In case you haven’t heard, the world’s 2nd largest economy beat the crap out of its big corps this year & made Wall Street lose $700 billion.

Some say China’s autocratic government has gone crazy trying to revive communism. Really? What the hell’s going on?

Grab your popcorn 🍿

Some say China’s autocratic government has gone crazy trying to revive communism. Really? What the hell’s going on?

Grab your popcorn 🍿

There’s a 🌊 change going on in Chinese economy. It has caused much anxiety & confusion among western investors.

It started with Chinese government going on a killing spree of big-tech excesses.

Chinese consumer tech giants like Alibaba, Tencent & Didi were kings of the world in past decade.

Chinese consumer tech giants like Alibaba, Tencent & Didi were kings of the world in past decade.

Sales & profits were up only. And they enjoyed low taxes and subsidies from local governments eager to remake Silicon Valley on their soil.

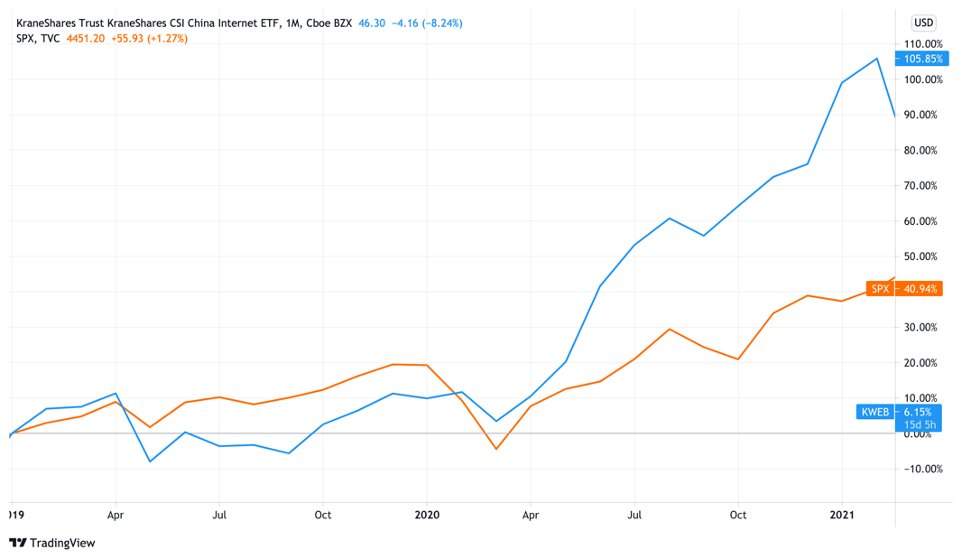

From 2019 to Feb 2021, the return on Chinese internet stocks more than doubled that of S&P 500.

From 2019 to Feb 2021, the return on Chinese internet stocks more than doubled that of S&P 500.

But since late last year, wind suddenly blew the other direction.

Last Oct, the recording-breaking IPO of Jack Ma’s Ant Financial Group was pulled by the government. In July, it ordered app stores to remove the apps of Didi, the Chinese Uber, for data security violation.

Last Oct, the recording-breaking IPO of Jack Ma’s Ant Financial Group was pulled by the government. In July, it ordered app stores to remove the apps of Didi, the Chinese Uber, for data security violation.

Alibaba & Tencent got fined billions of $$ for anti-trust reasons. Then came various crackdowns of companies in gaming, crypto, cloud computing, fintech… By end summer, the blacklist was getting long.

China’s internet stocks listed in the US, used to be darlings of Wall Street, dropped over 50% since Feb. Investors lost 400 billion $$ in July alone. So far the government’s attitude is “Your problem we don’t care”.

But you haven’t seen nothing yet.

Hoping to rein in real estate speculation, the government forced debt limit on property developers. It led to a liquidity crisis at China’s largest developer Evergrande.

Hoping to rein in real estate speculation, the government forced debt limit on property developers. It led to a liquidity crisis at China’s largest developer Evergrande.

The company is close to bankruptcy. The knock-on effect—in both financial market and consumer sentiment—is slowing down entire global economy as we speak.

So why is Chinese government going psycho?

Trick question. It’s not.

However sudden the changes in regulations may seem, it’s been a long time coming. Covid-19 delayed things & bunched together various regulatory actions that would have come out sooner.

Trick question. It’s not.

However sudden the changes in regulations may seem, it’s been a long time coming. Covid-19 delayed things & bunched together various regulatory actions that would have come out sooner.

For tech companies, antitrust & data security had been sore spots for a while.

Think Amazon & Google are stifling competition? Try being a startup in China. It’s the real life Squid Game.

Think Amazon & Google are stifling competition? Try being a startup in China. It’s the real life Squid Game.

Even though Chinese consumer internet market is huge, it’s more monopolized than in most countries, w/ ‘super apps’ like WeChat taking up entire market.

But big tech’s contribution to overall economy is dubious at best.

But big tech’s contribution to overall economy is dubious at best.

In the US, the entire tech sector contributes only 2% of total employment and 6% of GDP, and yet, the 5 biggest tech firms alone—Apple, MS, Amazon, Google, Facebook—accounts for 23% of total stock market cap. The pattern is similar in rest of the world.

If you’re an autocratic government, it’s only a matter of time before you wake up & realize you’re getting worse end of the bargain in your dealing w/ big tech—

You’re supporting them w/ low tax & subsidy, in the name of developing ‘high tech’. But internet companies’ tech is in fact not very ‘high’. Most of their large profits are not from unique IPs, but from network effect, economy of scale & low operating cost.

These companies are not helping you— not creating much employment, not paying enough tax, not giving you a leg up in tech competition, yet sucking up massive capital w/ profits only benefiting small group of people, making the rich richer.

Not to mention that data is the true richness of the 21st century. And these firms profit off of data from your population, which, as you see it, should be a public asset owned by you on behalf of your people.

If crypto/web3 is the western version of giving power back to the people, cracking down big tech is the Chinese version of trying to do the same.

(If you disagree, no need to yell at me. I’m only the messenger telling you how you’d look at this if you were the Chinese gov.)

(If you disagree, no need to yell at me. I’m only the messenger telling you how you’d look at this if you were the Chinese gov.)

And what’s up with the Evergrande debacle?

For past 20 yrs Chinese economy has grown quickly. But much of it is “bullshit growth”.

Bullshit growth is accomplished by over investment. How does it work?

For past 20 yrs Chinese economy has grown quickly. But much of it is “bullshit growth”.

Bullshit growth is accomplished by over investment. How does it work?

Growth targets are handed top down from central to local governments. If the latter have problem reaching targets, they simply build more stuff— highways, bridges, houses— to fill the gap.

This is not hard to do since most banks are state owned. Govs can tell banks where to lend money— in this case, to property development.

Overtime, bigger & bigger share of GDP is composed of bullshit constructions. Over 40% of China’s GDP now is fixed capital investment, much higher than rest of world.

This game can go on for a long time, as banks are awash with savings, cuz population is making more money but with few alternative options for assets to invest in.

And banks suffer no consequence if they make terrible loans, since they’re basically part of government.

So much of the resources the society saved end up subsidizing wasteful bullshit investments to beautify GDP growth numbers. Meanwhile, the household sector is getting smaller & smaller slice of the economic 🥧

The pent-up demand for assets have nowhere to go except stocks & real estate (the asset shortage problem I wrote abt b/f). Chinese stock market is under-developed. So most of asset demand turns into real estate speculation.

The ever-rising house price makes home ownership less affordable, forces people to take on more debt & drives up inequality, just like stock market inflation is driving up inequality in the US & causing social conflicts.

In a sense this is the sign of our time. Just different renditions in different countries.

The CCP is of course aware of the bullshit, but growth took priority in past 2 decades & much of the talk about income distribution was lip service only.

The CCP is of course aware of the bullshit, but growth took priority in past 2 decades & much of the talk about income distribution was lip service only.

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter)

But now the wind appears shifting, because—

It’s the “Common Prosperity” szn.

Xi Jinping wants to make Chinese society more equal & competition more fair. And he thinks now that China’s economy has come such a long way, it’s high time to start solving income distribution puzzle.

Xi Jinping wants to make Chinese society more equal & competition more fair. And he thinks now that China’s economy has come such a long way, it’s high time to start solving income distribution puzzle.

Plus, Covid-19 exposed the social stability risk of high inequality & made the issue more pressing

(I’m sure the CCP watched the mob takeover of US Capitol w/ interest & took copious notes.)

(I’m sure the CCP watched the mob takeover of US Capitol w/ interest & took copious notes.)

The recent policy shifts, from regulating big tech to posing borrowing limits on real estate devs, are all trying to walk in that direction.

“Trying” is the keyword here. If these are easy problems, they would have been solved already.

“Trying” is the keyword here. If these are easy problems, they would have been solved already.

Take real estate for example. Beijing wants to limit house price, but can’t kill the market either, as 80% of household net worth is in real estate. Sharp price corrections would screw existing property owners & trigger painful recession.

(And the real estate market, fully aware it’s too big to fail, continues speculating on with abandon.)

So the government has to tackle this the only way it knows how— gradually, conservatively, with trials & error.

So the government has to tackle this the only way it knows how— gradually, conservatively, with trials & error.

But is China going back to communism?

Hell no.

Hell no.

The memory of the disastrous economic management from the first 30 yrs of CCP regime is still fresh. The experience of recent decades is sharp contrast & drives home the benefit of market economy for the party leadership. No way they’re bringing back the old way.

Instead, the CCP narrative is China needs to invent a new economic regime that’s more equal & fair while still leveraging the benefit of markets.

In other words, capitalism but w/o concentration of wealth, socialism but w/o bunch of losers free riding on welfare, a.k.a. something never existed in modern human history.

If you’re feeling doubtful about this vision, you’re not alone. Though you have to admit the CCP dares to dream.

How will this go down? Nobody knows. But China is setting up ‘demonstration zones’ in Shenzhen & the eastern province of Zhejiang to explore routes to this ‘common prosperity’.

These zones are lab rats for CCP’s governing experiments, just like how free market was first tried out in Shenzhen 30 yrs ago. Their local governments are assigned targets for social goals like size of middle class & education, rather than GDP growth targets.

Why I’m still bullish about China.

Part of it is b/c fundamentals are still quite strong.

Part of it is b/c fundamentals are still quite strong.

https://twitter.com/RealNatashaChe/status/1438940842987765764?s=20

But here’s something more important.

Experienced venture capitalists bet on big industry trends & competent entrepreneurs, emphasis on the latter.

This is b/c startup is messy and future uncertain. But if the entrepreneur is experienced & capable, they’ll figure things out.

Experienced venture capitalists bet on big industry trends & competent entrepreneurs, emphasis on the latter.

This is b/c startup is messy and future uncertain. But if the entrepreneur is experienced & capable, they’ll figure things out.

The same logic applies when you assess a country. Is the leadership experienced and flexible enough to figure stuff out on the fly when they’re trying to steer the country in new direction?

You can answer this by looking at what they did & how they did it in the past.

You can answer this by looking at what they did & how they did it in the past.

You may not be a fan of CCP ideology or autocratic power. But you’ve got to accept that regime has by & large delivered on the economic front.

They understand the reality of their country. They’re patient w/ solving big problems through iterations, & practical enough to change tactic when something doesn’t work.

These’re qualities you’d want to see in a company founder. They’re no less important in a country government that’s trying to chart a new path.

The regulatory shifts have negative impacts no doubt. And I fully expect China’s growth to not be so stellar for next few yrs. But I’m long term optimistic and the fundamentals remain solid.

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future posts. Be civil.

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future posts. Be civil.

• • •

Missing some Tweet in this thread? You can try to

force a refresh