You want a strong currency, you export.

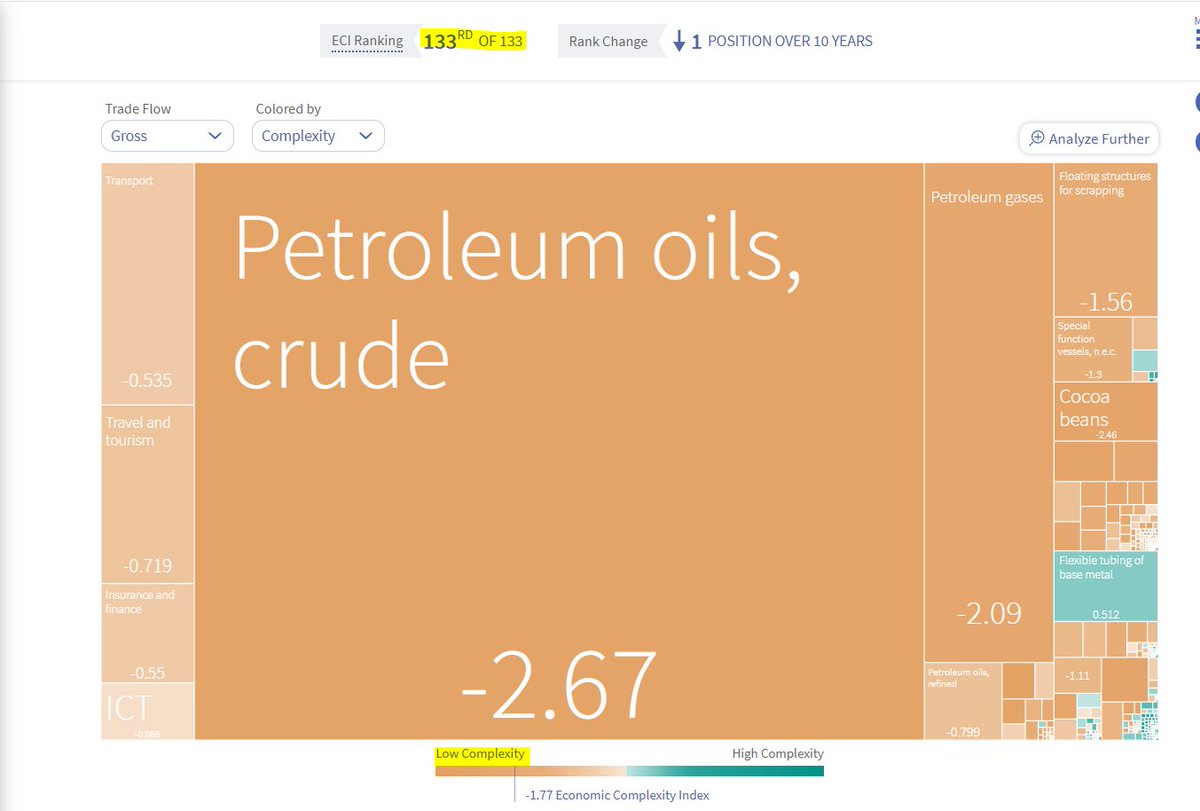

Nigeria technically has no exports apart from oil. This data map is 2019, and Cocoa is a "rounding error".

Keep in mind, Exports are NOT the only way to get forex, but so far, on exports, the nation has failed.

Data Source: Harvard KSG

Nigeria technically has no exports apart from oil. This data map is 2019, and Cocoa is a "rounding error".

Keep in mind, Exports are NOT the only way to get forex, but so far, on exports, the nation has failed.

Data Source: Harvard KSG

It gets worse.

"Nigeria's largest goods exports are in low and moderate complexity products"

translation? anyone can export crude oil, the wealth is in adding value to the crude oil or cocoa exports

"Nigeria's largest goods exports are in low and moderate complexity products"

translation? anyone can export crude oil, the wealth is in adding value to the crude oil or cocoa exports

"Diversifying the economy" is all talk

The Nigeria economy is diversified, Oil is less than 15% of GDP. Problem is Nigeria has only one export source of Forex. Remove remittances, the Nigeria Naira will collapse.

The data shows Nigeria has put all its eggs in the oil basket

The Nigeria economy is diversified, Oil is less than 15% of GDP. Problem is Nigeria has only one export source of Forex. Remove remittances, the Nigeria Naira will collapse.

The data shows Nigeria has put all its eggs in the oil basket

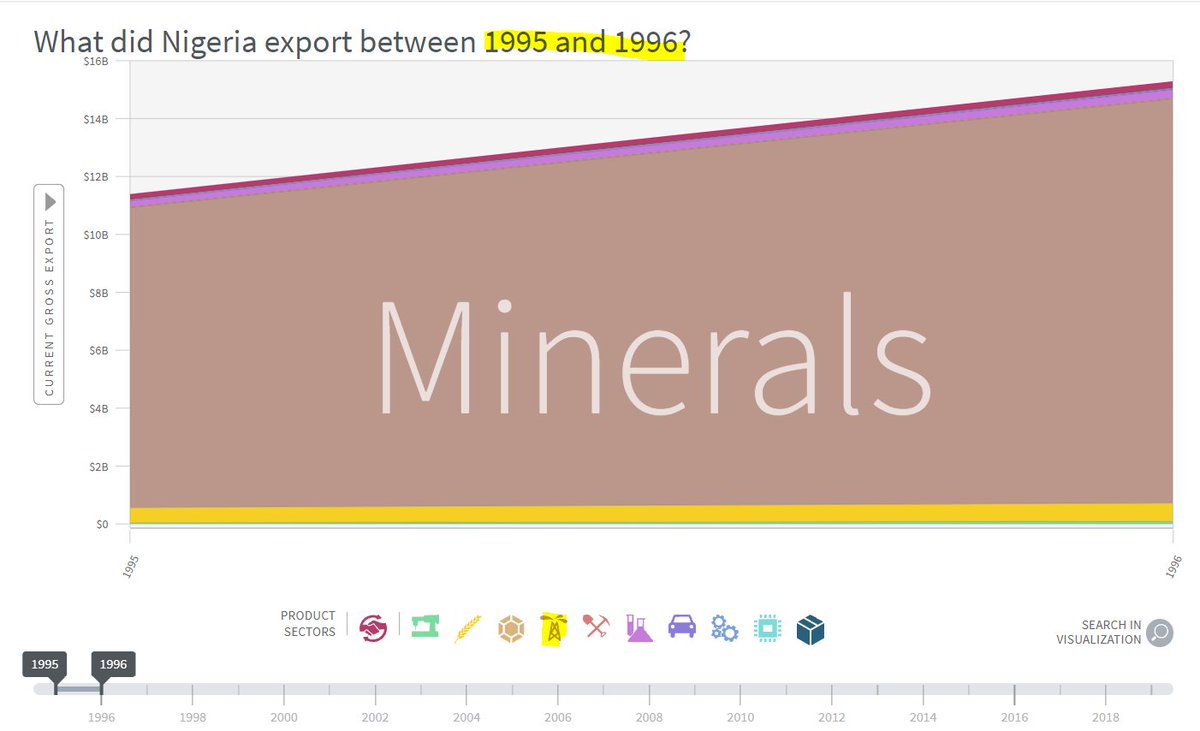

The Nigerian economy presently is INCREASING its reliance on crude oil, but its share of the global crude oil market is DECLINING.

Essentially, the fish is growing in a pond getting smaller and smaller....

Nigeria has not increased its share of any other export product.

Essentially, the fish is growing in a pond getting smaller and smaller....

Nigeria has not increased its share of any other export product.

This data is from 2019, the COVID recession happened in 2020.

In 2020, Nigeria is reported to have spent 98% of its revenues on debt servicing.

The Exchange rate is a fuel gauge, if the car is running low on gas, it shows. To keep the car moving, you put in fuel.

Period.

In 2020, Nigeria is reported to have spent 98% of its revenues on debt servicing.

The Exchange rate is a fuel gauge, if the car is running low on gas, it shows. To keep the car moving, you put in fuel.

Period.

• • •

Missing some Tweet in this thread? You can try to

force a refresh