A week of terrible political news for Democrats has also been a week of good news on the economy and Covid. But will the objectively good news move public sentiment? A few thoughts 1/

The employment report was almost all good news, confirming surveys suggesting that the third-quarter air pocket was behind us. Labor force participation still low, but overall recovery very much on track 2/

Aside from Delta receding, good news on the effectiveness of vaccine mandates. NYC at 91 percent compliance, not facing the crunch widely predicted 2/ nytimes.com/2021/11/01/nyr…

So when national mandates go into effect Jan. 4, they should work. And reduced Covid risk should ripple through the economy, helping demand shift to services and reducing pressure on supply chain 3/

But will the public notice? Two things give me pause. First, reality gets filtered through partisan lens. From Michigan Consumer Survey 4/

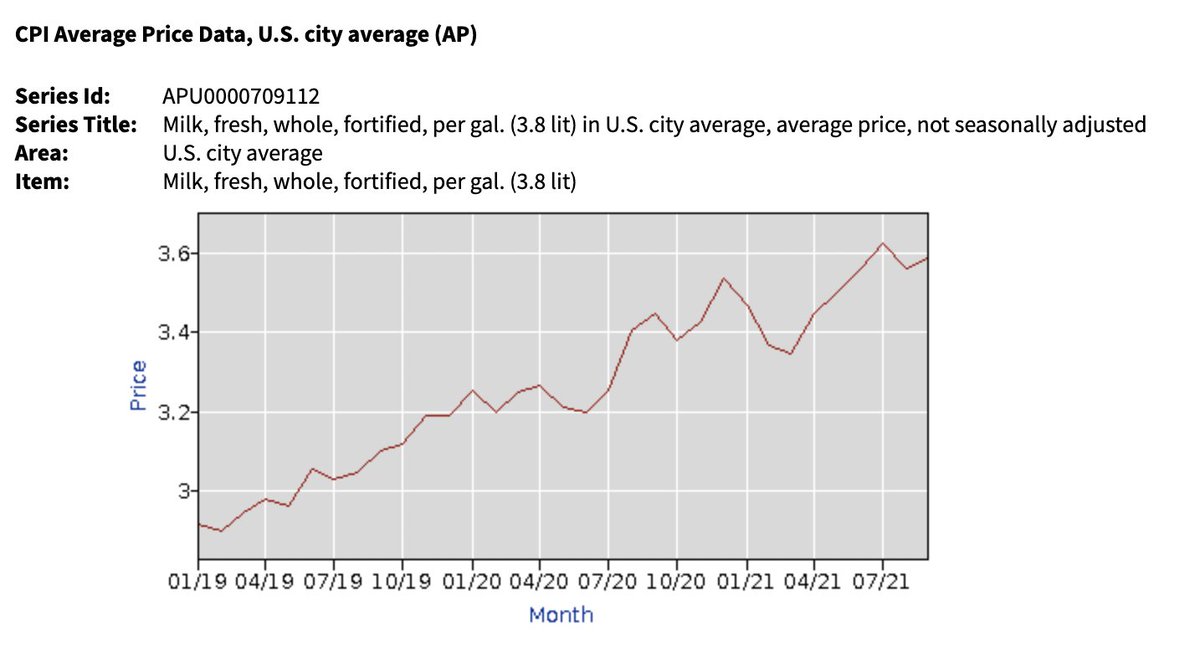

Second, media narrative: some news orgs seem to have decided that the economy is bad, and aren't checking basic facts 5/

So it's all too possible that good news won't penetrate. Even if people are doing well, they'll imagine that other people like them are hurting. Dems need to sell success hard; but it might not work 7/

• • •

Missing some Tweet in this thread? You can try to

force a refresh