🔟Stocks from my growth basket that I slowly add to every time there's rotation out of growth stocks due to Macro or Valuation reasons.

$TWLO $DOCU $CRWD $SQ $ETSY $FVRR $ROKU $TTD $PTON $U

(Yeah yeah, these are all FinTwit favs, no originality points there, I know).

$TWLO $DOCU $CRWD $SQ $ETSY $FVRR $ROKU $TTD $PTON $U

(Yeah yeah, these are all FinTwit favs, no originality points there, I know).

I would rather keep or add to my capital to the

-Well capitalized secular growth Co.'s with

-innovative & well executing Mgmt. Teams

-high Margin recurring revenues

-Co.'s offering effective solutions by leveraging the latest tech

-developing Network effects/Switching costs.

-Well capitalized secular growth Co.'s with

-innovative & well executing Mgmt. Teams

-high Margin recurring revenues

-Co.'s offering effective solutions by leveraging the latest tech

-developing Network effects/Switching costs.

Investing is as complicated as you want to make it.

To keep it simple, few questions I ask myself during the high volatility periods

✔️Do I understand these Companies, their Industry, underlying trends and would like to hold them for the next 5 yrs? Yes

To keep it simple, few questions I ask myself during the high volatility periods

✔️Do I understand these Companies, their Industry, underlying trends and would like to hold them for the next 5 yrs? Yes

✔️Could these companies be in a much better/stronger position 5 yrs from now from a fundamental/quality standpoint? Yes, if they continue executing and capitalize on opportunities before them.

✔️Do they have any Fundamental or Balance sheet risk at the moment? No

✔️Can Tech trends change, competition increase, customer preferences evolve? Of course, but based on what we know today, they have a good chance at ongoing success for the next few years.

✔️Can Tech trends change, competition increase, customer preferences evolve? Of course, but based on what we know today, they have a good chance at ongoing success for the next few years.

✔️Can these stocks continue to fall due to Macro reasons or valuation concerns? Of course, that's the reason I'm buying slowly but at a price that I think will still return a good return over a 3-5 yr period.

Few other comments

✅I would love to add more to these other holdings but they usually don't drop much due to their dominance, quality, already proven profitability: $AMZN $FB $GOOG $V $MA $PYPL $ISRG $CMG $CRM $VEEV $MTCH $NKE

✅I would love to add more to these other holdings but they usually don't drop much due to their dominance, quality, already proven profitability: $AMZN $FB $GOOG $V $MA $PYPL $ISRG $CMG $CRM $VEEV $MTCH $NKE

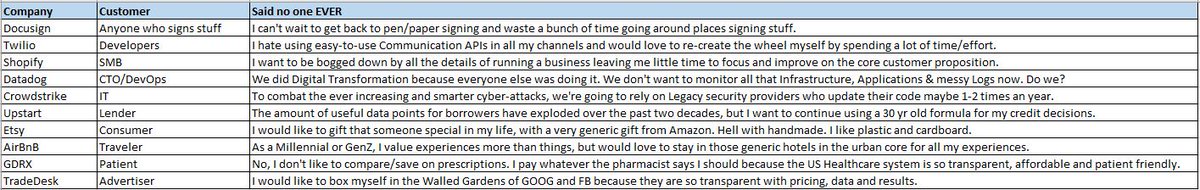

✅Few more growth Co.'s that I haven't added as often but always high up in the Watchlist : $MELI $SE $SHOP $DDOG $NET $ABNB

✅Two stocks at the current levels that I would be really surprised if they don't generate a good market beating return over the next 3-5 yrs?

$ZM $TDOC

That would mean that the Mgmt really missed on growth strategy/execution. Will have to see the next few (normalized) qrtrs.

$ZM $TDOC

That would mean that the Mgmt really missed on growth strategy/execution. Will have to see the next few (normalized) qrtrs.

What type of an Investor you are (your experience, risk tolerance, Portfolio goals based on age and Income requirements) should determine your actions for volatile phases of the Market. Trying to preserve the gains, do nothing or slowly starting to get aggressive.

For someone with decades left to invest, and choosing the long-term individual stock picking route (in place of or in addition to Indexing), slowly adding to the high quality companies in secular growth areas, in your area of expertise or circle of competence,

monitoring the thesis effectively and only taking action when needed (from Fundamental or Portfolio reasons) should yield good results over time.

Disc : Long all the stocks mentioned in this thread. As usual, these are not recommendations. Do your DD.

/END

Disc : Long all the stocks mentioned in this thread. As usual, these are not recommendations. Do your DD.

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh