Few Highlights behind the $UPWK Thesis:

LTM:

• $UPWK: 154%

• $FVRR: 16%

YTD:

• $UPWK: 42%

• $FVRR: (-7%)

NTM:

• In my opinion: $UPWK outperforms $FVRR

[Save this tweet]

Let's review a few snippets behind my thesis: Thread👇

LTM:

• $UPWK: 154%

• $FVRR: 16%

YTD:

• $UPWK: 42%

• $FVRR: (-7%)

NTM:

• In my opinion: $UPWK outperforms $FVRR

[Save this tweet]

Let's review a few snippets behind my thesis: Thread👇

1/ First, a bet on any Biz' is the Management. Let’s start here.

I’ve seen @hydnbrwn on social channels. I’ve been impressed by their passion for @Upwork' mission. I almost can’t tell the difference btw a Founder vs CEO!

The New Mgmt additions LTM have been strong. Thanks, HB!

I’ve seen @hydnbrwn on social channels. I’ve been impressed by their passion for @Upwork' mission. I almost can’t tell the difference btw a Founder vs CEO!

The New Mgmt additions LTM have been strong. Thanks, HB!

2/ @AznWeng shared a couple of data points from Revelera showing massive accelerations in the No of new clients showing their products on UPWK. *July and August* seem to have the strongest momentum in their history.

All Courtesy of @Revealera

All Courtesy of @Revealera

3/ @AznWeng also showed a massive acceleration in the entire industry for remote workers.

Ya'll might want to checkout @Revealera - lots of good stuff on alternative data metrics.

Ya'll might want to checkout @Revealera - lots of good stuff on alternative data metrics.

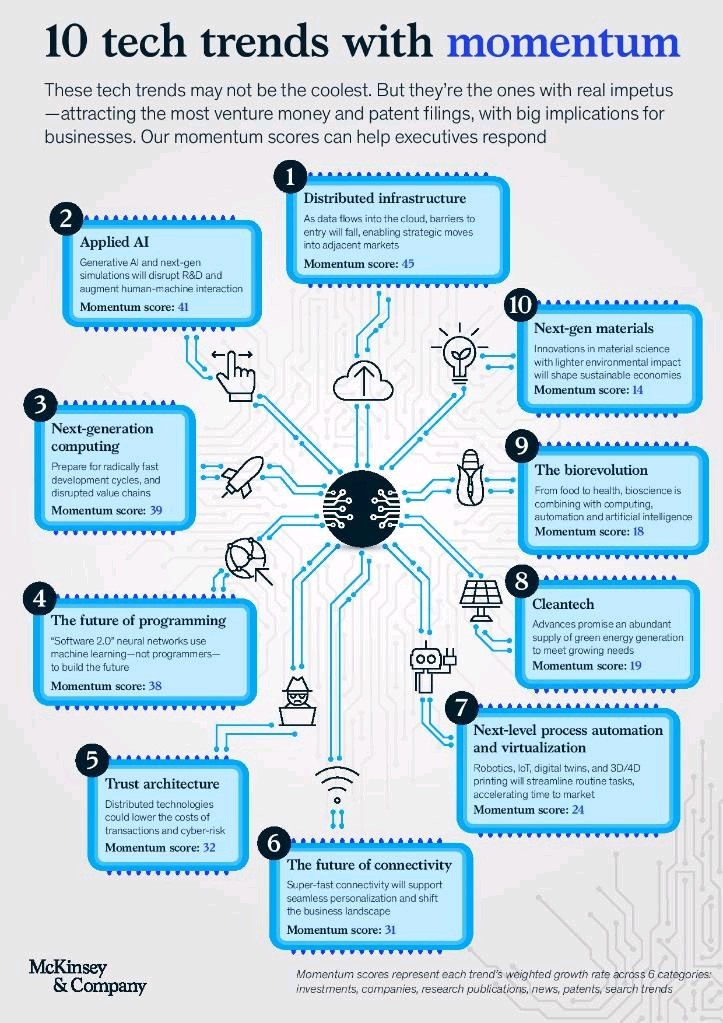

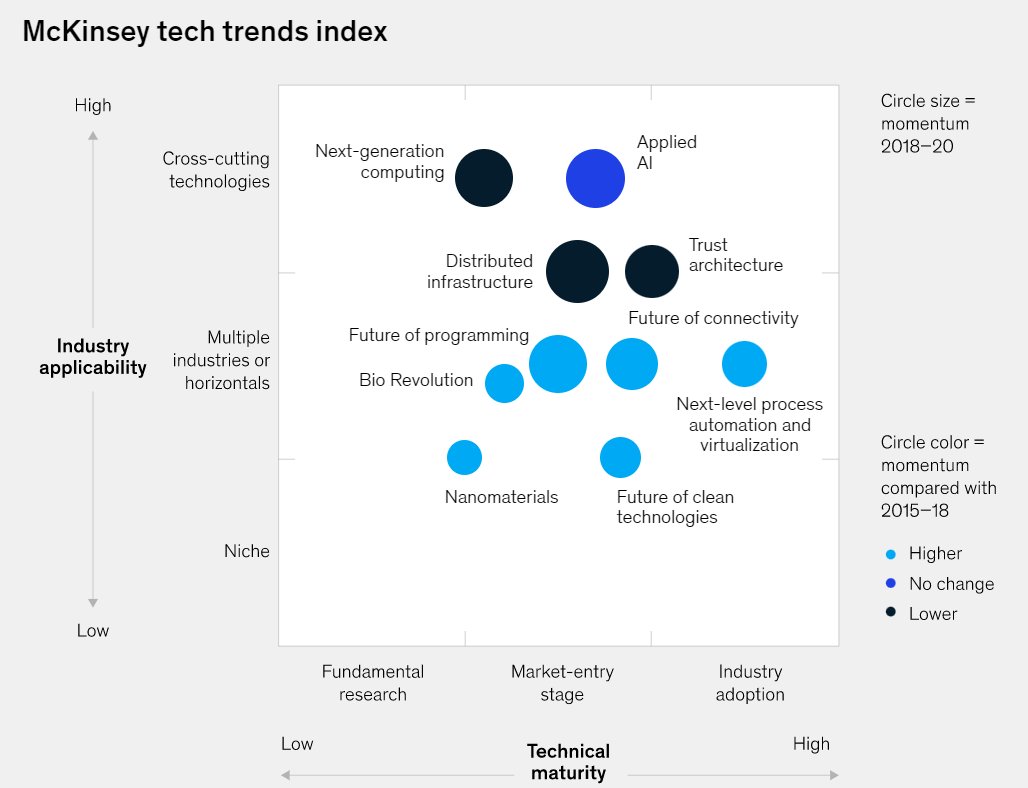

4/ McKinsey has been sharing *lots* of info lately showing the massive attrition.

Many are quitting *without a job lined* - signals a % of this population are moving into gig platforms or following their entrepreneurial passions.

Good report to digest

mckinsey.com/business-funct…

Many are quitting *without a job lined* - signals a % of this population are moving into gig platforms or following their entrepreneurial passions.

Good report to digest

mckinsey.com/business-funct…

5/ / I got the opportunity to meet w. a Deloite partner a few weeks back.

Businesses across industries are addressing workforce capacity and capability challenges via ‘gig’ workers, freelancers engaging these platforms more. Industries have become more willing to telework.

Businesses across industries are addressing workforce capacity and capability challenges via ‘gig’ workers, freelancers engaging these platforms more. Industries have become more willing to telework.

6/ Upwork had two important investor conferences over the past few weeks.

They highlighted that have seen over 100% YoY in contract new deals signed recently by their enterprise sales.

We should hear more next quarter. They have increased investment into different areas of biz

They highlighted that have seen over 100% YoY in contract new deals signed recently by their enterprise sales.

We should hear more next quarter. They have increased investment into different areas of biz

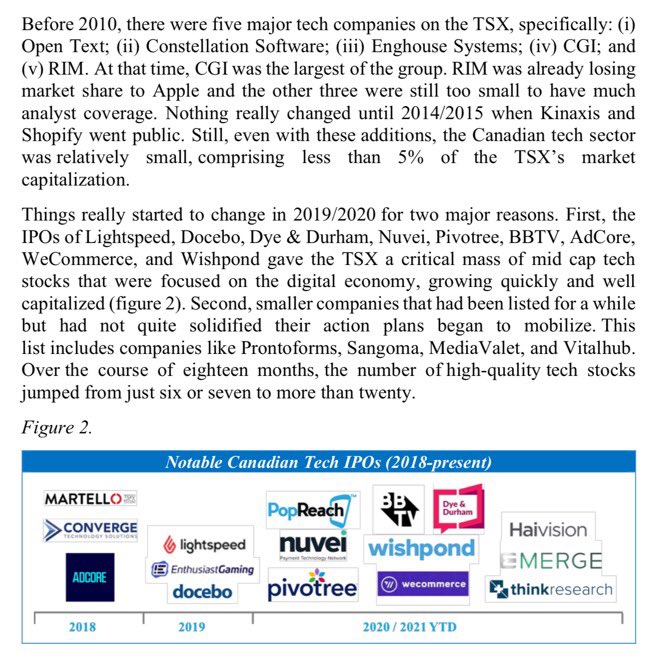

7/ A couple of research were conducted recently:

Corporations have increasingly become bullish on consistently spending on Gigs.

$UPWK DOMINATES the Enterprise and Fortune 500 Space with *over 51% market share* with deep expertise.

This trend should be captured by them.

Corporations have increasingly become bullish on consistently spending on Gigs.

$UPWK DOMINATES the Enterprise and Fortune 500 Space with *over 51% market share* with deep expertise.

This trend should be captured by them.

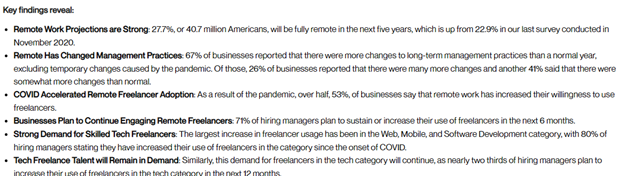

8/ The Future of the Remote work trends (Continuation)

The second picture captures results from their findings.

The second picture captures results from their findings.

9/ Areas of Enterprise demand:

I shared this before, but Upwork’s Competitive Advantage over their peers is that they have significantly more talent pool in IT, Web, and Software Development than FVRR's areas of branding, marketing and support.

This is a huge part of the thesis

I shared this before, but Upwork’s Competitive Advantage over their peers is that they have significantly more talent pool in IT, Web, and Software Development than FVRR's areas of branding, marketing and support.

This is a huge part of the thesis

10/ Take-rate expansion: Large Enterprise deals allow higher take-rate.

They've introduced new products that should serve as major growth catalyst –

Project catalogue in <12-mnths is driving over 10%+ new clients, Talents services & Ad-based services should increase take-rate.

They've introduced new products that should serve as major growth catalyst –

Project catalogue in <12-mnths is driving over 10%+ new clients, Talents services & Ad-based services should increase take-rate.

11/ A large part of Upwork's Moat and Competitive Advantage is that their platform combines a unique comprehensive hybrid-model that can't be matched by Fiverr.

This is combined with the significant scaled economics and flywheel network in a marketplace

This is combined with the significant scaled economics and flywheel network in a marketplace

11A/ As this post by 16oz and shared by @buccocapital shows:

I personally believe the future of work will be gradually distributed and coordinated.

The link to the full future workforce is here: upwork.com/research/futur…

I personally believe the future of work will be gradually distributed and coordinated.

The link to the full future workforce is here: upwork.com/research/futur…

https://twitter.com/buccocapital/status/1444723551009914884?s=20

12/ I remain *extremely* bullish on the content creator and passion economy. Remote and Gig work is changing *how* work gets executed.

Fiverr will do well, but I prefer than own a mix bags, I want to hold the market leader. I’m confident UPWK outperforms all its peers.

Fiverr will do well, but I prefer than own a mix bags, I want to hold the market leader. I’m confident UPWK outperforms all its peers.

13/ My analysis and write-up on $UPWK. I fully compare them to $FVRR.

This is a full write-up compare to this thread.

For anyone interested.

seekingalpha.com/article/445212…

This is a full write-up compare to this thread.

For anyone interested.

seekingalpha.com/article/445212…

14/ This is my original $UPWK thread and thesis:

I used to be very bullish on FVRR, but I later started learning about UPWK. This thread has evolved since I picked UPWK in February 2021 this year.

In this thread, I break it down

Check it out:

I used to be very bullish on FVRR, but I later started learning about UPWK. This thread has evolved since I picked UPWK in February 2021 this year.

In this thread, I break it down

Check it out:

https://twitter.com/InvestiAnalyst/status/1444322831278485510?s=20

15/ This is an unpopular thread as I knw 99% of Fintwit is obsessed over $FVRR while only <0.5% knw $UPWK exists. Just want to bring awareness/show the data. No hate on FVRR

This is just my personal view. $UPWK is my 4th largest position. They report on Oct 27! Let d race begin.

This is just my personal view. $UPWK is my 4th largest position. They report on Oct 27! Let d race begin.

16/ In Summary:

+ Industry & Enterprise Moat/⬆️Market Share

+ Top Mgmt @hydnbrwn

+ Growing TAM

+ High-margin, cash-flowing, & accelerating growth available at a great price!

Closer to $UPWK's Earnings report, I'll do another write-up + My Model. Cheers!

investianalystnewsletter.substack.com/welcome

+ Industry & Enterprise Moat/⬆️Market Share

+ Top Mgmt @hydnbrwn

+ Growing TAM

+ High-margin, cash-flowing, & accelerating growth available at a great price!

Closer to $UPWK's Earnings report, I'll do another write-up + My Model. Cheers!

investianalystnewsletter.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh