The counterintuitive idea behind the Kelly Criterion that's striking to me is that you can improve returns by taking less risk. Seems like many use Kelly to justify more risk, but I believe the opposite, especially after accounting for uncertainty and correlation. Thread:

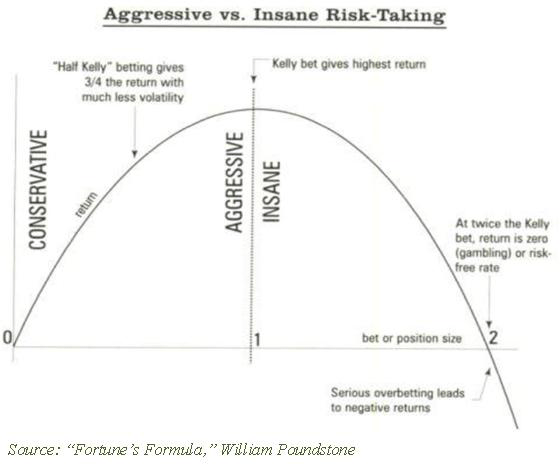

Kelly tells you the mathematically optimal bet size given the risk/reward of a bet. When you bet too big, your returns fall. Not risk-adjusted returns, actual returns. Overbet enough and your returns go negative. But when you underbet, you still get most of the returns.

Given this asymmetry of severe punishment for overbetting but small penalty for underbetting, it seems wise to always underbet. If you're currently overbetting, it's a no-brainer to reduce size - returns go up, risk goes down, plus you'll sleep better and probably live longer.

Kelly size generally increases in bets with: higher expected value, smaller downside, and higher win rate. For example, for a bet with a lotto style payoff, with a very low win rate and 100% downside, Kelly will recommend a tiny size, even if the bet has enormous upside.

Much of the Kelly literature deals with gambling, where you can confidently calculate the risk and reward. But in financial markets, we can only guess at these. This introduces another variable into the calculation, uncertainty.

I'm not sure what the official definitions are, but I think risk and uncertainty are very different. To me, risk is the chance you get unlucky, even as you have a good understanding of the bet. Uncertainty is the possibility that your understanding of the bet is flat out wrong.

Ex: you play a dice game with good odds. You roll a bad number and lose. Got unlucky but it was still a good bet. That's risk.

But if you can't see the entire die so you're not sure how many sides it has. And maybe the die is loaded. That's uncertainty.

But if you can't see the entire die so you're not sure how many sides it has. And maybe the die is loaded. That's uncertainty.

Uncertainty is more dangerous than risk. Kelly says to only make +EV bets. Make enough +EV bets and you are certain to get rich. Make enough -EV bets and you are certain to go broke. Worse than getting unlucky is being on the path to certain destruction.

Due to uncertainty, feedback is critical. We are mostly blind but we can get a faint sense of the dimensions of our bets when we observe the results. I think PNL is the best feedback. It's not perfect but it's the best we have. History is useful but PNL comes from the present.

Lack of feedback is a major risk of very long holding periods and investing philosophies that emphasizes toughing out large multi-year drawdowns. You make so few bets and get so little feedback, that your career could be half over by the time you realize you made a mistake.

And, due to uncertainty, the tails in payoffs are less attractive, i.e. strategies with extremely high win rate with infinite risk, or extremely low win rate with massive upside. These bets have EV that sits on a knife edge between +/- as rare events have massive impact.

A strategy you thought had a 10% win rate could easily be 5% in reality, making it deeply -EV, but you didn't know because you got lucky before. Or a strategy you thought had 300% loss potential but turns out it was 3000%. You need a huge sample to clearly see extreme tails.

Another variable traders need to deal with is correlation. You could be making bets that are properly sized in isolation, but combined into a portfolio, result in serious overbetting.

For example, holding many oil stocks is really just one big oil bet. So what would the correct Kelly size be for a long crude futures position? Apply the same logic to every country, sector, factor, correl to GDP etc. Seems likely most portfolios are overbetting on something.

This is where hedges come in. Hedges get a bad rep but I think properly used can unlock a much higher floor and ceiling. They can greatly reduce both uncertainty and correlation, overall making a bet stronger even while giving up upside.

To conclude, given the asymmetry of over vs under betting, it's prudent to never overbet. And we need to further discount Kelly estimates due to uncertainty/correlation. Not to mention the psychological havoc that drawdowns wreak. Much wiser to err on the side of caution. End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh