We've published a lot of research over the past 15 years...some insightful, some weird, a lot of cringe.

So I asked my team to try and force rank the top 30 best hits...

(this is their ranking, not mine, so note potential recency bias!)

So I asked my team to try and force rank the top 30 best hits...

(this is their ranking, not mine, so note potential recency bias!)

Everything from asset allocation strategies and global value investing, to farmland investing, to startups, and even whether institutions should be managed by a robot.

With thousands of pieces of content, we thought it was time to sift through them all and try to rank the best!

With thousands of pieces of content, we thought it was time to sift through them all and try to rank the best!

So here we go, starting with a countdown from 30….what will be the winner at #1?

#30/ We just celebrated the 5-year anniversary of the podcast. Since 2016, Meb has talked with top investors and entrepreneurs to bring you insights on today’s market and help you grow your wealth through smarter investing decisions. Here’s 10 of our favorite episodes:

39: Ed Thorp

100: Elroy Dimson

124: @HowardMarksBook

125: @ThomasUBarton1

202: Joe Davis, @Vanguard_Group

286: Jeremy Grantham, @GMOInsights

294: @verdadcap

310: @katykam

317: Chris Cole, @ArtemisVol

329: @SamanthaMcLemor

100: Elroy Dimson

124: @HowardMarksBook

125: @ThomasUBarton1

202: Joe Davis, @Vanguard_Group

286: Jeremy Grantham, @GMOInsights

294: @verdadcap

310: @katykam

317: Chris Cole, @ArtemisVol

329: @SamanthaMcLemor

#29/ At the depths of the Global Financial Crisis back in March of 2009, we asked a simple question…was it “Time to do a Templeton?” Turns out it was a GREAT idea…

mebfaber.com/2009/03/08/is-…

mebfaber.com/2009/03/08/is-…

#28/ Some people learn visually. In addition to the podcast we started posting some unique content to our YouTube channel. You can find our podcasts segmented by topic, as well as our YouTube only Chart Book series…

youtube.com/channel/UCKvWz…

youtube.com/channel/UCKvWz…

#27/ Investors love to justify stock markets being expensive by pointing to the often-repeated justification that it’s ok since “bond yields are low.”

But did they even stop and ask...."is that true"?

mebfaber.com/2021/01/06/sto…

But did they even stop and ask...."is that true"?

mebfaber.com/2021/01/06/sto…

#26/ A recent survey by @NatixisIM revealed that U.S. investors expect 17% real returns on their portfolio (so about 20% with inflation). Is that remotely likely? We tackle the topic in “What Will Be Obvious 20 Years from Now? (With a Sharpe of 0.76)?”

mebfaber.com/2012/08/22/wha…

mebfaber.com/2012/08/22/wha…

#25/ It’s hard to invest during drawdowns, yet all asset classes go through them (it’s a feature, not a bug!). So, we might as well look at helpful strategies. We talk about bond drawdowns in “When Things Go on Sale, People Run Out of The Store”.

mebfaber.com/2011/03/12/whe…

mebfaber.com/2011/03/12/whe…

#24/ Investors often spend countless hours on their investment portfolio.But is that time well spent? How much extra return are you getting on the hours you’re scrutinizing 10Ks? We explore the topic in, “The Best Way to Add Yield To Your Portfolio”.

mebfaber.com/2017/07/06/bes…

mebfaber.com/2017/07/06/bes…

#23/ Right now, there are decent odds that there’s a lump sum of money out there to which you’re entitled.

We’ve found millions for our followers over the years and highlighted how in “Sidewalk Money”. Drop us an email or tweet how much you found!

mebfaber.com/2020/11/17/sid…

We’ve found millions for our followers over the years and highlighted how in “Sidewalk Money”. Drop us an email or tweet how much you found!

mebfaber.com/2020/11/17/sid…

#22/ We don’t spend a ton of time on politics and policy . We should be encouraging everyone to become an investor and participate through inclusive capitalism. Here are few of our ideas in “How to Narrow the Wealth and Income Gap”.

mebfaber.com/2020/12/07/how…

mebfaber.com/2020/12/07/how…

#21/ We’re often asked about the best books when it comes to learning how to invest. Here are our favorites in, “Learning How to Invest”.

mebfaber.com/2019/08/29/lea…

mebfaber.com/2019/08/29/lea…

#20/ It's important to have an investing plan (yet many still don’t). Years like 2020 remind us just how important keeping your cool can be when things go crazy. We penned the piece “Investing in the Time of Corona” during the depths of the pandemic.

mebfaber.com/2020/03/15/inv…

mebfaber.com/2020/03/15/inv…

Two other pieces on the theme include “Office Hours Summary: You Are Not Alone”

mebfaber.com/2018/01/09/off…

and “The Zero Budget Portfolio”.

mebfaber.com/2017/01/03/zer…

mebfaber.com/2018/01/09/off…

and “The Zero Budget Portfolio”.

mebfaber.com/2017/01/03/zer…

#19/ People often assume that an expensive market that continues to climb means a value approach no longer works. We believe differently, and discuss in: “You Would Have Missed 961% In Gains Using The CAPE Ratio, And That’s A Good Thing”.

mebfaber.com/2019/01/06/you…

mebfaber.com/2019/01/06/you…

#18/ Investors often ignore the impact of taxes & implement a high yielding dividend strategy in a taxable account w/o considering if it outperforms.

Is there a better way?

We think so: “Do You Pay Taxes? Then Avoid Dividends and Do this Instead”.

mebfaber.com/wp-content/upl…

Is there a better way?

We think so: “Do You Pay Taxes? Then Avoid Dividends and Do this Instead”.

mebfaber.com/wp-content/upl…

#17/ Investors often assume bonds are risk free, with many believing their bond portfolios couldn’t suffer major drawdowns.Neither is true.

We take a look at how to attempt to build a low risk portfolio in the piece “The Stay Rich Portfolio”.

mebfaber.com/2020/03/05/the…

We take a look at how to attempt to build a low risk portfolio in the piece “The Stay Rich Portfolio”.

mebfaber.com/2020/03/05/the…

#16/ Global bond indexes have a curious feature – they’re most often weighted by how much debt a country has. Is there a better way? We examine a value strategy applied to global sovereign bonds…. “Finding Yield in a 2% World”.

mebfaber.com/wp-content/upl…

mebfaber.com/wp-content/upl…

#15/ Fees are one of the most impactful determinants of portfolio performance, yet are woefully overlooked by the average investor. We tackled this topic in a few short pieces, “Would You Pay Your Advisor $1,000,000 in Fees?”

mebfaber.com/2015/10/18/wou…

mebfaber.com/2015/10/18/wou…

#14/ Most investors have a hilariously short time horizon for their investments. In the piece “How Long Can You Handle Underperforming?” we tackle just how much pain you have to accept to outperform. It’s more than you think.

cambriainvestments.us1.list-manage.com/track/click?u=…

cambriainvestments.us1.list-manage.com/track/click?u=…

#13/ Institutional money managers direct the flow of enormous sums of capital. Often their approach is needlessly complicated and complex, and riddled with high fee funds. But does it have to be that way? We tackle the topic in a series of articles...

Cloning the Largest Hedge Fund in the World: @RayDalio @Bridgewater's All Weather

mebfaber.com/2014/12/31/clo…

mebfaber.com/2014/12/31/clo…

#12/ Investing has changed over the years, but what remains important is how you develop your strategy and approach. What is the foundation?

Check out our paper “The Investment Pyramid” where we cut the carbs on the way to a more thoughtful portfolio.

mebfaber.com/wp-content/upl…

Check out our paper “The Investment Pyramid” where we cut the carbs on the way to a more thoughtful portfolio.

mebfaber.com/wp-content/upl…

#11/ Booms and bubbles have been a feature of markets for as long as people have invested. Is there a way to ride the bubble, profit, and still survive?

Our view: "Learning to Love Investment Bubbles: What if Sir Isaac Newton had been a Trendfollower?"

papers.ssrn.com/sol3/papers.cf…

Our view: "Learning to Love Investment Bubbles: What if Sir Isaac Newton had been a Trendfollower?"

papers.ssrn.com/sol3/papers.cf…

#10/ What if you could invest in the top hedge funds? Now, what if you could invest in them for free? turns out, you can do just that. Invest with the House examines how to copy luminary investors such as Seth Klarman, Warren Buffett, and David Tepper.

amazon.com/Invest-House-H…

amazon.com/Invest-House-H…

#9/ Many inventors have implemented the time-honored investment philosophy of investing in high yielding dividend stocks. But what are they overlooking? The book Shareholder Yield examines a holistic approach to yield.

amazon.com/Shareholder-Yi…

amazon.com/Shareholder-Yi…

Since stocks buybacks – a component of this strategy – is so misunderstood, here is a FAQ on share buybacks.

mebfaber.com/2019/08/05/faq…

mebfaber.com/2019/08/05/faq…

When presented with the historical evidence for shareholder yield, why do investors still cling to their dividend strategy? Damn good marketing.

mebfaber.com/2013/11/05/the…

mebfaber.com/2013/11/05/the…

#8/ While average, annual stock returns of 9% or so will make you a lot of money over the years, what if you want to go after massive returns? We cover this concept in two pieces over the past two years in “The Get Rich Portfolio”

mebfaber.com/2020/03/03/the…

mebfaber.com/2020/03/03/the…

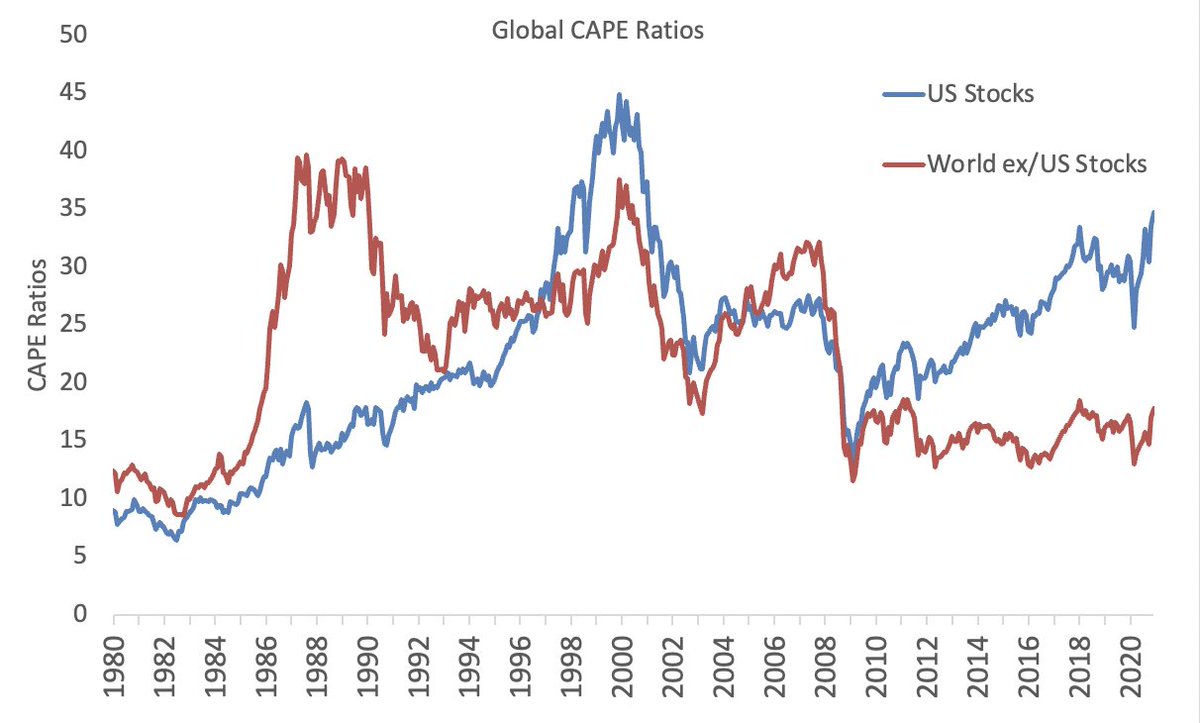

#7/ Are most of your stock holdings based here in the U.S.? If so, you’re a victim of “home country bias” (most people are, overweighting their stock allocations to their own country’s stocks). But it’s a big world out there with an abundance of wonderful investment options...

To provide an overview, our book Global Value presents a strategy of investing in global stocks, all the while trying to avoid bubbles in any one market or markets when everything is going crazy.

amazon.com/Global-Value-B…

amazon.com/Global-Value-B…

Our value framework was based on building 10-year price to earnings ratios for every country in the world. While we were the first to put these together, many researchers have followed and publish them (here is a list of resources free and paid alike).

https://twitter.com/MebFaber/status/969654417979973632?s=20

https://twitter.com/mebfaber/status/969654417979973632

We summarized some of the best research by others in the piece “The Case for Global Investing.”

mebfaber.com/2020/01/10/the…

mebfaber.com/2020/01/10/the…

#6/ Commentators love to point out how large market moves impact markets and portfolio returns, and if you just miss the best days, your returns are meager (which is true). What they miss is that most of these days tend to “cluster” together along with the worst days too.

We examine outliers and their impact in “Where the Black Swans Hide & The 10 Best Days Myth.”

mebfaber.com/wp-content/upl…

mebfaber.com/wp-content/upl…

#5/ Many investors struggle with the psychological challenge of deciding between a buy and hold and a trend following approach. This paper rejects the “one or the other” fallacy, finding a middle ground that gives investors a combination of both worlds:

cambriainvestments.com/wp-content/upl…

cambriainvestments.com/wp-content/upl…

#4/ There’s an old market saying “during a time of crisis, correlations go to 1." This paper examined what asset classes have generally performed well when stocks crash, and offered readers a simple tail risk system designed to help hedge that pain.

mebfaber.com/wp-content/upl…

mebfaber.com/wp-content/upl…

#3/ What are the top investment portfolios in history? The book reached a stunning conclusion – while the portfolios all performed nicely, one of the most significant determinants of performance is often a factor most overlook!

amazon.com/Global-Asset-A…

amazon.com/Global-Asset-A…

#2/ it feels like just yesterday Meb sat down to talk about the ideas in is first book, The Ivy Portfolio, with Mark Haines and Erin Burnett on the floor of CNBC. That was all the way back in 2009, but we still talk to people that were introduced to our ideas through the book.

Ivy popularized some of our favorite market concepts, including endowment style investing, cloning hedge funds, tactical risk management, investing in listed hedge funds at discounts, and our famous “down in a row” mean reversion system.

amazon.com/Ivy-Portfolio-…

amazon.com/Ivy-Portfolio-…

#1/ The paper that started it all! This white paper introduced a simple trend following system in a practical and simple format.

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

The Journal of Wealth Management published a 10-year retrospective on the original paper, which is now one of the most downloaded academic papers on SSRN in history!

Readers and friends have crafted endless variants of the simple model, and we published a companion piece a few years later, “Relative Strength Strategies for Investing”.

cambriainvestments.com/wp-content/upl…

cambriainvestments.com/wp-content/upl…

During the pandemic, we penned another trend paper that many would find counterintuitive called “All Time Highs A Good Time to Invest? No. A Great Time”.

cambriainvestments.com/wp-content/upl…

cambriainvestments.com/wp-content/upl…

Lastly, some may find our whimsical “Three Way Model” a fun offshoot too.

mebfaber.com/2015/06/16/thr…

mebfaber.com/2015/06/16/thr…

• • •

Missing some Tweet in this thread? You can try to

force a refresh