1/ Coming up from a deep dive on the DeFi 2.0 rabbit hole. My learnings:

I. Where Are We Now?

II. NFTs, DAOs, and DeFi Are A Feedback Loop

III. Crypto Is A "Nuclear Reactor" For Money and Memes

IV. What's Going On In DeFi 2.0?

V. Other Trends

rhyslindmark.com/defi2/

I. Where Are We Now?

II. NFTs, DAOs, and DeFi Are A Feedback Loop

III. Crypto Is A "Nuclear Reactor" For Money and Memes

IV. What's Going On In DeFi 2.0?

V. Other Trends

rhyslindmark.com/defi2/

4/ In 2021 (right), there's less complete trash in the space then there was in 2017 (left).

Amazing that BitConnect was still in the Top 20 in Dec 2017.

Amazing that BitConnect was still in the Top 20 in Dec 2017.

6/

II. NFTs, DAOs, and DeFi Are Feedback Loop

I was inspired by @ljxie's tweet the other day.

It's correct to think of our new abbreviation alphabet soup as a mutually enforcing feedback loop.

II. NFTs, DAOs, and DeFi Are Feedback Loop

I was inspired by @ljxie's tweet the other day.

It's correct to think of our new abbreviation alphabet soup as a mutually enforcing feedback loop.

https://twitter.com/ljxie/status/1448876946218106880

7/

- DeFi in Web3 is like routing and bandwidth logic in Web2. Throughput infrastructure.

- NFTs in Web3 are like JPEGs in Web2. They provide us with meaning. Your grandma can send them.

- DAOs in Web3 are like wikis and forums in Web2. A network-native way to coordinate.

- DeFi in Web3 is like routing and bandwidth logic in Web2. Throughput infrastructure.

- NFTs in Web3 are like JPEGs in Web2. They provide us with meaning. Your grandma can send them.

- DAOs in Web3 are like wikis and forums in Web2. A network-native way to coordinate.

8/ This is all aligned with @nickgrossman and @thedanigrant's Myth of the Infrastructure Phase from 2018. usv.com/writing/2018/1…

I've updated it here for 2021. God, so much infrastructure.

I've updated it here for 2021. God, so much infrastructure.

9/ These cooperative relationships are crucial.

As Dawkins notes in The Selfish Gene:

"Selection favors genes which succeed in the presence of other genes which in turn succeed in the presence of them."

Crypto is exhibit A for this with memes.

...But what powers these memes?

As Dawkins notes in The Selfish Gene:

"Selection favors genes which succeed in the presence of other genes which in turn succeed in the presence of them."

Crypto is exhibit A for this with memes.

...But what powers these memes?

10/

III. Crypto Is A "Nuclear Reactor" For Money and Memes

We're going to need to go a bit further back in history for this section.

Let's start with this great @waitbutwhy image that shows the branching possibilities of life:

III. Crypto Is A "Nuclear Reactor" For Money and Memes

We're going to need to go a bit further back in history for this section.

Let's start with this great @waitbutwhy image that shows the branching possibilities of life:

11/ Branches also exist for the universe. But which branch happens?

Before genes, physical laws "choose" a branch. Stars.

After genes, biological evolution chooses. Biosphere and the tree of life.

After memes, cultural evolution chooses. Technosphere and the tree of ideas.

Before genes, physical laws "choose" a branch. Stars.

After genes, biological evolution chooses. Biosphere and the tree of life.

After memes, cultural evolution chooses. Technosphere and the tree of ideas.

12/ Genes and memes need energy to replicate.

- Genes "found" photosynthesis and mitochrondria to access energy.

- Memes found the Agricultural Revolution (farms) and Industrial Revolution (fossil fuels) to access energy.

Industrial Revolution exploited the atom frontier.

- Genes "found" photosynthesis and mitochrondria to access energy.

- Memes found the Agricultural Revolution (farms) and Industrial Revolution (fossil fuels) to access energy.

Industrial Revolution exploited the atom frontier.

