Maybe the US markets are not about Evergrande ... maybe it is Washington.

A thread to explain.

Let's start with this from CNN (!).

They are finally saying the quiet part out loud. His presidency is on fire, because his own party is the problem.

1/4

edition.cnn.com/2021/09/22/pol…

A thread to explain.

Let's start with this from CNN (!).

They are finally saying the quiet part out loud. His presidency is on fire, because his own party is the problem.

1/4

edition.cnn.com/2021/09/22/pol…

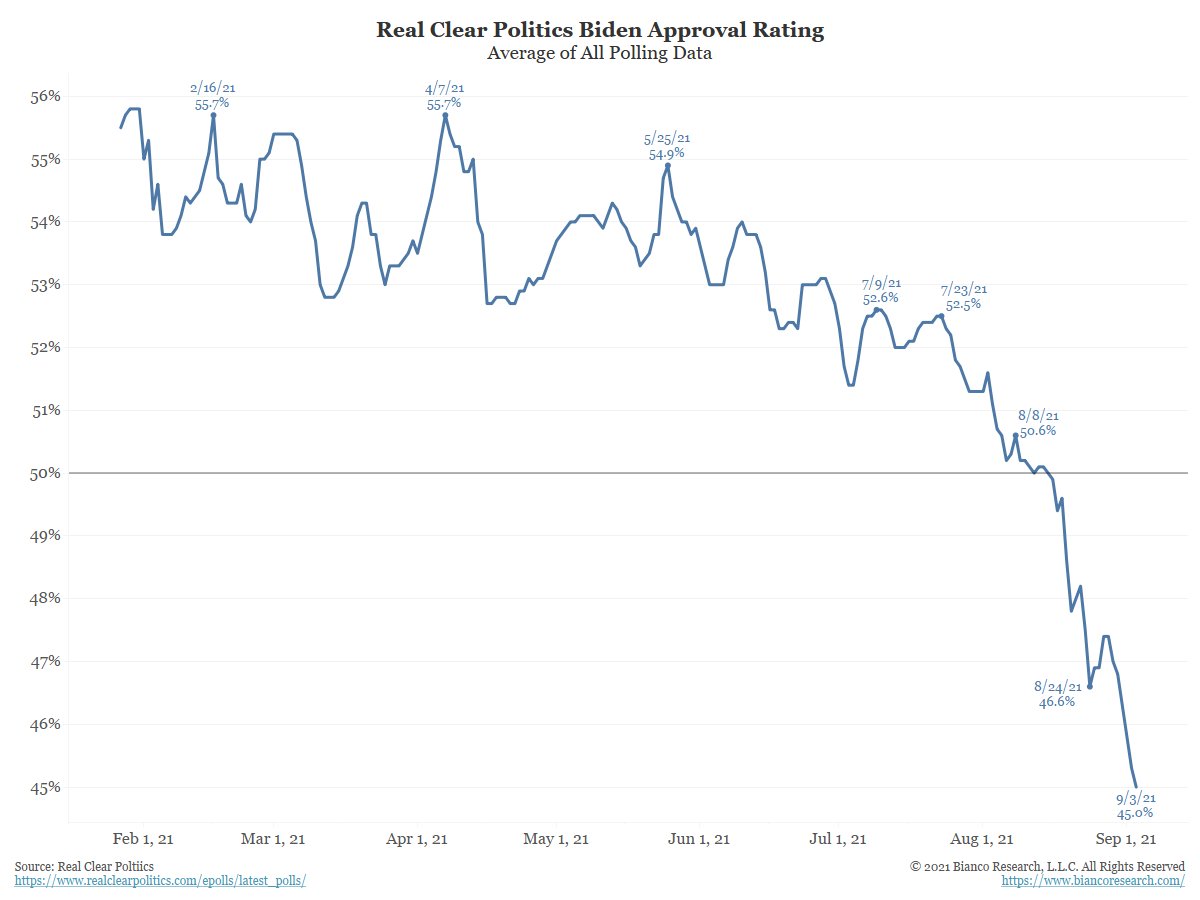

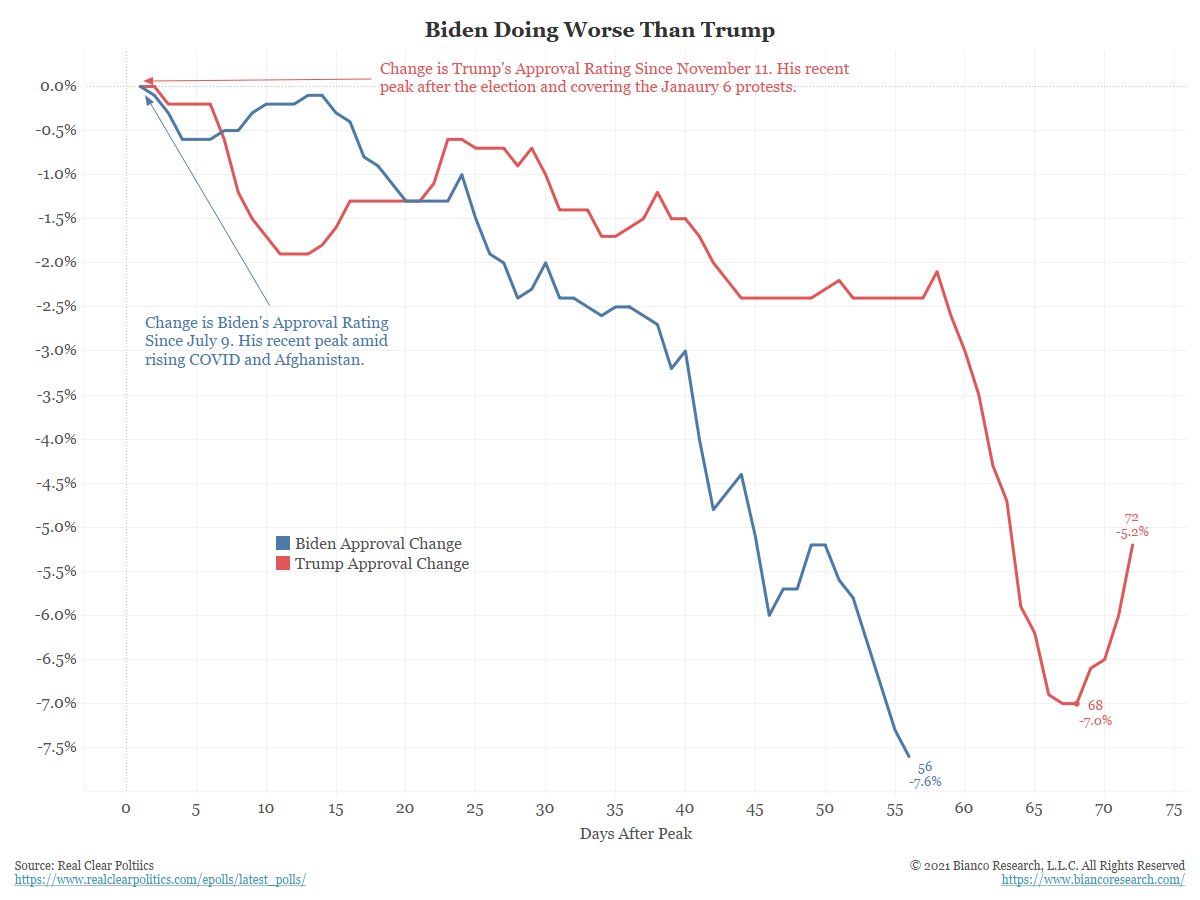

While his appr rating might be bottoming (Gallup today at 43%, so we'll see), his disappr keeps making new highs.

In a polarized world where the vast majority will never chg their opinion (either way), this is a big move and only about 2% higher than Trump on election day.

2/4

In a polarized world where the vast majority will never chg their opinion (either way), this is a big move and only about 2% higher than Trump on election day.

2/4

Rs are saying "Ds, you do it"

Biden is going have to use his political capital to get Ds to pass spending/debt ceiling.

Again, see Biden's approval/disapproval chart above ... what political capital? It seems to be disappearing by the day.

3/4

cnn.com/2021/09/22/pol…

Biden is going have to use his political capital to get Ds to pass spending/debt ceiling.

Again, see Biden's approval/disapproval chart above ... what political capital? It seems to be disappearing by the day.

3/4

cnn.com/2021/09/22/pol…

Why is this important, because a never ending stream of Wall Street Pundits on financial TV confidently saying the spending bill will be passed and the debt ceiling will be raised. Assumed in these comments is all this will happen without any drama.

Are we sure?

4/4

Are we sure?

4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh