WHERE WE STAND: the SEC has a few days left to delay on bitcoin futures ETFs. If hear nothing, the first ETF filed (ProShares) will be free to launch on 10/18 as the 75 days req will have passed. That said, this is an unusual situation but no news is prob good news at this point.

THAT SAID, the crypto crowd may be overestimating the demand for these ETFs. It's a big step no doubt but we see only $4b in first 12mo (and some think that's too high!) but that's just 5% of crypto fund aum, 3% of bitcoin futures, and 1% of bitcoin mkt cap and 1% of all ETF flow

Here's a look at the assets of the bitcoin futures ETF in Canada vs its physically backed peers. No bites at all. Yes, the US will be dif bc futures ETFs will be only game in town for a while, that's why we saying $4b. If physically launched at same time we'd drop that to <$100m.

A question I get a lot: where can I go to hear first whether they deny or approve these? My answer is ANYWHERE as this will spread like wild fire. But I'd recommend the Terminal, @Business (of course) and @CoinDesk who tends to be on ball w breaking news.

Another question we get is: will they approve many at once? IMO no, I think they put them on at time a la airplanes on a runway bc they prob nervous about overhwelming underlying market (even tho prob not a big deal). That said, it would be more fair to put them out all at once.

Finally, if anyone has anything that counters any of this (or confirms it) or any non-obvious things to say on this topic, my DMs are open and I totally honor off record or on background information.

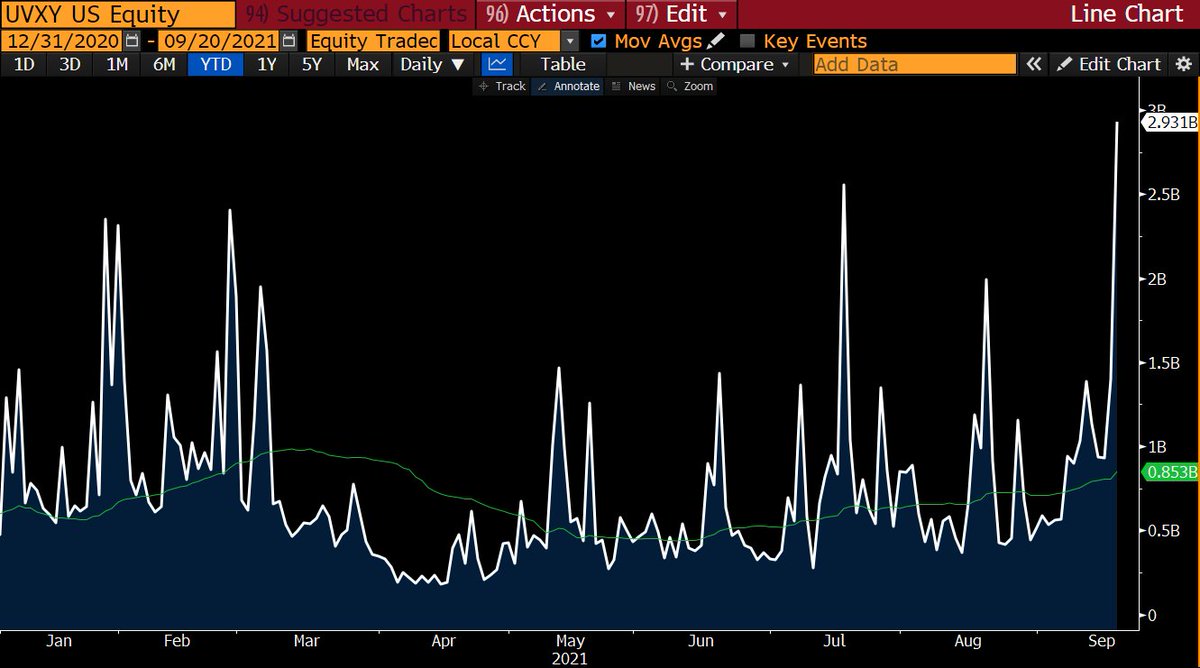

Quick note on this chart: I charted the inverse futures one but it has same microscopic assets as the long-only one which is $HBIT so my point is entirely in tact.

Quick correction: the futures % is off, it would be much more, I had wrong denominator for open interest.

• • •

Missing some Tweet in this thread? You can try to

force a refresh