This is a comprehensive thread on the Buy-Now-Pay-Later Trend.

Why have the World's Largest Retailers chosen Affirm's BNPL solution instead of building their solution in-house?

This thread explores $AFRM's Competitive Advantage and the current Credit Card disruption:

Why have the World's Largest Retailers chosen Affirm's BNPL solution instead of building their solution in-house?

This thread explores $AFRM's Competitive Advantage and the current Credit Card disruption:

My Story with Affirm & BNPL started from tracking them on private Mkt's + Day 1 of the IPO:

I started accumulating shares from IPO day as seen below:

I have followed the story from the beginning, so I'm happy to share my journey/learnings:

I started accumulating shares from IPO day as seen below:

I have followed the story from the beginning, so I'm happy to share my journey/learnings:

https://twitter.com/InvestiAnalyst/status/1349484275393986562?s=20

1/ Let's begin with First Principles:

What is BNPL and how does a BNPL transaction work?

Who are the key partners?

Below is a great overview by my friend @mariogabriele. It breaks down all the key partners. BNPL is more complex under the surface, but this is a good starter:

What is BNPL and how does a BNPL transaction work?

Who are the key partners?

Below is a great overview by my friend @mariogabriele. It breaks down all the key partners. BNPL is more complex under the surface, but this is a good starter:

2/Key BNPL Success Determinants:

1/ Frictionless POS payment/checkout solution

2/ Relationship w Merchants

3/ History, experience & knowledge w. Underwriting/Credit

4/ Trust: Do consumers know and trust your Brand.

5/ Access to Capital: due to the high-velocity biz.

1/ Frictionless POS payment/checkout solution

2/ Relationship w Merchants

3/ History, experience & knowledge w. Underwriting/Credit

4/ Trust: Do consumers know and trust your Brand.

5/ Access to Capital: due to the high-velocity biz.

3/ Fintech BNPL Landscape & Distribution Models:

1. Direct Merchants across 3-continents: $AFRM $APT Klarna

2. Networks: $MA, $V

3. Issuers: Chase

4. White-label: Limepay

[H/t to @studios for the graphic]

1. Direct Merchants across 3-continents: $AFRM $APT Klarna

2. Networks: $MA, $V

3. Issuers: Chase

4. White-label: Limepay

[H/t to @studios for the graphic]

4/ *My* personal Thesis is that Affirm could be a future leader and emerge into a larger Fintech. What moat do they have?

It's important to understand the thesis & competitive advantage as primarily being the value for merchant and consumers. It's a 2-sided network

Let's go!

It's important to understand the thesis & competitive advantage as primarily being the value for merchant and consumers. It's a 2-sided network

Let's go!

5/ A) First-Mover Advantage in North America.

$AFRM was first to begin within this industry back in 2013/14 within the US.

They have a significant head start and 10-years of core competency before any of these recent current players that provides industry experience.

$AFRM was first to begin within this industry back in 2013/14 within the US.

They have a significant head start and 10-years of core competency before any of these recent current players that provides industry experience.

6/ Data, Data, and Data!

A huge part of $AFRM is the data preservation on every transaction that helps make their a) AI risk models better. Data for underwriting is unique to AFRM's ecosystem b) Understand customer transactions c) better enables them to improved lead generation

A huge part of $AFRM is the data preservation on every transaction that helps make their a) AI risk models better. Data for underwriting is unique to AFRM's ecosystem b) Understand customer transactions c) better enables them to improved lead generation

7/ BNPL Economics:{H/t @arampell}

$AFRM is working hard on building a ubiquitous parallel network for managing transactions for large retailers allowing product manufacturers avoid network rails like $V.

One result of this is new MDR fees for AFRM

$AFRM is working hard on building a ubiquitous parallel network for managing transactions for large retailers allowing product manufacturers avoid network rails like $V.

One result of this is new MDR fees for AFRM

https://twitter.com/arampell/status/1435692960264323073?s=20

8/Secondly, this is a core part of the moat. As a parallel network, there is much potential for many transactions and payments to happen on BNPL payment rails due to SKU level that BNPL receives - imagine what these 3-parties can create in the future!

https://twitter.com/arampell/status/1435692953058504704?s=20

9/This could be the reason why recently Walmart and Target recently updated their layaway services in-order for them to use adopt $AFRM's BNPL solution.

h/t @Mayhem4Markets

h/t @Mayhem4Markets

https://twitter.com/Mayhem4Markets/status/1441130814591291394?s=20

10/ Tech & AI Competency:

Also, this is why Max gave this definition of Affirm.

$AFRM is NOT just a BNPL provider, but it is a much larger data ecosystem and data collector that can unlock value across commerce w/ their VA stack

Listen.h/t @MarceloPLima

Also, this is why Max gave this definition of Affirm.

$AFRM is NOT just a BNPL provider, but it is a much larger data ecosystem and data collector that can unlock value across commerce w/ their VA stack

Listen.h/t @MarceloPLima

https://twitter.com/MarceloPLima/status/1443201399874113537?s=20

11/ Efficient Underwriting:

This blends from d earlier point, but as a result of having a significant head-start, experience, tons of data points. They have of the best underwriting for customer credit (More loans, Less default) which is crucial. This *debit* data is defensible.

This blends from d earlier point, but as a result of having a significant head-start, experience, tons of data points. They have of the best underwriting for customer credit (More loans, Less default) which is crucial. This *debit* data is defensible.

12/ Risk Management & Capital market access:

Over the past 10-years, they've built risk models that can withstand different economic environments.

This is crucial for large partners like AMZN. In addition, they have an efficient capital market for managing liquidity risks.

Over the past 10-years, they've built risk models that can withstand different economic environments.

This is crucial for large partners like AMZN. In addition, they have an efficient capital market for managing liquidity risks.

13/ $AFRM has one of the best checkout conversion rates within the industry. This is the holy grail for merchants.

Affirm has built a special speciality within the consumer payments points and checkout.

Below are my notes.

Affirm has built a special speciality within the consumer payments points and checkout.

Below are my notes.

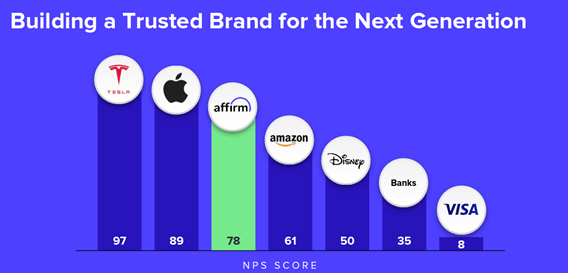

14/ Brand & Consumer Cognitive referent (Kudos @DennisHong17)

CC is the brand power that $ABNB, $UBER, hold.

In N-America, $AFRM is the first cognitive referent that emerges for Gen X consumers when you mention BNPL. This is an underrated moat. Trust is important to consumers.

CC is the brand power that $ABNB, $UBER, hold.

In N-America, $AFRM is the first cognitive referent that emerges for Gen X consumers when you mention BNPL. This is an underrated moat. Trust is important to consumers.

15/ Merchant Network Effects: $AFRM's base of merchants from t Peloton, Shopify to Walmart. The interesting thing is that each deal allows access to more consumers

Every merchant will rather pick a BNPL provider that allows them to reach more consumers, strong N-effects.

Every merchant will rather pick a BNPL provider that allows them to reach more consumers, strong N-effects.

16/ $AFRM's Bargaining power increases with each new major deal and stickiness

As shown by the Cohort stickiness which is very hard to pull off in a transaction-based industry.

As AFRM partnership grows with AMZN & SHOP, I expect their bargaining power to strengthen their Moat.

As shown by the Cohort stickiness which is very hard to pull off in a transaction-based industry.

As AFRM partnership grows with AMZN & SHOP, I expect their bargaining power to strengthen their Moat.

17/ Increasingly, BNPL like AFRM are helping Increase Lead Generation, Conversion & Brand Marketing for Merchants.

Due to the data and parallel network that these BNPL platforms own, they've become good at driving traffic for businesses. An extra value-added to up MDR's

Due to the data and parallel network that these BNPL platforms own, they've become good at driving traffic for businesses. An extra value-added to up MDR's

20/ Future TAM/Growth Opportunity:

I don't believe in using TAM or neither do I believe in the $10T TAM. I just know that displacing even 20-30% of Credit Cards is a tremendous opportunity worth over 100B. 75% of US customers use BNPL products. A 4-horse race

I don't believe in using TAM or neither do I believe in the $10T TAM. I just know that displacing even 20-30% of Credit Cards is a tremendous opportunity worth over 100B. 75% of US customers use BNPL products. A 4-horse race

21/ New products and new verticals could be a key catalyst leveraging both their existing merchant partnerships + Their Data Advantages

https://twitter.com/InvestiAnalyst/status/1442950318677975041?s=20

21/ The 2021 holidays are going to be huge!

Recently, Walmart and Target stripping their solution to use Affirm's BNPL -- Together Affirm's Chart checkout solutions.

The impact of the holidays would be huge - read their press release on their survey

affirm.com/press/releases…

Recently, Walmart and Target stripping their solution to use Affirm's BNPL -- Together Affirm's Chart checkout solutions.

The impact of the holidays would be huge - read their press release on their survey

affirm.com/press/releases…

22/ Future Growth Estimates (h/t @Marlin_Capital)

CS had a $26.5B GMV est in '24 for $AFRM without $AMZN GMV. $AMZN is expected to add $20B in GMV by '24 according to CS Investor Survey. That gets us to $46.5B in '24 GMV, good for a 77% CAGR

CS had a $26.5B GMV est in '24 for $AFRM without $AMZN GMV. $AMZN is expected to add $20B in GMV by '24 according to CS Investor Survey. That gets us to $46.5B in '24 GMV, good for a 77% CAGR

https://twitter.com/Marlin_Capital/status/1437537092020719619?s=20

23/Risk/Areas I am cautious:

a) Competition has caught up. Klarna but especially SQ & APT have a dominant presence within Fashion and Retail Industry, Low AoV sectors.

I will watch this metric as the effect of new partnerships take-hold:

a) Competition has caught up. Klarna but especially SQ & APT have a dominant presence within Fashion and Retail Industry, Low AoV sectors.

I will watch this metric as the effect of new partnerships take-hold:

https://twitter.com/InvestiAnalyst/status/1403728798596534272

24/ Ops Leverage: I would expect to see some improvement to profitability, but I'm giving them a pass bcos this is a period they truly need to reinvest in Tech due to d opportunity as compared to other names like of mine like $CRWD who can afford too.

https://twitter.com/InvestiAnalyst/status/1436070403919826950?s=20

25/ The *Pedigree of the Founder: @mlevchin

Despite da risks, I trust Max. A core part of my thesis.

Ppl easily forget Max was da co-founder/CTO of PYPL. The key architect amongst a powerful group. Remarkable intelligent and knows how to build products!

[h/t @mariogabriele]

Despite da risks, I trust Max. A core part of my thesis.

Ppl easily forget Max was da co-founder/CTO of PYPL. The key architect amongst a powerful group. Remarkable intelligent and knows how to build products!

[h/t @mariogabriele]

26/ All the way back in May 2021 (nobody cared about AFRM):

I mentioned and discussed why I was really bullish on $PLTR x $AFRM Founding Team below:

I mentioned and discussed why I was really bullish on $PLTR x $AFRM Founding Team below:

https://twitter.com/InvestiAnalyst/status/1391887999265173507?s=20

27/ Max is also a people leader; Glassdoor Ratings 94%!

Well respected by Peers, Founders in the Bay Area & Employees.

It's exceptionally rare to see a technical + people leader (Top 1%)

Well respected by Peers, Founders in the Bay Area & Employees.

It's exceptionally rare to see a technical + people leader (Top 1%)

28/ My AFRM stock story:

Obviously I bought at IPO: 93 -> Trimmed @ 147 -> added @ 77 & 55. I reduced after Under-whelming results in March 2021 and downloads were weak.

Some of my earlier work

Obviously I bought at IPO: 93 -> Trimmed @ 147 -> added @ 77 & 55. I reduced after Under-whelming results in March 2021 and downloads were weak.

Some of my earlier work

https://twitter.com/InvestiAnalyst/status/1349802891624632320?s=20

29/ Below is a complete analysis of last quarter's earnings call.

This industry is still significantly under-owned due to skeptics. Many of my past BNPL or $AFRM tweets were some lowest engaged, but I prefer it this way.

This industry is still significantly under-owned due to skeptics. Many of my past BNPL or $AFRM tweets were some lowest engaged, but I prefer it this way.

https://twitter.com/InvestiAnalyst/status/1391913016208203776

30/ Back in April 2021, these Adobe external trends were pointing towards significant changes happening within BNPL. I rmbr this helped me continue to hold on to AFRM despite being almost down [-40%]

Anyways, it has been an interesting journey with AFRM.

Anyways, it has been an interesting journey with AFRM.

https://twitter.com/InvestiAnalyst/status/1391913038979035141?s=20

31/ If you are still struggling to understand the moat of this industry, please read @arampell's thread and follow his work on the Fintech & BNPL Industry

See breakdown of the economics of the industry:

See breakdown of the economics of the industry:

https://twitter.com/arampell/status/1435692945387048964

32/ I've personally done lots of work on this industry:

My previous write-up on BNPL & AMZN:

seekingalpha.com/article/445673…

My previous write-up on BNPL & AMZN:

seekingalpha.com/article/445673…

33/ Thread on my SQ & APT Thread:

https://twitter.com/InvestiAnalyst/status/1422971565235314693?s=20

35/ Final Words,

Ultimately as $V, $MA, $AMEX conquered the credit card industry, I believe $AFRM, $APT x $SQ and Klarna can all have unbridled access to unbundling consumer credit.

Below is a summary of this thread and my AFRM thesis :

$AFRM = Tech + Risk + Talent + Data.

Ultimately as $V, $MA, $AMEX conquered the credit card industry, I believe $AFRM, $APT x $SQ and Klarna can all have unbridled access to unbundling consumer credit.

Below is a summary of this thread and my AFRM thesis :

$AFRM = Tech + Risk + Talent + Data.

36/ This thread is super long, so I'll stop but I'll put a compilation of all my write-ups on the key catalysts and further discussions on the competitive moat. I will touch on more of the financial/valuation metrics which cant be all covered in a thread

investianalystnewsletter.substack.com/welcome

investianalystnewsletter.substack.com/welcome

37/ Anything to add or what I've I missed? @arampell

Anyways, this is a thread of my journey (not advice).

Tagging a few other $AFRM bulls to share ideas: @MarceloPLima @saxena_puru @masterly_in @BlaineCapital @dhaval_kotecha @Marlin_Capital @LuoshengPeng @MT_Capital1

Anyways, this is a thread of my journey (not advice).

Tagging a few other $AFRM bulls to share ideas: @MarceloPLima @saxena_puru @masterly_in @BlaineCapital @dhaval_kotecha @Marlin_Capital @LuoshengPeng @MT_Capital1

38/ If you are still with me, thanks for reading!

- If still was helpful, feel free to share. Most importantly, I'd love to get your feedback!

Let me know your thoughts!

Thank you and Stay Safe x @InvestiAnalyst

- If still was helpful, feel free to share. Most importantly, I'd love to get your feedback!

Let me know your thoughts!

Thank you and Stay Safe x @InvestiAnalyst

• • •

Missing some Tweet in this thread? You can try to

force a refresh