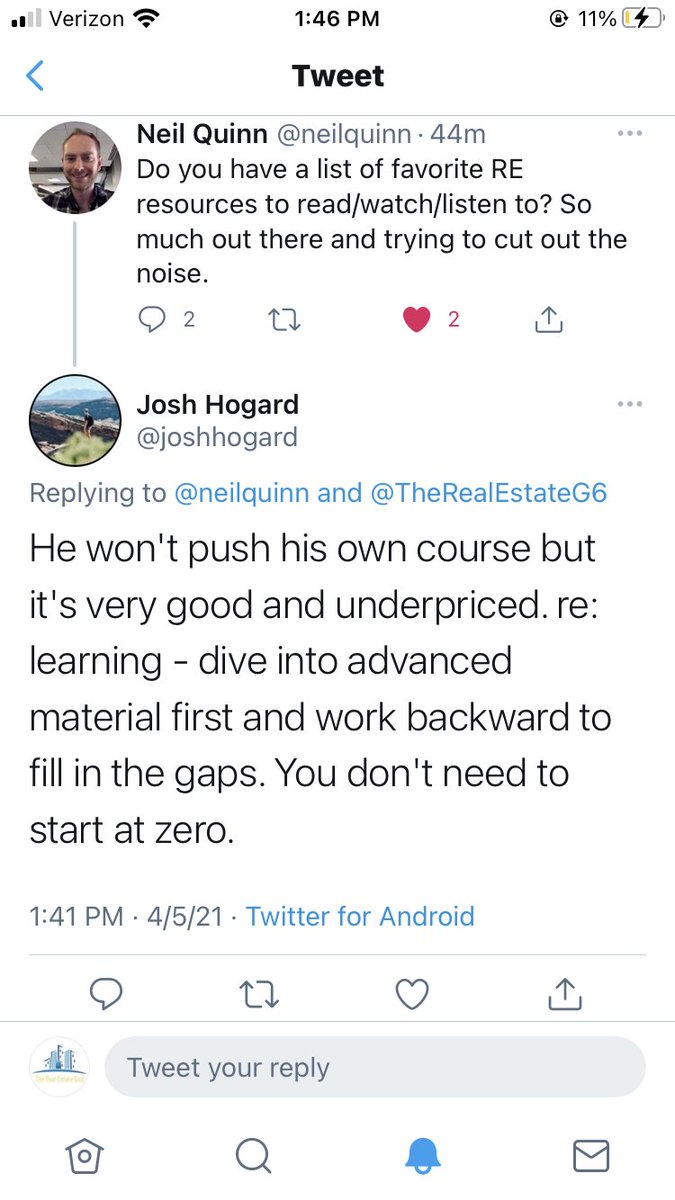

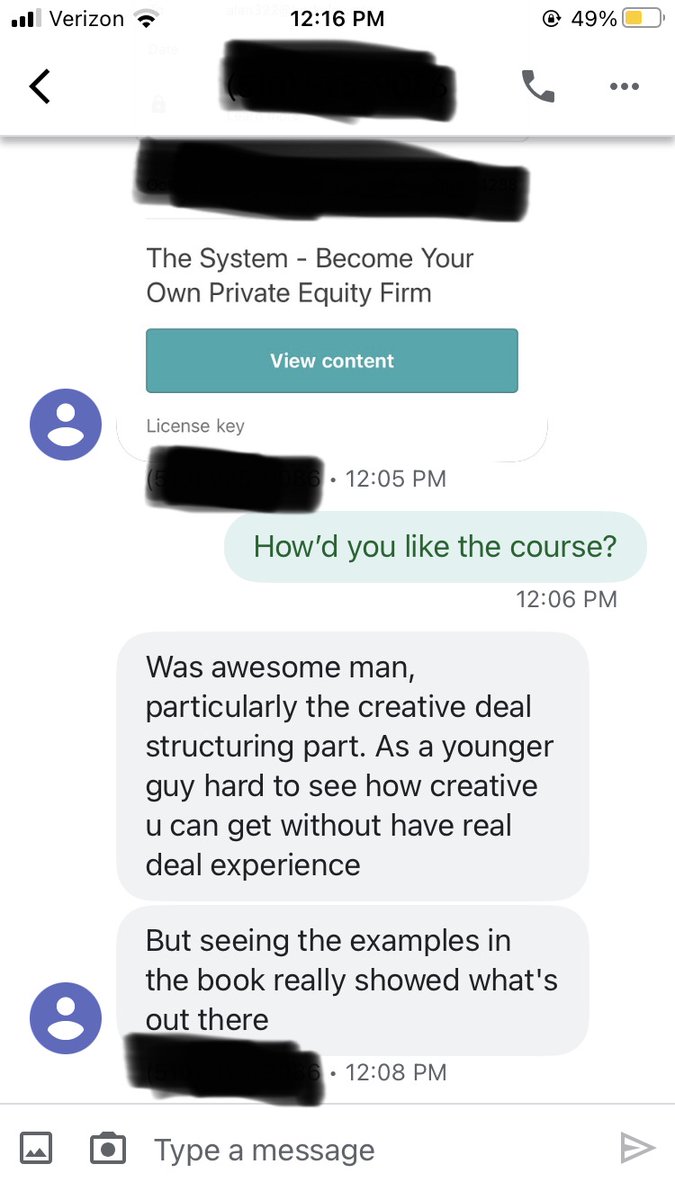

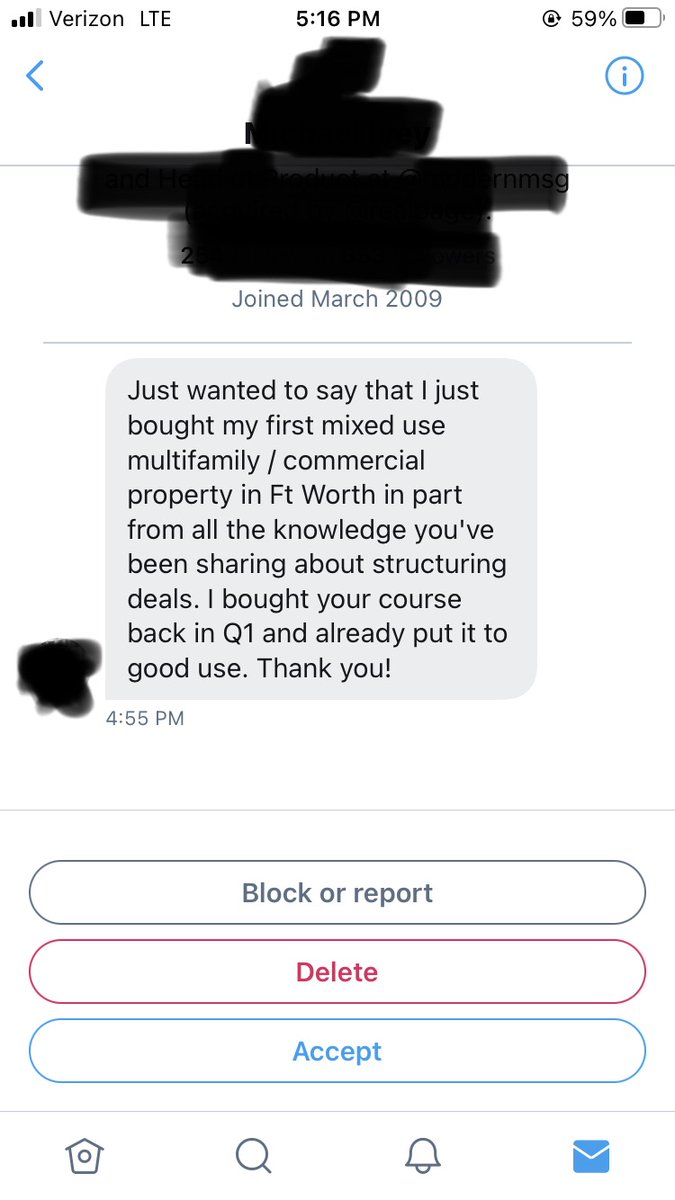

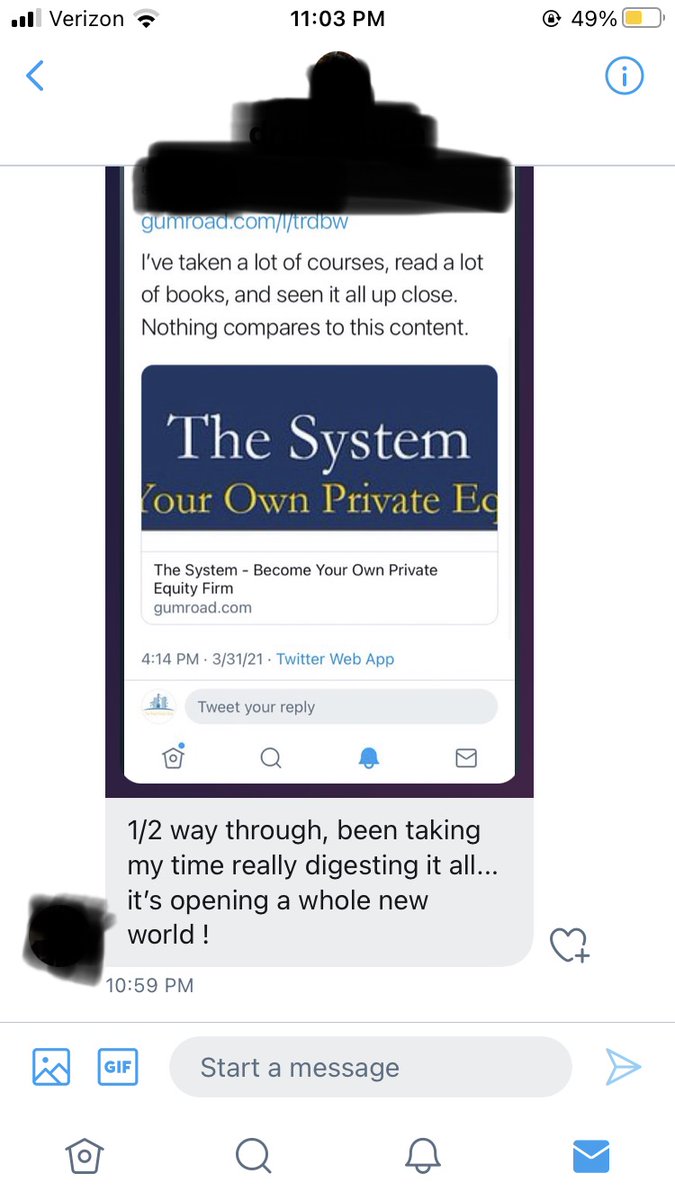

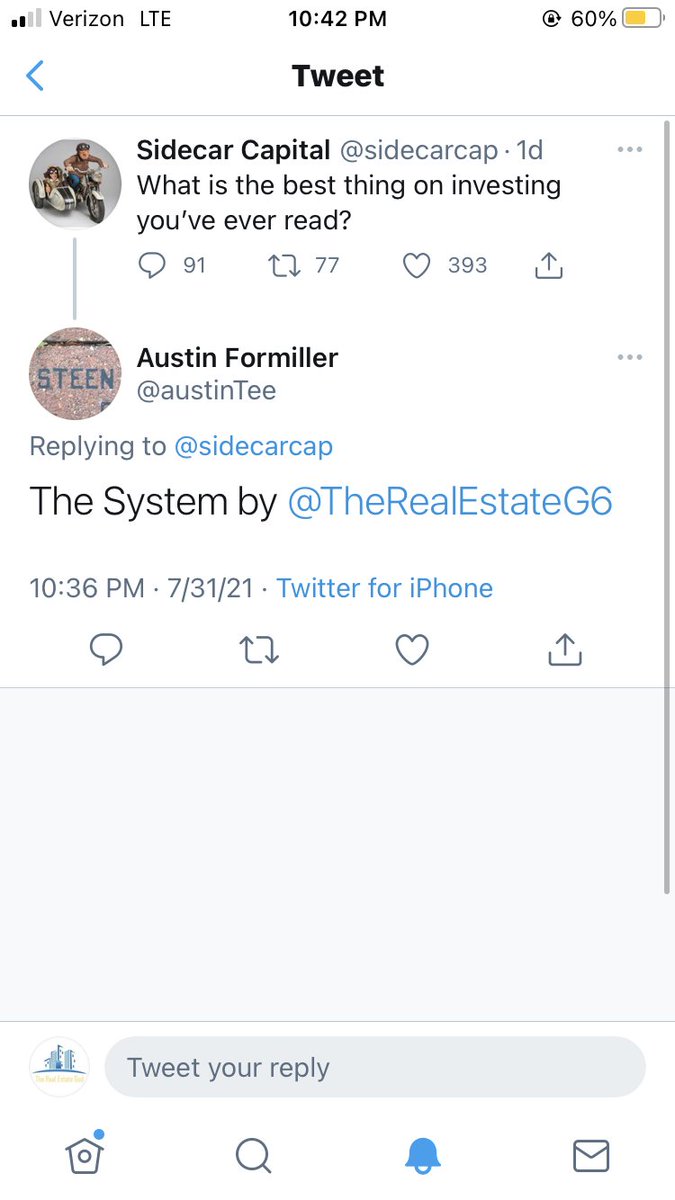

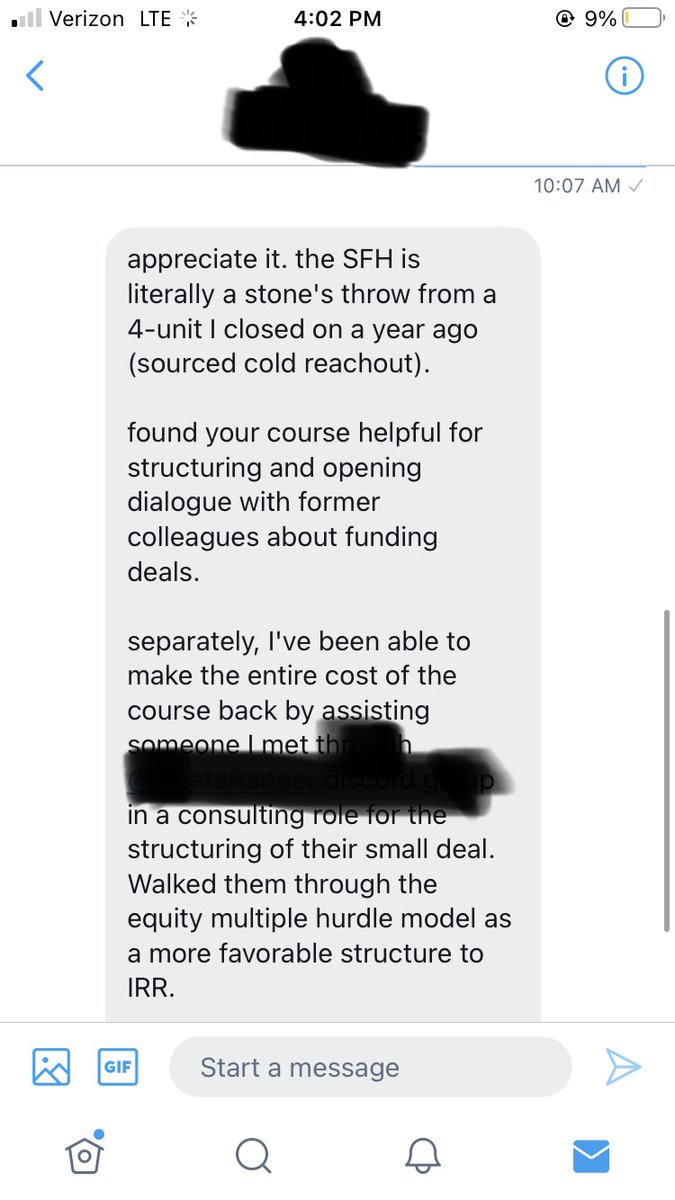

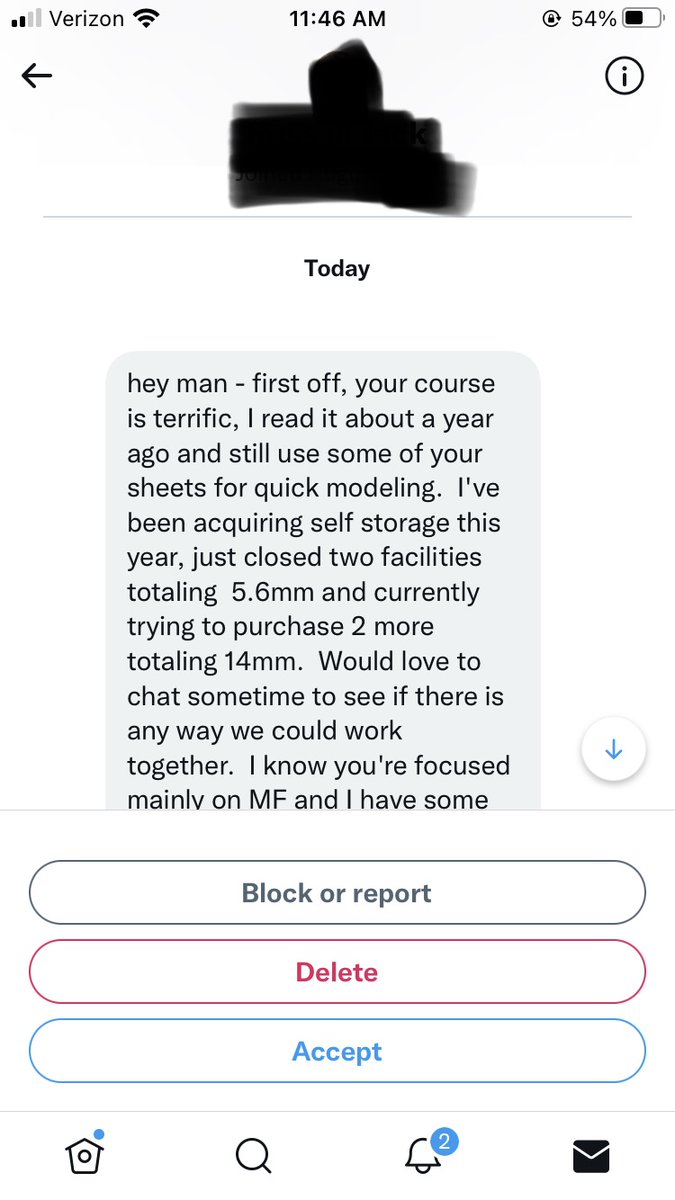

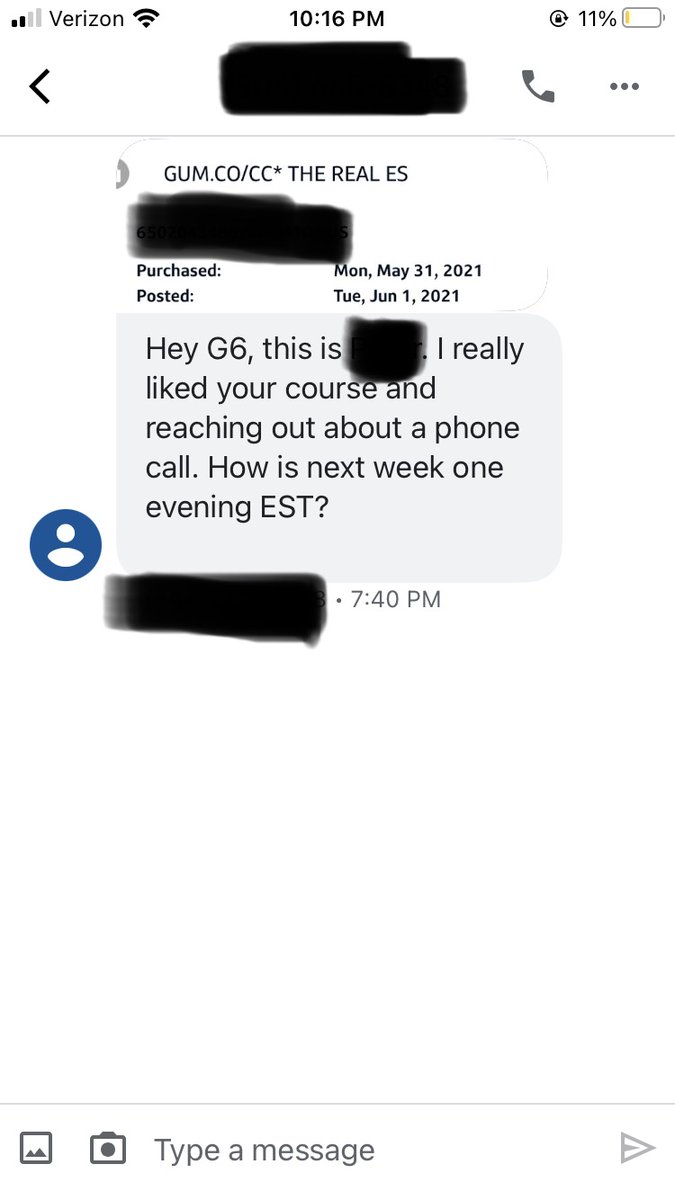

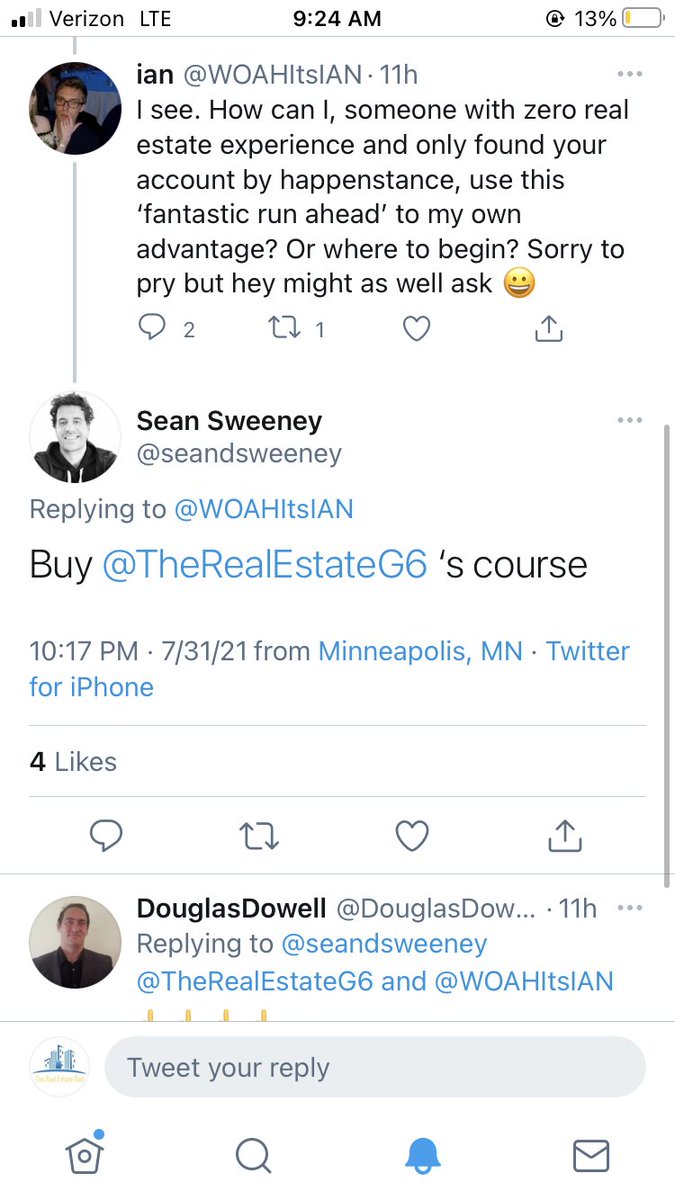

