"If you missed X, you don't want to miss Y" - it's not a very resourceful shill and I don't like it at all but...

...if you missed $JEWEL, you may not want to miss $ROME :)

@romedaofinance builds an RPG game powered by $OHM-like currency. Check why I find it interesting: 🧵👇

...if you missed $JEWEL, you may not want to miss $ROME :)

@romedaofinance builds an RPG game powered by $OHM-like currency. Check why I find it interesting: 🧵👇

1)

So far $ROME was just considered as another $OHM fork. There were so many of them that the narrative ended abruptly and most forks fell into oblivion. $ROME suffered a lot too. After presale it commenced its journey down as whitelisted presalers were taking hefty profits.

So far $ROME was just considered as another $OHM fork. There were so many of them that the narrative ended abruptly and most forks fell into oblivion. $ROME suffered a lot too. After presale it commenced its journey down as whitelisted presalers were taking hefty profits.

2)

But $ROME didn't fall. It survived the death spiral when many traitor Romans refused to cooperate and abandoned the (III,III) treaty (analogous to 3,3 in $OHM). Faith in @romedaofinance came back with the updated plans for Rome expansion.

medium.com/@RomeDAO/romed…

But $ROME didn't fall. It survived the death spiral when many traitor Romans refused to cooperate and abandoned the (III,III) treaty (analogous to 3,3 in $OHM). Faith in @romedaofinance came back with the updated plans for Rome expansion.

medium.com/@RomeDAO/romed…

3)

@romedaofinance announced the details of their APYRPG - RPG game on top of $ROME - token inspired by $OHM model. Unlike other lazy $OHM forks, $ROME is not just a rebase token for a project with no ambitions other than a reserve currency for chain X. It's a in-game currency.

@romedaofinance announced the details of their APYRPG - RPG game on top of $ROME - token inspired by $OHM model. Unlike other lazy $OHM forks, $ROME is not just a rebase token for a project with no ambitions other than a reserve currency for chain X. It's a in-game currency.

4)

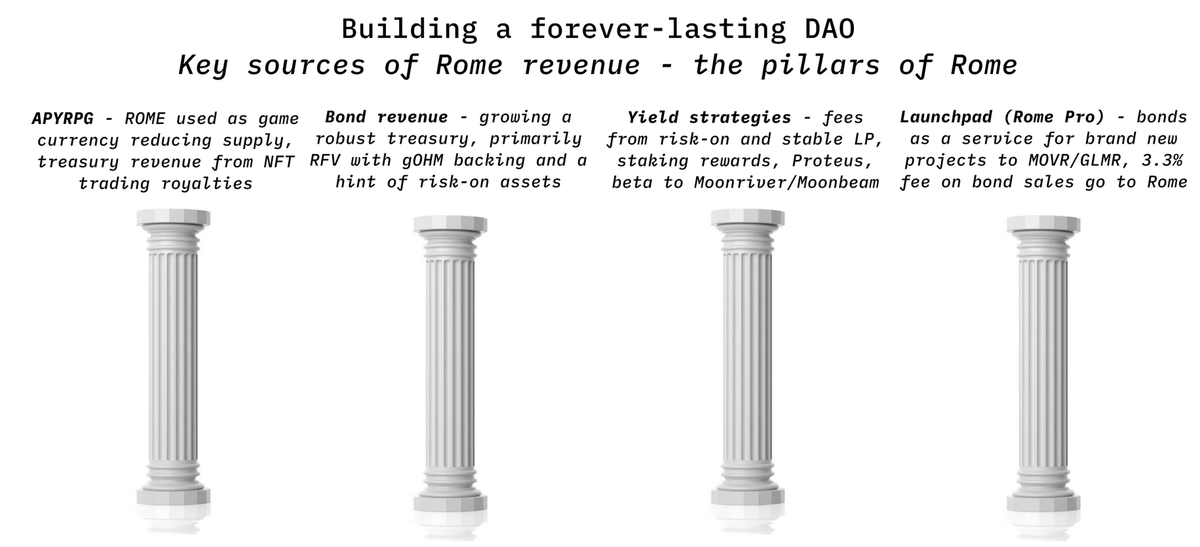

$OHM model for $ROME was chosen as it had proven to be a good way to bootstrap the community via staking and build the treasury via bonds. It's one of the pillars of Rome revenue to build sustainable DAO but not the only one. There are also yield strategies and a launchpad.

$OHM model for $ROME was chosen as it had proven to be a good way to bootstrap the community via staking and build the treasury via bonds. It's one of the pillars of Rome revenue to build sustainable DAO but not the only one. There are also yield strategies and a launchpad.

5)

The game is yet to be released but we know the upcoming phases of expansion:

- Campaign 1: Quests, NFT distribution, battles, spoils of war

- Campaign 2: Heroes, resource farming, professions

- Campaign 3: Grand vision of APYRPG (imperial Rome)

The game is yet to be released but we know the upcoming phases of expansion:

- Campaign 1: Quests, NFT distribution, battles, spoils of war

- Campaign 2: Heroes, resource farming, professions

- Campaign 3: Grand vision of APYRPG (imperial Rome)

6)

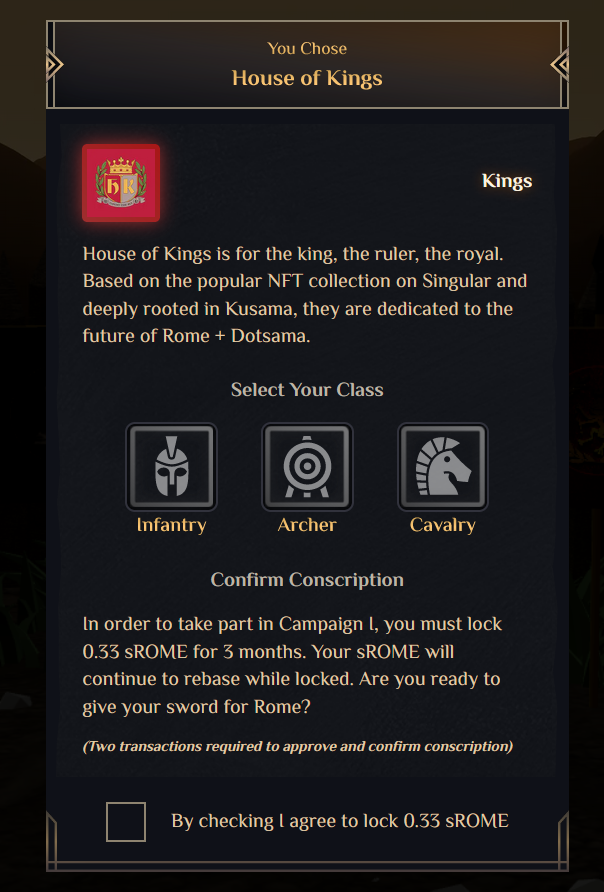

Campaign 1 is about to start in 1 day. Until this time you can create your in-game character by choosing a house, a class and a character name. This will be your on-chain identity in Rome and your selection will impact which in-game items (NFTs) your hero can equip.

Campaign 1 is about to start in 1 day. Until this time you can create your in-game character by choosing a house, a class and a character name. This will be your on-chain identity in Rome and your selection will impact which in-game items (NFTs) your hero can equip.

7)

To participate in Campaign 1, you have to confirm your conscription and it requires you to lock 0.33 sROME (staked $ROME) for 3 months. It will continue to rebase while locked so you are not losing anything other than opportunity cost of locking but it's not a high price imo.

To participate in Campaign 1, you have to confirm your conscription and it requires you to lock 0.33 sROME (staked $ROME) for 3 months. It will continue to rebase while locked so you are not losing anything other than opportunity cost of locking but it's not a high price imo.

