The big resource macro tail wind that I’m hearing from industry guys is the lack of labour is surprising everyone. Everyone is struggling to attract and train mining industry people.

Was talking to a coal industry veteran today and it was very revealing

Was talking to a coal industry veteran today and it was very revealing

The record coal pricing in Australia is now moving around the globe. Port capacity is a huge issue everywhere along with rail, shipping etc. But, they industry is in shock how tough it is to try to hire and train people. Especially mining workers

Some of us aren’t so surprised that the industry has ‘lost a generation’. One comment that stuck with me is ‘we are competing with fedex’ for workers. Seems like the idea of tolling away in a 4-5ft coal seam aint as much fun as playing the video game ‘minecraft’

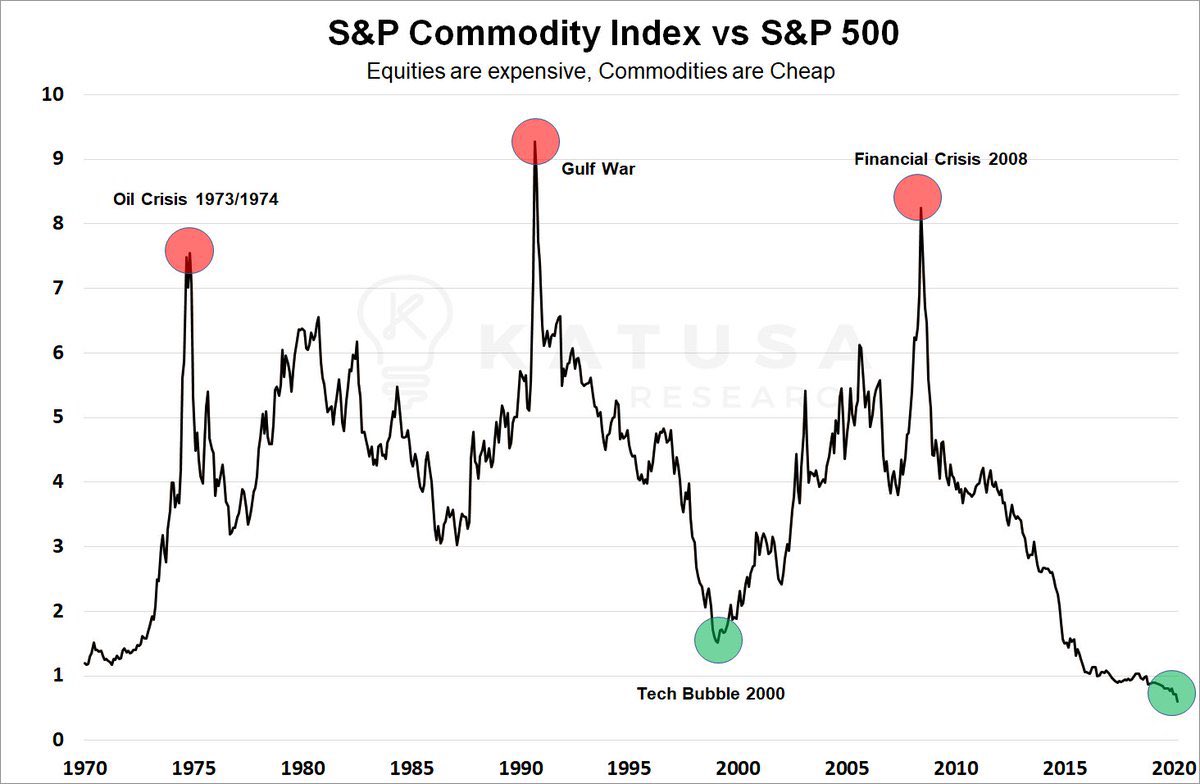

I’m expecting massive wage inflation to follow mind blowing price rises as we proceed along in this resource bull. These industries have been battered and broken by the 10 year plus bear market. The owners are gun shy about expansion if it means committing to big wage increases

As an example, unless the steel industry gets long term contracts with great pricing they won’t sign long term met coal deals with coal producers. Until the coal industry gets those long term solid pricing deals they are content to wait and model expansion but not execute

Despite the fact that we are seeing all time high coal prices I think the supply response will remain muted and the labour market will just get tighter and tighter. The industry will need to double miner wages or more this cycle. And they will deserve every penny.

This leads me back to the #uranium industry that still doesn’t even have a uranium price that justifies mine restarts or new mine builds. The #uranium price is most certainly going to go bonkers very soon. Just like met coal.

The #uranium industry will be back of the bus trying to source labour and equipment. Many other resource companies are already trying and failing miserably to ramp up. I expect the supply forecasts to fall way behind current models unless like met coal uranium heads to ATH $180

Be prepared to be patient as a there will continue to be conviction tests ahead. But just know the uranium price is too low and the longer it stays low the higher the price rise will ultimately be. We will be well paid to wait it out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh