The SBI Q2 Report is out. Six slides bear upon #XRP and #Ripple and then I just type a couple more thoughts..

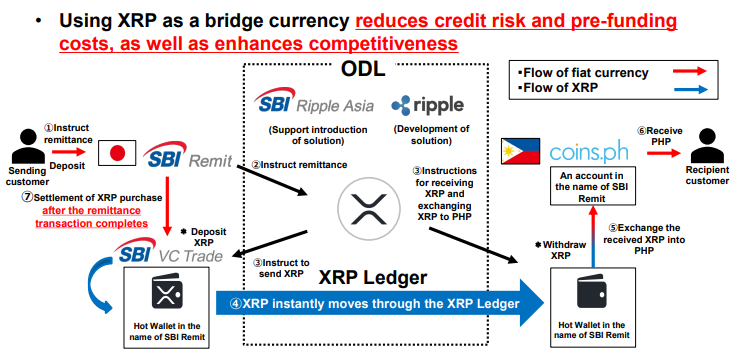

1) First up - ODL makes the presentation! (p.181) JPY-PHP is Japan's first DA remittance service. sbigroup.co.jp/english/invest…

1) First up - ODL makes the presentation! (p.181) JPY-PHP is Japan's first DA remittance service. sbigroup.co.jp/english/invest…

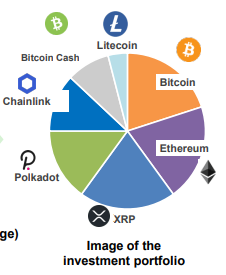

4) SBI is launching a crypto fund of the DA they sell with a large portion as #XRP. (not clear if it will be 50% as reported last year, but doubtful?) (p.174)

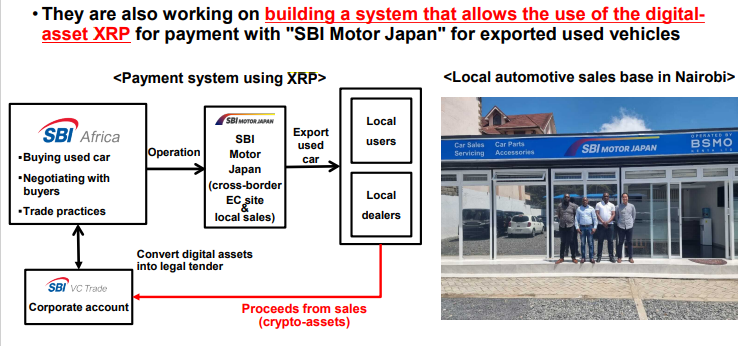

5) #XRP is central to their remittance strategy, obviously, but as SBI goes all-in with DeFi, tokenized assets and NFTs, will XRP find an expanding role? (p.153)

And now, boring text with no pictures-

SBI describes itself as a personal online bank that is pivoting to include larger corporate accounts, their regional revitalization efforts require it. It means providing FX liquidity in traditional ways, too, not just Ripple/XRP. 🤔

SBI describes itself as a personal online bank that is pivoting to include larger corporate accounts, their regional revitalization efforts require it. It means providing FX liquidity in traditional ways, too, not just Ripple/XRP. 🤔

They move forward w/ Osaka Exchange providing global DA liquidity, too. #XRP is presented very specifically for xborder tx's. I presume more ODL corridors are on the way, but will their consideration of XRP change as their DA ambitions grow? NFT? Sidechains? That's the q.

• • •

Missing some Tweet in this thread? You can try to

force a refresh