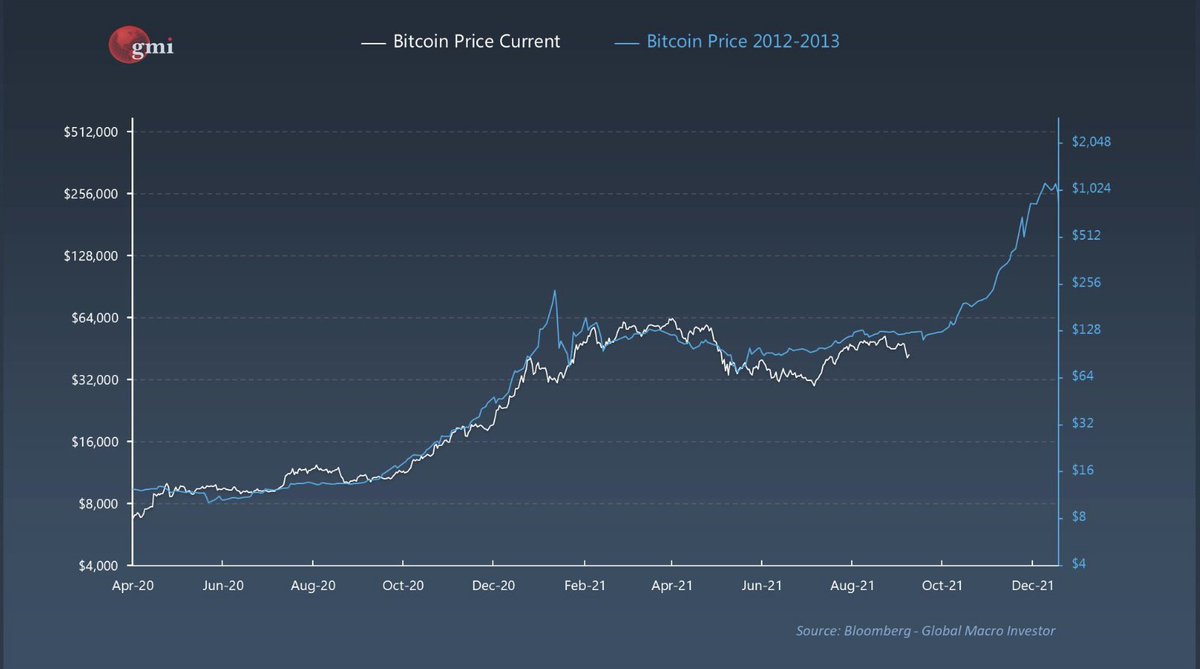

If you don’t see by now that the tokenization of everything is the biggest thing we have ever seen and will ever see, I cant help you as much. It dwarfs all other opportunities for risk reward over time. Web 3.0 is something few yet understand but will change business forever. 1/

I’m working on getting RV into that world over time. So much cool shit in our plans!

But I’m working on setting up some other projects too.

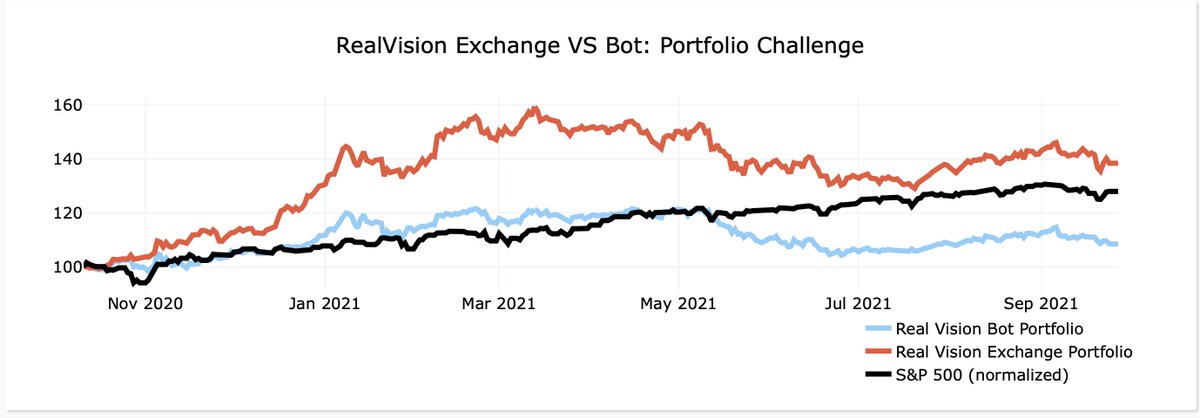

Hedge funds in crypto produce amazing alpha but are capital starved. I’m going to solve that with a crypto fund of funds.

But I’m working on setting up some other projects too.

Hedge funds in crypto produce amazing alpha but are capital starved. I’m going to solve that with a crypto fund of funds.

Sadly that is currently only for HNW and institutions as laws make it hard for normal people.

That launches very soon and solves some big issues for crypto hedge funds, family offices, investors and institutions.

That launches very soon and solves some big issues for crypto hedge funds, family offices, investors and institutions.

There is another project I’m a founder of that will tokenise the worlds biggest existing communities but cant share more info yet but it’s big news and has a ludicrous list of investors.

Let’s all play our part, build businesses, create opportunities and over time we will change the world.

There is plenty of time to sleep when we are dead! Too much to do!

More to come …

There is plenty of time to sleep when we are dead! Too much to do!

More to come …

• • •

Missing some Tweet in this thread? You can try to

force a refresh