Congress is currently debating the contents of a large social spending bill that would, among other things, help millions of people gain access to health insurance. This thread explains why making these changes is important for the health of millions of people.

Two of the changes under consideration would make the premium subsidies in the American Rescue Plan Act (ARPA) permanent and provide poor people in the 12 states that haven’t expanded #Medicaid access to subsidized marketplace coverage.

Recent U.S. Census data show that nearly 4 of 10 poor adults living in Medicaid nonexpansion states are uninsured, more than twice the rate of those in states that have expanded Medicaid. Moreover this gap is growing as more people in nonexpansion states become uninsured.

A recent study from Jessica Banthin and colleagues at the @UrbanInstitute, found that the two provisions would lower the number of uninsured Americans by 7 million. commonwealthfund.org/publications/i…

As you can see in the exhibit below, poor people would make the biggest gains in health insurance coverage.

Coverage gains from filling the Medicaid coverage gap and making the subsidies permanent would decrease the number of uninsured across all races and ethnicities.

People in Medicaid nonexpansion states would see the biggest gains in coverage as a result of filling the Medicaid coverage gap and making the ARPA subsidies permanent, the number of uninsured would drop by 30% or more in FL, KS, TX, NC, SD, SC, GA, TN, MI, AL.

Expanding Medicaid and marketplace coverage will extend the safety net coverage that proved so important during the pandemic to more people.

Older adults below Medicare age eligibility have the largest enrollment in the marketplace; making premiums more affordable will ease their financial burdens and help those retiring before Medicare age afford their health care.

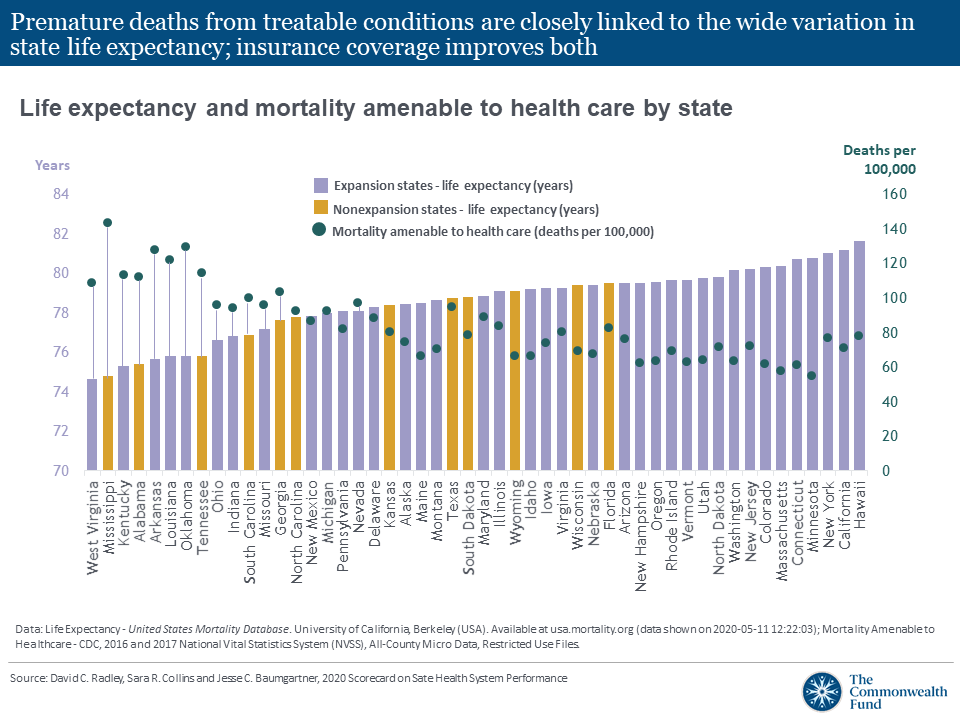

Continuous, comprehensive and affordable health insurance and health care is associated with fewer preventable deaths and improved life expectancy. Expanding health insurance isn’t the only solution, but it is a necessary one.

For more updates on research on health care coverage and access, join our mailing list at the bottom of this page: commonwealthfund.org/coverage-and-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh