Excellent summary of a Phenomenal book : Tren Griffin's "Charlie Munger – The Complete Investor".

So many investing and life lessons in this one. h/t @BigNitin 👏

biginvestorblog.com/2015/08/23/boo…

So many investing and life lessons in this one. h/t @BigNitin 👏

biginvestorblog.com/2015/08/23/boo…

My fav pts from the summary, ended up being almost the entire summary.

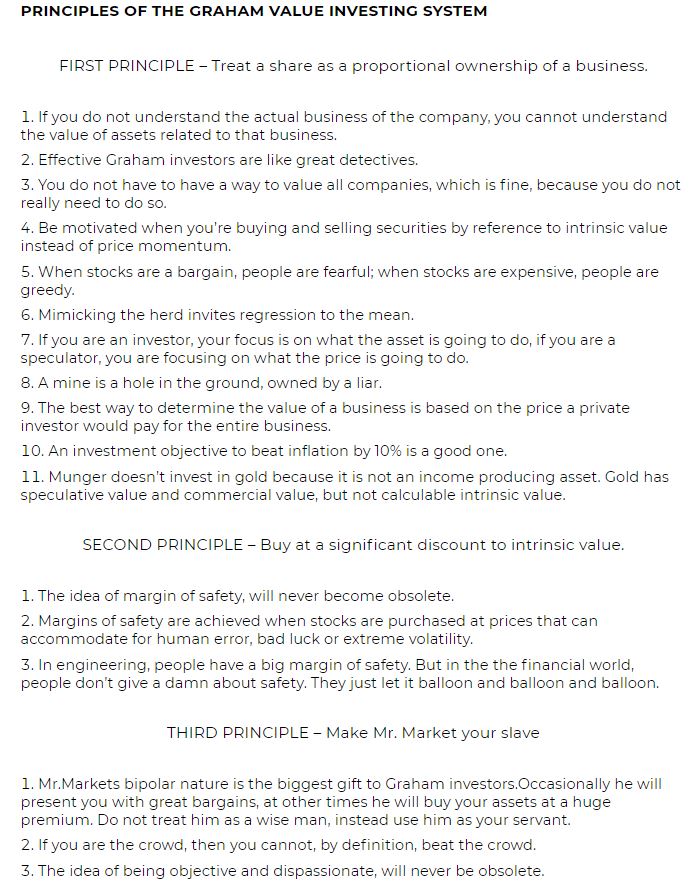

Basics of Value Investing system and important points from "Worldly Wisdom" and "The Right Stuff". ⬇️

Basics of Value Investing system and important points from "Worldly Wisdom" and "The Right Stuff". ⬇️

The Principles of Value Investing system.

Of course the quant formulas from 80 yrs ago based on Book Value & Tangible capital doesn't apply as much today, but the principles of Intrinsic Value, Margin of Safety (in Quality & Quantity), Market psychology will always be relevant.

Of course the quant formulas from 80 yrs ago based on Book Value & Tangible capital doesn't apply as much today, but the principles of Intrinsic Value, Margin of Safety (in Quality & Quantity), Market psychology will always be relevant.

• • •

Missing some Tweet in this thread? You can try to

force a refresh