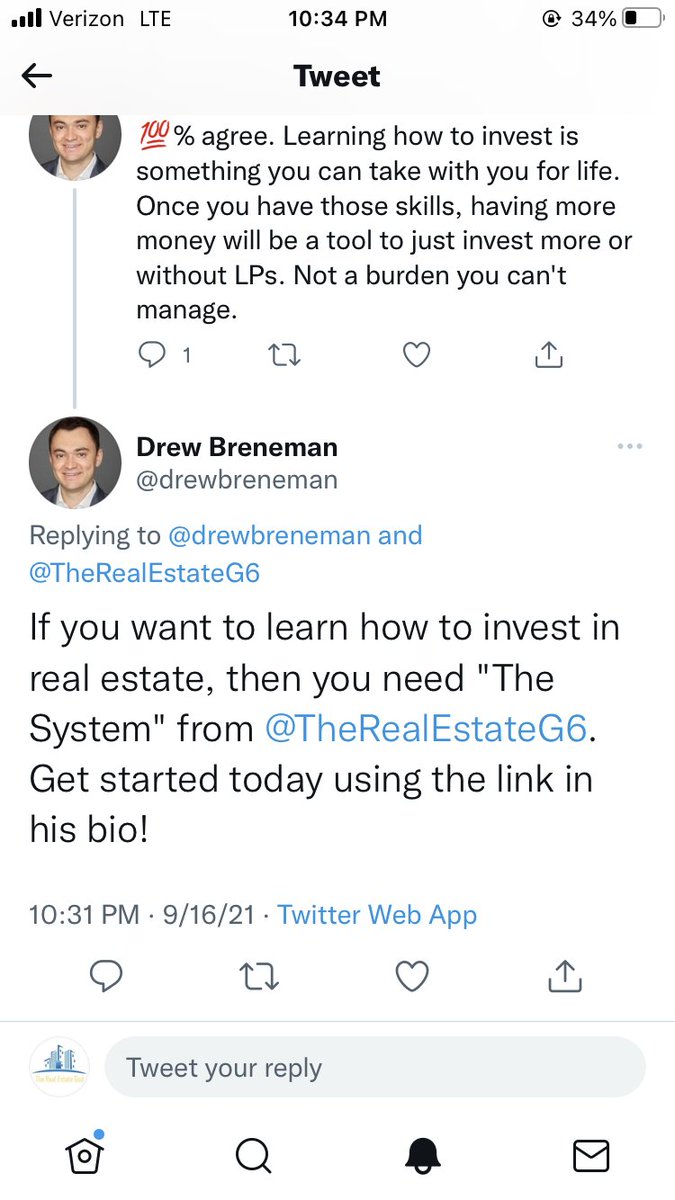

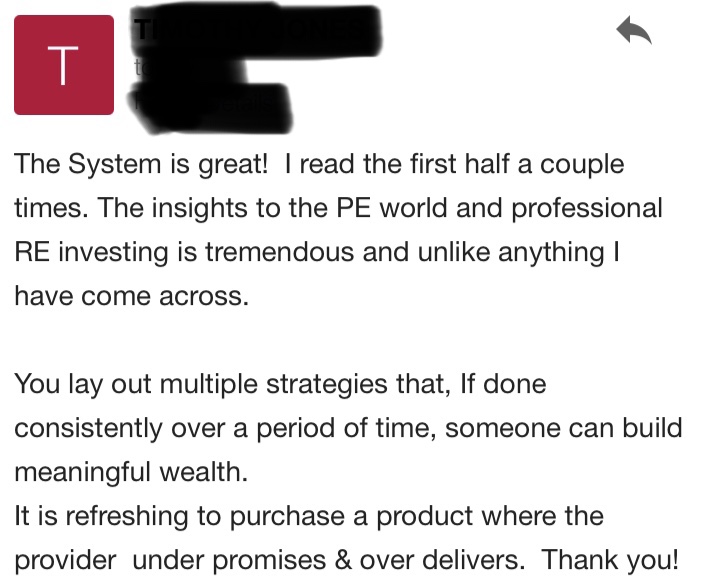

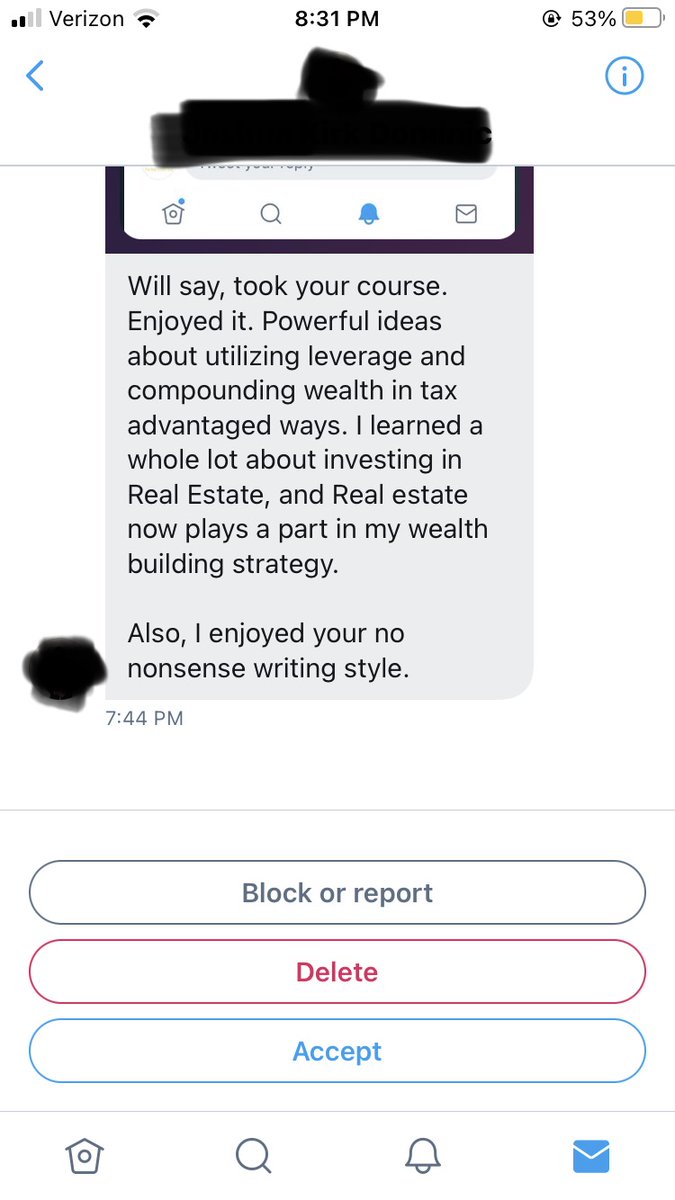

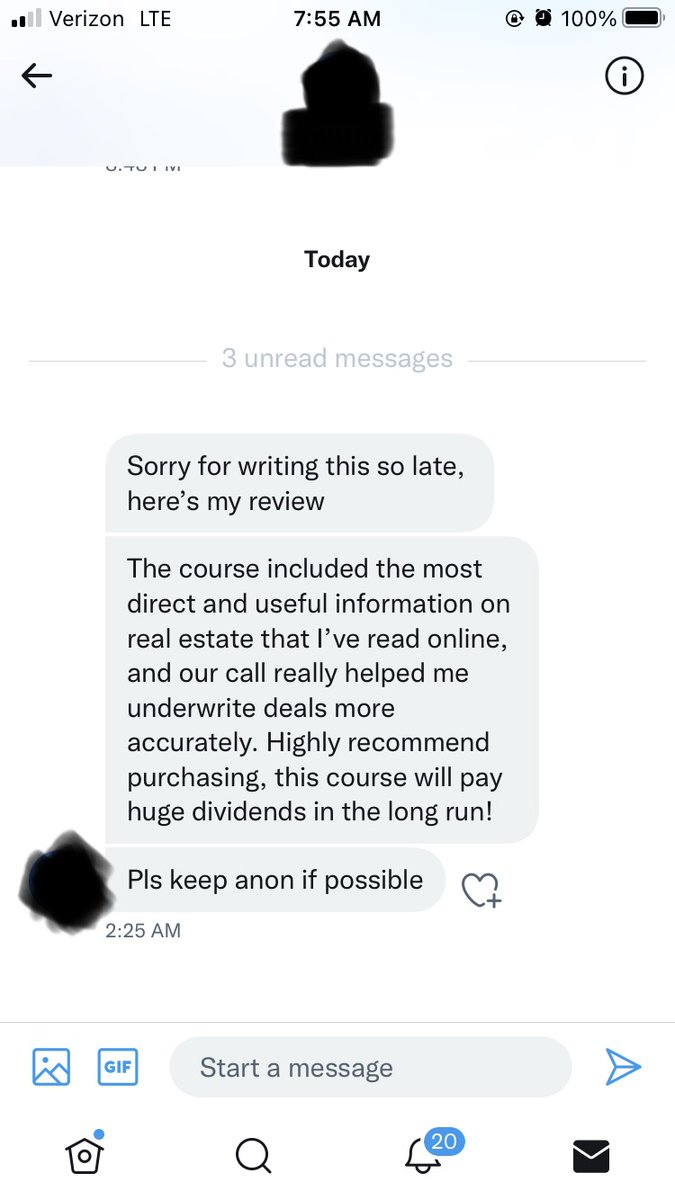

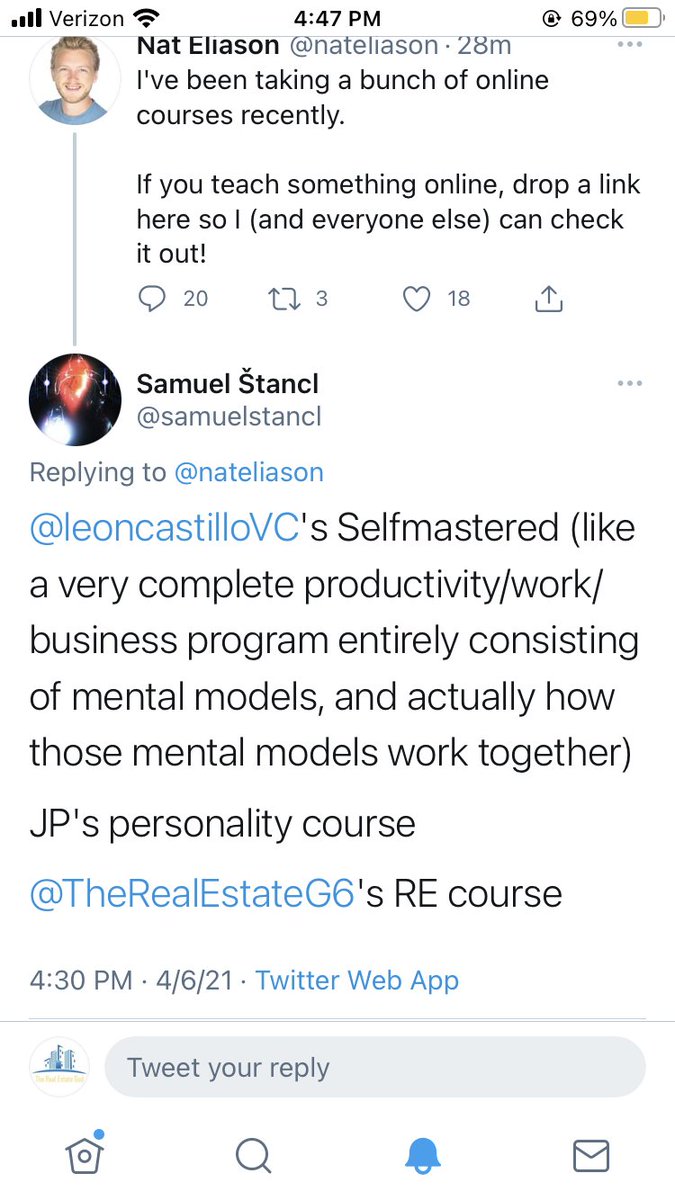

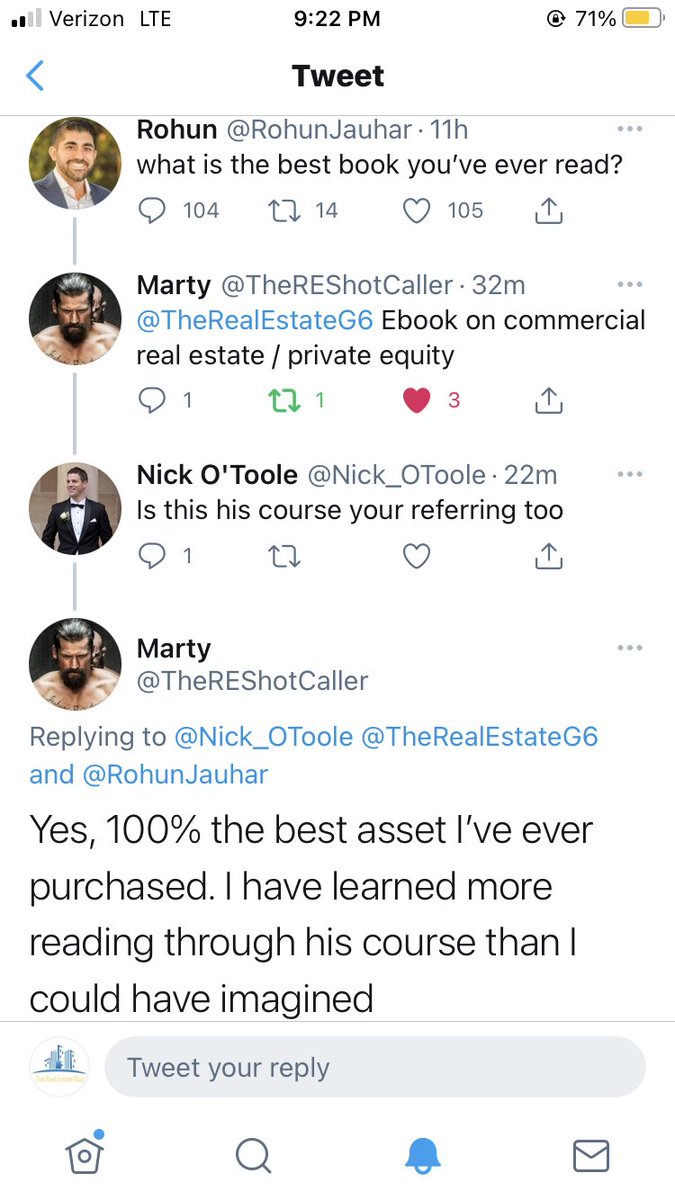

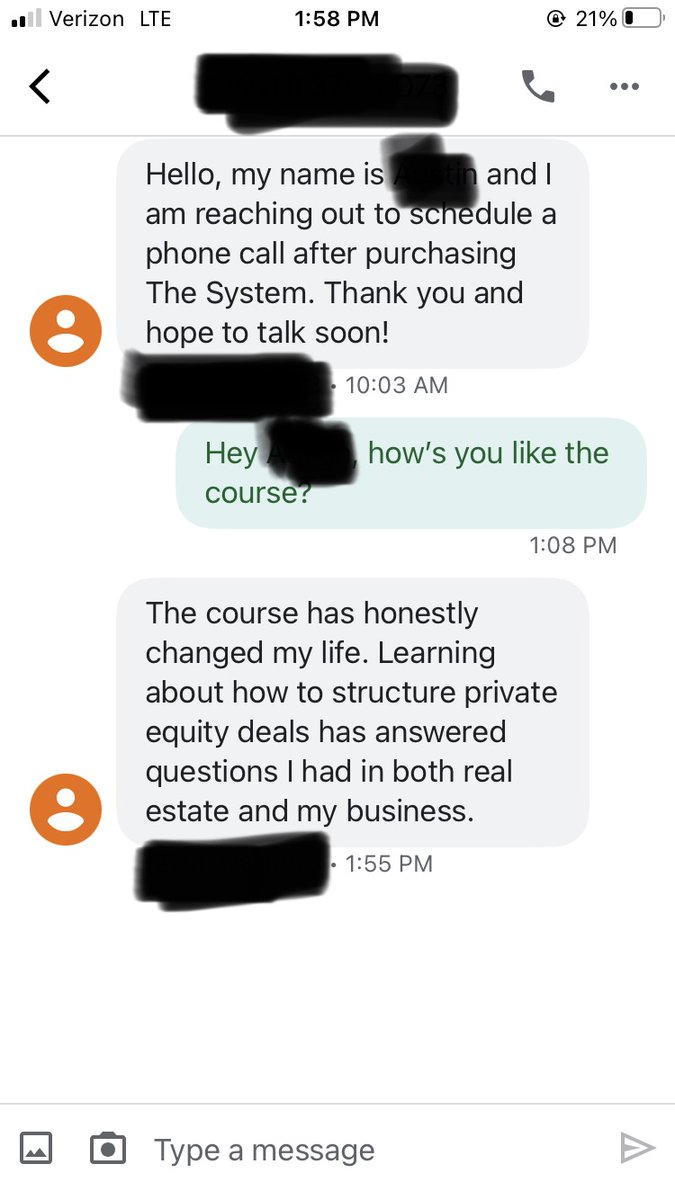

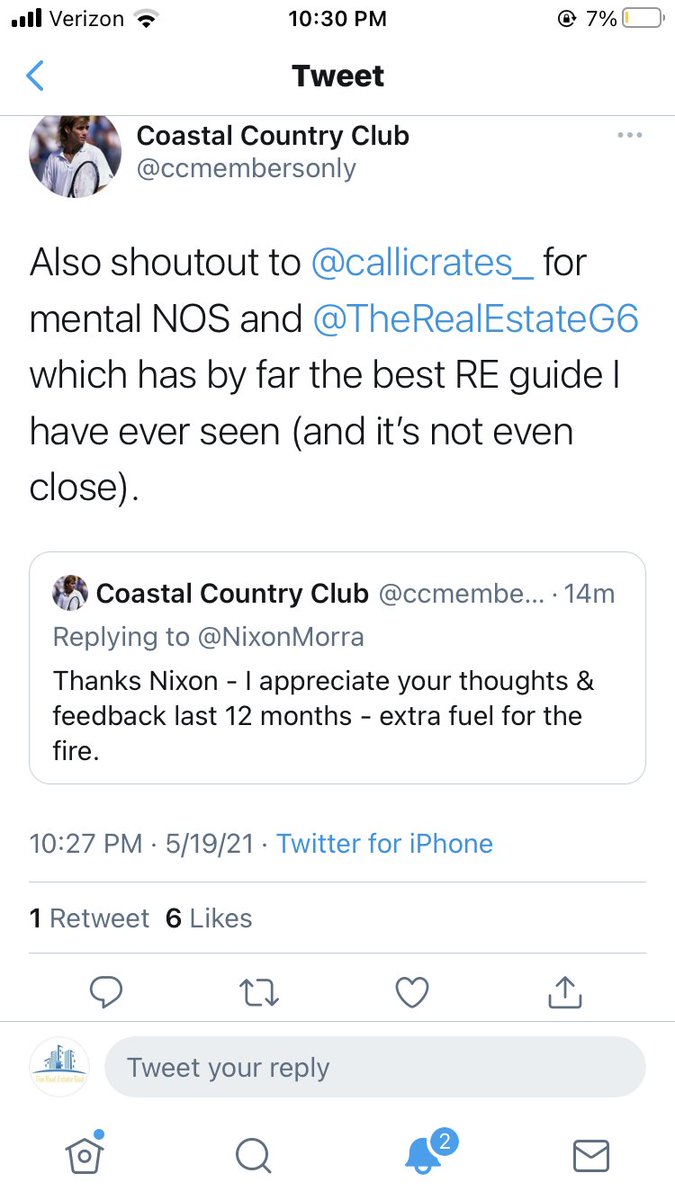

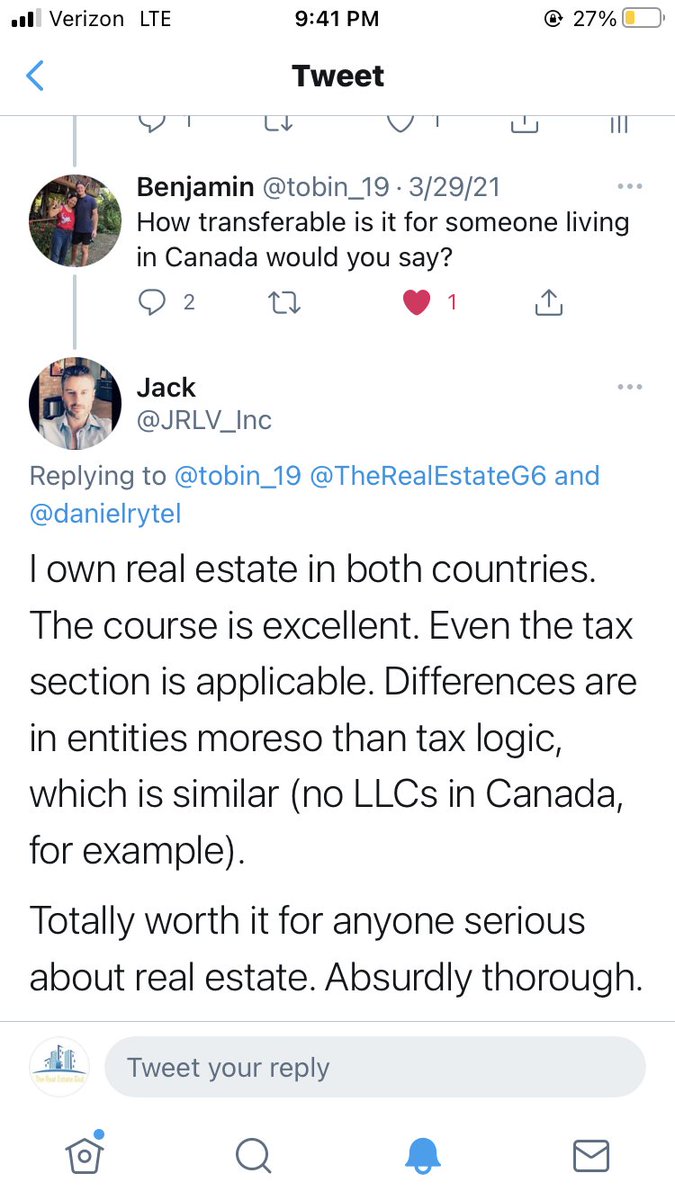

Rarely promote my course but it's been a while since I posted any new reviews

Some new reviews are below and course is linked at the bottom of the thread

If you have any questions, feel free to send a DM

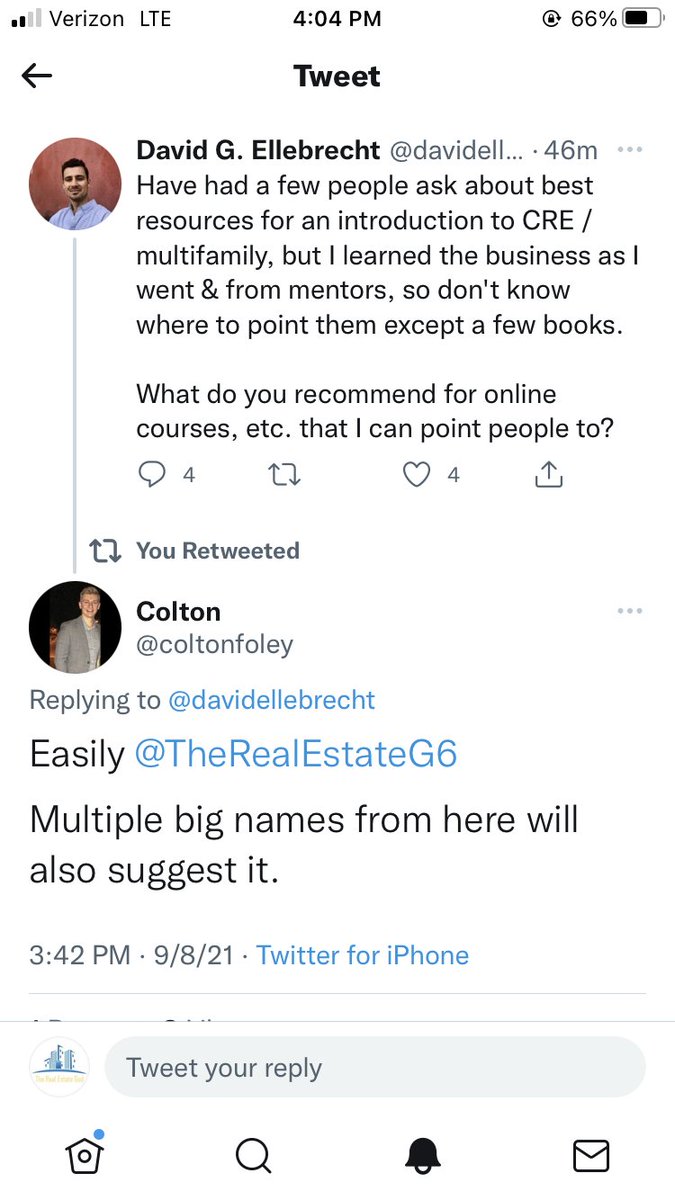

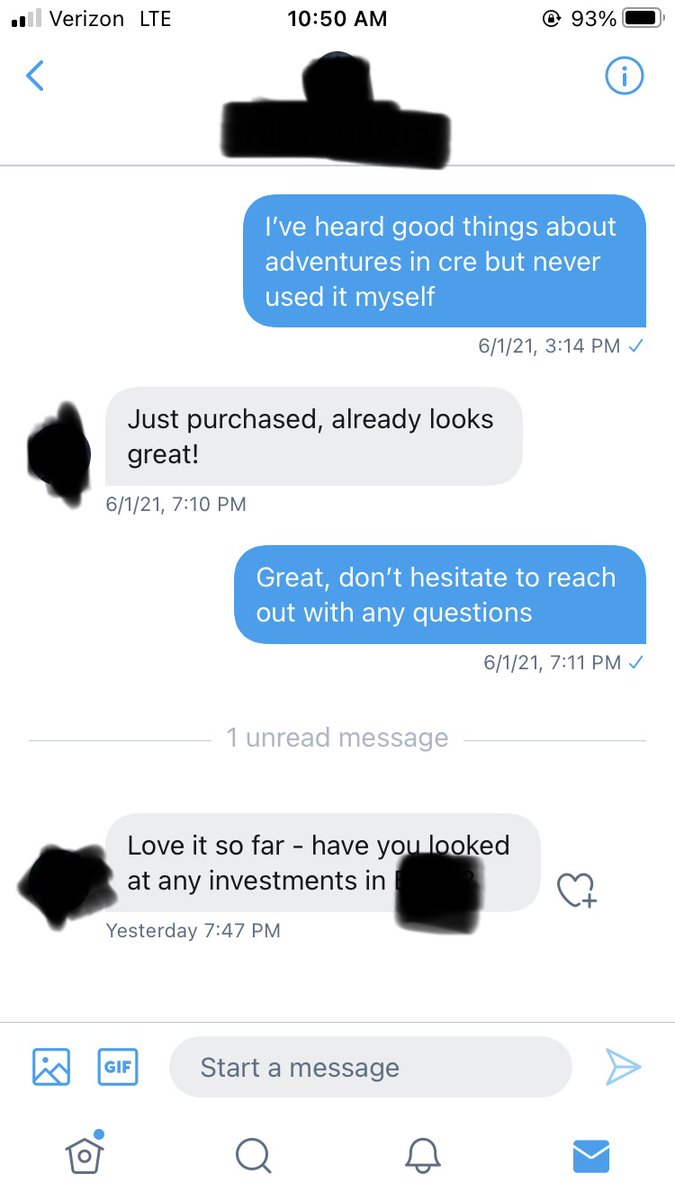

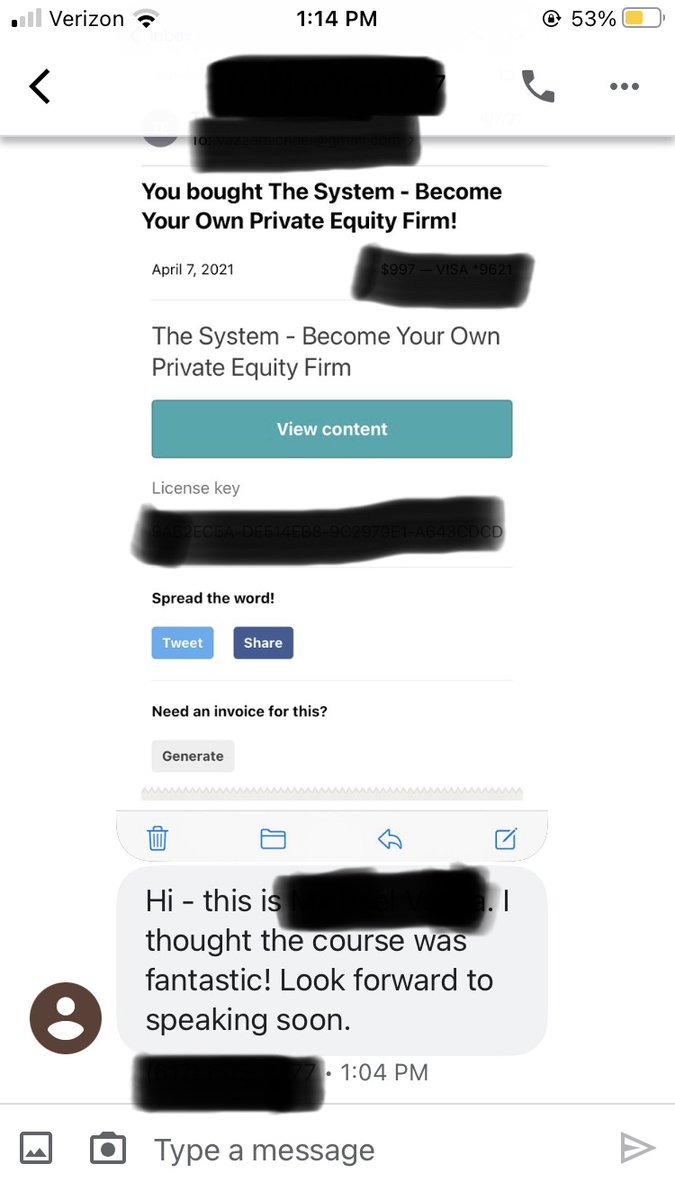

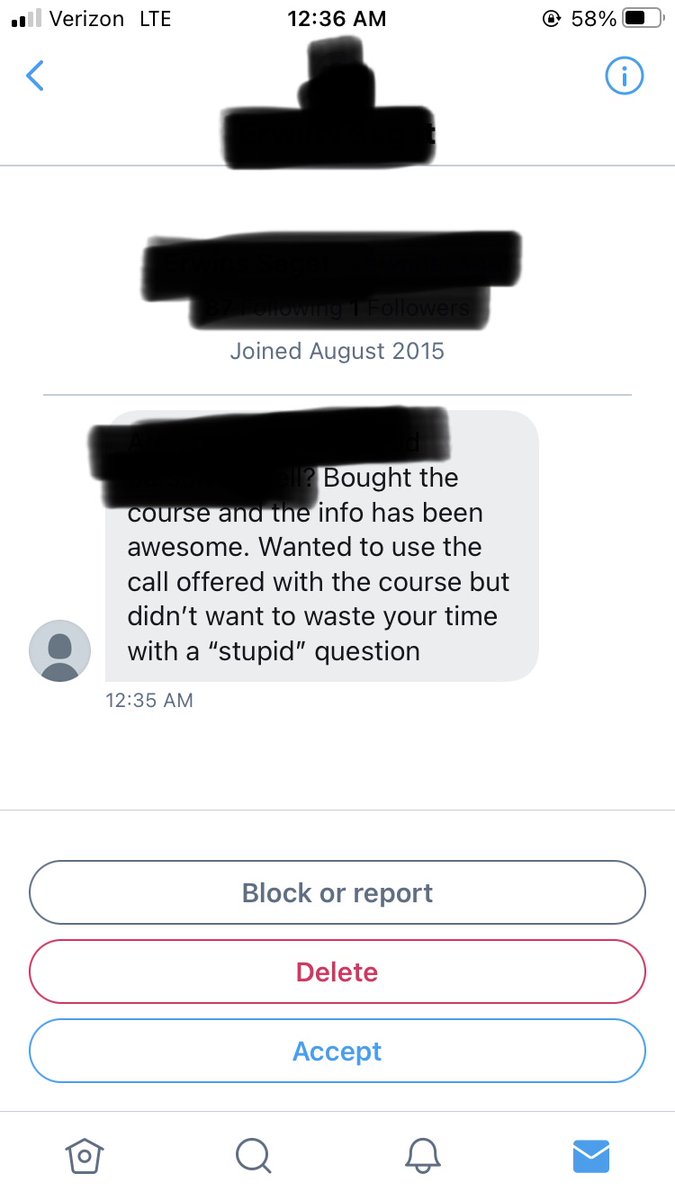

Some new reviews are below and course is linked at the bottom of the thread

If you have any questions, feel free to send a DM

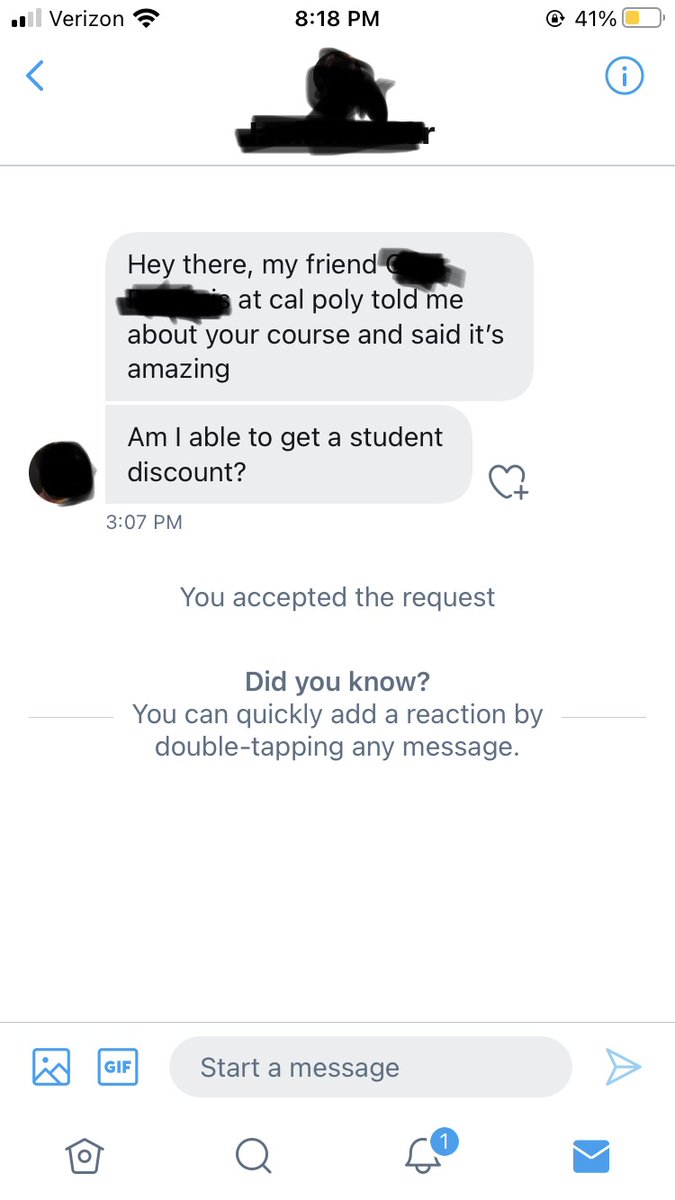

Link is below. As a reminder, students and veterans get 75% off (DM for discount code)

therealestategod.gumroad.com/l/trdbw

therealestategod.gumroad.com/l/trdbw

• • •

Missing some Tweet in this thread? You can try to

force a refresh