I had been planning to do a daily China thread this week. But things got a little busy, so I am behind schedule. In any case, here are some observations on why the Renminbi (CNY) is so stable, despite the risk aversion around Evergrande...

Let us start with a recap:

white line is usdcnh (the cnh is holding at around the strongest level since 2018 [low is strong])

yellow line is CNY vs basket (the CNY is strong on a broad basis, around a 5y high [high is strong on this metric]

white line is usdcnh (the cnh is holding at around the strongest level since 2018 [low is strong])

yellow line is CNY vs basket (the CNY is strong on a broad basis, around a 5y high [high is strong on this metric]

Hence, while many Chinese assets (from real estate credit to tech equities) have been on the back foot, the currency has been stable, or even strengthening.

It is worth comparing to the early COVID shock, which was China centric in Jan-Feb 2020 (before the Milan outbreak). At that point, CNY outperformed on a basket basis, and vs the EUR (although it did slide vs a globally strong USD, not shown)

Hence, the experience from 2020 and 2021 is that the CNY (or CNH) is resilient to (even) domestic shocks.

But was it always like this?

But was it always like this?

NO! Anybody who traded in 2015 will remember the days when the CNY was under extreme pressure as a function of domestic economic weakness, unwinding of carry trades and counter-productive FX policy.

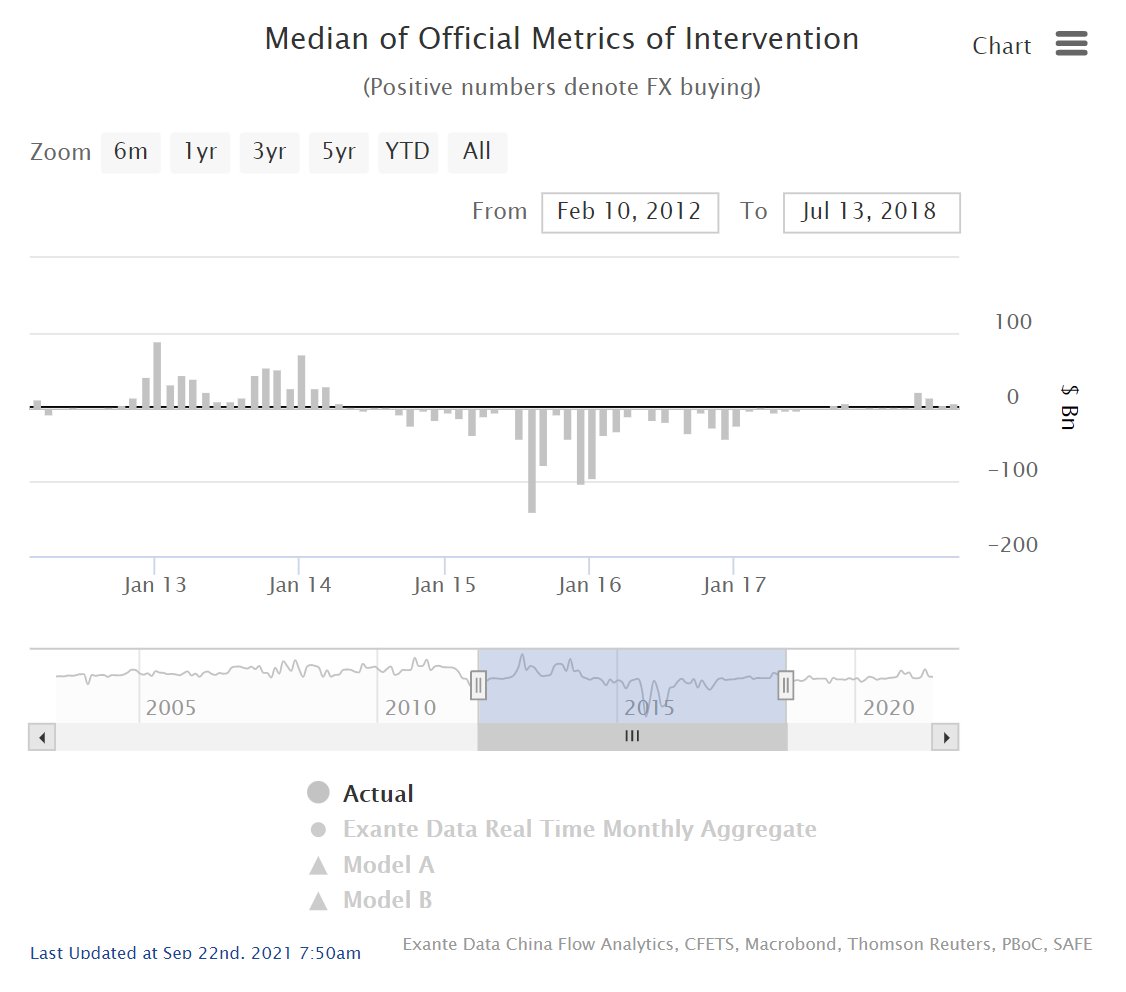

Back in August 2015 the CNY dropped very quickly (about 5% vs the USD) and the PBOC had to step in and intervene in probably the biggest support operation in the history of the world (>$100bn in August alone)

(and the cumulative interventions added up to around $1000bn)

(and the cumulative interventions added up to around $1000bn)

What has changed since?

Back in 2015, China was working towards currency convertibility (free cross-border movement of capital). But in January 2017 something fundamentally changed. China was able to stabilize the currency, without spending any money (FX) on it?

Back in 2015, China was working towards currency convertibility (free cross-border movement of capital). But in January 2017 something fundamentally changed. China was able to stabilize the currency, without spending any money (FX) on it?

Behind the scenes, they closed all the holes in the balance of payments (from current account to capital account), and the currency stabilized (it also helped that a lot of carry trades had been unwound by then).

The key point is that China is a unique country. The economy is huge. But it is still able to micro manage the currency, via various types of intervention: direct or much more subtle. Whether they need it (right now) is a different topic.

Right now, the balance of payments is supported by strong exports, and lack of FX drain from outbound tourism (we can do a separate thread on all that later).

But let us first talk about what the PBOC wants (because it has a history if getting it, at least on the FX front). The PBOC and the broader policy apparatus wants a resilient currency: a reserve currency.

They have been working very hard, especially over the last five years to achieve reserve currency status, and they have had some success. Look at this chart of CNY share of global reserves. It is going up (and this was before Russia bought more a few months ago).

At this juncture, they have a big challenge at hand in the local real estate market. The last thing they want is that sectoral instability to be mirrored in macro instability, and the currency is the most overt reflection of such instability.

Macro weakness can trigger capital flight dynamics, and that is bad, and especially bad if you want a reserve currency reputation.

They want their currency to behave like a reserve currency & since they have little external debt (especially in foreign currency) and still $3 trillion in reserves (as well as all the informal levers) they have a lot of ways to get what they want (and > six years of credibility)

The bottom line is: The Chinese currency is trading very resiliently in the face of even a domestically generated shock (outperforming other Asian currencies). And this is not very surprising, given the structure of the external balance sheet and the desires of policy makers.

I will leave it at that. How much damage we will see around Chinese real estate remains unknown. But it is pretty clear that policy makers will work very hard to avoid damage to the CNY's reputation. END

• • •

Missing some Tweet in this thread? You can try to

force a refresh