Recent amazing $SPELL and $INV rides encouraged me to look into other projects that issue overcollateralized stablecoins. I compared $MKR, $SPELL, $FLX, $INV and $LQTY to find out that $LQTY seems to be extremely undervalued relatively to others. Will it have its moment soon?

1)

To compare the projects I collected the following data from @coingecko:

- MC for a governance token (e.g. $SPELL, $INV, $LQTY)

- MC for a stablecoin (e.g. $MIM, $DOLA, $LUSD)

- TVL in the protocol

- Governance token MC / stablecoin MC ratio

- Governance token MC / TVL ratio

To compare the projects I collected the following data from @coingecko:

- MC for a governance token (e.g. $SPELL, $INV, $LQTY)

- MC for a stablecoin (e.g. $MIM, $DOLA, $LUSD)

- TVL in the protocol

- Governance token MC / stablecoin MC ratio

- Governance token MC / TVL ratio

2)

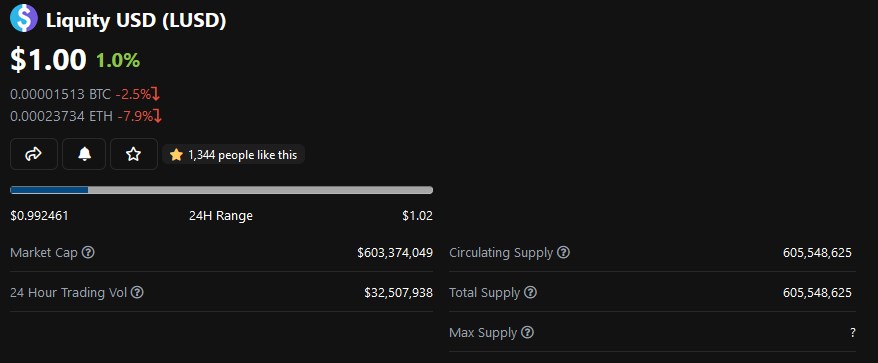

Taking these ratios into consideration, it seems that $LQTY is the most undervalued relatively to others. Its TVL is $2.2B, MC for stablecoin, $LUSD, is more than $600M and MC for the (non)governance token, $LQTY, is only $63M. I ran a few simulations of $LQTY MC...

Taking these ratios into consideration, it seems that $LQTY is the most undervalued relatively to others. Its TVL is $2.2B, MC for stablecoin, $LUSD, is more than $600M and MC for the (non)governance token, $LQTY, is only $63M. I ran a few simulations of $LQTY MC...

3)

If $LQTY MC / $LUSD MC was at the level of competing projects, $LQTY MC would be:

- At $MKR/DAI: $199M; 3.2x

- At $SPELL/MIM: $4445M; 7.1x

- At $FLX/RAI: $553M; 8.6x

- At $INV/DOLA: $941M; 15.1x

That's a lot of room for growth.

If $LQTY MC / $LUSD MC was at the level of competing projects, $LQTY MC would be:

- At $MKR/DAI: $199M; 3.2x

- At $SPELL/MIM: $4445M; 7.1x

- At $FLX/RAI: $553M; 8.6x

- At $INV/DOLA: $941M; 15.1x

That's a lot of room for growth.

4)

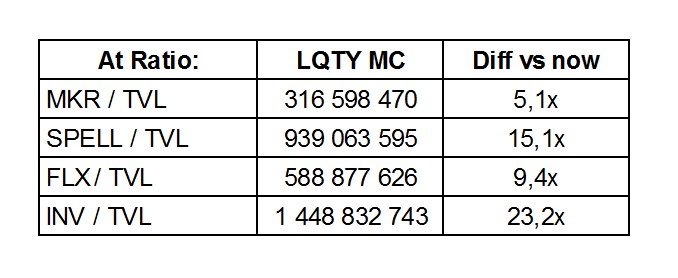

If $LQTY mC / TVL was at the level of competing projects, $LQTY MC would be:

- At $MKR/TVL: $317M; 5.1x

- At $SPELL/TVL: $939M; 15,1x

- At $FLX/TVL: $589M; 9,4x

- At $INV/TVL: $1449M; 23,2x

That's even more room for growth.

If $LQTY mC / TVL was at the level of competing projects, $LQTY MC would be:

- At $MKR/TVL: $317M; 5.1x

- At $SPELL/TVL: $939M; 15,1x

- At $FLX/TVL: $589M; 9,4x

- At $INV/TVL: $1449M; 23,2x

That's even more room for growth.

5)

Is @LiquityProtocol a good project? Absolutely. It's like Maker but instead of DAI it issues LUSD and only accepts the most trustless collateral on Ethereum, $ETH. This way it solves the most criticized issues with Maker - accepting centralized collateral like USDC or WBTC.

Is @LiquityProtocol a good project? Absolutely. It's like Maker but instead of DAI it issues LUSD and only accepts the most trustless collateral on Ethereum, $ETH. This way it solves the most criticized issues with Maker - accepting centralized collateral like USDC or WBTC.

6)

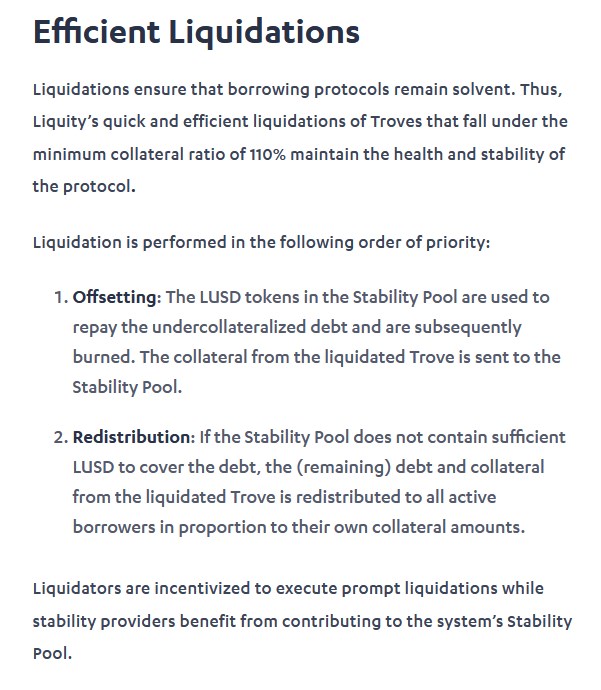

But it's not the only improvement introduced by $LQTY. The efficient liquidations process with the Stability Pool, where users provide LUSD used to quickly liquidate risky positions, makes sure the protocol remains solvent even at unprecedentedly low collateral ratio of 110%.

But it's not the only improvement introduced by $LQTY. The efficient liquidations process with the Stability Pool, where users provide LUSD used to quickly liquidate risky positions, makes sure the protocol remains solvent even at unprecedentedly low collateral ratio of 110%.

7)

Collateral ratio at 110% means, you can borrow up to 90% of the dollar value of your provided collateral. Of course, it's risky and prone to liqudation in case of $ETH dump but it makes borrowing highly capital efficient for those ready to accept the risk.

Collateral ratio at 110% means, you can borrow up to 90% of the dollar value of your provided collateral. Of course, it's risky and prone to liqudation in case of $ETH dump but it makes borrowing highly capital efficient for those ready to accept the risk.

8)

Borrowing is also interest-free. Unlike other borrowing protocols which charge variable (and unpredictable) interest rates for the whole duration of the loan, users at Liquity pay a one-time fee as low as 0.5% of the borrowed amount. No interest is charged later.

Borrowing is also interest-free. Unlike other borrowing protocols which charge variable (and unpredictable) interest rates for the whole duration of the loan, users at Liquity pay a one-time fee as low as 0.5% of the borrowed amount. No interest is charged later.

9)

What's the most exciting for me is that the protocol is fully decentralized and, therefore, censorship resistant. Noone can change or upgrade the contracts and there are no admins that could alter or halt the operation of the protocol in any way.

What's the most exciting for me is that the protocol is fully decentralized and, therefore, censorship resistant. Noone can change or upgrade the contracts and there are no admins that could alter or halt the operation of the protocol in any way.

10)

@LiquityProtocol has even decided to not host a front-end for the protocol. Remember when @Uniswap team removed some assets from their hosted website? This was the fear of the regulator charging them for supporting securities trading. Such a situation cannot happen with here.

@LiquityProtocol has even decided to not host a front-end for the protocol. Remember when @Uniswap team removed some assets from their hosted website? This was the fear of the regulator charging them for supporting securities trading. Such a situation cannot happen with here.

11)

@LiquityProtocol doesn't run its own web interface. Their smart contracts on Ethereum are open for everyone to use and can be accessed via third party front-ends. Operators running front-ends are incentivized by a share of $LQTY rewards their users earn in the Stability Pool.

@LiquityProtocol doesn't run its own web interface. Their smart contracts on Ethereum are open for everyone to use and can be accessed via third party front-ends. Operators running front-ends are incentivized by a share of $LQTY rewards their users earn in the Stability Pool.

12)

Full decentralization at smart contract and front-end level also means there is no governance needed. All the protocol parameters are either preset or algorithmically controlled by the protocol itself. There are no human interventions required. Fully immutable protocol.

Full decentralization at smart contract and front-end level also means there is no governance needed. All the protocol parameters are either preset or algorithmically controlled by the protocol itself. There are no human interventions required. Fully immutable protocol.

13)

Because no governance is required, $LQTY is not really a governance token. It's a utility token that captures 100% of the revenue generated by the Liquity protocol. This is why more than 80% of $LQTY circulating supply is currently staked in the protocol.

Because no governance is required, $LQTY is not really a governance token. It's a utility token that captures 100% of the revenue generated by the Liquity protocol. This is why more than 80% of $LQTY circulating supply is currently staked in the protocol.

14)

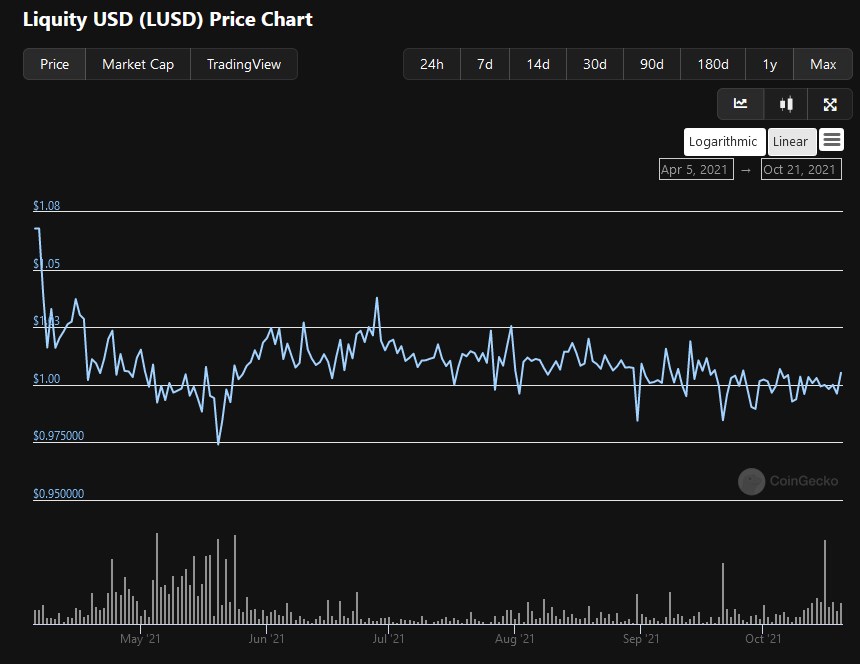

Has a full decentralization proved itself a good approach to build a stablecoin? Thanks to efficient liquidations in the Stability Pool and redemption mechanism, when anyone can exchange 1 $LUSD for 1$ worth of ETH, $LUSD has been extremely stable around 1$ since launch.

Has a full decentralization proved itself a good approach to build a stablecoin? Thanks to efficient liquidations in the Stability Pool and redemption mechanism, when anyone can exchange 1 $LUSD for 1$ worth of ETH, $LUSD has been extremely stable around 1$ since launch.

15)

$LUSD stability has inspired a lot of confidence in other protocols which adopted $LUSD in their products. The best example is @OlympusDAO that introduced LUSD and LUSD-OHM LP bonds which attracted $120M of LUSD into $OHM treasury.

$LUSD stability has inspired a lot of confidence in other protocols which adopted $LUSD in their products. The best example is @OlympusDAO that introduced LUSD and LUSD-OHM LP bonds which attracted $120M of LUSD into $OHM treasury.

16)

Undoubtedly @LiquityProtocol is a great project and its $LUSD is a true decentralized stablecoin. However, $LQTY token hasn't been performing well despite a growing adoption of $LUSD. Maybe it's going to change now when other stablecoin issuers got considerably more traction?

Undoubtedly @LiquityProtocol is a great project and its $LUSD is a true decentralized stablecoin. However, $LQTY token hasn't been performing well despite a growing adoption of $LUSD. Maybe it's going to change now when other stablecoin issuers got considerably more traction?

Of course, it's not financial advice :) Just my thoughts.

If you want to learn more about @LiquityProtocol:

- liquity.org/features/inter… - a short overview of the most important features of the protocol

- docs.liquity.org - deep-dive into the protocol's mechanics

If you want to learn more about @LiquityProtocol:

- liquity.org/features/inter… - a short overview of the most important features of the protocol

- docs.liquity.org - deep-dive into the protocol's mechanics

• • •

Missing some Tweet in this thread? You can try to

force a refresh