UK SONIA Curve Ripping Higher….

$HSBC +100bps = +$5.7B of Incremental NII that can absorb any tiny China losses in the future.

+$2.0B comes from UK alone… another $1.3B from Hong Kong HIBOR alone which is pegged to $DXY Fed Funds…

$HSBC +100bps = +$5.7B of Incremental NII that can absorb any tiny China losses in the future.

+$2.0B comes from UK alone… another $1.3B from Hong Kong HIBOR alone which is pegged to $DXY Fed Funds…

https://twitter.com/gamesblazer06/status/1452610568804716546

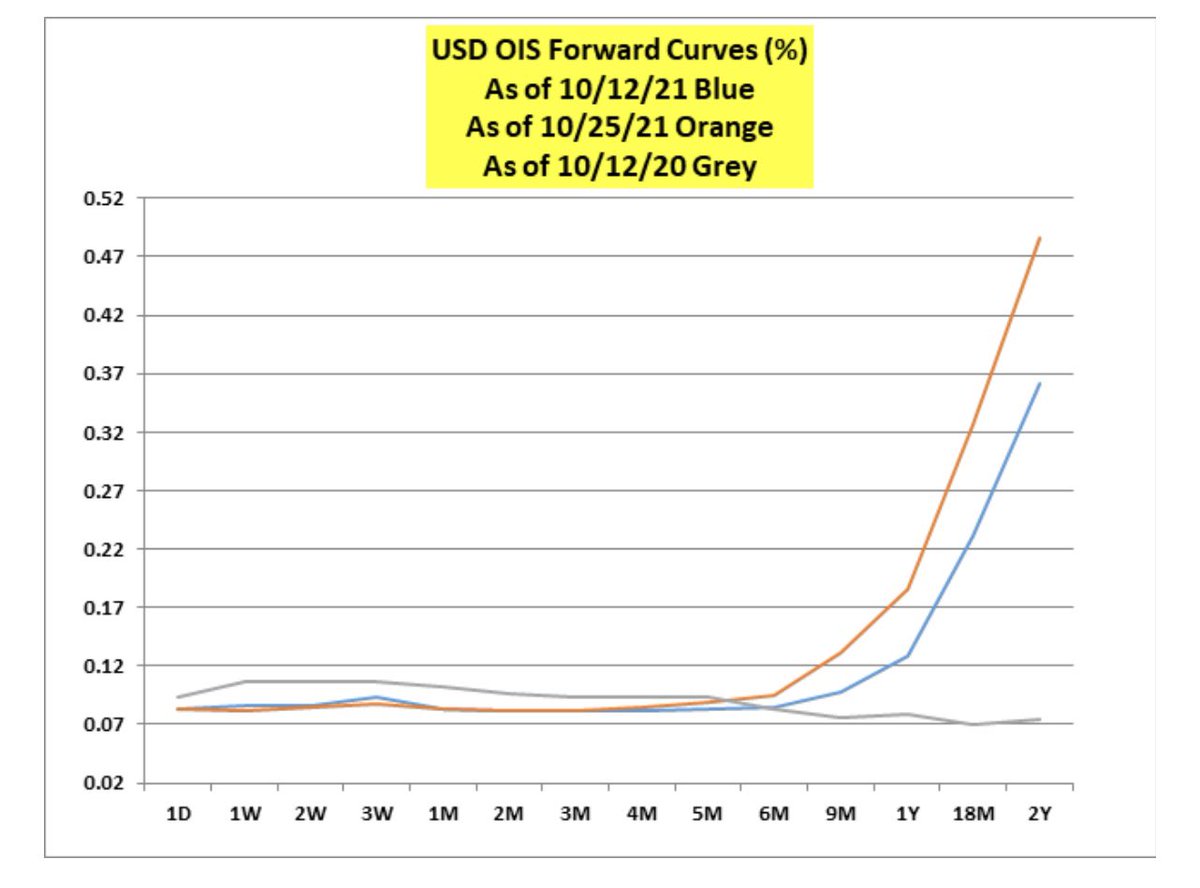

So if the Short Thesis is built around a $DXY Wrecking Ball.. perhaps we might be forgetting the additional Credit Loss Absorption power on Sheet in an environment where there is SRF, Fed RRP (could go back to Zero) and $DXY Swap lines as ubiquitous as telephone poles nowadays.

Stronger $DXY is good for $HSBC.

Macro guys have this trade on backwards.

• • •

Missing some Tweet in this thread? You can try to

force a refresh