Digital Bridge is finalizing a huge transformation from a stale legacy real estate biz to the best owner of digital infrastructure assets this side of $BYTE Index.

$DBRG = combo of Private Equity + Directly Held Digital Infra: data centers, fiber, towers, & more.

#CotD

🧵👇

1/

$DBRG = combo of Private Equity + Directly Held Digital Infra: data centers, fiber, towers, & more.

#CotD

🧵👇

1/

Led by Marc Ganzi and Ben Jenkins, $DBRG is poised to grow assets for years.

They built DBRG as an independent biz, then merged it into Colony Capital - taking over the combinedco. They sold all of CLNY's legacy real estate, positioning DBRG as THE pureplay dig infra holdco.

2/

They built DBRG as an independent biz, then merged it into Colony Capital - taking over the combinedco. They sold all of CLNY's legacy real estate, positioning DBRG as THE pureplay dig infra holdco.

2/

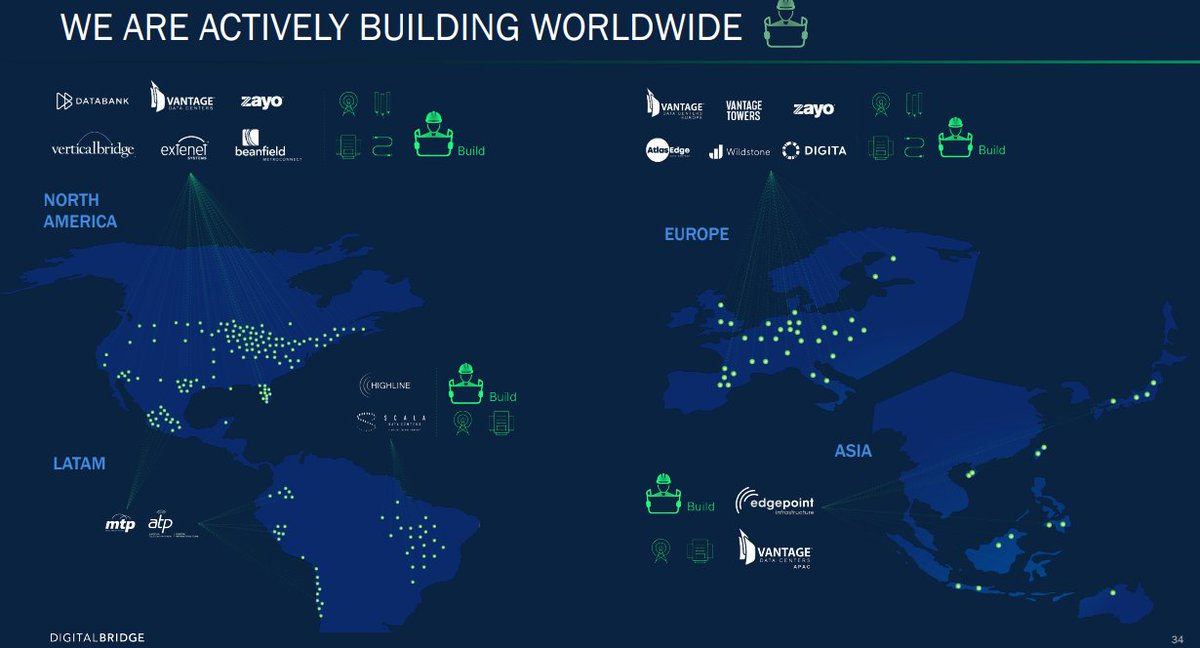

At its core, $DBRG is a Private Equity biz, raising large PE funds that target dig infra. Key holdings incl Zayo & Vantage Data Centers. It also uses co-invest funds and bal sheet capital for large takeouts. It is expanding into other alternative investments (eg, credit & HF).

3/

3/

This combination of raising PE-style GP funds ("Investment Management") + Balance Sheet investing ("Operating") differentiates Digital Bridge and gives it the ability to combine two incredible economic models together.

$DBRG is a leader in digital infra investing ( $BYTE 👀).

4/

$DBRG is a leader in digital infra investing ( $BYTE 👀).

4/

From a standing start 7 years ago, Marc & Ben built Digital Bridge into a collection of world-class digital infra assets: towers, wifi, fiber, data centers, edge infra & more.

Marc previously built, ran, & sold a leading towerco.

Ben was a Senior Partner at Blackstone ($BX).

5/

Marc previously built, ran, & sold a leading towerco.

Ben was a Senior Partner at Blackstone ($BX).

5/

Imagine what Digital Bridge might become in the next 10 yrs.

To serve the demand for reliable, fast, ubiquitous internet, huge investments in digital infra are required. $DBRG will play a key role - acquiring and building assets to meet this demand, raising more $$ to do it.

6/

To serve the demand for reliable, fast, ubiquitous internet, huge investments in digital infra are required. $DBRG will play a key role - acquiring and building assets to meet this demand, raising more $$ to do it.

6/

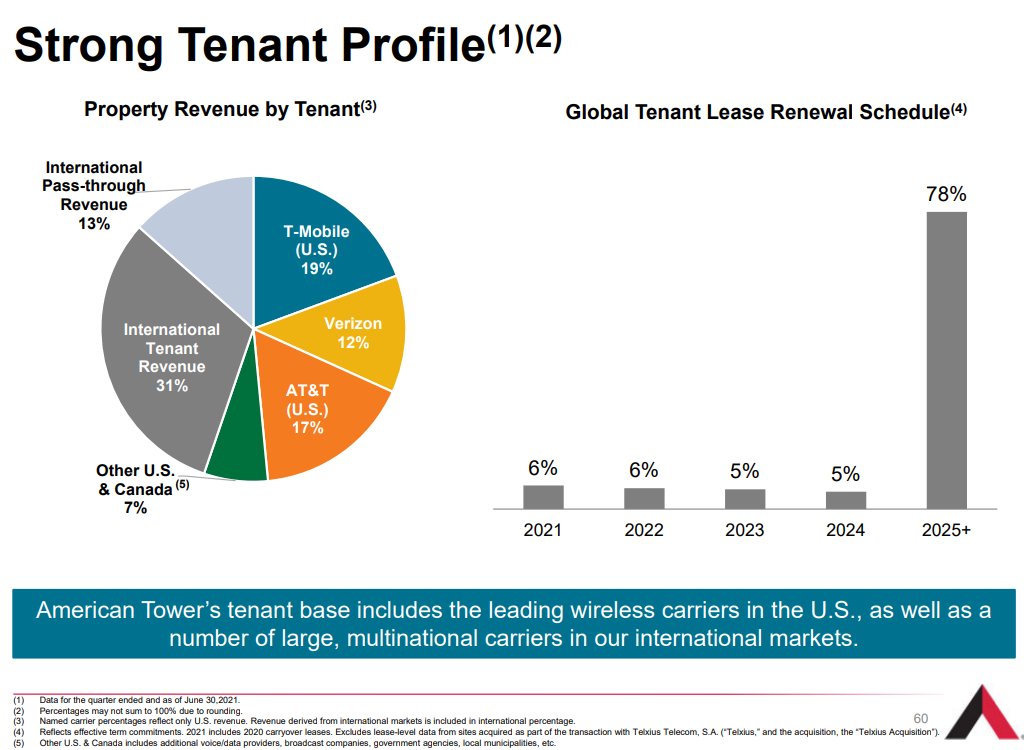

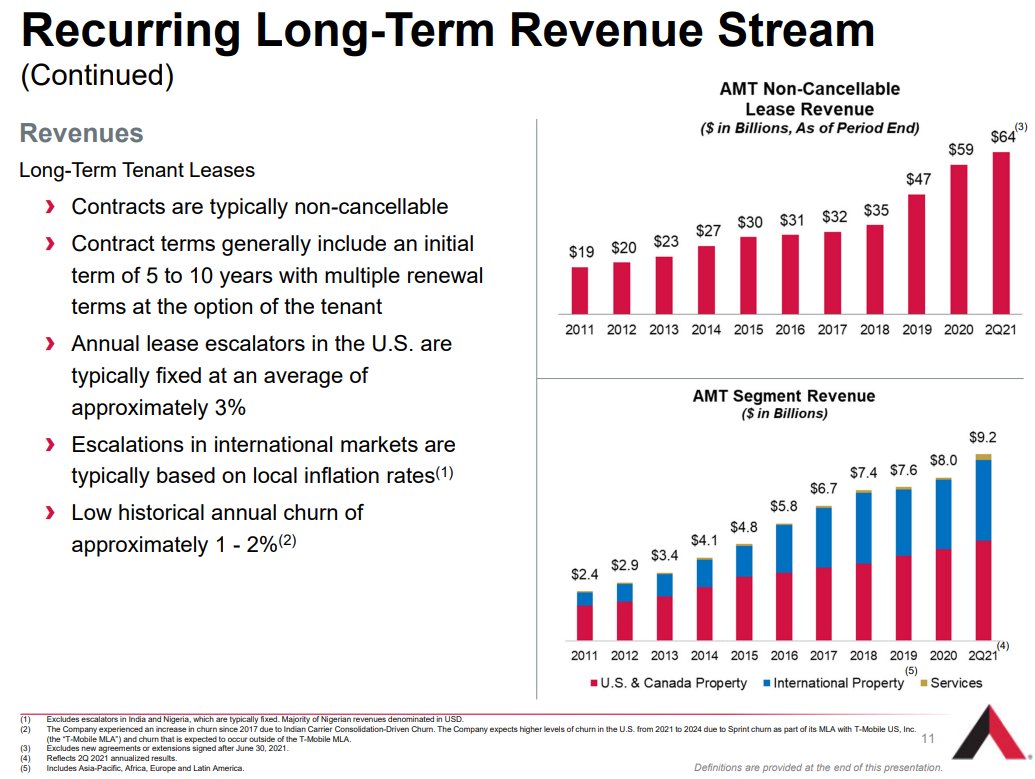

The value creation opp in Digital Infra is breathtaking. It's the 21st Century's Class-A real estate, fueled by growth from high-quality tenants.

As we digitize everything (including the actual world - Zuck?), our need for physical assets to handle that will grow as well.

7/

As we digitize everything (including the actual world - Zuck?), our need for physical assets to handle that will grow as well.

7/

All cos have plenty of risks, including $DBRG. examples include:

- Is it growing too fast?

- Hungry, aggressive management can cut both ways...

- It wants infra multiples on its Operating assets, but if it has to sell and reinvest, does it deserve them?

8/

- Is it growing too fast?

- Hungry, aggressive management can cut both ways...

- It wants infra multiples on its Operating assets, but if it has to sell and reinvest, does it deserve them?

8/

Note:

I never intend Tweets as investment advice. This is meant as a basic, high-level overview of what $DBRG does and how one might begin to look at the business.

-End-

Please Like, Follow, & RT if you find these useful - 4 down, 1 to go! 🤸♂️🤸♀️

I never intend Tweets as investment advice. This is meant as a basic, high-level overview of what $DBRG does and how one might begin to look at the business.

-End-

Please Like, Follow, & RT if you find these useful - 4 down, 1 to go! 🤸♂️🤸♀️

https://twitter.com/compound248/status/1453731224267026439

• • •

Missing some Tweet in this thread? You can try to

force a refresh