#Distribution Below is how an index return distribution can "potentially" evolve with time AS OBSERVED at starting time t=0.

As an example, one can view this as a potential #Nifty return distribution with PDFs given by Nov month end options (t=1), Dec month end options (t=2)..

+

As an example, one can view this as a potential #Nifty return distribution with PDFs given by Nov month end options (t=1), Dec month end options (t=2)..

+

and so on (T=1 can be weekly also but I reckon weekly distributions won't look that smooth based on what I observed of option price/IV behavior).

Things to note:

At t=0 nothing is random, everything deterministic and pdf is a dirac-delta function.

+

Things to note:

At t=0 nothing is random, everything deterministic and pdf is a dirac-delta function.

+

And with time, probability of index moving away from its mean (colored with orange ticks) goes up and so pdf spreads wider and it's peak value keeps coming down in order to assign more weight to returns away from its mean.

+

+

I put more weight (fat tails) on lower returns as is observed mostly with stock index returns.

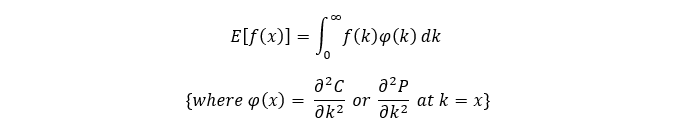

If one were to price a customized/exotic european payoff expiring at, say, T=3, then an expected value of that payoff with that distribution at t=3 could be used to price it.

(end)

If one were to price a customized/exotic european payoff expiring at, say, T=3, then an expected value of that payoff with that distribution at t=3 could be used to price it.

(end)

• • •

Missing some Tweet in this thread? You can try to

force a refresh