The 1st time I used deFi, it felt like I witnessed something so huge that my brain couldn't process.

I had to lie down on the couch for a few hrs to let the adrenaline pass.

That's the magical moment I always refer back to whenever market sells off.

I had to lie down on the couch for a few hrs to let the adrenaline pass.

That's the magical moment I always refer back to whenever market sells off.

https://twitter.com/FredWick7/status/1440459344923873286?s=20

Price is down. It sucks. But ultimately I'm in this space because crypto is one of the great experiments in human history and I don't want to miss a second of it.

It may sound unrelated, but last time I felt a magical moment like that was in 2001 when China joined WTO.

It may sound unrelated, but last time I felt a magical moment like that was in 2001 when China joined WTO.

I was in school and went to a party at a professor's where we gathered to watch the WTO ceremony on TV.

I remember biking back to dorm after midnight in freezing wind of Beijing winter, yet didn't feel cold at all cuz I was running on the high of having just witnessed history.

I remember biking back to dorm after midnight in freezing wind of Beijing winter, yet didn't feel cold at all cuz I was running on the high of having just witnessed history.

China took off soon after and became one of the greatest economic miracles in modern time.

Why am I telling you this?

Cuz it may seem that most analysis I write on crypto is quite cerebral. But TBH my conviction mostly doesn't come from logic, which has no imagination.

Why am I telling you this?

Cuz it may seem that most analysis I write on crypto is quite cerebral. But TBH my conviction mostly doesn't come from logic, which has no imagination.

It comes from the intuition deep down that I can't articulate, yet it somehow knows something is world changing way before my small left brain can pick it up.

The analysis etc only comes after.

If you're feeling depressed about ST market movements, I suggest you look for your own magical epiphanies.

Either that, or take the left-brain approach--do extensive research to arrive at your own conclusion about the space.

If you're feeling depressed about ST market movements, I suggest you look for your own magical epiphanies.

Either that, or take the left-brain approach--do extensive research to arrive at your own conclusion about the space.

Cuz at the end of day your conviction has to build on something deeper than an up-only price history or some influencers' propaganda on twitter.

Otherwise you'd likely buy/sell at the worst time.

Otherwise you'd likely buy/sell at the worst time.

There're a lot of shit, scams, fads, and stupidity in crypto. And being world changing is not for the faint of heart. It'll be a bumpy road. And if you don't create your own conviction, you're not gonna enjoy this ride.

And quit looking to some crypto gurus to give price predictions. Those are no more than comfort food for your scared inner child.

Those people don't know more than you if you put in the time to learn. It's a new space. There's no experts.

Those people don't know more than you if you put in the time to learn. It's a new space. There's no experts.

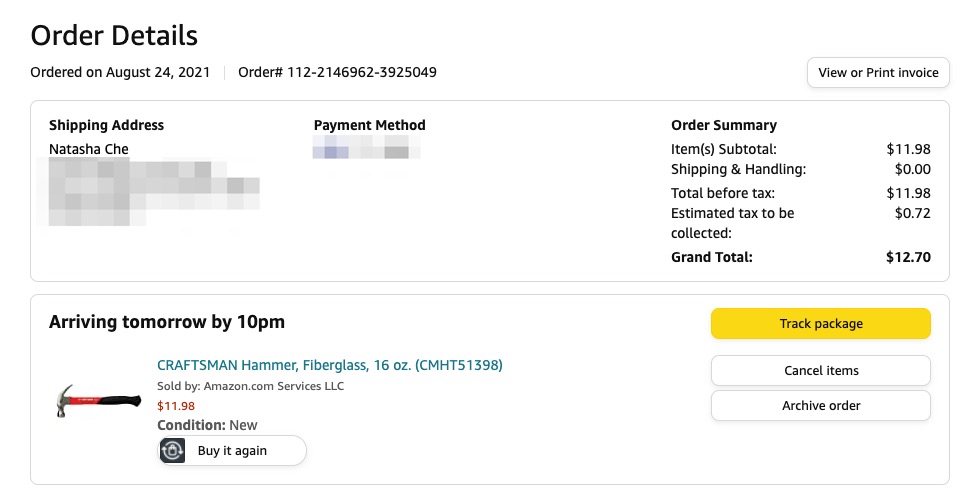

https://twitter.com/RealNatashaChe/status/1415325248979832832?s=20

Life is a game. Irony is the more you can take things NOT seriously, the more you can play at full capacity. So lighten up.

Ok I'm done with this stinky long rant. Bye.

• • •

Missing some Tweet in this thread? You can try to

force a refresh