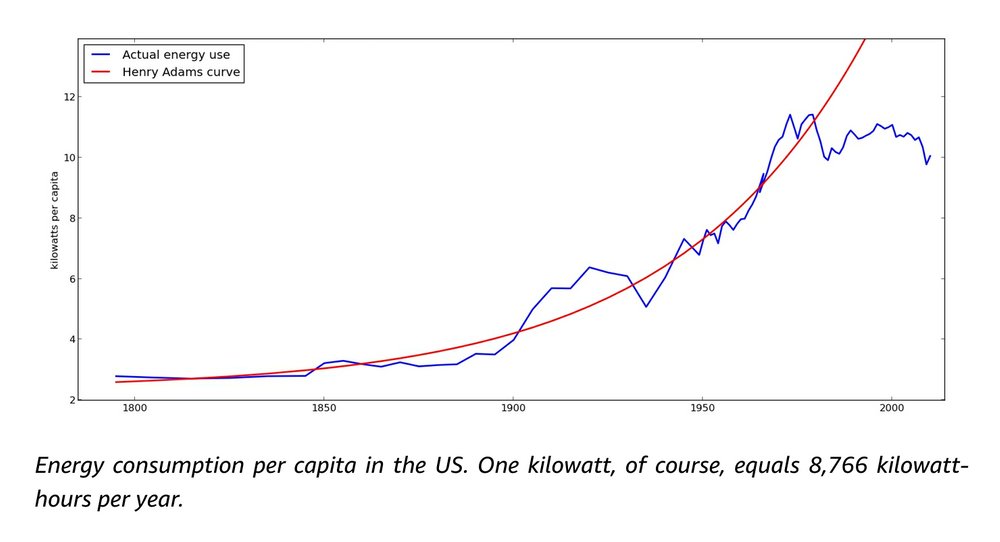

13/ But what about the internet and Information Revolution?

It exploited the bits frontier.

But bits aren't energy! Energy use per capita hasn't gone up in the last 50 years.

It exploited the bits frontier.

But bits aren't energy! Energy use per capita hasn't gone up in the last 50 years.

14/ The internet makes lots of money (GAFA). But it's less than it "should."

Partially b/c the internet is an info tech, not an energy tech like the previous revolutions.

Partially b/c it's hard to monetize bits. Wiki creates tons of value but Jimmy needs to beg to capture it.

Partially b/c the internet is an info tech, not an energy tech like the previous revolutions.

Partially b/c it's hard to monetize bits. Wiki creates tons of value but Jimmy needs to beg to capture it.

15/ So we get Web2:

Ads: Google, Facebook

E-commerce: Amazon (selling atoms)

SaaS: Stripe, etc. (providing gated access to an API)

Ads: Google, Facebook

E-commerce: Amazon (selling atoms)

SaaS: Stripe, etc. (providing gated access to an API)

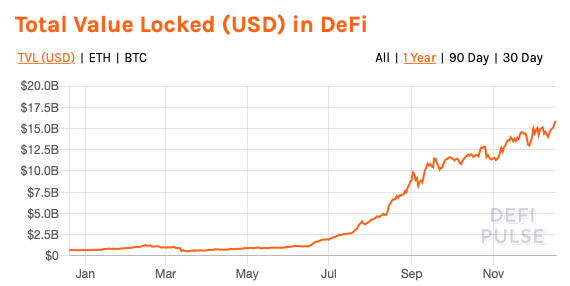

16/ Crypto and Web3 have allowed us to monetize previously unmonetizable memes.

There is a massive frontier of value to be captured and recycled here.

-BTC gains put into ETH pre-sale

-ETH gains put into DeFi infra

-VCs and crypto whales pumping gains back into the ecosystem

There is a massive frontier of value to be captured and recycled here.

-BTC gains put into ETH pre-sale

-ETH gains put into DeFi infra

-VCs and crypto whales pumping gains back into the ecosystem

17/ This is why crypto is a nuclear reactor.

It hits a vast amount of memetic value that wasn't capture-able before. This isn't direct energy (in the joules) sense, but is valuable in the memetic sense.

Printing magic internet money is immensely powerful and cannot be stopped.

It hits a vast amount of memetic value that wasn't capture-able before. This isn't direct energy (in the joules) sense, but is valuable in the memetic sense.

Printing magic internet money is immensely powerful and cannot be stopped.

18/

IV. So What's Going On In DeFi 2.0?

First off, can we not call it DeFi 2.0? It sounds like MBA speak. Is there nothing else? Like maybe OwnerFi or WeFi or LiqFi or even "Pepe meme lulz gm gn wagmiFi"

IV. So What's Going On In DeFi 2.0?

First off, can we not call it DeFi 2.0? It sounds like MBA speak. Is there nothing else? Like maybe OwnerFi or WeFi or LiqFi or even "Pepe meme lulz gm gn wagmiFi"

19/ DeFi 2.0 (ZoomerFi) is a bit tough to grok.

Like DeFi 1.0 (BoomerFi), it is a network of cooperative, self-reinforcing protocols.

It's GenZ kids (Crypto Class 2018) who grew up on liquidity farming and DAOs, and are now iterating on those mechanisms.

Like DeFi 1.0 (BoomerFi), it is a network of cooperative, self-reinforcing protocols.

It's GenZ kids (Crypto Class 2018) who grew up on liquidity farming and DAOs, and are now iterating on those mechanisms.

20/ Much of DeFi 2.0 is focused on a more effective way to route liquidity. Instead of allowing the mercenary market to do so, it gives this power to the DAOs themselves. (Coasian POV h/t @samkazemian)

This is why they call it Protocol-Owned Liquidity.

This is why they call it Protocol-Owned Liquidity.

https://twitter.com/samkazemian/status/1450171827389562889

21/ Let's look at some specific projects:

@OlympusDAO buys liquidity for their native $OHM token.

-It's like a continuous ICO (trading OHM for tokens).

-It's like an algo stablecoin (DAO issues $OHM backed by treasury).

-It's like an on-chain Fed (assets back a currency).

@OlympusDAO buys liquidity for their native $OHM token.

-It's like a continuous ICO (trading OHM for tokens).

-It's like an algo stablecoin (DAO issues $OHM backed by treasury).

-It's like an on-chain Fed (assets back a currency).

22/ @KlimaDAO is an Olympus fork (kind of like a v1 of Olympus Pro).

But instead of buying DAI or liquidity for $OHM, it bonds carbon offset tokens for $KLIMA.

But instead of buying DAI or liquidity for $OHM, it bonds carbon offset tokens for $KLIMA.

23/ Like Olympus, @TokenReactor is focused on liquidity. They're making liquidity as abundant for Web3 as bandwidth is for Web2.

They use subDAOs (reactors), to allocate tokens across AMMs and liquidity providers through "Liquidity Directors"—incentivized liquidity allocators.

They use subDAOs (reactors), to allocate tokens across AMMs and liquidity providers through "Liquidity Directors"—incentivized liquidity allocators.

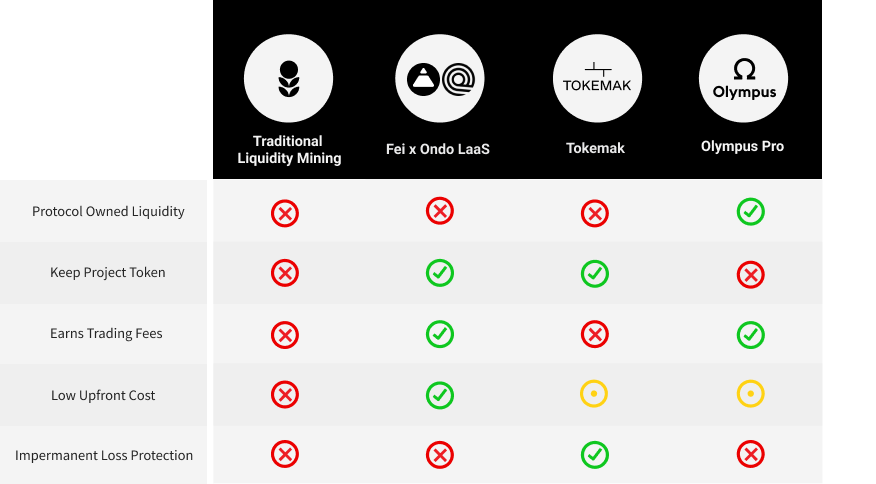

24/ @joey__santoro of @feiprotocol gives this great table of how these approaches to liquidity differ.

medium.com/fei-protocol/n…

medium.com/fei-protocol/n…

25/ @AlchemixFi isn't in the liquidity space. They're closer to @PoolTogether_.

Alchemix makes "self-repaying loans". You give collateral to get a loan. The interests is paid off by putting the collateral in yield farms. At the end, you get your collateral back. It's "no-loss."

Alchemix makes "self-repaying loans". You give collateral to get a loan. The interests is paid off by putting the collateral in yield farms. At the end, you get your collateral back. It's "no-loss."

@AlchemixFi @PoolTogether_ 26/ @RariCapital is focused on lending markets, like Compound or Aave.

But Compound controls which markets form. With Rari Fuse, users can create any market pair.

@Uniswap made a permissionless DEX for the long-tail of assets. Rari made a permissionless protocol for lending.

But Compound controls which markets form. With Rari Fuse, users can create any market pair.

@Uniswap made a permissionless DEX for the long-tail of assets. Rari made a permissionless protocol for lending.

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap 27/ ofc, there are more projects in "DeFi 2.0" like @fraxfinance. But these are some of the leaders.

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance 28/ For me, the crucial part of DeFi 2.0 is that they have all done token swaps with each other and collaborate regularly.

**Memes replicating in the presence of other memes.**

**Memes replicating in the presence of other memes.**

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance 29/ One other crucial idea from a group selection / memetic perspective:

All memes (including intersubjective, code-governed myths like DAOs) want to both survive (retention) and spread (acquisition and transmission).

All memes (including intersubjective, code-governed myths like DAOs) want to both survive (retention) and spread (acquisition and transmission).

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance 30/ DAOs spread through viral memes like (3,3).

But they also need capital to survive. Digitally native memes/myths had trouble surviving w/o access to capital (like GAFA monetizing the attention economy).

But crypto allows memes to stick around:

But they also need capital to survive. Digitally native memes/myths had trouble surviving w/o access to capital (like GAFA monetizing the attention economy).

But crypto allows memes to stick around:

https://twitter.com/RhysLindmark/status/1407424268376309760?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1407424268376309760%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.rhyslindmark.com%2Fdefi2%2F

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance 31/

https://twitter.com/naval/status/1439791325927264268?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1439791325927264268%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.rhyslindmark.com%2Fdefi2%2F

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance 32/ As @ohmzeus notes below, protocol-owned liquidity allows DAOs to survive for much longer.

If a DAO doesn't have a deep bank account, it might die during a bear market. But with "Proof-of-Reserves", it can stick around:

If a DAO doesn't have a deep bank account, it might die during a bear market. But with "Proof-of-Reserves", it can stick around:

https://twitter.com/ohmzeus/status/1378756220601966593

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus 33/ Other things to note about DeFi 2.0:

Many of the community leaders are pseudonymous.

Hi @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1

Also, lol @TrustlessState lookin' like a black sheep here :)))

Many of the community leaders are pseudonymous.

Hi @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1

Also, lol @TrustlessState lookin' like a black sheep here :)))

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 34/ Pseudonymity allows these folks to be a bit more risky in their actions.

(Olympus could be viewed as a continuous ICO and the SEC no likely that.)

Feels network-native, digitally native, and native to COVID.

(Olympus could be viewed as a continuous ICO and the SEC no likely that.)

Feels network-native, digitally native, and native to COVID.

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 35/

https://twitter.com/RhysLindmark/status/1440780489766277124?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1440780489766277124%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.rhyslindmark.com%2Fdefi2%2F

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 36/ DeFi 2.0 LARPs with NFTs For Meaning.

DeFi is just money. So these projects "inject" meaning through NFTs and other inspiration.

DeFi is just money. So these projects "inject" meaning through NFTs and other inspiration.

https://twitter.com/OlympusDAO/status/1448071241127112708?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1448071241127112708%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.rhyslindmark.com%2Fdefi2%2F

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 37/ DeFi 2.0 (+ crypto generally) have a new set of 2021 memes to replace legacy 2017 memes like HODL and BUIDL.

Many of these are profile-native like (3, 3), (☢️,☢️), (🌳,🌳).

HODL of old has been replaced by wagmi and ngmi.

Insiders wagmi. Outsiders ngmi.

Many of these are profile-native like (3, 3), (☢️,☢️), (🌳,🌳).

HODL of old has been replaced by wagmi and ngmi.

Insiders wagmi. Outsiders ngmi.

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 38/ One interesting part of wagmi is that it's naturally collaborative by nature.

**Memes that survive in the presence of other memes that also survive in the presence of them.**

**Memes that survive in the presence of other memes that also survive in the presence of them.**

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 39/ gm and gn are powerful because they happen every day, so it has natural survivability.

Kind of similar to praying five times a day or weekly mass.

Kind of similar to praying five times a day or weekly mass.

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 40/ "iykyk" (if you know, you know) is another powerful meme. This is memetically fit because it's FOMO-inducing. You want to learn about the thing that you don't know about. iykyk has spread outside of crypto as well.

https://twitter.com/delitzer/status/1439220320905224195?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1439220320905224195%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.rhyslindmark.com%2Fdefi2%2F

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 41/ Zooming out from the memes specifically, I'm pretty darn bullish on DeFi 2.0.

Disclaimer: Through my research, I gained exposure to DeFi 2.0:

I have roughly $2,000 of FXS, TRIBE, OHM, ALCX, and TOKE, all of which is staked. I also bought $500 of RARI.

see rhyslindmark.eth

Disclaimer: Through my research, I gained exposure to DeFi 2.0:

I have roughly $2,000 of FXS, TRIBE, OHM, ALCX, and TOKE, all of which is staked. I also bought $500 of RARI.

see rhyslindmark.eth

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 42/ Tried to buy Verra carbon offsets to Toucan bridge to get TCO2 to get BCT to bond into KLIMA, but couldn't figure out the Verra part 😂😂😂

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState 43/ If you want to learn more about DeFi 2.0, there's a ton of good content.

