Banks don’t really care about 5s30s

https://twitter.com/PondSagg/status/1453087608192516106

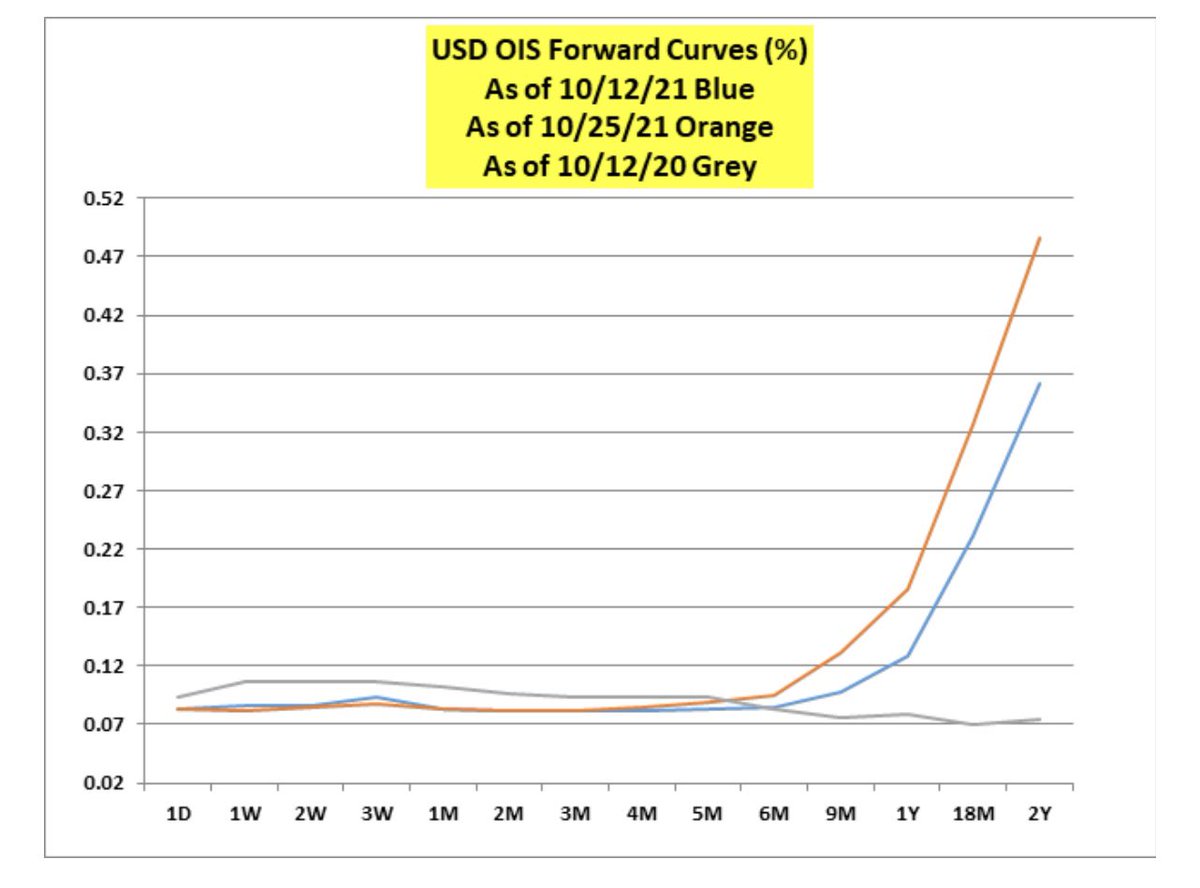

It’s really 10Y3M… coz most funding at Front End of the Curve… as well as loans are mostly Front End as well … other 25% is long end mainly coz of XS Cash gets reinvested at the long end 10-30years. Rule of thumb is 75% of $XLF NII is front end.. rest back end.

Belly useless.

Belly useless.

Banks are made up of Floating Rate Loans LIBOR/Prime etc.. all move with the Front End of Curve… almost matched against Deposits funding all front end…that lags.. the only reason back end matters is all this XS Cash HQLA that has to be reinvested in Cash/TLT/Agencies.

$BAC will make +$8B Pretax… with +100bps Parallel Shift.. U can see skew to Front End of Curve… Also $BAC Longs don’t even care if the Curve Flattens on Rate Hikes… Still $5.5B Pretax on +100bps IOR & -25bps Flattening on Long End…

Parallel Shifts are Glorious! 👇

$XLF

Parallel Shifts are Glorious! 👇

$XLF

• • •

Missing some Tweet in this thread? You can try to

force a refresh