Stagflation is the economic risk that everyone is going to be talking about in the days and weeks ahead.

Here's a simple breakdown on the topic:

Here's a simple breakdown on the topic:

1/ There's a lot of talk right now about the risks of stagflation.

@Business published an article titled "Stagflation Is All Anyone in Markets Wants to Talk About Now"—it's serious.

This thread provides a simple framework for understanding stagflation and our current situation:

@Business published an article titled "Stagflation Is All Anyone in Markets Wants to Talk About Now"—it's serious.

This thread provides a simple framework for understanding stagflation and our current situation:

2/ Stagflation is pretty scary.

The "stag" refers to economic stagnation—low growth and high unemployment.

The "flation" refers to inflation.

Putting it together, "stagflation" is an economic condition defined by the presence of low growth, high unemployment, and inflation.

The "stag" refers to economic stagnation—low growth and high unemployment.

The "flation" refers to inflation.

Putting it together, "stagflation" is an economic condition defined by the presence of low growth, high unemployment, and inflation.

3/ For most of history, economists believed stagflation was an effectively impossible condition.

Accepted economic theory—the so-called "Phillips Curve" developed by William Phillips—suggested there was a clear inverse relationship between inflation and unemployment.

Accepted economic theory—the so-called "Phillips Curve" developed by William Phillips—suggested there was a clear inverse relationship between inflation and unemployment.

4/ The theory suggested that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment.

It had generally played out that way in macro theatre over the years, so no one questioned it.

But this all changed in the 1970s...

It had generally played out that way in macro theatre over the years, so no one questioned it.

But this all changed in the 1970s...

5/ Triggered by the oil crisis of 1973—when an OPEC oil embargo sent oil prices skyrocketing and pinched consumers—the US experienced a recession with rising prices.

Inflation hit 11% in 1974 and GDP fell for 5 consecutive quarters, with unemployment reaching 9% in 1975.

Inflation hit 11% in 1974 and GDP fell for 5 consecutive quarters, with unemployment reaching 9% in 1975.

6/ For economists and the public alike, this is a big, scary problem.

Why?

Well, prices are rising but household incomes are not—consumers can't afford the same amount of goods or services as before.

Quality of life can decline precipitously.

Why?

Well, prices are rising but household incomes are not—consumers can't afford the same amount of goods or services as before.

Quality of life can decline precipitously.

7/ It creates a big headache for economic policymakers, as their typical toolkit for reducing inflation—namely increasing interest rates—is likely to further exacerbate the growth and unemployment challenges.

They get caught between a rock and a hard place—with no easy outs.

They get caught between a rock and a hard place—with no easy outs.

8/ Economist Arthur Okun developed the Misery Index—the sum of unemployment and inflation—as a measure of the pain experienced by the American public.

The index reached 20% in the 1970s—a tough time for America.

With the history as context, let's come back to the present...

The index reached 20% in the 1970s—a tough time for America.

With the history as context, let's come back to the present...

9/ Prior to the onset of COVID in 2020, the combination of a historically low U.S. unemployment rate and a Federal Reserve struggling mightily to hit its 2% inflation target resulted in a Misery Index of just 5%.

But as we all know, a lot has changed since March 2020:

But as we all know, a lot has changed since March 2020:

10/ The global economic lockdowns (and roving lockdowns since) sent unemployment skyrocketing.

In the U.S., it hit almost 15%, but the impact was global.

Despite reopenings and a better-than-expected recovery, unemployment has remained stubbornly high—sitting at ~5% in the U.S.

In the U.S., it hit almost 15%, but the impact was global.

Despite reopenings and a better-than-expected recovery, unemployment has remained stubbornly high—sitting at ~5% in the U.S.

11/ Further, several shocks to the system—including the supply chain disarray (see thread below)—are creating an environment of rising inflation.

Even Fed Chair Jerome Powell—ever the optimist—was forced to call the inflation "frustrating" in a recent speech.

Even Fed Chair Jerome Powell—ever the optimist—was forced to call the inflation "frustrating" in a recent speech.

https://twitter.com/SahilBloom/status/1442499701551419392

12/ Comparisons to the 1970s are abound—in particular given the surging energy and commodity prices that were a driving factor of the first documented bout with stagflation.

With natural gas, crude, and coal prices all spiking simultaneously, the comparisons don't feel way off.

With natural gas, crude, and coal prices all spiking simultaneously, the comparisons don't feel way off.

https://twitter.com/sahilbloom/status/1444702393892024321

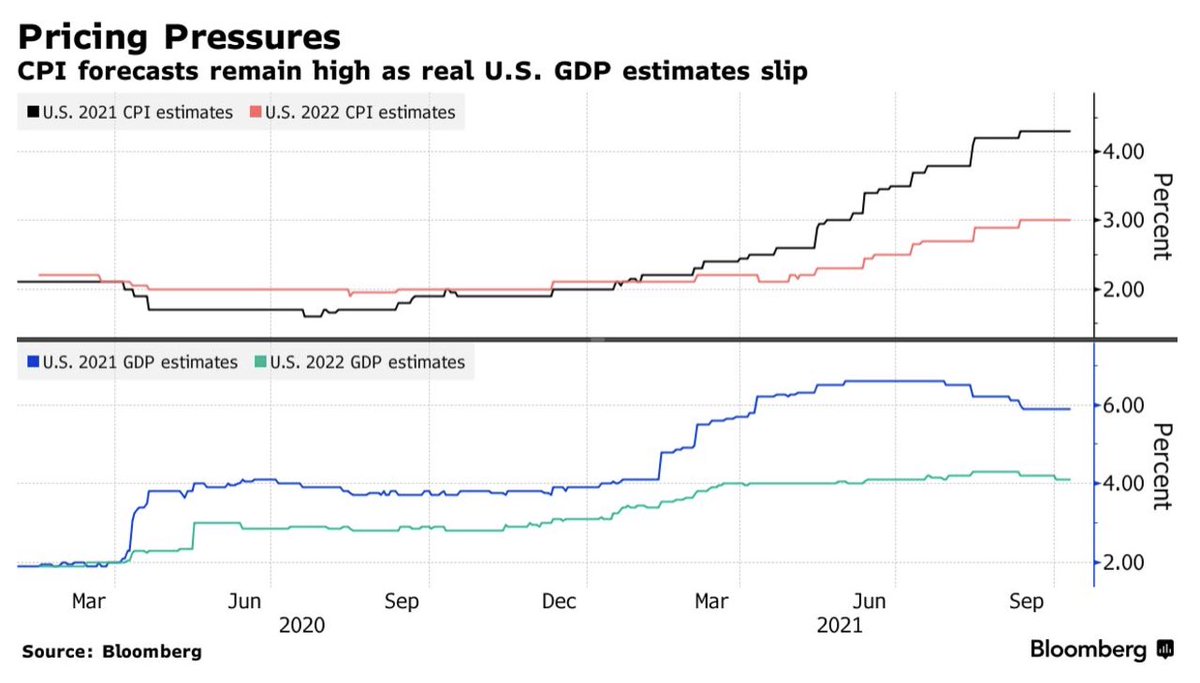

13/ Market observers remain mixed on the severity of stagflation risks.

Bridgewater co-CIO Greg Jensen called out rising prices that choke growth as a key risk to which most investors are overexposed.

A consensus appears to be forming that some degree of stagflation is likely.

Bridgewater co-CIO Greg Jensen called out rising prices that choke growth as a key risk to which most investors are overexposed.

A consensus appears to be forming that some degree of stagflation is likely.

14/ But the persistence and degree of the stagflation is a clear point of debate.

@jimcramer declared the stagflation fears overblown.

@Nouriel sees persistent mild stagflation as the likely outcome.

The economic data and insights of the coming months will be key.

@jimcramer declared the stagflation fears overblown.

@Nouriel sees persistent mild stagflation as the likely outcome.

The economic data and insights of the coming months will be key.

15/ Several underlying factors to keep an eye on in the months ahead:

Supply Chains—easing of the blockages or continued disarray?

Energy & Commodities—price stability, softening, hardening, or volatility?

Fiscal & Monetary Policy—continued strong support or scaled down?

Supply Chains—easing of the blockages or continued disarray?

Energy & Commodities—price stability, softening, hardening, or volatility?

Fiscal & Monetary Policy—continued strong support or scaled down?

17/ What comes next is anyone's guess, but developing an understanding of the basics is a great place to start.

Follow me @SahilBloom for more breakdowns on business and finance.

I also cover these topics in my newsletter. You can subscribe below: sahilbloom.substack.com

Follow me @SahilBloom for more breakdowns on business and finance.

I also cover these topics in my newsletter. You can subscribe below: sahilbloom.substack.com

18/ For more on stagflation, check out the articles below:

bloomberg.com/news/articles/…

bloomberg.com/news/newslette…

bloomberg.com/news/articles/…

bloomberg.com/news/newslette…

• • •

Missing some Tweet in this thread? You can try to

force a refresh