Throughout the 2010s, the Federal Reserve constantly tightened monetary policy prematurely—with disastrous results.

Today, the Federal Reserve is again tightening policy. Did they get it right this time, or are they repeating the same mistake? 🧵

apricitas.substack.com/p/the-federal-…

Today, the Federal Reserve is again tightening policy. Did they get it right this time, or are they repeating the same mistake? 🧵

apricitas.substack.com/p/the-federal-…

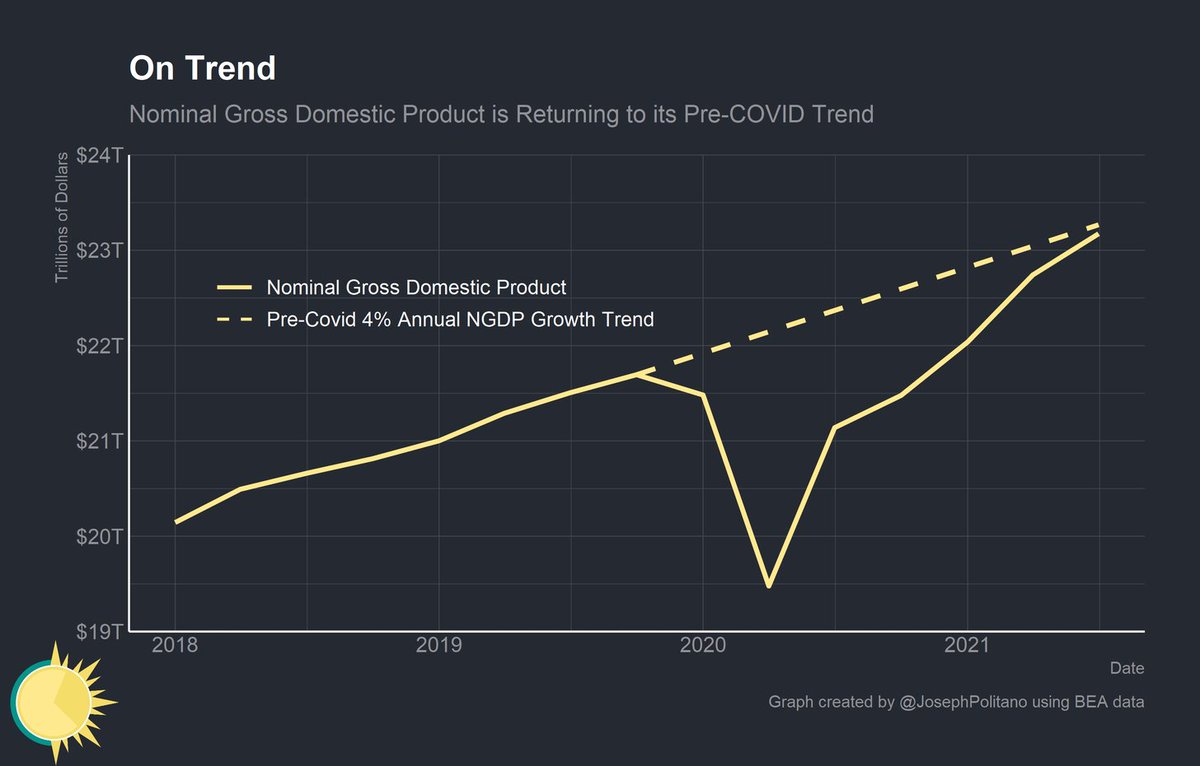

First, let's look at Nominal Gross Domestic Product (NGDP). NGDP growth was low throughout the 2010s and never returned to the pre-recession trend after 2008. Today, NGDP has practically returned to its pre-pandemic trend!

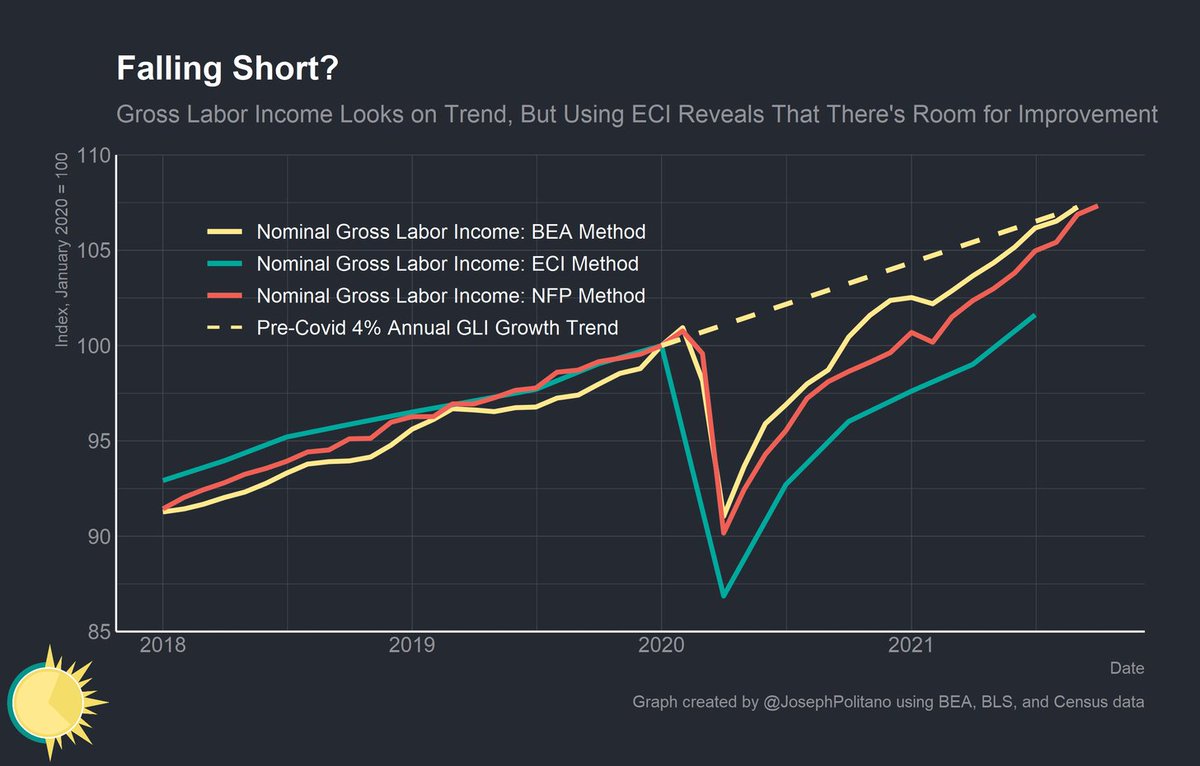

Gross Labor Income (GLI), which measures the total worker compensation, also appears to be on trend by traditional measures. However, using the enjoyment cost index, which allows us to better track GLI in real time, shows that there's still room for improvement.

