Sep 23, 2021 - Weekly expiry, preceded by the FOMC meet and not to mention the gap up which then turned out to be a trending day

Here’s how the strangles were converted into straddles & how the positions were managed!

Time for a Thread 🧵

Here’s how the strangles were converted into straddles & how the positions were managed!

Time for a Thread 🧵

• Wednesday night (IST) there was an event, FOMC meet

• Markets were jittery, as they say, when US sneezes the world catches cold

• Both Dow & Nifty were weak

• All eyes were fixed on the Fed Reserve Chair Jerome Powell’s take on interest rate and the pace of asset purchases

• Markets were jittery, as they say, when US sneezes the world catches cold

• Both Dow & Nifty were weak

• All eyes were fixed on the Fed Reserve Chair Jerome Powell’s take on interest rate and the pace of asset purchases

• So didn’t wanted to get caught on the wrong side, hence on Wednesday noon Shorted a strangle

• ~700-800 points away from where the BNF was about to close i.e. 37k levels

• 37800 CE @ 43 & 37700 CE @ 34 & 36200 PE 28 & 36300 PE at 34

• ~700-800 points away from where the BNF was about to close i.e. 37k levels

• 37800 CE @ 43 & 37700 CE @ 34 & 36200 PE 28 & 36300 PE at 34

• On Wednesday 37K strike witnessed heavy CE & PE Open interest 2.5mn & 2mn of CE & PE writing respectively

• On Wed night, the cat was out of the bag and Mr. Powell kept interest rates at zero & continued the current pace of asset purchases

• Dow celebrated the news and on Thursday morning (weekly expiry) i.e. Sep 23, 2021 BNF opened with a gap up of ~300 points and opened at 37241

• Dow celebrated the news and on Thursday morning (weekly expiry) i.e. Sep 23, 2021 BNF opened with a gap up of ~300 points and opened at 37241

• PE legs were trading in single digits by then so squared them off

• At the gap up open of 300 points, it was very clear that BNF will get support from short covering rally from 37k, 37100 & 37200 CE writers

• At the gap up open of 300 points, it was very clear that BNF will get support from short covering rally from 37k, 37100 & 37200 CE writers

• Before the market started off these were my levels 37300-37400 immediate resistance followed by R1: 37600-37625 & R2: 37800

• 37700 CE was slightly trading above my cost by then

• Was observing only two things:

1.Price action

2.Change in open interest

• Was observing only two things:

1.Price action

2.Change in open interest

• At the gap-up open of 300 points, it was very clear that there will be short covering rally from 37k, 37100 & 37200 CE writers, but then I thought it might face resistance at 37500

• At 10 am BNF made solid 4 back to back green candles (15min TF) and closed at 37600 by then 37500 PE writers > CE writers, so closed all the PE legs

• At 10.15am, 37500 PE writers were overpowering CE writers it was imminent that BNF was going to witness more short covering

• All this while, was rolling up PE’s till 37000, as I was expecting BNF may reverse from 37500

• At 10.20am BNF closed >36600 (on the charts) and by then 37600 PE writers > 37600 CE writers, hence concluded that 37500 could be a strong support for the day

• At 10.20am BNF closed >36600 (on the charts) and by then 37600 PE writers > 37600 CE writers, hence concluded that 37500 could be a strong support for the day

• So now that it was clear that 37500 would act like a support for the day, with 37600 PE also witnessing more PE writing

• Closed 37k Pes and just shorted 37700 PE at 158 & 37800 CE at 223

• Basically converted 37700 & 37800 into straddle from strangle

• Closed 37k Pes and just shorted 37700 PE at 158 & 37800 CE at 223

• Basically converted 37700 & 37800 into straddle from strangle

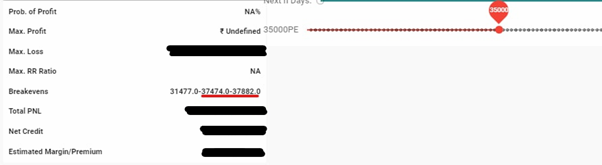

• Post doing these all adjustments, the Break even range was 37500-37900

• Since view on the support for the day was clear i.e. 37500 had to manage only if BNF crosses the upside breakeven

• Since view on the support for the day was clear i.e. 37500 had to manage only if BNF crosses the upside breakeven

• Post 12noon, BNF sustained >37700 in spot, so thereafter 37700CE writers too were taken to the laundry

• BNF took exact resistance at 37800 as indicated in the charts, and thus the strangle which was converted into straddle worked like a charm

• Since it was an expiry day, it was clear that need to put a fight only for just 6 hours, and the short covering rally usually never disappoints, this is how the positions were managed

And that's how we roll🥳🥳🥳

https://twitter.com/AdityaTodmal/status/1440980819737137154?s=20

Hope you enjoyed reading this thread! 🧵

Will be posting more such curiosity-inducing threads 🤠

Will be posting more such curiosity-inducing threads 🤠

• • •

Missing some Tweet in this thread? You can try to

force a refresh