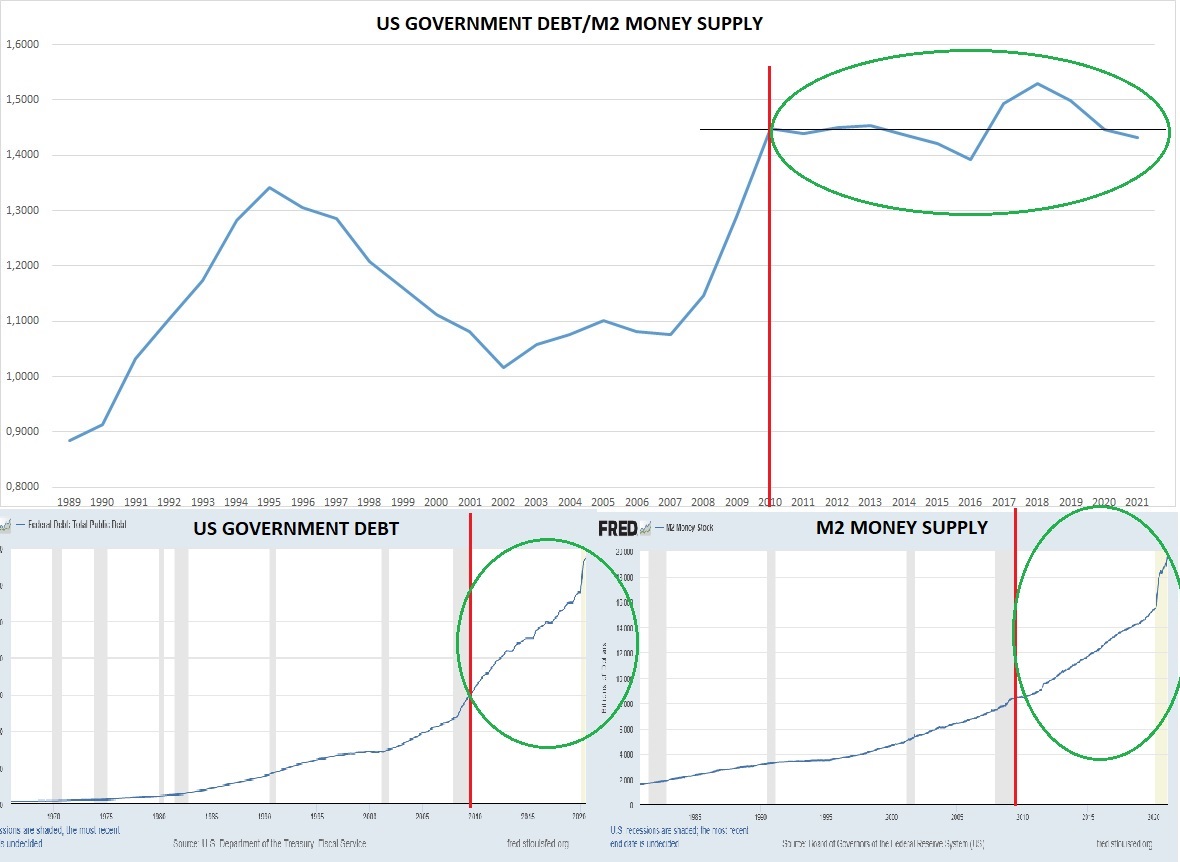

Hilo 1- parte de la antesala del #rodrigazo fue la caida de las materias primas que exportamos y el aumento de la energia q importabamos te suena? mira este ratio mientras mas aumenta la energia con respecto a los alimentos, mas cae.Te dejo un fragmento de un libro Mario Rapoport

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh