Several high g tech co's are at eye-watering multiples

What IRR can you get over 3,5,7 yrs if their P/S multiple halves or gets cut to a third?

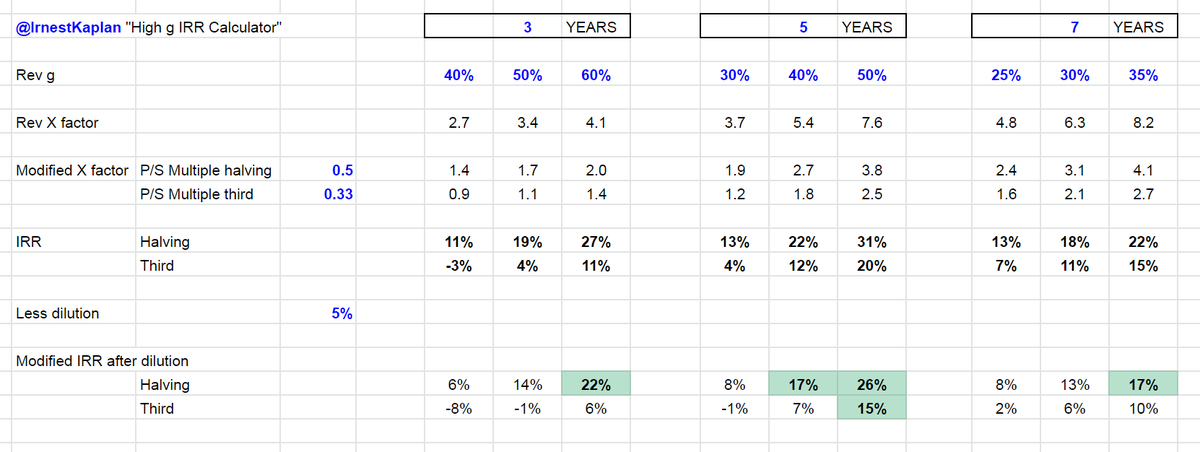

Here's my basic IRR calculator for this situation

Bottom line - if multiples get tanked, it's going to be hard to get a decent IRR

What IRR can you get over 3,5,7 yrs if their P/S multiple halves or gets cut to a third?

Here's my basic IRR calculator for this situation

Bottom line - if multiples get tanked, it's going to be hard to get a decent IRR

The calculator is simple & self explanatory

(link at end of thread)

We consider 3, 5 & 7 yr timeframes

Assume compound forw rev growth

Assume 2 scenarios on P/S multiple (halving & "thirding")

Assume dilution

Work out the final IRR

Green blocks means >15% IRR over that period

(link at end of thread)

We consider 3, 5 & 7 yr timeframes

Assume compound forw rev growth

Assume 2 scenarios on P/S multiple (halving & "thirding")

Assume dilution

Work out the final IRR

Green blocks means >15% IRR over that period

Lets use $CRWD - Crowdstrike as an example

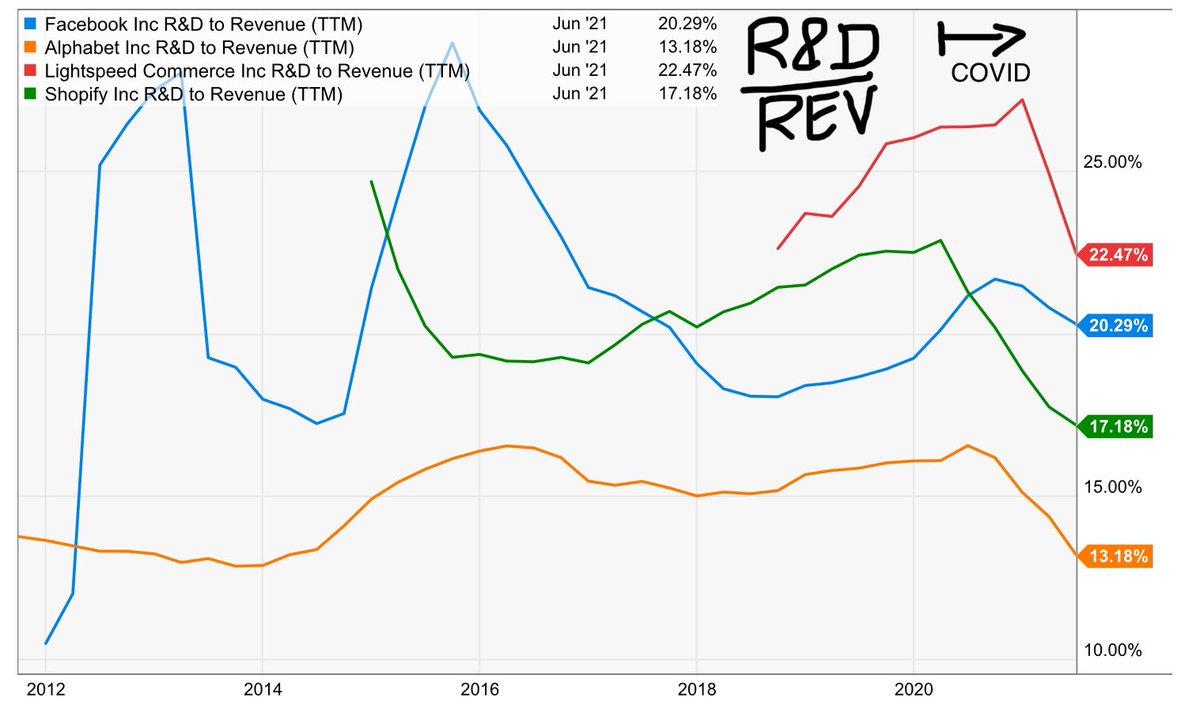

Have a look at the @ycharts chart below

Rev g declining. Now on about 70% (blue line)

P/S multiple has gone up hugely to 51x. Was about 20x before COVID (where the cursor is in the chart)

#Shares has gone up about 10% in last 1.5y

Have a look at the @ycharts chart below

Rev g declining. Now on about 70% (blue line)

P/S multiple has gone up hugely to 51x. Was about 20x before COVID (where the cursor is in the chart)

#Shares has gone up about 10% in last 1.5y

So let's start thinking about the future

Over the next 3y, what can $CRWD compound its rev at?

It's already quite big now at $1B. For IT Security that's not small.

Is it 40/50/60%? I'd say 50% would be a good achievement

Over the next 3y, what can $CRWD compound its rev at?

It's already quite big now at $1B. For IT Security that's not small.

Is it 40/50/60%? I'd say 50% would be a good achievement

Next

Can the PS multiple go down to 17x in 3y?

Why not?

It was around that multiple before COVID and was growing faster then.

That's a third of the current multiple

(It does depend though on the growth & profitability. $CRWD has a high GP mgn of 74%)

Can the PS multiple go down to 17x in 3y?

Why not?

It was around that multiple before COVID and was growing faster then.

That's a third of the current multiple

(It does depend though on the growth & profitability. $CRWD has a high GP mgn of 74%)

And what about dilution?

I think it could easily be 5% per yr for the next 3y

Well if that's the case, look at the IRR calculator, go to 3 years, 50% rev g column and look at the IRR. Its 4% if the multiple is a third

After dilution its a negative 1%.

I think it could easily be 5% per yr for the next 3y

Well if that's the case, look at the IRR calculator, go to 3 years, 50% rev g column and look at the IRR. Its 4% if the multiple is a third

After dilution its a negative 1%.

One can say 3 yrs is too short, lets look at 5 yrs

Ok, but then the rev g needs to be a bit lower.

By the way, because $CRWD is now on $1B rev, that Rev X factor row conveniently represents their revenue at the end of the period.

You can do the same for 7y

Ok, but then the rev g needs to be a bit lower.

By the way, because $CRWD is now on $1B rev, that Rev X factor row conveniently represents their revenue at the end of the period.

You can do the same for 7y

I have no clue what the forward rev g is going to be - but my feeling is it will continue slowing

Current fcasts are 61%, 38% and 32% (FY22, 23 & 24)

If that were to happen, it wld mean 43% compounded. Even if PS multiple only halved, we'd still get only 6% IRR from here.

Current fcasts are 61%, 38% and 32% (FY22, 23 & 24)

If that were to happen, it wld mean 43% compounded. Even if PS multiple only halved, we'd still get only 6% IRR from here.

Bottom line is that the multiples can fluctuate wildly and if they were to come down to more "reasonable levels", the IRR we can expect from here is not too good

Unless growth can stay fairly high for quite a while - but that is hard to get comfort on

Unless growth can stay fairly high for quite a while - but that is hard to get comfort on

Tagging @vijay9933

Our discussion in another thread prompted me to do these calculations.

Am just sharing this so you can see, it might help to view things differently and help shape your thinking

Our discussion in another thread prompted me to do these calculations.

Am just sharing this so you can see, it might help to view things differently and help shape your thinking

Tagging a few friends to have a look

@saxena_puru

@Crussian17

@MadsC007

@Badpak

@MyuranRaj

@10kdiver

@Investing_Lion

@gabrielkaplan

@FromValue

@JonahLupton

@hhhypergrowth

@CJOppel

@BahamaBen9

@Picolinie

@FrankYanWang

@aadhansen

@EugeneNg_VCap

@dhaval_kotecha

@saxena_puru

@Crussian17

@MadsC007

@Badpak

@MyuranRaj

@10kdiver

@Investing_Lion

@gabrielkaplan

@FromValue

@JonahLupton

@hhhypergrowth

@CJOppel

@BahamaBen9

@Picolinie

@FrankYanWang

@aadhansen

@EugeneNg_VCap

@dhaval_kotecha

Some more investing friends

@Investmentideen

@investing_city

@InvestmentTalkk

@PelotonHolder

@clueless_1337

@PatternProfits

@InvestiAnalyst

@mukund

@Invesquotes

@benitoz

@iramneek

@plantmath1

@Matt_Cochrane7

@skaushi

@Investmentideen

@investing_city

@InvestmentTalkk

@PelotonHolder

@clueless_1337

@PatternProfits

@InvestiAnalyst

@mukund

@Invesquotes

@benitoz

@iramneek

@plantmath1

@Matt_Cochrane7

@skaushi

Also would like @honam to take a look

• • •

Missing some Tweet in this thread? You can try to

force a refresh