Solana is also following ETH in 2017 (haven't got the chart to hand - if anyone has it pls add it).

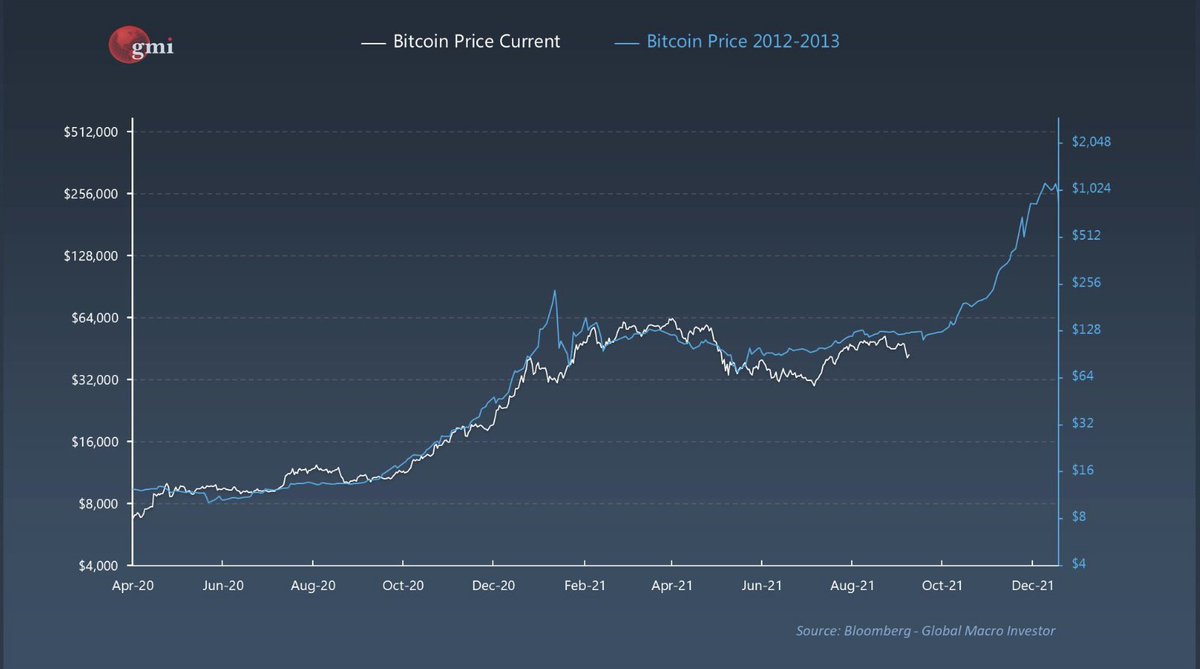

These are all priced according to Metcalfe's Law hence why they are so similar to previous periods. The super high correlation is just spooky however... but a useful framework.

These are all priced according to Metcalfe's Law hence why they are so similar to previous periods. The super high correlation is just spooky however... but a useful framework.

WAGMI.

• • •

Missing some Tweet in this thread? You can try to

force a refresh