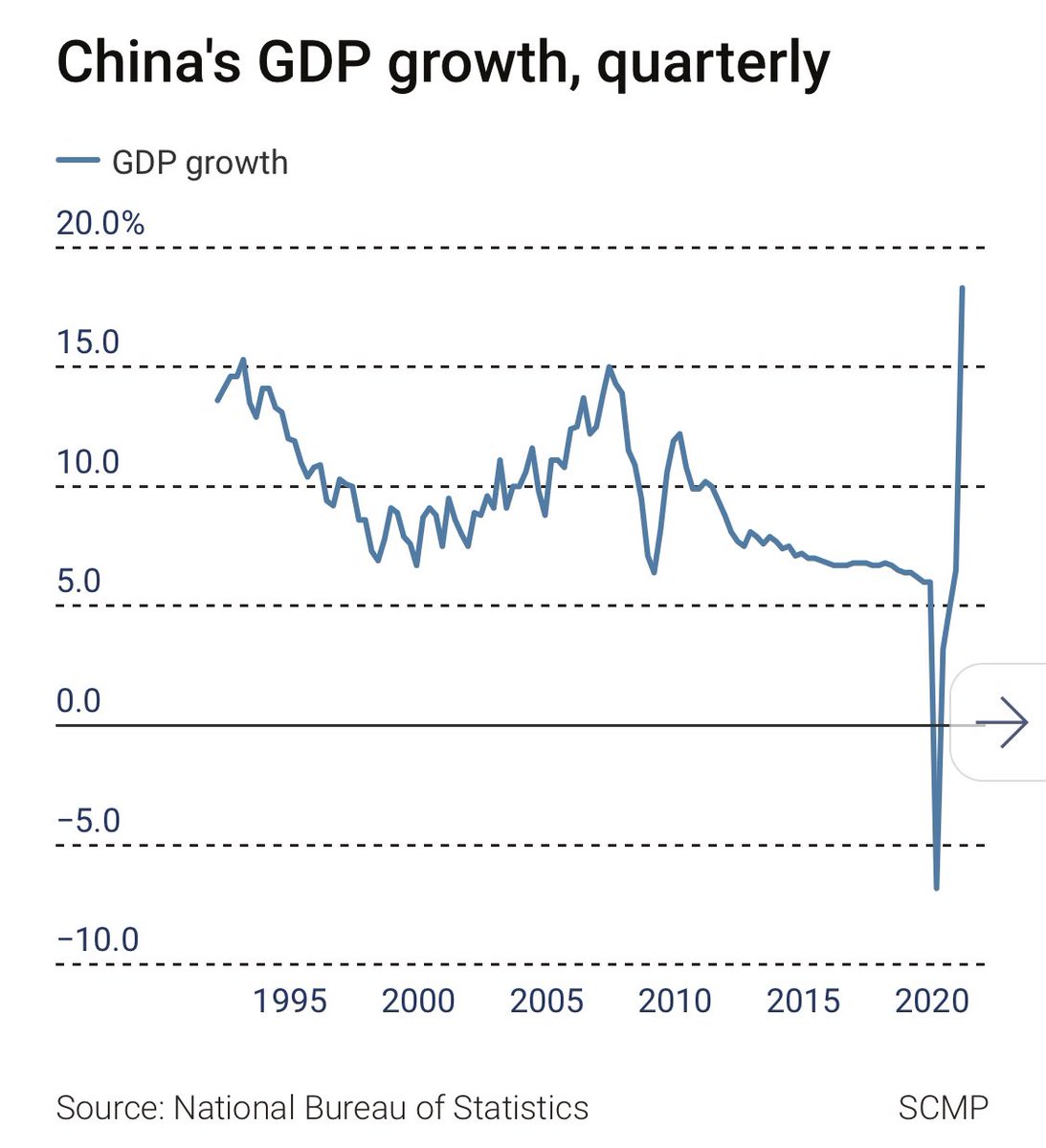

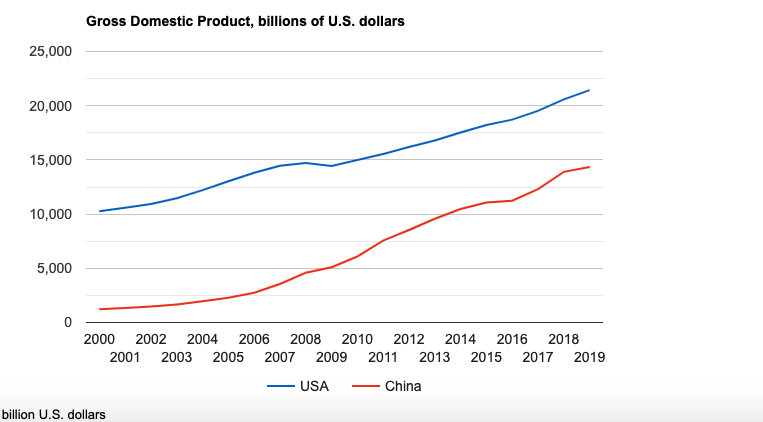

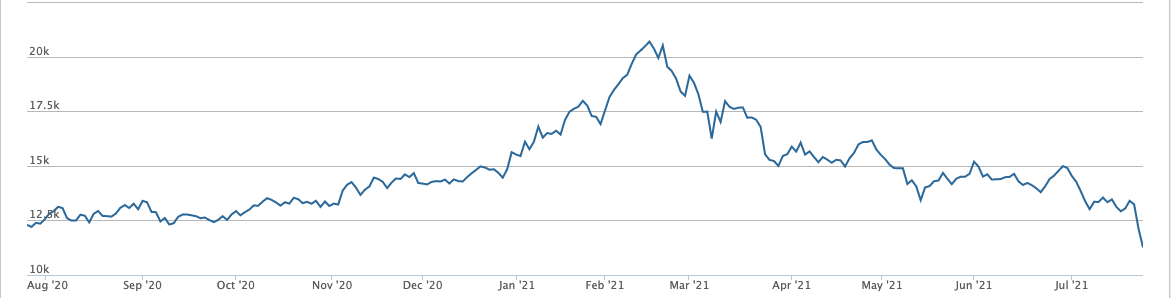

China's tech etc crackdown is leading to a huge valuation change, eg here NASDAQ Golden Dragon Index capturing lge and mid cap Ch tech stocks trading in NY. Buying opportunity or giant wake up call? Here's why it's more likely the latter /1

Fair to say that every sector has its own tale to tell.. fintech, data, tutoring, music streaming etc. But the big pic narrative is abt the pol crackdown on private firms, especially those with lots of foreign investment (direct and via listings in the US), interest and ideas./2

More private firms are being brought to heel as control > growth and innovation.Contradiction is clear. Government doubtless believes in power of tech firms to change the world in its favour but clampdown is frustrating its own ambition. Not widely appreciated yet, or priced /3

U might say, stocks tell us little about the economy, but equally the value investors put on firms tells abt unbiased prospects of those firms at cutting edge of the economy. As crackdown continues, re-valuation of stocks will too. But this is bigger than stock mkt alone. Ends

• • •

Missing some Tweet in this thread? You can try to

force a refresh