1/x

Megacable - #CotD 2:5

With 4.1 mm unique subs (incl 3.75 mm broadband), Megacable is Mexico's #2 cableco. It's an example of a non-US $BYTE Index holding in last-mile connectivity.

High-Single Digits % Sub Growth + A Few % Price = Secular Growth near 10% p.a.

🧵👇

Megacable - #CotD 2:5

With 4.1 mm unique subs (incl 3.75 mm broadband), Megacable is Mexico's #2 cableco. It's an example of a non-US $BYTE Index holding in last-mile connectivity.

High-Single Digits % Sub Growth + A Few % Price = Secular Growth near 10% p.a.

🧵👇

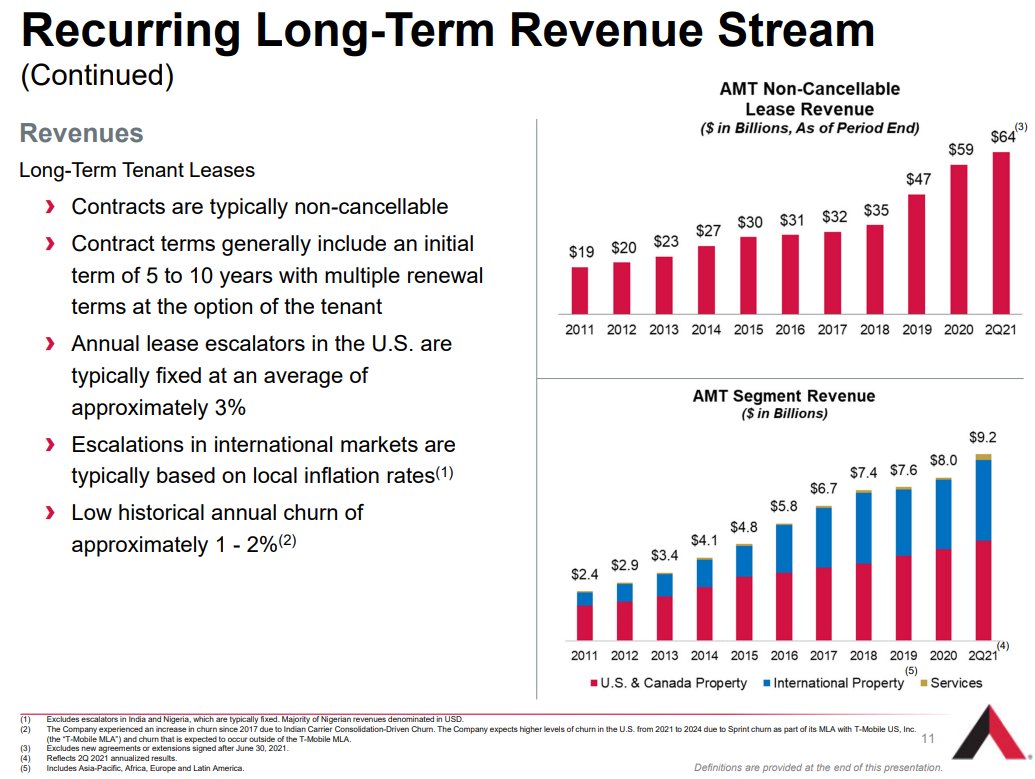

EBITDA margins for non-US cablecos are often higher than in the US, as the cost pressure of video is less acute.

OTOH, ongoing capital intensity also tends to be higher, esp. for EM-based cos actively doing new-builds.

Mega:

50% EBITDA Margins and 30%+ CapEx as % Revenue.

2/

OTOH, ongoing capital intensity also tends to be higher, esp. for EM-based cos actively doing new-builds.

Mega:

50% EBITDA Margins and 30%+ CapEx as % Revenue.

2/

Given "EM risk" & higher capital intensity, Mega trades at a large discount to US comps:

<4.5x 2021E EV/EBITDA.

US cablecos are 8-12x and often carry 4-5x in debt! Compare to Mega's Net Debt/EBITDA @ 0.6x.

When Mega slows its growth CapEx phase, might its FCF margin expand?

3/

<4.5x 2021E EV/EBITDA.

US cablecos are 8-12x and often carry 4-5x in debt! Compare to Mega's Net Debt/EBITDA @ 0.6x.

When Mega slows its growth CapEx phase, might its FCF margin expand?

3/

Even with large Growth CapEx (including fiber upgrades), Mega's EBITDA - CapEx - Interest - Taxes leaves ample Pre-Tax Equity FCF. It uses this to pay a meaningful & growing dividend: a 4.2% yield today.

In pesos, Mega's dividend has CAGR'd in the teens for the past 5 yrs.

4/

In pesos, Mega's dividend has CAGR'd in the teens for the past 5 yrs.

4/

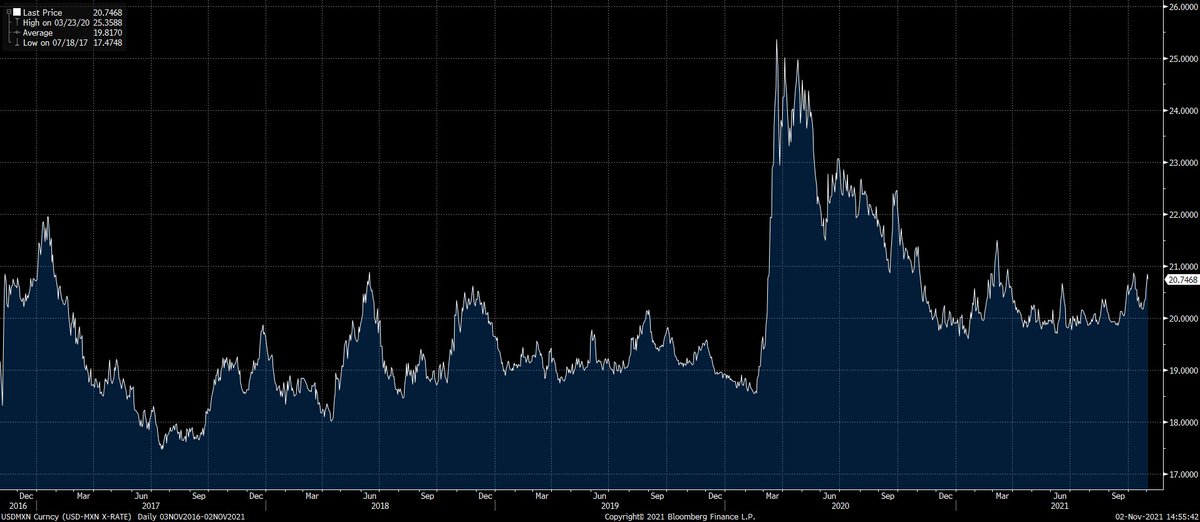

While the peso isn't a strong currency, it's been ok the past 5 yrs, leaking ~1.6% p.a. vs USD.

Mega has raised prices slightly in excess of its Fx headwind, w/ ARPU ranging from +2-5% over the same period.

In peso terms, Mega's had 15 yrs of uninterrupted top-line growth.

5/

Mega has raised prices slightly in excess of its Fx headwind, w/ ARPU ranging from +2-5% over the same period.

In peso terms, Mega's had 15 yrs of uninterrupted top-line growth.

5/

Mega has a two share class structure, through which the founding Bours family owns >60% of the co.

As the 2nd largest cableco in Mexico, Mega could likely find a suitor. But don't expect it: Mega remains in investment phase and doesn't appear to be positioning for a sale.

6/

As the 2nd largest cableco in Mexico, Mega could likely find a suitor. But don't expect it: Mega remains in investment phase and doesn't appear to be positioning for a sale.

6/

All investments have risks. Mega's include:

- Domicile

- Currency

- Insider control

- Huge ongoing investment cycle

Like many digital infra cos, Mega's shown strong predictability & resilience, allowing for inflation+ pricing, recurring revenue, growth, & strong margins.

7/

- Domicile

- Currency

- Insider control

- Huge ongoing investment cycle

Like many digital infra cos, Mega's shown strong predictability & resilience, allowing for inflation+ pricing, recurring revenue, growth, & strong margins.

7/

Note - I never intend Tweets as investment advice. This is meant as a basic, high-level overview of what Megacable does and how one might begin to look at the business.

-End-

Please Like, Follow, & RT if you find these useful.

2 down, 3 to go! 🤸♀️🤸♂️

-End-

Please Like, Follow, & RT if you find these useful.

2 down, 3 to go! 🤸♀️🤸♂️

https://twitter.com/compound248/status/1453731224267026439?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh