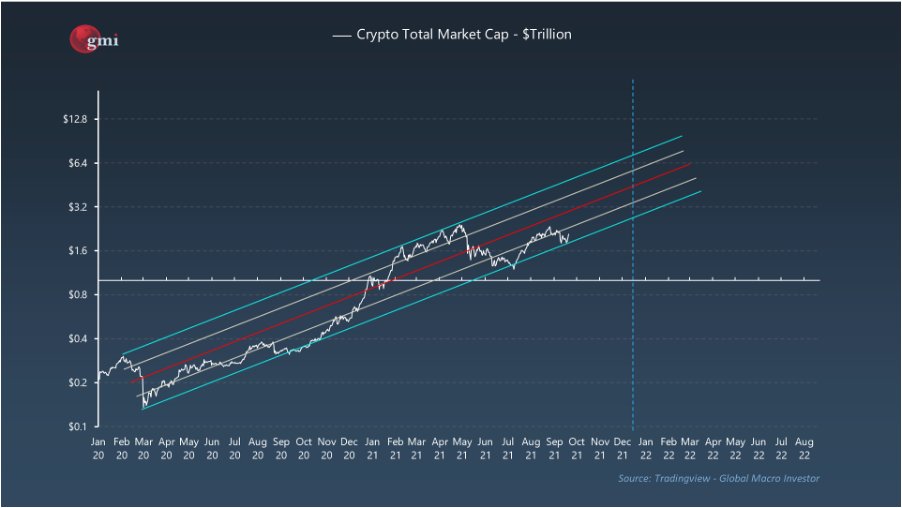

Im finding it very hard to not get extremely bullish about the next few months. Almost every crypto chart looks coiled and ready for a big move after months of consolidation. Here are the two charts that matter to me right now:

This is total market cap. It is likely ready to move from 2 standard deviation oversold vs trend to overbought. That looks to me that the entire space can 3x into year end and 6x into next year ( I think the cycle extends).

The outright chart of market cap is ludicrously bullish once it crossed $900m in market cap and will be an acceleration point. Wave 3 in technical analysis term ushered in by this giant cup and handle/wedge.

Almost every chart of every crypto looks equally coiled, even the small, under appreciated projects.

Writing GMI currently and doing work on all of this and this set up for the acceleration phase is as good as I have ever seen.

Buckle up and good luck.

Writing GMI currently and doing work on all of this and this set up for the acceleration phase is as good as I have ever seen.

Buckle up and good luck.

• • •

Missing some Tweet in this thread? You can try to

force a refresh