Random disorganized thoughts on "rebalancing" 👇👇👇

Why do we rebalance?

Cos market movements change asset prices, which causes our actual exposures to deviate from the ones we want.

Also, our views on asset returns and (co)risk might change and need to be updated.

1/n

Why do we rebalance?

Cos market movements change asset prices, which causes our actual exposures to deviate from the ones we want.

Also, our views on asset returns and (co)risk might change and need to be updated.

1/n

The trading problem (ignoring txn cost) is to:

- forecast expected returns (alpha) over some forward horizon

- model risk (including the relationship between assets)

- find a set of asset weights we think maximizes our objective (risk-adjusted returns) subject to some stuff

2/n

- forecast expected returns (alpha) over some forward horizon

- model risk (including the relationship between assets)

- find a set of asset weights we think maximizes our objective (risk-adjusted returns) subject to some stuff

2/n

Rebalancing is really just shunting weights back in line when the market moves them away from where we want them.

In practice, rebalancing can look a bit more complicated because your alphas and risk estimates are changing too.

So let's assume your asset views are fixed.

3/n

In practice, rebalancing can look a bit more complicated because your alphas and risk estimates are changing too.

So let's assume your asset views are fixed.

3/n

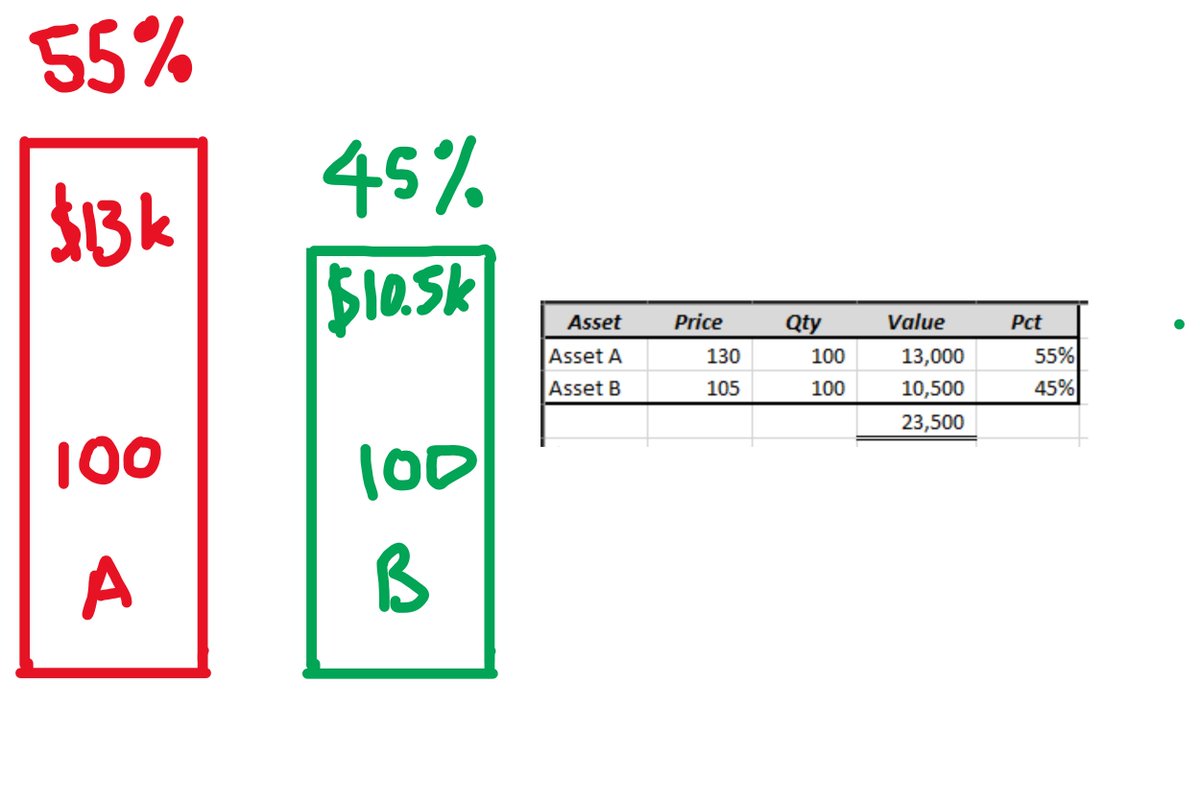

Assume we want a 50/50 dollar allocation to two assets: Asset A and Asset B.

You have $20k

You buy 100 units of Asset A, trading at $100 - a total value of $10k

You buy 100 units of Asset B, trading at $100 - a total value of $10k

4/n

You have $20k

You buy 100 units of Asset A, trading at $100 - a total value of $10k

You buy 100 units of Asset B, trading at $100 - a total value of $10k

4/n

Now market stuff happens...

Asset A goes up 30%

Asset B goes up 5%

Now we've got more money overall.

But our exposures are lopsided.

We have 55% of our money in Asset A and 45% of our money in Asset B

5/n

Asset A goes up 30%

Asset B goes up 5%

Now we've got more money overall.

But our exposures are lopsided.

We have 55% of our money in Asset A and 45% of our money in Asset B

5/n

So whadda we do?

Well... we probably don't want to just allow our portfolio exposures to wax and wane to the whims of the market gods.

We wanted a 50/50 allocation to the assets. So we need to push them back in line....

So we would sell some of A and buy B with it.

6/n

Well... we probably don't want to just allow our portfolio exposures to wax and wane to the whims of the market gods.

We wanted a 50/50 allocation to the assets. So we need to push them back in line....

So we would sell some of A and buy B with it.

6/n

So - assuming we're compounding our capital - we would:

- sell 10 units of Asset A

- buy 12 units of Asset B

So that our exposures are now equal to what we want them to be.

