Everyone knows Apple, Amazon, Microsoft...

But how do you find the next $AFRM, $PLTR, or $USPT early?

Here are 9 GREAT resources for finding stock ideas (8 of them are FREE):

But how do you find the next $AFRM, $PLTR, or $USPT early?

Here are 9 GREAT resources for finding stock ideas (8 of them are FREE):

1: ETFs

Look through the holdings of high-growth ETFs

Google the ETF symbol and “holdings”

These are worth cracking open:

▪️ $ARKF / $ARKG / $ARKK / $ARKW

▪️ $FFTY

▪️ $HACK

▪️ $IZRL

▪️ $TMFC

Look through the holdings of high-growth ETFs

Google the ETF symbol and “holdings”

These are worth cracking open:

▪️ $ARKF / $ARKG / $ARKK / $ARKW

▪️ $FFTY

▪️ $HACK

▪️ $IZRL

▪️ $TMFC

2: Fund Managers

Type a fund you respect into @Whalewisdom

You can see all their holding and get emails of any changes

These funds are worth tracking:

▪️AKre Capital

▪️AKO Capital

▪️Dorsey Asset

▪️Fundsmith

▪️Polen Capital

More funds:

Type a fund you respect into @Whalewisdom

You can see all their holding and get emails of any changes

These funds are worth tracking:

▪️AKre Capital

▪️AKO Capital

▪️Dorsey Asset

▪️Fundsmith

▪️Polen Capital

More funds:

https://twitter.com/BrianFeroldi/status/1362028341709127684?s=20

3: Newly Public Companies

▪️Direct Listings

▪️IPOs

▪️SPACs

Are a great idea source

Helpful resources:

▪️ IPOscoop.com

▪️ spactrack.net

▪️Direct Listings

▪️IPOs

▪️SPACs

Are a great idea source

Helpful resources:

▪️ IPOscoop.com

▪️ spactrack.net

4. Screeners

@Finviz is great for screening by sector/industry

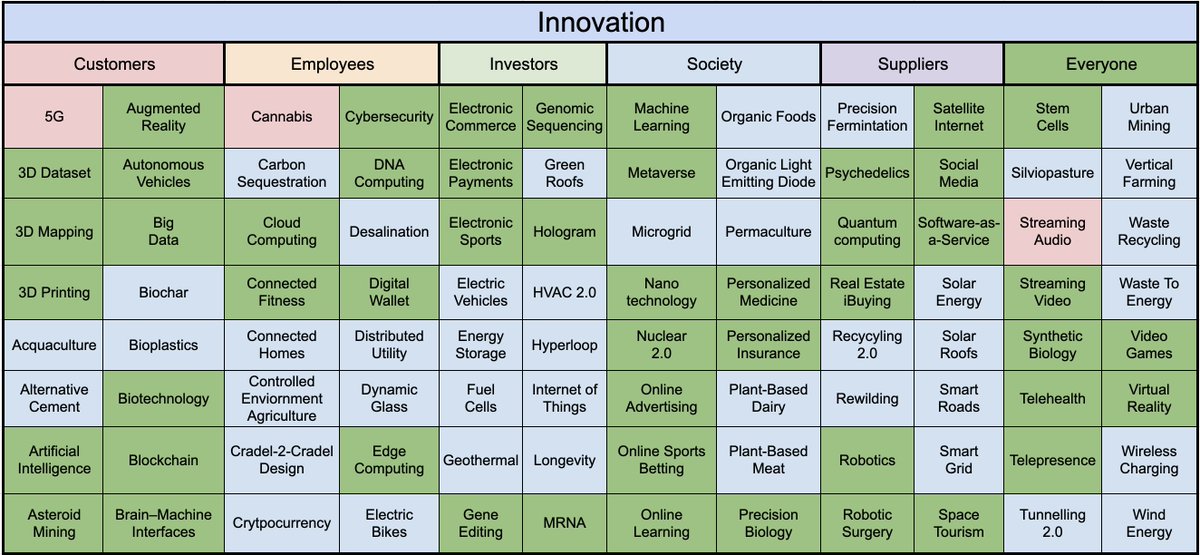

@Stockcard is great for screening by themes (like the mega-trends listed below)

@Finviz is great for screening by sector/industry

@Stockcard is great for screening by themes (like the mega-trends listed below)

5: Your Family & Friends

Look through your credit card statements

Observe the brands your friends buy

Notice any patterns? Find out if the company is public

Look through your credit card statements

Observe the brands your friends buy

Notice any patterns? Find out if the company is public

6: Podcasts

These podcasts are great at uncovering hidden gems

@chitchatmoney

@investing_city

@motleyfoolmoney

@MFIndustryFocus

@marketfoolery

@RBIpodcast

These podcasts are great at uncovering hidden gems

@chitchatmoney

@investing_city

@motleyfoolmoney

@MFIndustryFocus

@marketfoolery

@RBIpodcast

7: Free Articles / Substacks

@themotleyfool main page has TONS of free content

I like @FromValue & Bert Hochfeld on seeking alpha

@Beth_Kindig has great content

The substacks of:

@jaminball

@marketplunger1

@StockMarketNerd

Are all worth reading

@themotleyfool main page has TONS of free content

I like @FromValue & Bert Hochfeld on seeking alpha

@Beth_Kindig has great content

The substacks of:

@jaminball

@marketplunger1

@StockMarketNerd

Are all worth reading

8: FinTwit

TONS of people share ideas on FinTwit

I’ve gotten ideas from:

@LiebermanAustin

@anandchokkavelu

@hhhypergrowth

@Matt_Cochrane7

@jablamsky

@saxena_puru

@StackInvesting

@TomGardnerFool

and SO MANY MORE!

TONS of people share ideas on FinTwit

I’ve gotten ideas from:

@LiebermanAustin

@anandchokkavelu

@hhhypergrowth

@Matt_Cochrane7

@jablamsky

@saxena_puru

@StackInvesting

@TomGardnerFool

and SO MANY MORE!

9: Paid services

I paid for:

@TMFStockAdvisor

@TMFRuleBreakers

For YEARS before I worked for them

If you get 1 good idea from a paid service, the subscription more than pays for itself

I paid for:

@TMFStockAdvisor

@TMFRuleBreakers

For YEARS before I worked for them

If you get 1 good idea from a paid service, the subscription more than pays for itself

Finding stocks ideas is one thing

Figuring out if they are worth buying is another

This is where checklists are helpful

Create your own, or download & use mine for free:

brianferoldi.gumroad.com/l/zWXye

Figuring out if they are worth buying is another

This is where checklists are helpful

Create your own, or download & use mine for free:

brianferoldi.gumroad.com/l/zWXye

Want to learn HOW to research a company in detail?

@brian_stofffel_ and I teach this weekly on our YouTube channel

Check it out for free here:

youtube.com/brianferoldiyt

@brian_stofffel_ and I teach this weekly on our YouTube channel

Check it out for free here:

youtube.com/brianferoldiyt

Enjoy this thread?

Follow me @brianferoldi

I regularly tweet about money, investing, and personal finance

Follow me @brianferoldi

I regularly tweet about money, investing, and personal finance

Summary:

1: ETFs

2: Fund managers

3: IPOs

4: Screeners

5: Your friends & family

6: Podcasts

7: Free articles

8: Fintwit

9: Paid services

Where else?

1: ETFs

2: Fund managers

3: IPOs

4: Screeners

5: Your friends & family

6: Podcasts

7: Free articles

8: Fintwit

9: Paid services

Where else?

• • •

Missing some Tweet in this thread? You can try to

force a refresh