8)

Conscription will also grant you a non-transferrable NFT with a poem written by a community member, translated into Latin by a separate community member along with a 3D model rendered by a third. Engaged community is always a good sign, isn't it?

Conscription will also grant you a non-transferrable NFT with a poem written by a community member, translated into Latin by a separate community member along with a 3D model rendered by a third. Engaged community is always a good sign, isn't it?

9)

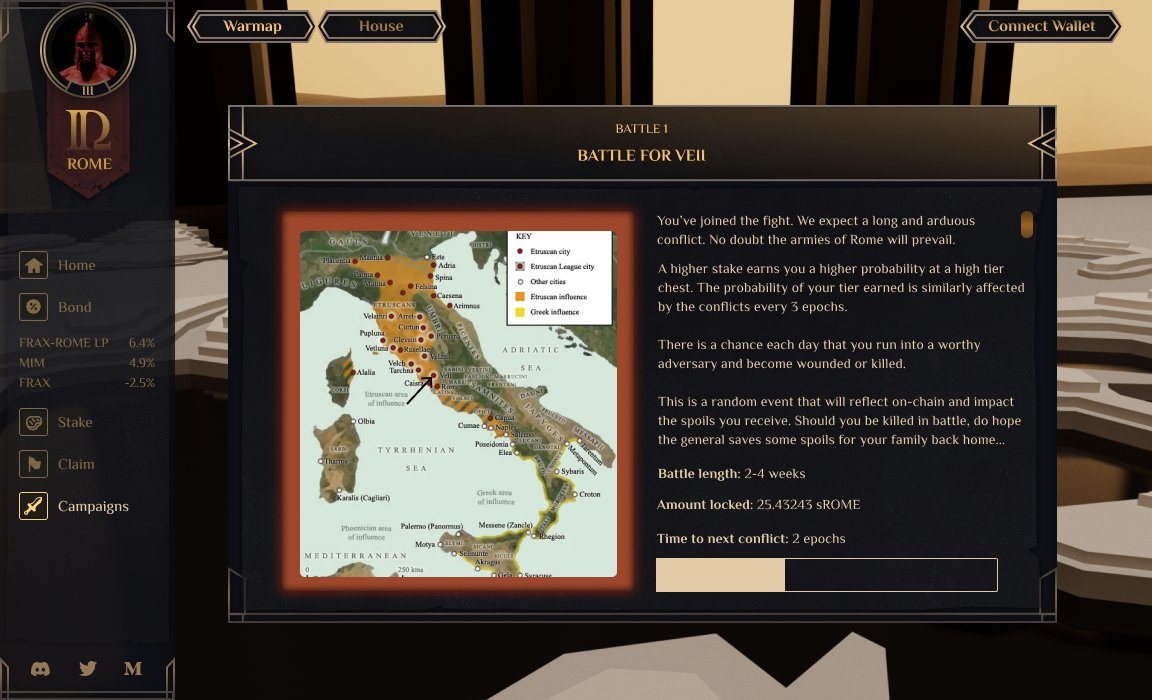

Campaign 1 will be a 3-month-long series of battles and quests during which users will be able to lock sROME to earn specific tiers of chests. The more sROME is locked, the higher a probability to get a higher-tier chest but lower stakes are not excluded from high tiers too.

Campaign 1 will be a 3-month-long series of battles and quests during which users will be able to lock sROME to earn specific tiers of chests. The more sROME is locked, the higher a probability to get a higher-tier chest but lower stakes are not excluded from high tiers too.

10)

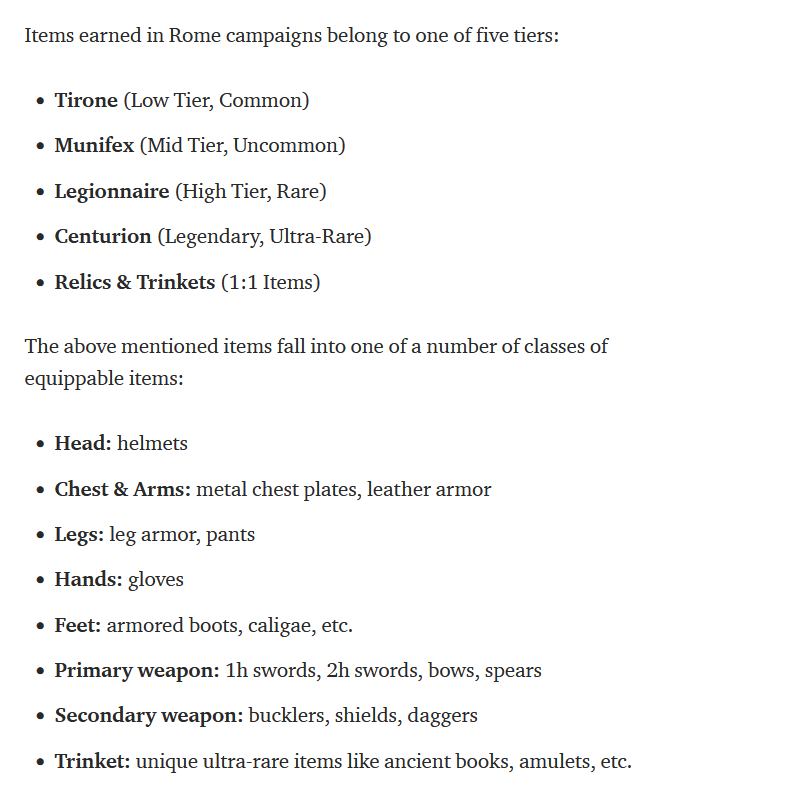

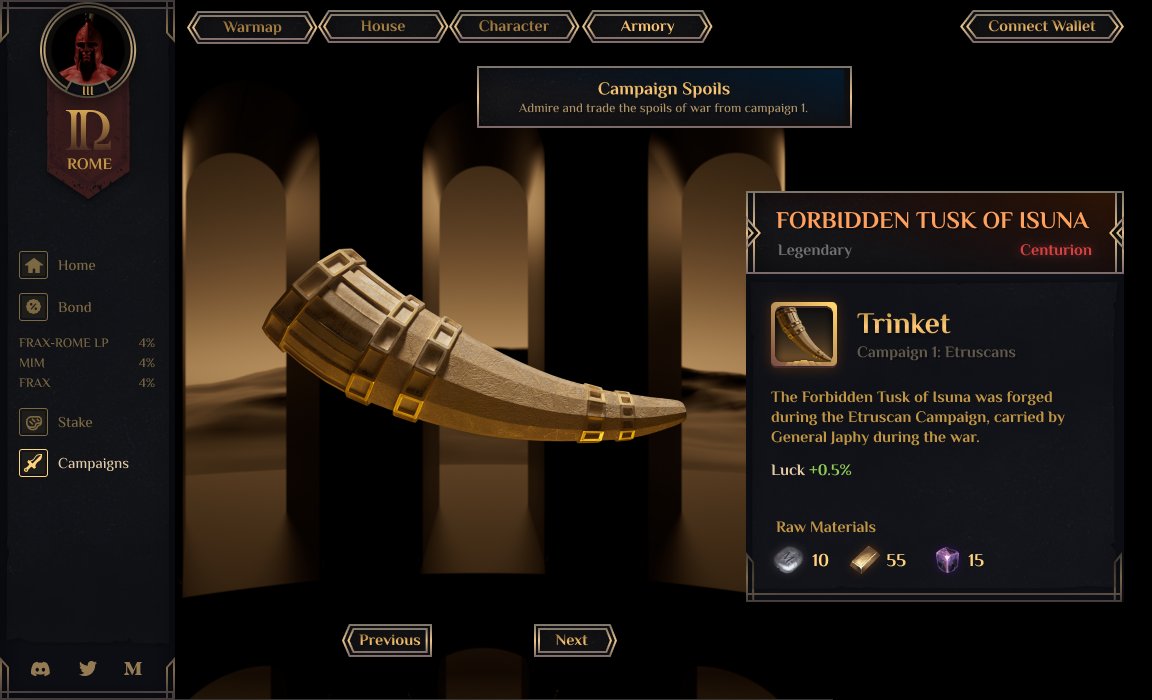

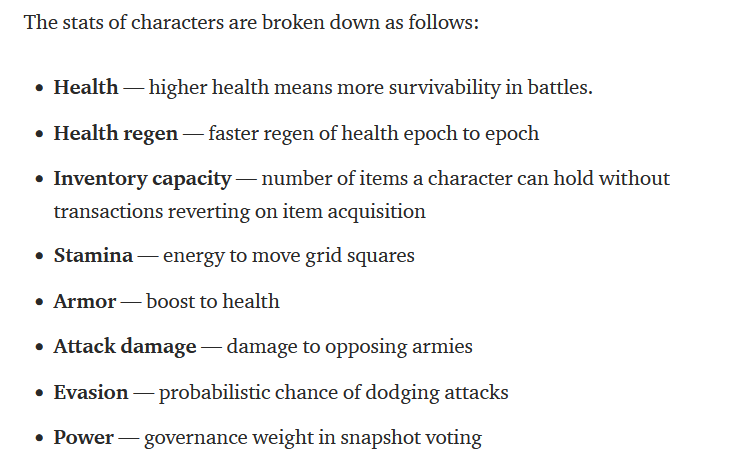

Items earned in Rome campaigns will fall into a number of classes and tiers - some will be very rare and (probably) valuable. Each item will be showcased in the armory, a comprehensive place to view all the items and their stats. It should be ready by the end of Campaign 1.

Items earned in Rome campaigns will fall into a number of classes and tiers - some will be very rare and (probably) valuable. Each item will be showcased in the armory, a comprehensive place to view all the items and their stats. It should be ready by the end of Campaign 1.

11)

During Campaign 2, the armory will enhance its functionality as a marketplace to enable trading NFTs. Moreover, heroes will unlock and armory items will be used to boost their stats. Many more in-game elements (consumables, resources, professions) are to be introduced too.

During Campaign 2, the armory will enhance its functionality as a marketplace to enable trading NFTs. Moreover, heroes will unlock and armory items will be used to boost their stats. Many more in-game elements (consumables, resources, professions) are to be introduced too.

12)

By Campaign 3, the NFT economy of Rome is thriving and the broader experience of the the RPG can be unlocked:

"In this stage, it becomes a proper grand strategy RPG. The map becomes a grid of a few hundred grid squares across Europe, Africa, and Asia."

By Campaign 3, the NFT economy of Rome is thriving and the broader experience of the the RPG can be unlocked:

"In this stage, it becomes a proper grand strategy RPG. The map becomes a grid of a few hundred grid squares across Europe, Africa, and Asia."

13)

In sync with the latest trend of veTokens (model introduced by $CRV, adopted by $FXS, $YFI and soon many other protocols), the Team is also building contracts for a gauge-weighted voting system (vesROME) for how resource allocation functions and house actions take place.

In sync with the latest trend of veTokens (model introduced by $CRV, adopted by $FXS, $YFI and soon many other protocols), the Team is also building contracts for a gauge-weighted voting system (vesROME) for how resource allocation functions and house actions take place.

14)

There are many plans how to make this game an interesting experience that combines DeFi, NFTs and metaverse. This amalgamation of crypto segments bears a close resemblance to @DefiKingdoms $JEWEL, however, two projects are different and don't really compete with each other.

There are many plans how to make this game an interesting experience that combines DeFi, NFTs and metaverse. This amalgamation of crypto segments bears a close resemblance to @DefiKingdoms $JEWEL, however, two projects are different and don't really compete with each other.

15)

Although there is not much yet to see, I consider $ROME as a good exposure to gaming / metaverse trend. This is not my area of expertise though, therefore, I could be very wrong :) The Team has a lot to deliver yet but when they do, it will be too late for a good investment.

Although there is not much yet to see, I consider $ROME as a good exposure to gaming / metaverse trend. This is not my area of expertise though, therefore, I could be very wrong :) The Team has a lot to deliver yet but when they do, it will be too late for a good investment.

16)

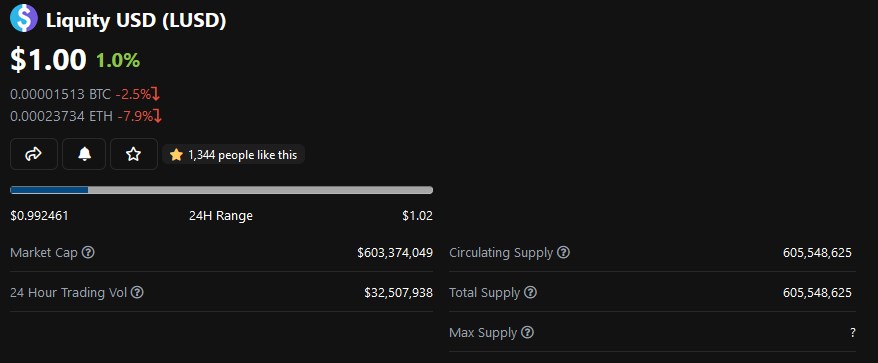

It's also worth noting that current $ROME MC is already $200M while the treasury holds only $38M in ROME-FRAX LP, $FRAX, $MIM and $MOVR. 5x premium is not the highest we have seen in case of $OHM forks but it's definitely not low.

It's also worth noting that current $ROME MC is already $200M while the treasury holds only $38M in ROME-FRAX LP, $FRAX, $MIM and $MOVR. 5x premium is not the highest we have seen in case of $OHM forks but it's definitely not low.

17)

Nevertheless, there are many GameFi projects with higher MC and ridiculously high FDV which don't have heavy treasuries and are valued purely based on expectations. In case of $ROME, when staked, you are not diluted by token unlocks because you benefit from rebases.

Nevertheless, there are many GameFi projects with higher MC and ridiculously high FDV which don't have heavy treasuries and are valued purely based on expectations. In case of $ROME, when staked, you are not diluted by token unlocks because you benefit from rebases.

18)

I don't know if $ROME is a good buy now. Maybe wait for a pull back? But you should definitely join the Campaign 1 by:

1. Getting 0.33 ROME: app.solarbeam.io/exchange/swap

2. Staking ROME for sROME: romedao.finance/stake

3. Locking sROME for 3 months: romedao.finance/house

I don't know if $ROME is a good buy now. Maybe wait for a pull back? But you should definitely join the Campaign 1 by:

1. Getting 0.33 ROME: app.solarbeam.io/exchange/swap

2. Staking ROME for sROME: romedao.finance/stake

3. Locking sROME for 3 months: romedao.finance/house

19)

If you don't have any funds on Moonriver, you will need to bridge them in: app.solarbeam.io/bridge.

The bridge used to give some $MOVR for gas but if it doesn't work you can use gas-less swaps to exchange one of the supported assets for MOVR: app.solarbeam.io/bridge/gas-swap

If you don't have any funds on Moonriver, you will need to bridge them in: app.solarbeam.io/bridge.

The bridge used to give some $MOVR for gas but if it doesn't work you can use gas-less swaps to exchange one of the supported assets for MOVR: app.solarbeam.io/bridge/gas-swap

20)

This is not a buy recommendation. I hold $ROME as my GameFi exposure but I'm ready to hold it 0 if it fails miserably :) I wanted to write about $ROME earlier but procrastinated because of Christmas and it pumped in the meantime. I hope this thread won't mark the top :)

This is not a buy recommendation. I hold $ROME as my GameFi exposure but I'm ready to hold it 0 if it fails miserably :) I wanted to write about $ROME earlier but procrastinated because of Christmas and it pumped in the meantime. I hope this thread won't mark the top :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh