DCA aka Dollar Cost Averaging📚

The most effective tool for a normie to invest

▪️ What is it?

▪️ Why is it so effective?

▪️ How it looks in reality?

▪️ Three types

▪️ When to use DCA & when do not

▪️ DCA out

▪️ Advanced techniques 🧐

1/25

The most effective tool for a normie to invest

▪️ What is it?

▪️ Why is it so effective?

▪️ How it looks in reality?

▪️ Three types

▪️ When to use DCA & when do not

▪️ DCA out

▪️ Advanced techniques 🧐

1/25

▪️ What is it?

Book explanation:

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across multiple purchases in an effort to reduce the impact of volatility on the overall purchase

2/25

Book explanation:

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across multiple purchases in an effort to reduce the impact of volatility on the overall purchase

2/25

In my own simple words, the trick is, we ain't trying to catch the precise bottom or the top.

We are merely trying to build an average price at a logical place with multiple buys or sell orders while being very close to it and still gaining immense profits.

3/25

We are merely trying to build an average price at a logical place with multiple buys or sell orders while being very close to it and still gaining immense profits.

3/25

▪️ Why is it so effective?

Because for most people catching the exact bottom or the top is a mission close to impossible.

This way we can get very close to buying the bottom & very close to selling the top and all of that with very little stress. Win-Win.

4/25

Because for most people catching the exact bottom or the top is a mission close to impossible.

This way we can get very close to buying the bottom & very close to selling the top and all of that with very little stress. Win-Win.

4/25

Most people don't have the resources to understand how bottoming structures look like.

It's also very hard to handle, both the bottoms & the tops psychologically and actually make the buys & then take the profits.

This method solves all of those problems

5/25

It's also very hard to handle, both the bottoms & the tops psychologically and actually make the buys & then take the profits.

This method solves all of those problems

5/25

▪️ How it looks in reality?

You set multiple levels of orders, starting at -40% pullback from the past ATH & then you continue with each order at another -5% it goes lower.

In this example, we set 5 orders in which 4 got filled and we made an avg buy price of 34 000$.

6/25

You set multiple levels of orders, starting at -40% pullback from the past ATH & then you continue with each order at another -5% it goes lower.

In this example, we set 5 orders in which 4 got filled and we made an avg buy price of 34 000$.

6/25

The buying range was going from 39 000 to 26 000$

Considering we used the same amount for buying, i.e. 10 000$ worth of #BTC at each level (4/5), we bought 1,176 #Bitcoin. Our average price is 34 000$

A price most would wish to have these days... Currently at 47% profit

7/25

Considering we used the same amount for buying, i.e. 10 000$ worth of #BTC at each level (4/5), we bought 1,176 #Bitcoin. Our average price is 34 000$

A price most would wish to have these days... Currently at 47% profit

7/25

▪️ Three types

There are three types to do DCA-in/out based on:

1) Percentage

2) Round numbers

3) Time

8/25

There are three types to do DCA-in/out based on:

1) Percentage

2) Round numbers

3) Time

8/25

1) Percentage-wise

This type we have described in the example above.

You merely layer your orders in a price range you wanna buy. Could be -40% to -80% for example.

2) Round numbers

You set buys at each round number

Can look like this: 40K - 35K - 30K - 25K and so on

9/25

This type we have described in the example above.

You merely layer your orders in a price range you wanna buy. Could be -40% to -80% for example.

2) Round numbers

You set buys at each round number

Can look like this: 40K - 35K - 30K - 25K and so on

9/25

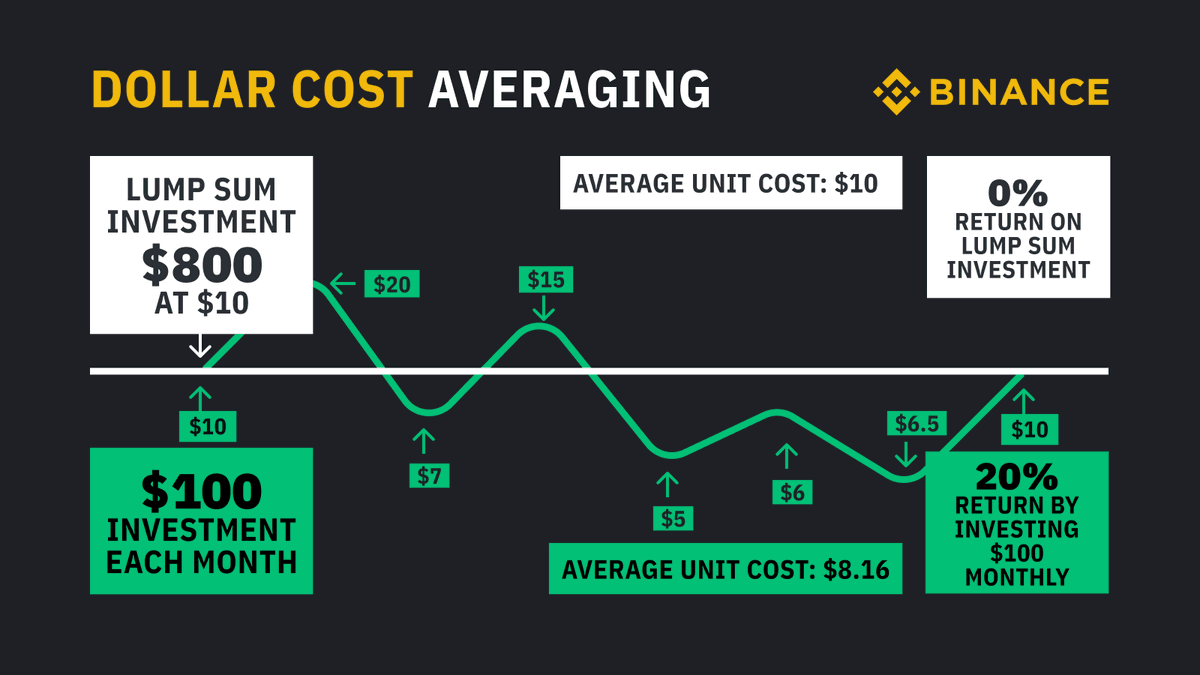

3) Time-wise

In this type, you are not trying to catch the bottom you are simply averaging your price every single time period.

For example, you buy every single week/month or a year.

This method I highly recommend for your pension saving.

10/25

In this type, you are not trying to catch the bottom you are simply averaging your price every single time period.

For example, you buy every single week/month or a year.

This method I highly recommend for your pension saving.

10/25

A monthly period is the best for smaller amounts used for pension saving.

Yearly is better for higher investments.

For example, if you own a company and wanna safely store your profits somewhere safe for a longer period of time and avoid inflation. A good one is #Bitcoin

11/25

Yearly is better for higher investments.

For example, if you own a company and wanna safely store your profits somewhere safe for a longer period of time and avoid inflation. A good one is #Bitcoin

11/25

▪️ When to use DCA & when do not

DCA is a great tool in time-proven markets with upside potential or at the very least in a market with strong fundamental values

It's a bad tool if you wanna buy a depreciative asset or one with no core values. Many $ALTs fall in here

12/25

DCA is a great tool in time-proven markets with upside potential or at the very least in a market with strong fundamental values

It's a bad tool if you wanna buy a depreciative asset or one with no core values. Many $ALTs fall in here

12/25

Let's use #Bitcoin as an example.

We understand its core values, we understand how halving works, and so on and therefore we expect it to continue to grow in Price & Value in time.

In such a market, this is one of the most effective stress-free tools you can use.

13/25

We understand its core values, we understand how halving works, and so on and therefore we expect it to continue to grow in Price & Value in time.

In such a market, this is one of the most effective stress-free tools you can use.

13/25

If you use it for an $ALT that will keep on depreciating as there is no demand for it and its values are just a copypasta or something similar, then this tool won't make much sense.

