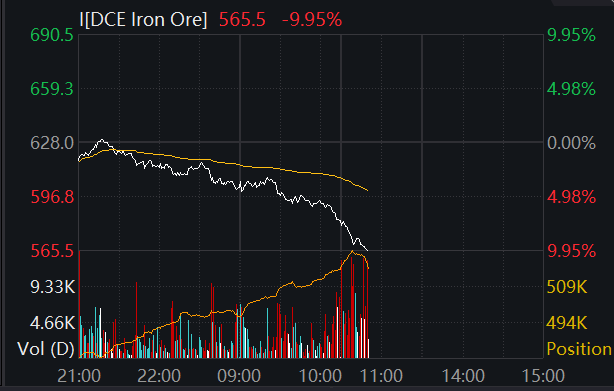

The most-traded #ironore contract fell below 600 yuan per ton, down 5.65%, for the first time since May 2020.

SGX #ironore index futures due December fells more than 3%.

#China #future

SGX #ironore index futures due December fells more than 3%.

#China #future

The most-traded #ironore contract extended its decline to 8.04% at 577.5 yuan/ton.

The most-traded #ironore contract in #China dives to the limit down.

SGX #ironore future plunges 7%.

Iron ore stockpiles in 7 major ports from Australia and Brazil recorded 12.92 mln tons from Oct.25-31, rosed by 0.33 mln tons w/w, slightly above 2021 average, data shows.

SGX #ironore future plunges 7%.

Iron ore stockpiles in 7 major ports from Australia and Brazil recorded 12.92 mln tons from Oct.25-31, rosed by 0.33 mln tons w/w, slightly above 2021 average, data shows.

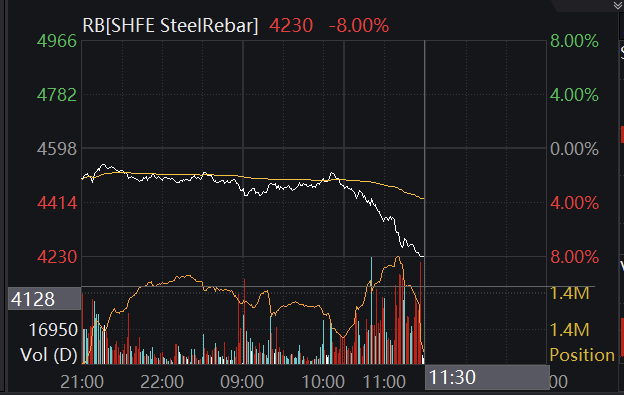

#China #Steel rebar futures shed to limit-down, at 4,230 yuan per ton.

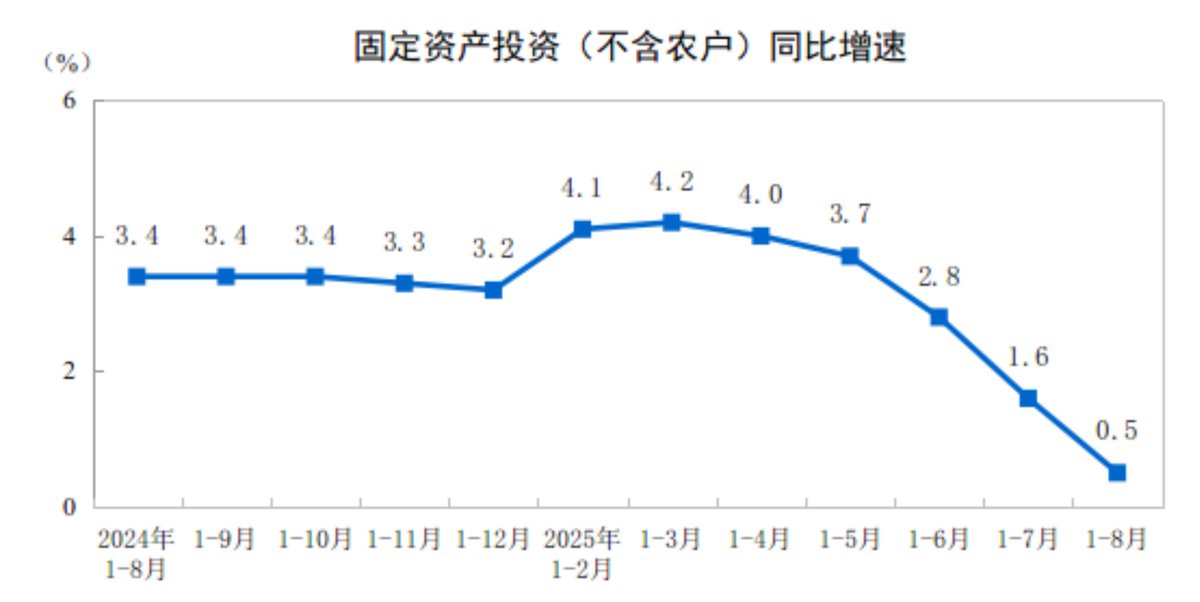

Daily crude steel output in the final third of October drooped to the lowest since March 2020.

Frequent requests from local govts to curb output, while steel demand has dampened mills’ willingness to produce.

Daily crude steel output in the final third of October drooped to the lowest since March 2020.

Frequent requests from local govts to curb output, while steel demand has dampened mills’ willingness to produce.

• • •

Missing some Tweet in this thread? You can try to

force a refresh