ok so I always talk about having a plan for *BEFORE* things happen

so lemme just talk you through the basics of what I'm thinking and planning rn

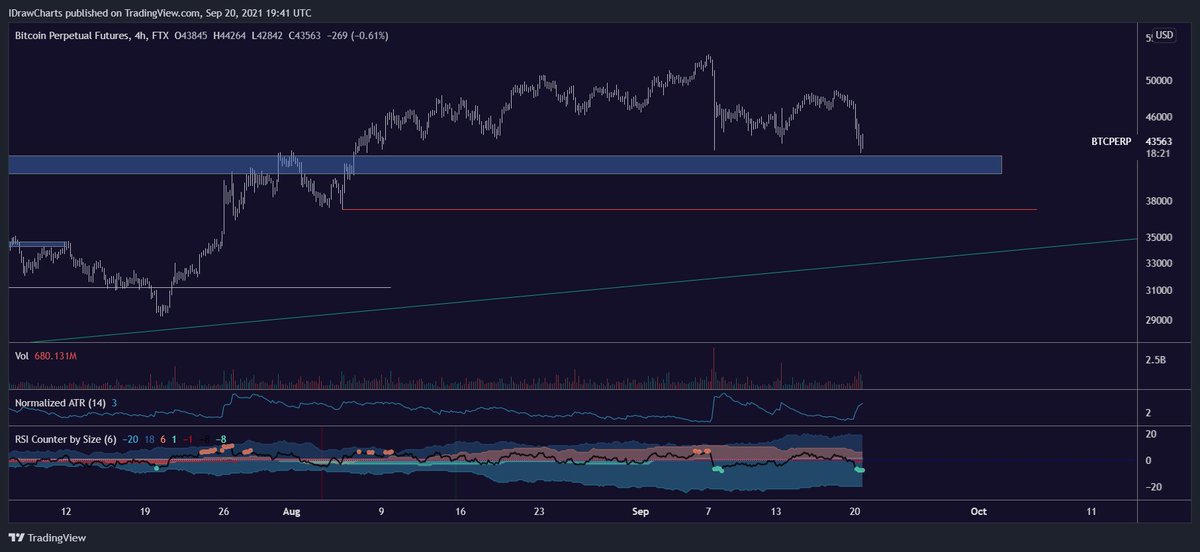

using this chart (I watch a lot of other stuff besides charts, but this will do for the example)

so lemme just talk you through the basics of what I'm thinking and planning rn

using this chart (I watch a lot of other stuff besides charts, but this will do for the example)

top grey line: previous ATH

indicator on the chart: volume profile for previous ATH distribution range. This is important.

the value area is marked by the second grey line and bottom red line

the value area mean that price was accepted into that range previously

indicator on the chart: volume profile for previous ATH distribution range. This is important.

the value area is marked by the second grey line and bottom red line

the value area mean that price was accepted into that range previously

how do we know it was accepted? because that's where most of the volume was. It's where market participants were willing to interact.

The green line is just the average price at which volume occurred during that range

The green line is just the average price at which volume occurred during that range

if price breaks out of a previously accepted value area and sustains, it means that value area is no longer considered by the majority of the market to be a "fair price"

one side or the other is in control, because they see the previous value area prices as a bargain

one side or the other is in control, because they see the previous value area prices as a bargain

we broke up and through that area

if indeed that area is cheap, it ought to be bid back up fairly rapidly.

which means that any price below the second grey line would be a bargain.

if indeed that area is cheap, it ought to be bid back up fairly rapidly.

which means that any price below the second grey line would be a bargain.

if the market does *not* see that price as cheap, price may very well be accepted back into the value area

this is not a bad thing, just means there isn't enough momentum yet. I would not be bearish if that happens (remember I'm sitting on an average entry of 46k)

this is not a bad thing, just means there isn't enough momentum yet. I would not be bearish if that happens (remember I'm sitting on an average entry of 46k)

if that is the case, I would expect the market to continue to chop around the green line (average value)

I would hold my position.

I would hold my position.

but if the market breaks below that red line? The bottom of the value area? That's when I cut my position. That's when I know that there is not enough strength in the market and that I should be flat or short.

I have my plan, I will stick to it.

Life is easy this way.

I have my plan, I will stick to it.

Life is easy this way.

if you wanna learn a bit more about this type of analysis, @abetrade has a great blog on the topic (and some other stuff besides), would recommend checking it out

• • •

Missing some Tweet in this thread? You can try to

force a refresh