Podcasts w/ @BanklessHQ @TrustlessState @RyanSAdams were *immensely* helpful for me.

I honestly watched these six podcasts, roughly all back-to-back. 😂

(And then dreamed of protocol-owned liquidity.)

Podcasts w/ @BanklessHQ @TrustlessState @RyanSAdams were *immensely* helpful for me.

I honestly watched these six podcasts, roughly all back-to-back. 😂

(And then dreamed of protocol-owned liquidity.)

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams 1. KlimaDAO

2. DeFi 2.0 w/ @scupytrooples

3. Scoopy again

4. Rari w/ @jai_bhavnani

5. Tokemak w/ @LiquidityWizard

6. OHM w/ @ohmzeus

2. DeFi 2.0 w/ @scupytrooples

3. Scoopy again

4. Rari w/ @jai_bhavnani

5. Tokemak w/ @LiquidityWizard

6. OHM w/ @ohmzeus

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard 45/ My two favorite mega threads on DeFi 2.0 were:

@scupytrooples

and

@samkazemian

@scupytrooples

https://twitter.com/scupytrooples/status/1447398430574141445

and

@samkazemian

https://twitter.com/samkazemian/status/1450171826106028036

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian 46/ @nateliason has a great piece in @every that made me feel more comfortable on the risks (and risk-free floor) of OlympusDAO. every.to/almanack/olymp…

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian @nateliason @every 47/ @delitzer has an excellent piece that showcases some of the crazy DAO applications that will happen as things like Rari Fuse spread.

Dan was an excellent source for DeFi 1.0 and is still an excellent source for DeFi 2.0.

Dan was an excellent source for DeFi 1.0 and is still an excellent source for DeFi 2.0.

https://twitter.com/delitzer/status/1449233878757961733

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian @nateliason @every @delitzer 48/ This piece from Olympus helped me understand how it was different from other algorithmic stablecoins like ESD.

"ESD regulates supply via debt (liabilities) while OHM regulates supply via equity (assets)."

olympusdao.medium.com/comparison-of-…

"ESD regulates supply via debt (liabilities) while OHM regulates supply via equity (assets)."

olympusdao.medium.com/comparison-of-…

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian @nateliason @every @delitzer 49/ Lots of other good folks to follow (random top-of-mind is @Tetranode).

Thanks to all of you above for writing, coding, and spearheading this work!

Will be excited to see where it goes. 🤞

Thanks to all of you above for writing, coding, and spearheading this work!

Will be excited to see where it goes. 🤞

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian @nateliason @every @delitzer @Tetranode 50/ One random non-DeFi 2.0 note:

There's another section in my article on "Part V. Other Trends".

There's another section in my article on "Part V. Other Trends".

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian @nateliason @every @delitzer @Tetranode 51/ I want to highlight—#4: Decentralized Web Advocates Join Crypto.

It's great to see:

@sarahdrinkwater, @mala, @MartaBelcher all at @FilFoundation. V excited to see how they shape crypto mindset and policy!

It's great to see:

@sarahdrinkwater, @mala, @MartaBelcher all at @FilFoundation. V excited to see how they shape crypto mindset and policy!

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian @nateliason @every @delitzer @Tetranode @sarahdrinkwater @mala @MartaBelcher @FilFoundation 52/ Also, if you got this far, thanks for reading!

I only spend ~20% of my time in crypto, but I really enjoyed this recent dive.

If you want to check out how crypto relates to systems change more generally, check out this, which we finished last week:

roote.co/wisdom-age

I only spend ~20% of my time in crypto, but I really enjoyed this recent dive.

If you want to check out how crypto relates to systems change more generally, check out this, which we finished last week:

roote.co/wisdom-age

@AlchemixFi @PoolTogether_ @RariCapital @Uniswap @fraxfinance @ohmzeus @WartuII @sayinshallah @scupytrooples @Dionysus_Klima @ArchimedesCryp1 @TrustlessState @BanklessHQ @RyanSAdams @jai_bhavnani @LiquidityWizard @samkazemian @nateliason @every @delitzer @Tetranode @sarahdrinkwater @mala @MartaBelcher @FilFoundation 53/ gn

• • •

Missing some Tweet in this thread? You can try to

force a refresh