🇨🇳Evergrande's Backstory🇨🇳

🌎 The world demands answers.

From Fortune 500 to 1.95 Trillion in debt: How did China's #2 real estate giant get to this point?

How much cash does it *actually* have?

Will there be a bailout?

Who's gonna get f*cked?

Here goes. Story time.

👇

🌎 The world demands answers.

From Fortune 500 to 1.95 Trillion in debt: How did China's #2 real estate giant get to this point?

How much cash does it *actually* have?

Will there be a bailout?

Who's gonna get f*cked?

Here goes. Story time.

👇

1/ First, how bad is the current situation?

There's not much info on Evergrande's finances on the Western web (aka Google) so I had to dig through the Chinese web (aka Baidu).

This poster shows China's top 3 most indebted real estate co's in 2020:

#1 is Evergrande (@ 1.95T ¥!)

There's not much info on Evergrande's finances on the Western web (aka Google) so I had to dig through the Chinese web (aka Baidu).

This poster shows China's top 3 most indebted real estate co's in 2020:

#1 is Evergrande (@ 1.95T ¥!)

2/ According to the company's 2020 annual report, 674B ¥ (35%) is interest-bearing debt, which means it incurs new interest liability of 180+M ¥ every day!

Comparatively, it only has 158B in cash to repay all its short term debt + interest which means...

Major defaults to come.

Comparatively, it only has 158B in cash to repay all its short term debt + interest which means...

Major defaults to come.

3/ How did Evergrande land in such a shitty position?

To start, real estate developers are notoriously known to have terrible (i.e. long) cash conversion cycles. Long CCC means the company has tons of cash tied up in accounts receivables and/or inventory & therefore not "free."

To start, real estate developers are notoriously known to have terrible (i.e. long) cash conversion cycles. Long CCC means the company has tons of cash tied up in accounts receivables and/or inventory & therefore not "free."

4/ Real estate companies tend to have long CCCs because it takes many months per project to get from an empty piece of land to a marketable building. All the while, construction is extremely capital intensive and the company needs to hold a ton of inventory & equipment.

5/ But while Evergrande was already disadvantaged from the get go due to the nature of its industry, mismanagement at the exec level certainly exacerbated its cash problem 100x.

Allegedly Evergrande spends 1-2B yuan on football every year. And in the last 10 yrs, it burned >20B.

Allegedly Evergrande spends 1-2B yuan on football every year. And in the last 10 yrs, it burned >20B.

6/ But it didn't just stop at football.

The "real estate dev" also established an entire subsidiary for electric vehicles ("Evergrande Auto"), another for streaming media ("Hengten Networks"), an amusement park ("Evergrande Fairyland") & health chain ("Evergrande Spring").

Wut?

The "real estate dev" also established an entire subsidiary for electric vehicles ("Evergrande Auto"), another for streaming media ("Hengten Networks"), an amusement park ("Evergrande Fairyland") & health chain ("Evergrande Spring").

Wut?

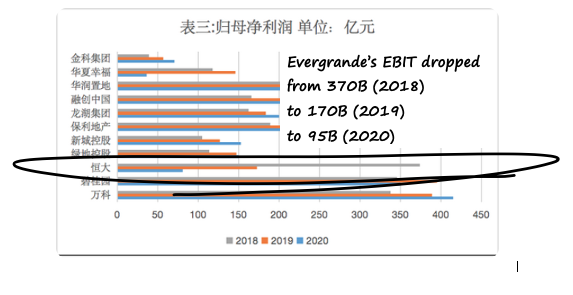

7/ By 2020, Evergrande had erased 75% of all operating income (EBIT) compared to 2018. EBIT in 2020 was only 95B ¥ compared to 355B ¥ just 2 years prior.

Furthermore, gross margins had also dropped >10% from 36% in 2018 to 24% in 2020.

Furthermore, gross margins had also dropped >10% from 36% in 2018 to 24% in 2020.

8/ Then on July 19, 2021, China's Guangfa Bank (one of Evergrande's biggest lenders) ordered a freeze on 132M RMB in deposits.

Two more banks (Hang Seng Bank & Bank of East Asia) then suspended new mortgages for Evergrande’s 2 new projects in HK.

The house of cards was falling.

Two more banks (Hang Seng Bank & Bank of East Asia) then suspended new mortgages for Evergrande’s 2 new projects in HK.

The house of cards was falling.

9/ When are Evergrande's current debt obligations due?

According to the schedule below, a significant chunk (335B) is due end of 2021 & another (166B) end of 2022 -- exact dates not specified.

According to the schedule below, a significant chunk (335B) is due end of 2021 & another (166B) end of 2022 -- exact dates not specified.

10/ Does Evergrande have enough cash+EBIT to meet its interest + principal obligations for all shareholders?

No.

No.

11/ What does the seniority waterfall look like? Who gets paid first? Who gets paid last?

1. the state (Evergrande's bank loans are state-owned assets & must be redeemed before all else)

2. suppliers (mostly in the form of commercial paper redemptions)

3. investors

4. employees

1. the state (Evergrande's bank loans are state-owned assets & must be redeemed before all else)

2. suppliers (mostly in the form of commercial paper redemptions)

3. investors

4. employees

12/ So what can Evergrande do now?

1. Liquidate existing assets (i.e. land) for cash

2. Restructure contract terms to push out maturity

3. Debt to equity swaps

4. Sell more equity

5. Declare bankruptcy

6. Wait for bailout

1. Liquidate existing assets (i.e. land) for cash

2. Restructure contract terms to push out maturity

3. Debt to equity swaps

4. Sell more equity

5. Declare bankruptcy

6. Wait for bailout

13/ Who wins & who gets f*cked under each scenario?

It's quite simple.

The state always wins because it'll be first to get paid and will always be able to force management to make decisions at the expense of every other stakeholder group.

Everyone else gets f*cked.

It's quite simple.

The state always wins because it'll be first to get paid and will always be able to force management to make decisions at the expense of every other stakeholder group.

Everyone else gets f*cked.

14/ Here are the primary source documents I used in my research in case anyone wants to do further digging:

2020 annual report (not a 10K because China doesn't abide by GAAP accounting): doc.irasia.com/listco/hk/ever…

baijiahao.baidu.com/s?id=170576305…

163.com/dy/article/GK4…

Happy weekend! 😃

2020 annual report (not a 10K because China doesn't abide by GAAP accounting): doc.irasia.com/listco/hk/ever…

baijiahao.baidu.com/s?id=170576305…

163.com/dy/article/GK4…

Happy weekend! 😃

• • •

Missing some Tweet in this thread? You can try to

force a refresh