Some inflation comment here. With annual CPI now at 4.2% and core at 3%, the post pandemic path of inflation is clearly stirring worries. The monthly changes this year so far are feisty, but there are some good reasons to think this isn't simply a post pandemic thing /1

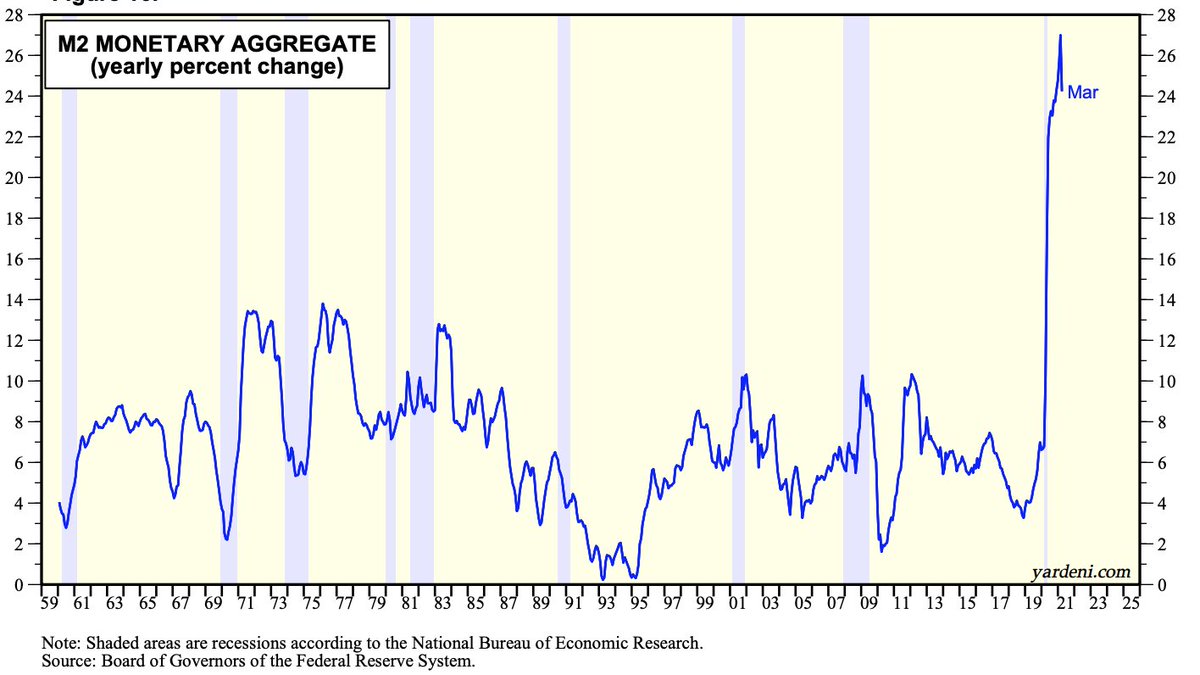

One key factor is the monetary backdrop which is still quite unusual, and accommodative in ways that we never saw after the GFC. Demand deposits, not just banks' balances at the Fed, are booming, making for potentially very fertile spending backdrop. /2

Materials shortages, long delivery times, supply chain choke points are joining rising commodity prices and rising pay in a chorus of inflation pressures, we haven't seen for a long time. Service workers comp rose by over 5% annualised in Q1, the biggest gain for 20 yrs /3

Powell et al/ inflation sceptics say this is all temporary and will wash out in/by 2022. Perhaps, but regime changes always feel like this when they start. The monetary/fiscal mutual reinforcement, and changed global supply conditions are likely to endure. /4

I think we can keep an open mind....but better be prepared for the possibility that inflation will prove stickier than ppl want to believe. Even this may not be all bad. End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh