Great way to start the first trade with @Delta_Exchange on $BTC

This was a get in get out scalp move that I really enjoyed taking.

A quick run down per the thread below.

Feel free to head on over to Delta, using this link for a discount on fees

delta.exchange/MindsetBTC

This was a get in get out scalp move that I really enjoyed taking.

A quick run down per the thread below.

Feel free to head on over to Delta, using this link for a discount on fees

delta.exchange/MindsetBTC

So we've already marked up our key HTF levels

Then we add fibs to suit the move on the 1H TF (15M TF shown here though)

Then we add fibs to suit the move on the 1H TF (15M TF shown here though)

As we see how price is playing out, we pull our target fibs on the recent swing low to swing high, and see that the 0.705 level of the target fibs lines up nicely with the 0.236 1H HTF fibs

Dropping in at the 5M TF, we can pull our target fibs again to see where we'd enter a move (at the confluence levels we explored above)

If we then pull some target fibs in the opposite direction, this can give us some areas of possible trouble, or target tak profit areas

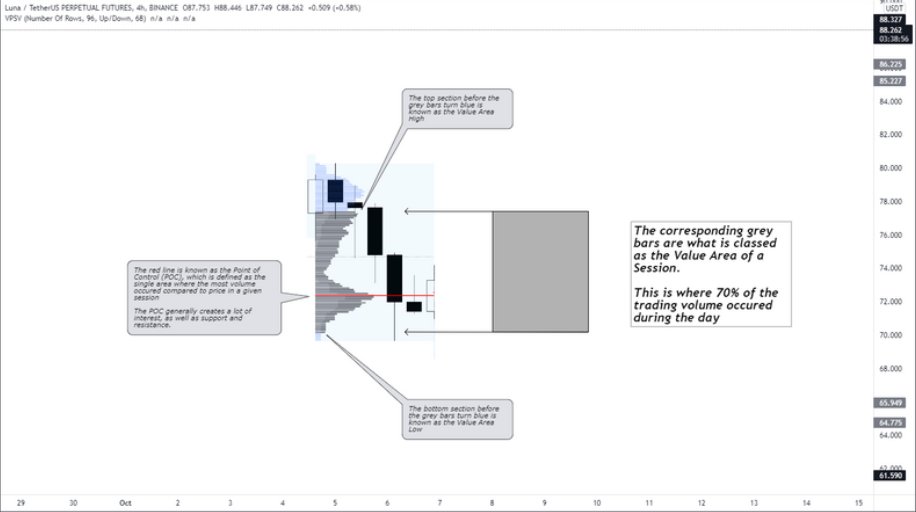

Also note that another factor of confluence was that price was trading at the Value Area Low of this region, which works well as a region to long.

Going back to our entry and long tool, you can see that our areas of trouble shown previously now line up with the -0.66 of our target fibs.

And? Well, lo and behold, we get an impluse move up and our targets are hit.

The same principles of the 5M chart can be used on a HTF chart, across any market.

Hopefully you can find some value in what I've shared here, and feel free to share.

Cheers,

Mindset ⚖️

The same principles of the 5M chart can be used on a HTF chart, across any market.

Hopefully you can find some value in what I've shared here, and feel free to share.

Cheers,

Mindset ⚖️

• • •

Missing some Tweet in this thread? You can try to

force a refresh