The FT paywall is down today! So here is some of the ace work of me and my colleagues for you to sample (and perhaps consider a full subscription). #FTfreetoday

In awe of a lot of the stuff produced by my colleagues over the past year, and I’m a bit worried about leaving some sterling stuff out. So here is a *very* brief, non-comprehensive list of articles I remember off the top of my head, a mix of my own work and others.

@rmilneNordic piece on the survivors and aftermath of Utøya - one of the worst mass murders in history - was haunting and touching. ft.com/content/be85f8…

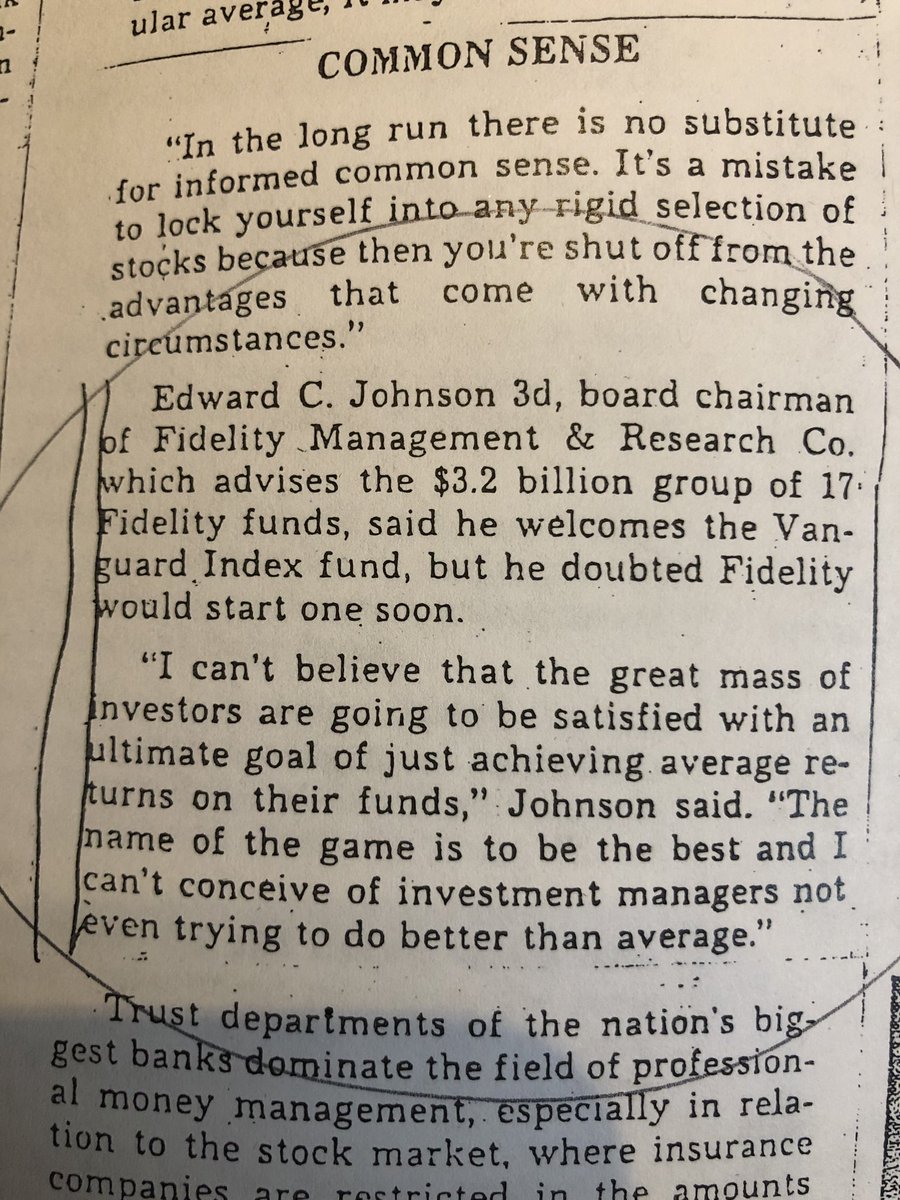

@rmilneNordic One of my best-read pieces of the past year is an adaptation from my recent book on the history of passive investing, which profiled BlackRock’s Larry Fink - the new undisputed King of Wall Street. ft.com/content/7dfd1e…

@rmilneNordic @KuperSimon's piece on Barcelona’s remarkable fall is just as riveting as one might expect. ft.com/content/c2c856…

Earlier this year, @SVR13 wrote a wonderful magazine feature exploring the parallels between cryptocurrency fandom and cultism, which I was privileged to help out on. ft.com/content/9e7876…

@SVR13 I loved this profile of Julian Robertson and his ‘Tiger cubs’ legacy by @journofletcher and @HarrietAgnew ft.com/content/e1d1c5…, but I have to admit that my favourite part of the accompanying news story was the very Wes Andersonian photo. ft.com/content/b2783e…

Probably my most-read piece of 2021 (still harvesting readers every week it seems) is this profile of Jane Street, the secretive but wildly profitable quasi-anarchist trading firm that put even Goldman Sachs and Citadel Securities to shame last year. ft.com/content/81811f…

The most mind-blowing stat of the year award goes to @patricianilsson for this nugget in a terrific investigation into the opaque online pornography empire MindGeek. ft.com/content/b50dc0…

Lastly, I loved writing this "salty" column on the parallels between the cryptocurrency phenomenon and Albania's epic 1990s pyramid scheme debacle. ft.com/content/810367…

• • •

Missing some Tweet in this thread? You can try to

force a refresh