If this seems obvious that's cos it is.

7/n

- sell 10 units of Asset A

- buy 12 units of Asset B

So that our exposures are now equal to what we want them to be.

If this seems obvious that's cos it is.

7/n

I think it's obvious WHY you'd do this:

- you wanted certain exposures

- market gods gave you different ones

- so you push 'em back in line.

The alternative is to just let your exposures and risk drift about. Which would be dumb.

8/n

- you wanted certain exposures

- market gods gave you different ones

- so you push 'em back in line.

The alternative is to just let your exposures and risk drift about. Which would be dumb.

8/n

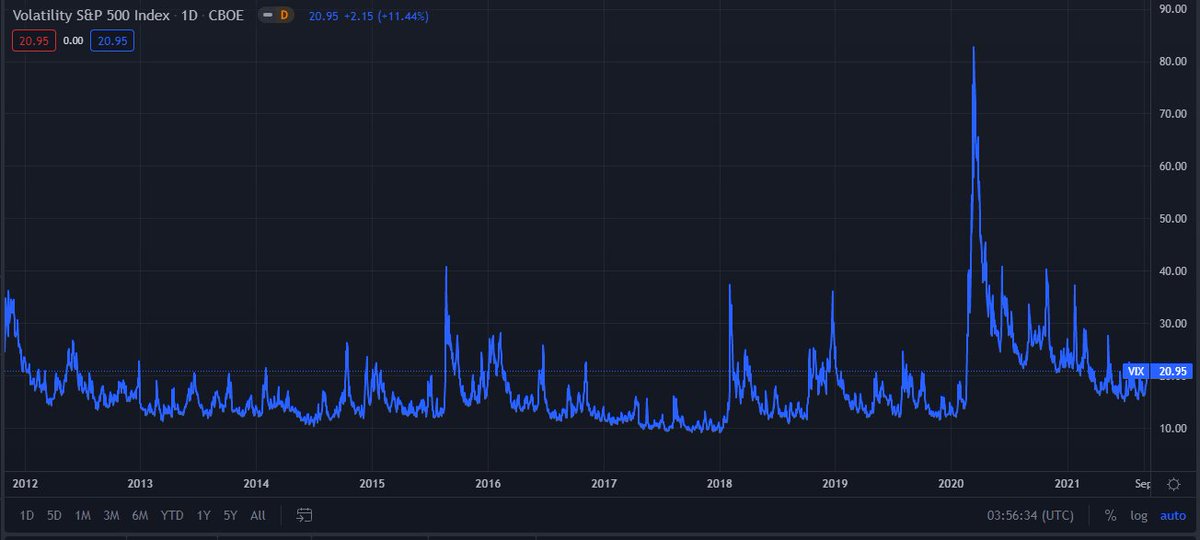

We expect rebalancing to improve our portfolio returns (over not doing it or doing it badly.)

That's because, if we allow our portfolio exposures to differ significantly from the ones we wanted, we run the risk of out-of-control risk in our portfolio.

9/n

That's because, if we allow our portfolio exposures to differ significantly from the ones we wanted, we run the risk of out-of-control risk in our portfolio.

9/n

So rebalancing keeps our risk in line - which should improve our overall expected portfolio returns, vs letting it all hang out.

There's nothing magical about this.

Managing risk improves our expected portfolio returns.

10/n

There's nothing magical about this.

Managing risk improves our expected portfolio returns.

https://twitter.com/therobotjames/status/1441976790944124931?s=20

10/n

What are other circumstances in which rebalancing might be expected to increase or reduce expected returns?

Well, ehen we rebalance we are selling the recent outperformer(s) and buying the recent underperformer(s).

11/n

Well, ehen we rebalance we are selling the recent outperformer(s) and buying the recent underperformer(s).

11/n

So if we see positive x-sectional momentum effects at the frequency we are rebalancing - we would expect rebalancing to hurt performance (ignoring risk management effects)

If we see x-sectional reversal effects we would expect rebalancing to help performance.

12/n

If we see x-sectional reversal effects we would expect rebalancing to help performance.

12/n

That is - if the thing that recently outperformed is likely to underperform in the future then rebalancing is going to help returns.

If the opposite is true it will hurt returns. (But you might need to do it anyway.)

13/n

If the opposite is true it will hurt returns. (But you might need to do it anyway.)

13/n

And if you think you have x-sectional lead/lag effects between your assets - it is best to model that in your return estimates (alphas) and risk model than try to shoehorn these considerations into rebalancing rules.

14/n

14/n

So - assuming fixed weights - rebalancing is mostly a trade-off between:

- managing risk - to improve portfolio geometric returns [more dynamic = better]

- minimizing trading costs [more dynamic = more expensive]

15/n

- managing risk - to improve portfolio geometric returns [more dynamic = better]

- minimizing trading costs [more dynamic = more expensive]

15/n

And now taking into account active views it's a navigation of the following trade-offs:

- the effectiveness/volatility/decay of your alpha signal (motivating fast rebalancing)

- the cost of trading (motivating less trading)

It's as simple and complicated as that, really.

16/n

- the effectiveness/volatility/decay of your alpha signal (motivating fast rebalancing)

- the cost of trading (motivating less trading)

It's as simple and complicated as that, really.

16/n

Useful reading on modelling and navigating these trade-offs:

Chapters 8 and 12 of Qua, Hua, Sorensen - Quantitative Equity Portfolio Management

17/17 Fin

Chapters 8 and 12 of Qua, Hua, Sorensen - Quantitative Equity Portfolio Management

https://twitter.com/macrocephalopod/status/1373216917058682881?s=20

17/17 Fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh