By now, you've probably heard that the U.S. debt ceiling is causing quite a bit of drama in political and financial circles.

Here's a simple breakdown of its history, purpose, and why you should (or shouldn't) care:

Here's a simple breakdown of its history, purpose, and why you should (or shouldn't) care:

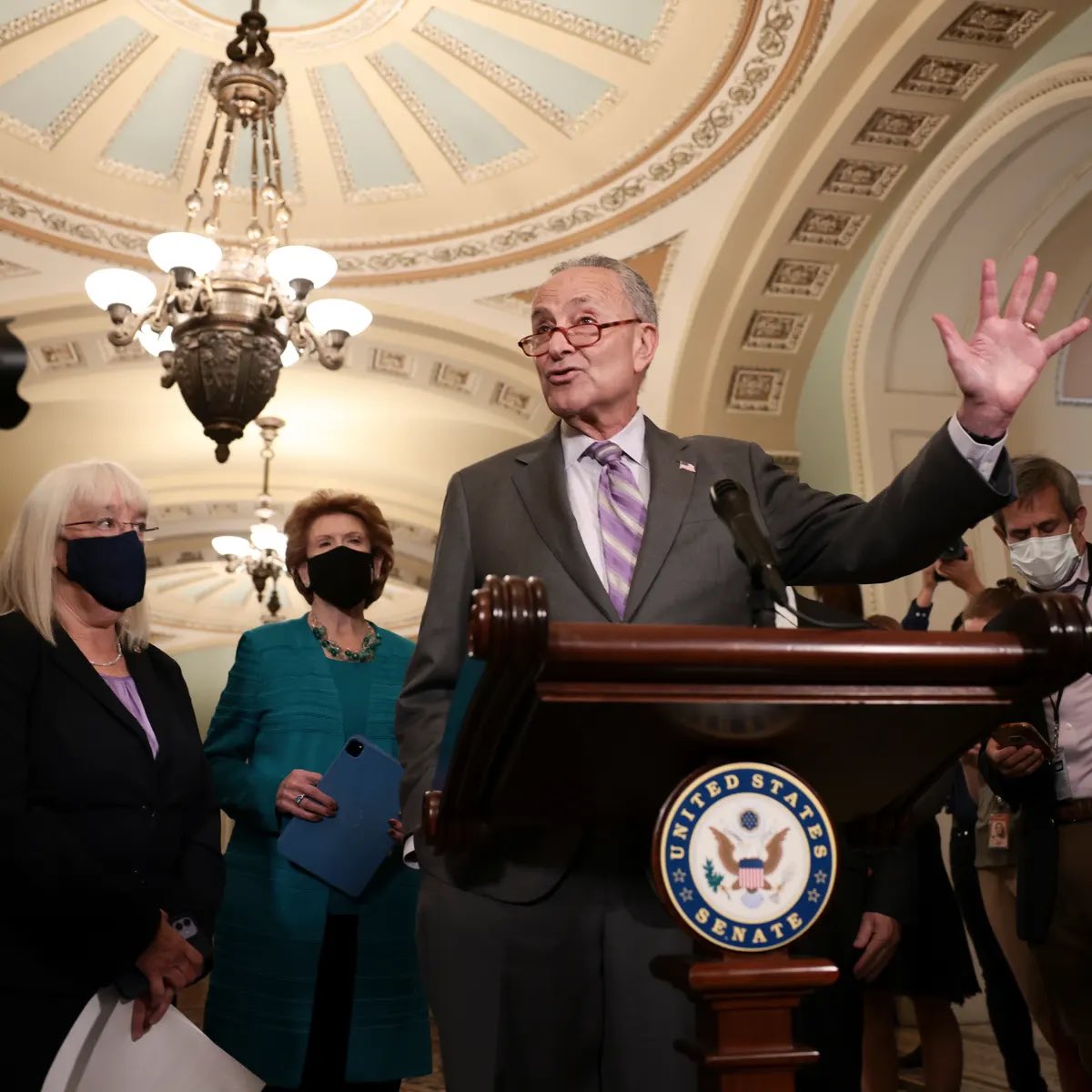

1/ In recent weeks, the so-called “debt ceiling” dominated the news.

There was fear-mongering—and congressional grandstanding—but few have a real understanding of what it all means.

This thread is my attempt to provide a (very) simple framework for understanding the situation:

There was fear-mongering—and congressional grandstanding—but few have a real understanding of what it all means.

This thread is my attempt to provide a (very) simple framework for understanding the situation:

2/ First, a short history lesson.

The United States debt ceiling was formally created as part of the Second Liberty Bond Act of 1917 during World War I.

It was an important step.

Prior to 1917, any debt issuance by the government had to be specifically authorized by Congress.

The United States debt ceiling was formally created as part of the Second Liberty Bond Act of 1917 during World War I.

It was an important step.

Prior to 1917, any debt issuance by the government had to be specifically authorized by Congress.

3/ This meant that anytime the government wanted to spend in excess of its revenues—on wars, infrastructure, whatever—Congress had to authorize the Treasury to issue new bonds or bills to raise that money.

This was a slow and clumsy process.

(my primer on bonds & yields below)

This was a slow and clumsy process.

(my primer on bonds & yields below)

https://twitter.com/SahilBloom/status/1370048060806471688

4/ The creation of the ceiling—which placed a cap on the total amounts of each type of debt the government could take on—was a step towards simplifying the process.

It's like having a credit card limit rather than having to get approved each time you want to buy something.

It's like having a credit card limit rather than having to get approved each time you want to buy something.

5/ Wars require a lot of spending—so unsurprisingly, WWII was the next major impetus for change.

In 1939, the modern form of the debt ceiling was created via the Public Debt Act, which created an aggregate debt limit (rather than a limit on each respective type of debt).

In 1939, the modern form of the debt ceiling was created via the Public Debt Act, which created an aggregate debt limit (rather than a limit on each respective type of debt).

6/ The debt ceiling was a balancing act—intended to ease the burden on the government while also forcing a degree of prudence.

Just as your credit card has a limit to make it easy to spend, but not beyond your means.

But the debt ceiling quickly began to feel perfunctory...

Just as your credit card has a limit to make it easy to spend, but not beyond your means.

But the debt ceiling quickly began to feel perfunctory...

7/ In fact, the aggregate debt ceiling was amended upwards in 1941, 1942, 1943, 1944, and 1945, before finally being reduced (slightly) in 1946.

In total, the debt ceiling has been raised 90+ times since its inception.

There's no partisan line here—it's happened continuously.

In total, the debt ceiling has been raised 90+ times since its inception.

There's no partisan line here—it's happened continuously.

8/ The reason is pretty simple...

The U.S. has run a deficit—more spending than revenues—in the vast majority of years since 1939, meaning it had to keep increasing its limit to stay in compliance.

But let's come back to the present and talk about our current situation...

The U.S. has run a deficit—more spending than revenues—in the vast majority of years since 1939, meaning it had to keep increasing its limit to stay in compliance.

But let's come back to the present and talk about our current situation...

9/ The current debt ceiling is $28.4 trillion, a figure that was reset on July 31 after being temporarily suspended since August 2019.

Treasury Secretary Janet Yellen recently told Congress that her department may not be able to pay the government's bills past October 18.

Treasury Secretary Janet Yellen recently told Congress that her department may not be able to pay the government's bills past October 18.

10/ Yellen indicated that without a ceiling increase, the U.S. would not be able to raise money (via debt issues) to fund ongoing obligations.

To be clear, raising the debt ceiling does not authorize new spending—it simply provides flexibility to fund prior authorized spending.

To be clear, raising the debt ceiling does not authorize new spending—it simply provides flexibility to fund prior authorized spending.

11/ These obligations include a whole lot of payments on prior issued debt.

If we are unable to make those payments on time due to an inability to borrow the funds to do it, that constitutes a default.

If that happens, it’s a big deal—technically, but more so psychologically.

If we are unable to make those payments on time due to an inability to borrow the funds to do it, that constitutes a default.

If that happens, it’s a big deal—technically, but more so psychologically.

12/ The U.S. has never—except for a minor technical episode in 1979—defaulted on its debts.

The U.S. is the financial "gold standard”—the dollar is the global reserve currency—so a default would create tremendous uncertainty.

It would have broad ripple effects across the world.

The U.S. is the financial "gold standard”—the dollar is the global reserve currency—so a default would create tremendous uncertainty.

It would have broad ripple effects across the world.

13/ The good news?

Looking past the partisan grandstanding leading us to the edge, we’ve been here before and survived.

The debt ceiling remains a (largely) perfunctory restriction with little purpose in modern times.

It has become a political tool rather than a financial one.

Looking past the partisan grandstanding leading us to the edge, we’ve been here before and survived.

The debt ceiling remains a (largely) perfunctory restriction with little purpose in modern times.

It has become a political tool rather than a financial one.

14/ In this instance, the "crisis" appears to have been averted—the Senate approved a small short-term debt ceiling increase on Thursday.

The House will vote to approve the measure this week.

They kicked the can down the road, with another battle set for early December...

The House will vote to approve the measure this week.

They kicked the can down the road, with another battle set for early December...

15/ In our increasingly partisan environment, it's fair to expect continued squabbles (and corresponding market turmoil) every time we approach the debt ceiling.

Perhaps doing away with it altogether—as some pundits have recently argued—is the right approach.

What do you think?

Perhaps doing away with it altogether—as some pundits have recently argued—is the right approach.

What do you think?

16/ This becomes an interesting first principles debate on the value and importance of the debt ceiling.

Does it serve a purpose as a “governor” on the government?

Or is it a procedural headache that causes market turmoil every time it comes up due to partisan weaponization?

Does it serve a purpose as a “governor” on the government?

Or is it a procedural headache that causes market turmoil every time it comes up due to partisan weaponization?

17/ I hope this simple breakdown helps you feel more well-informed about the debt ceiling.

Follow me @SahilBloom for more threads breaking down business and finance.

I also write about these topics in my newsletter every week. You should subscribe. sahilbloom.substack.com

Follow me @SahilBloom for more threads breaking down business and finance.

I also write about these topics in my newsletter every week. You should subscribe. sahilbloom.substack.com

18/ For more, I recommend the following articles:

bloomberg.com/news/articles/…

wsj.com/articles/debt-…

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

wsj.com/articles/debt-…

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh