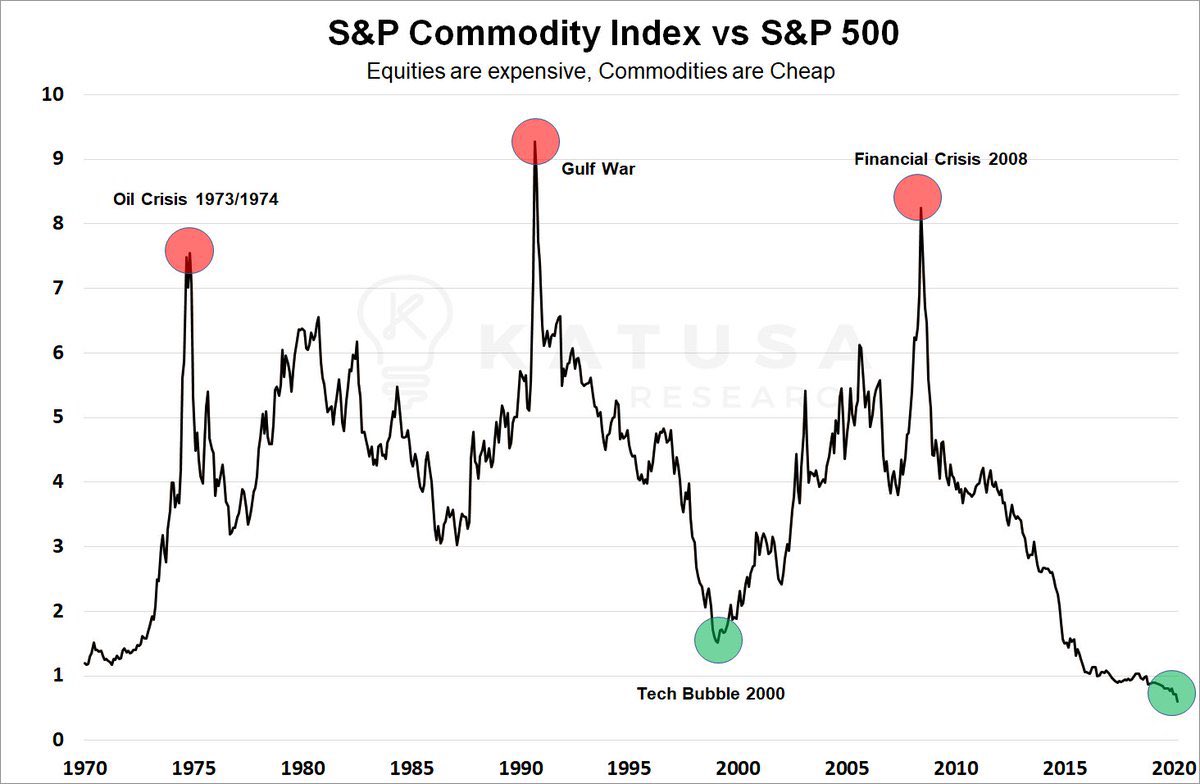

Most important chart right now. Forget the noise and volatility. Those who make the switch to commodities and commodity related stocks will massively out perform over the next decade.

For the retired, it will cement your retirement and allow you to improve your standard of living.

For those that have build up savings in there prime earning years it will mean compounding and earlier retirement.

For the youth, it’s a chance to not only start building wealth.

For those that have build up savings in there prime earning years it will mean compounding and earlier retirement.

For the youth, it’s a chance to not only start building wealth.

But for the youth this is where you made decisions that make all the difference in your careers. Choosing to seek work in the commodity sector will allow you to out earn and out invest your peers. Young lawyers, accountants, tech, marketing etc.

Build relationships with resource companies and watch your business grow with theirs. Work for them, build them, contract, consult, learn and prosper with them.

For those in other non-resource sectors you’ll experience relative wage deflation and focus your investments in money losing sectors. Struggle to avoid job cuts and spending cuts in shrinking businesses that face both margin pressure and valuation multiple compression.

Making these 10 year calls one of the very most important actions to take both investment wise and career related.

I’ll be continuing to build positions in small cap resource stocks and share my experience. Focus will be on undercovered companies and sectors.

I’ll be continuing to build positions in small cap resource stocks and share my experience. Focus will be on undercovered companies and sectors.

Getting deeply invested in companies that the investment community will end up supporting and raising capital for at much higher levels as they grow. Staying well ahead of the crowds is the goal. Building new positions in things I think can 10x or hopefully 20x+

• • •

Missing some Tweet in this thread? You can try to

force a refresh