1/ Theoretical potential for loan book growth for banks in EMs can be 2-2.5x of GDP. So, banks have always appeared as a no-brainer way to play the EMs.

But not all banks are created equal, while growing loan book is easy - managing risk is difficult.

But not all banks are created equal, while growing loan book is easy - managing risk is difficult.

2/ Risk is not only driven by the policy and macro volatility but also due to constant govt. intervention & corruption in loan disbursement decisions.

Chinese banks have been a case in point. While China is the 2nd largest economy, its banks are one of the weakest.

Chinese banks have been a case in point. While China is the 2nd largest economy, its banks are one of the weakest.

3/ I will highly recommend reading @MarcRuby's latest blog on the constant troubles that Chinese banks find themselves in.

netinterest.co/p/no-time-to-d…

In a ZIRP world, getting capital may be easy but managing risk is still difficult.

This is why $HDB has been so special.

netinterest.co/p/no-time-to-d…

In a ZIRP world, getting capital may be easy but managing risk is still difficult.

This is why $HDB has been so special.

4/ Indian banks have had their fair share of credit blow-ups & frauds.

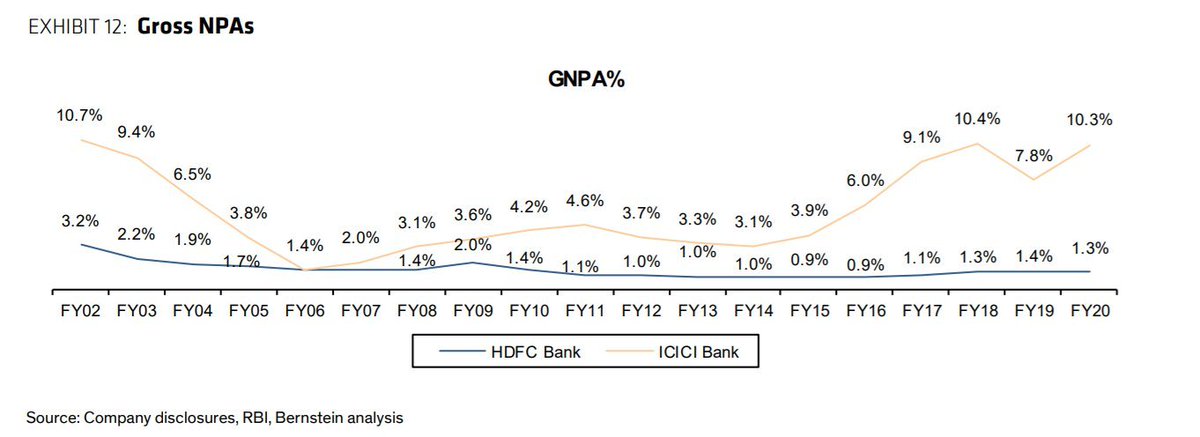

BUT, $HDB (#HDFCBANK) has the best lending practices in India with tight control over NPAs thru cycles.

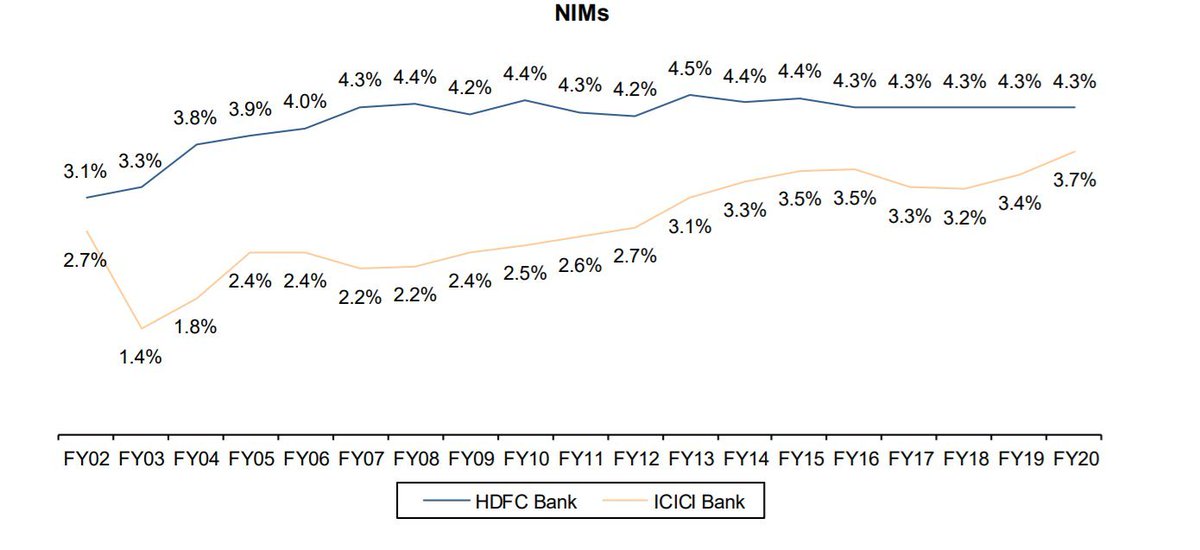

And NIMs are as stable as it gets despite the world turning to a Zero Interest Rate World.

BUT, $HDB (#HDFCBANK) has the best lending practices in India with tight control over NPAs thru cycles.

And NIMs are as stable as it gets despite the world turning to a Zero Interest Rate World.

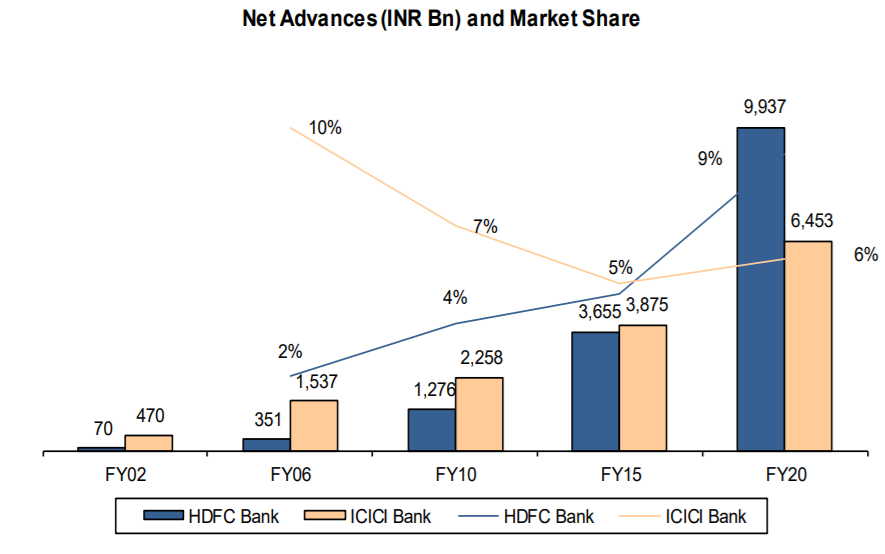

5/ Despite 2 decades 20%+ growth, $HDB is yet to saturate in any real term with 15% CAGR growth over the next decade easily achievable.

$HDB has been a true multiplier on India's growth & stock returns demonstrate that.

~65x in last 20yrs

~7x in last 10yrs

~2.5x in last 5yrs

$HDB has been a true multiplier on India's growth & stock returns demonstrate that.

~65x in last 20yrs

~7x in last 10yrs

~2.5x in last 5yrs

• • •

Missing some Tweet in this thread? You can try to

force a refresh