Covering China's business and market. #CN_Note #ChinaChart

Check out our real-time news website @MKTNews_Global

4 subscribers

How to get URL link on X (Twitter) App

🇨🇳In August, #China's total retail sales were recorded at 3.967 trillion yuan, up 3.4% y/y.

🇨🇳In August, #China's total retail sales were recorded at 3.967 trillion yuan, up 3.4% y/y.

🇨🇳NBS #PMI breakdown:

🇨🇳NBS #PMI breakdown:

https://twitter.com/Sino_Market/status/1843472202496409938🇨🇳NDRC: China's financial sector has recently stepped up its efforts to launch a package of incremental policies to promote a sustained economic upturn for the better.

https://twitter.com/Sino_Market/status/1813915734986420727

The "Decision on Comprehensively Deepening Reform and Advancing Chinese-style Modernization" proposes more than 300 major reform measures, all of which pertain to aspects of systems, mechanisms, and institutions.

The "Decision on Comprehensively Deepening Reform and Advancing Chinese-style Modernization" proposes more than 300 major reform measures, all of which pertain to aspects of systems, mechanisms, and institutions.

1⃣ #China's Jan-May industry output +5.6% y/y or +0.3% m/m.

1⃣ #China's Jan-May industry output +5.6% y/y or +0.3% m/m.

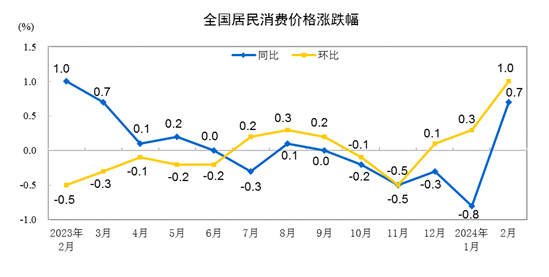

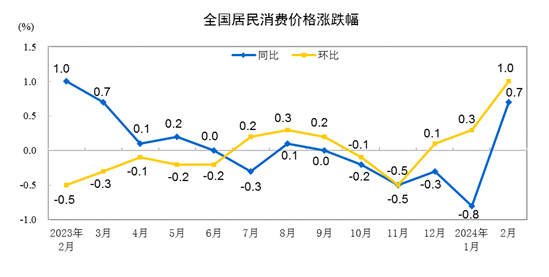

CHINA CPI BREAKDOWN:

CHINA CPI BREAKDOWN:

2) The gap between social retail consumption in 2024 and the level of potential trend is expected to narrow once again. There are several factors contributing to this:

2) The gap between social retail consumption in 2024 and the level of potential trend is expected to narrow once again. There are several factors contributing to this:

China's benchmark Shanghai Composite Index fell below the 3,000 threshold on Friday, hitting a new year-to-date low, as foreign investors’ outflow from the A-share market has entered an unprecedented stage.

China's benchmark Shanghai Composite Index fell below the 3,000 threshold on Friday, hitting a new year-to-date low, as foreign investors’ outflow from the A-share market has entered an unprecedented stage.https://x.com/Sino_Market/status/1715179900116808107

https://x.com/Sino_Market/status/1695727489669095806

2️⃣Securities Handling Fee cuts by three major exchanges.

2️⃣Securities Handling Fee cuts by three major exchanges.https://x.com/Sino_Market/status/1692464337443856490

https://x.com/Sino_Market/status/1712742251645059303

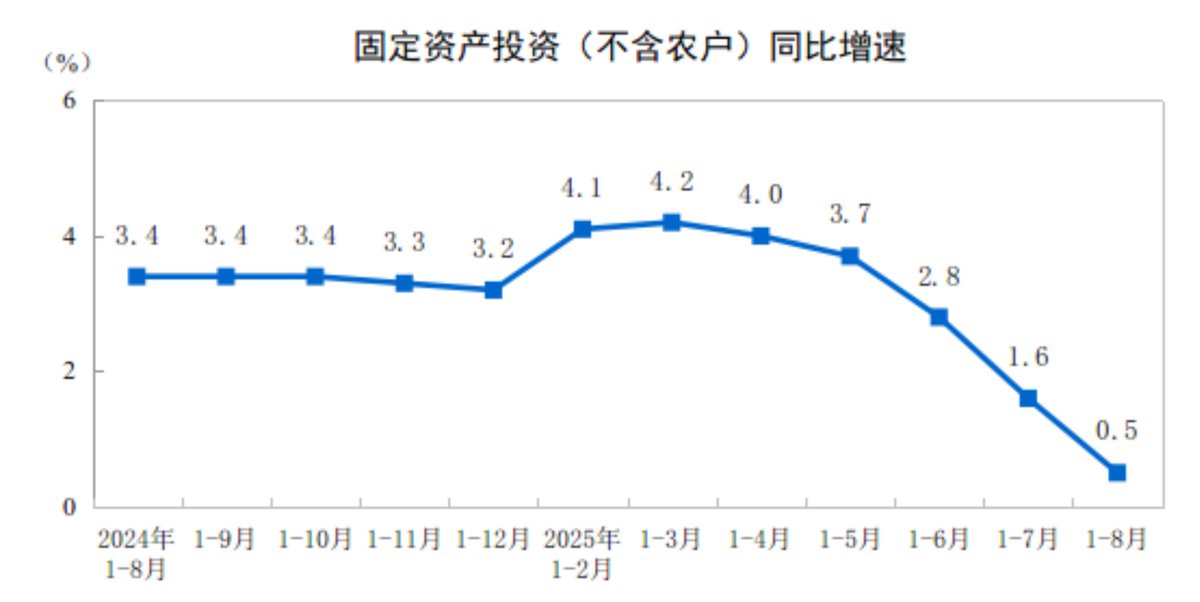

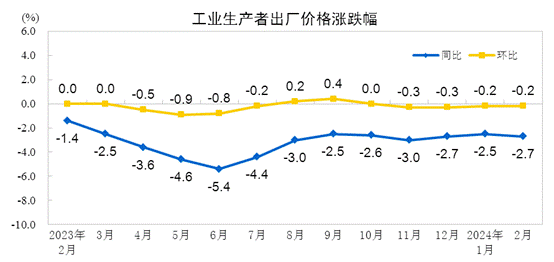

NBS:

NBS:

NBS:

NBS:

NBS: The PMI for China's manufacturing sector decreased by 2.7 PPs m/m, falling into the contraction zone after running above 50% for three consecutive months.

NBS: The PMI for China's manufacturing sector decreased by 2.7 PPs m/m, falling into the contraction zone after running above 50% for three consecutive months.