2/ Product portfolio:

• Liquid milk (72% of sales): Ultra milk, Ultra Mimi (for children), condensed milk

• Tea and health drinks (19% of sales): Jasmine tea, mung bean and tamarind drinks.

• Other (7.4% of sales): Production for 3rd parties such as Unilever

• Liquid milk (72% of sales): Ultra milk, Ultra Mimi (for children), condensed milk

• Tea and health drinks (19% of sales): Jasmine tea, mung bean and tamarind drinks.

• Other (7.4% of sales): Production for 3rd parties such as Unilever

3/ Competitive position:

• Indonesia's largest dairy brand ("Ultra Milk") with 40% market share in liquid milk

• Strength in UHT milk, which has shelf life of 6-9 months at room temperatures (convenient)

• Also has a presence in RTD tea with Teh Kotak

• Indonesia's largest dairy brand ("Ultra Milk") with 40% market share in liquid milk

• Strength in UHT milk, which has shelf life of 6-9 months at room temperatures (convenient)

• Also has a presence in RTD tea with Teh Kotak

4/ Market backdrop:

• Excellent demographics with population growth of 1%

• Indonesia's liquid milk consumption only 15 litres vs 56 litres in Malaysia

• Secular growth of ~10% per year, fastest of any FMCG segment in Indonesia

• Excellent demographics with population growth of 1%

• Indonesia's liquid milk consumption only 15 litres vs 56 litres in Malaysia

• Secular growth of ~10% per year, fastest of any FMCG segment in Indonesia

5/ Management:

• Family-run business, with Sabana Prawirawidjaja at the helm

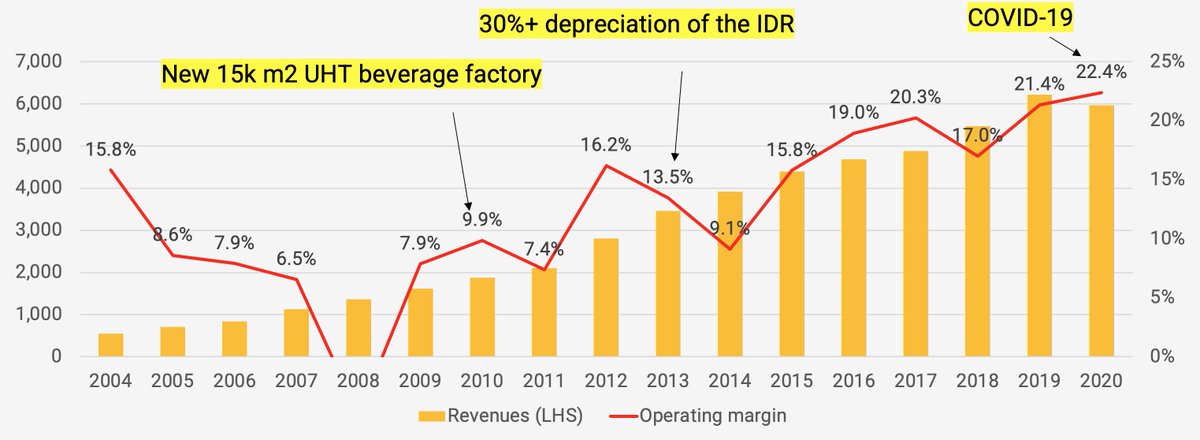

• Under his leadership, revenues have 10x in 15 years

• Conservative communication and balance sheet

• Sabana has been buying shares in the open market recently

• 10% buyback in 2020

• Family-run business, with Sabana Prawirawidjaja at the helm

• Under his leadership, revenues have 10x in 15 years

• Conservative communication and balance sheet

• Sabana has been buying shares in the open market recently

• 10% buyback in 2020

6/ Financials

• The long-term track record is excellent

• Management is guiding for 10% growth in 2021

• Also expressing optimism about the market

• Near-term margin pressure due to capacity expansion

• Competition is heating up but Ultrajaya dominates the UHT milk category

• The long-term track record is excellent

• Management is guiding for 10% growth in 2021

• Also expressing optimism about the market

• Near-term margin pressure due to capacity expansion

• Competition is heating up but Ultrajaya dominates the UHT milk category

7/ Share price

• Historically, growth and share price performance has come in spurts after major capacity expansions

• Note that the Rupiah has been a weak currency with persistent inflation, causing share prices in nominal terms to look impressive

• Historically, growth and share price performance has come in spurts after major capacity expansions

• Note that the Rupiah has been a weak currency with persistent inflation, causing share prices in nominal terms to look impressive

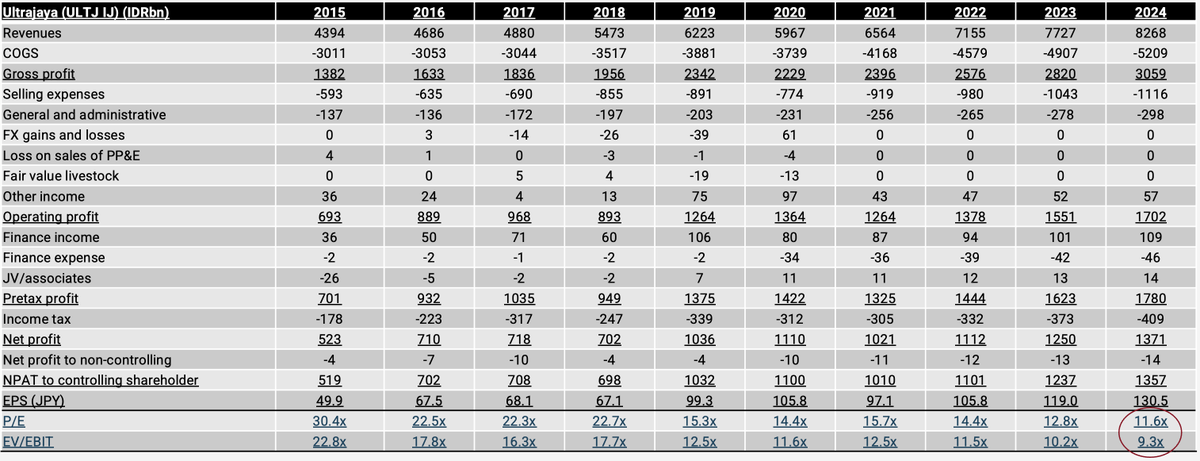

8/ Multiples

• Current multiples are low compared to historicals

• Peers trade closer to 17-18x

• But developed market peers don't enjoy the same underlying secular market growth. The move towards non-dairy alternatives is also much more prevalent in developed markets.

• Current multiples are low compared to historicals

• Peers trade closer to 17-18x

• But developed market peers don't enjoy the same underlying secular market growth. The move towards non-dairy alternatives is also much more prevalent in developed markets.

8/ Valuation

Assuming:

• 10% initial top-line growth in line with guidance

• Some margin pressure due to the planned construction of new production and distribution facilities

• A 20x P/E on 2024e earnings

Yields an upside of +72%.

Assuming:

• 10% initial top-line growth in line with guidance

• Some margin pressure due to the planned construction of new production and distribution facilities

• A 20x P/E on 2024e earnings

Yields an upside of +72%.

9/ Risks

• Competition from the likes of Greenfields is heating up

• Raw milk price + Rupiah FX rates are volatile

• No-name auditor

• Minority shareholding in certain distributors

• Weak liquidity (~US$50k per day)

• Competition from the likes of Greenfields is heating up

• Raw milk price + Rupiah FX rates are volatile

• No-name auditor

• Minority shareholding in certain distributors

• Weak liquidity (~US$50k per day)

• • •

Missing some Tweet in this thread? You can try to

force a refresh