However, it's still better to enter at -40% to -80% pullback than FOMO at the top

14/25

However, it's still better to enter at -40% to -80% pullback than FOMO at the top

14/25

▪️ DCA out

Not only is this a great tool to be buying the bottoms, but it's also a great one to be selling the tops, or very close to them 😉

It works in the same way, as getting in

You set multiple layers of sell orders and make an avg sell price. Then you DCA-in again

15/25

Not only is this a great tool to be buying the bottoms, but it's also a great one to be selling the tops, or very close to them 😉

It works in the same way, as getting in

You set multiple layers of sell orders and make an avg sell price. Then you DCA-in again

15/25

▪️ Advanced techniques

This technique is so simple therefore it's really hard to get some advanced techniques yet it wouldn't be me if I wouldn't tweak it a bit 😉

16/25

This technique is so simple therefore it's really hard to get some advanced techniques yet it wouldn't be me if I wouldn't tweak it a bit 😉

16/25

a) From where to start layering your bids?

It depends on the market & the cycle we are in. Some pullbacks are gonna be way bigger than others

I highly recommend however to start at -40% to -50% and all the way down to -70% to -90% depending on the market. This one $LUNA

17/25

It depends on the market & the cycle we are in. Some pullbacks are gonna be way bigger than others

I highly recommend however to start at -40% to -50% and all the way down to -70% to -90% depending on the market. This one $LUNA

17/25

b) What % size at each level?

Good one is to set a higher bid at your first buying level & then either slowly start decreasing or keep the rest of the other same

The first order can be anything from 25-50% of your desired allocation to secure a position. Spread the rest

18/25

Good one is to set a higher bid at your first buying level & then either slowly start decreasing or keep the rest of the other same

The first order can be anything from 25-50% of your desired allocation to secure a position. Spread the rest

18/25

This tool is good if you wanna make sure you have a position in the asset and then keep adding the rest.

Positives: It makes sure you have a big position in the asset

Negatives: Higher avg price

19/25

Positives: It makes sure you have a big position in the asset

Negatives: Higher avg price

19/25

The reverse scenario is where you start with a small allocation and keep making it bigger as price goes lower

Positives: You get a very big position very close to the bottom

Negatives: If the price doesn't go as deep, your largest orders do not get filled.

20/25

Positives: You get a very big position very close to the bottom

Negatives: If the price doesn't go as deep, your largest orders do not get filled.

20/25

Both are good and the best to be applied at different assets differently.

However, the most important thing is this! Both get you the average buy price close to the bottom and that's all you should care about.

Another example that can be applied. Whichever suit you.

21/25

However, the most important thing is this! Both get you the average buy price close to the bottom and that's all you should care about.

Another example that can be applied. Whichever suit you.

21/25

The same thing can be applied for profit-taking

You start to take a certain % out of the market at each x % it does.

As a normie or even a pro, when we are at a price discovery we do not know how far it can go. Making an avg exit ensures the best exit.

22/25

You start to take a certain % out of the market at each x % it does.

As a normie or even a pro, when we are at a price discovery we do not know how far it can go. Making an avg exit ensures the best exit.

22/25

You do not need to exit with everything you can always leave a moonbag or move some part into a longer-term hold (for many years).

You then apply the same DCA-in strategy to get into the market again when it starts dropping again into that -40 to -90% territory

23/25

You then apply the same DCA-in strategy to get into the market again when it starts dropping again into that -40 to -90% territory

23/25

This way you can outperform the market with a stress-free ride or get into a new one with a calm mind and good avg price

I highly recommend for most newcomers with less than 1-2 years experience to mainly follow this strategy until they learn about the price behavior more

24/25

I highly recommend for most newcomers with less than 1-2 years experience to mainly follow this strategy until they learn about the price behavior more

24/25

I hope you have found this thread valuable and easy to apply.

If you did, as always, please consider sharing it with your friends as they might find it helpful as well and it helps to spread the awareness

Thank you 😉🙌

#DCA #DollarCostAveraging #Strategy #Investment

25/25

If you did, as always, please consider sharing it with your friends as they might find it helpful as well and it helps to spread the awareness

Thank you 😉🙌

#DCA #DollarCostAveraging #Strategy #Investment

25/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh