵𝗲 𝗙𝗥𝗘𝗘 𝘃𝗲𝗿𝘀𝗶𝗼𝗻!

A THREAD 🧵

Please Like and Re-Tweet. It took a lot of effort to put this together.

#StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

A THREAD 🧵

Please Like and Re-Tweet. It took a lot of effort to put this together.

#StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

STEP 1: Download the #TradingView application on your mobile phone, and login into your account. One thing to note is that the web version doesn't let you add multiple watchlists, but the mobile version does.

STEP 2: Open #TradingView on your mobile and add all the watchlists that I'll provide you with.

I have attached a sample video on how you can add different #watchlist with the mobile app.

I have attached a sample video on how you can add different #watchlist with the mobile app.

Step 3: After adding the watchlists on the mobile app, refresh #TradingView on your desktop and voilà, you'll have the multiple watchlists you added on your mobile app directly on your desktop.

[Note: I added only 3 watchlists just to show you how it is done]

[Note: I added only 3 watchlists just to show you how it is done]

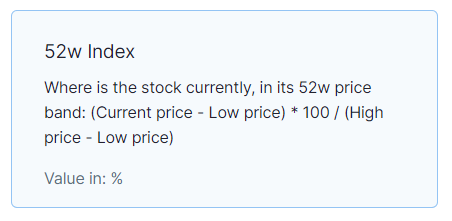

STEP 4: After you have added all the different sector watchlists, now its time to add the #stocks of that particular sector. This is not as tiring as adding the #watchlist with your mobile, you just have to copy and paste.

[Note: Remove the last comma]

[Note: Remove the last comma]

• • •

Missing some Tweet in this thread? You can try to

force a refresh