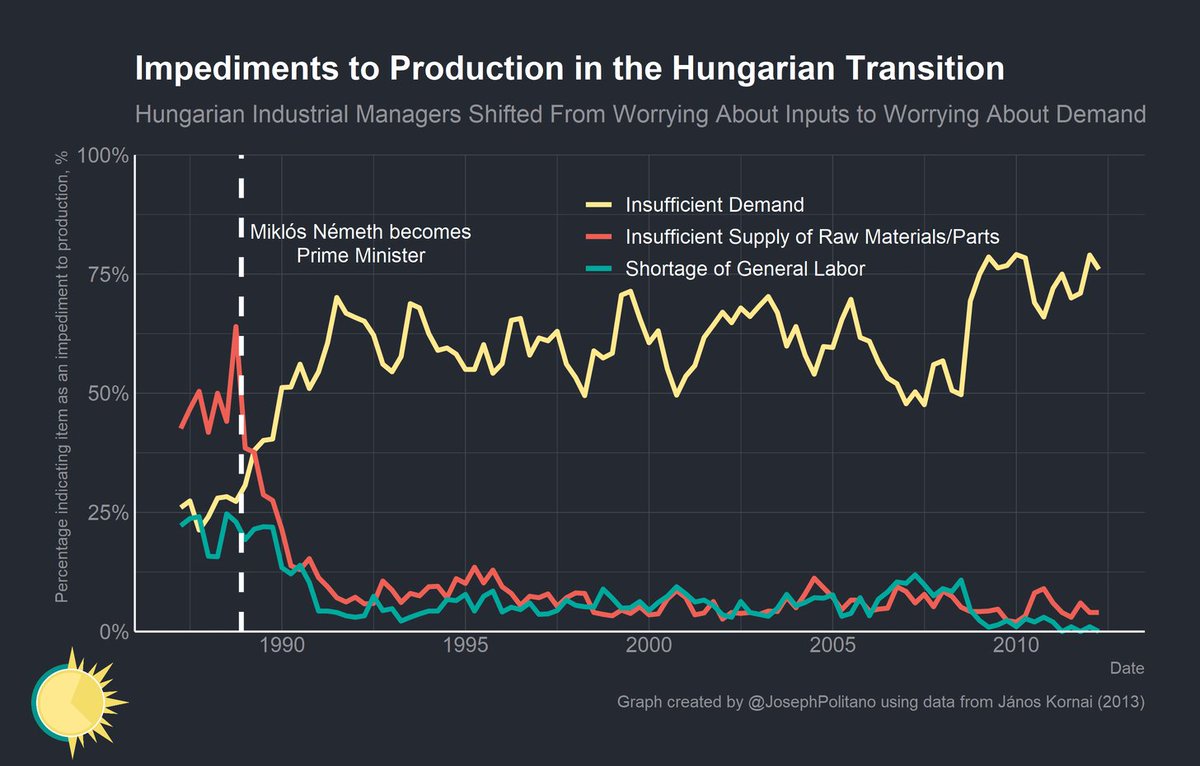

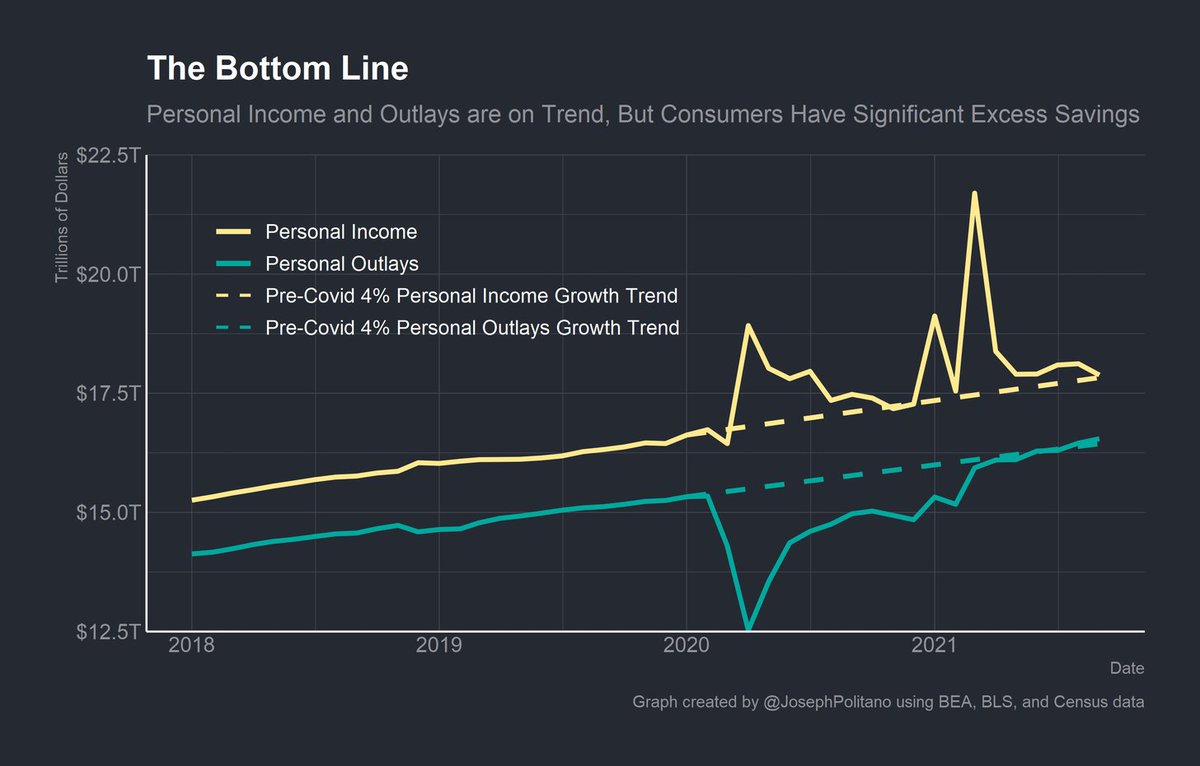

What explains the discrepancy between NGDP and GLI? In short, the pandemic broke the link between personal income and spending. Despite government transfers supporting personal income, the pandemic drove savings rates so high that aggregate spending has just now recovered.

Federal Reserve policy should normally bring NGDP above trend to compensate for periods spent below trend. However, the pandemic is a unique case. Personal income has already overshot expectations, it's only the pandemic that has held expenditures, and therefore NGDP, back.

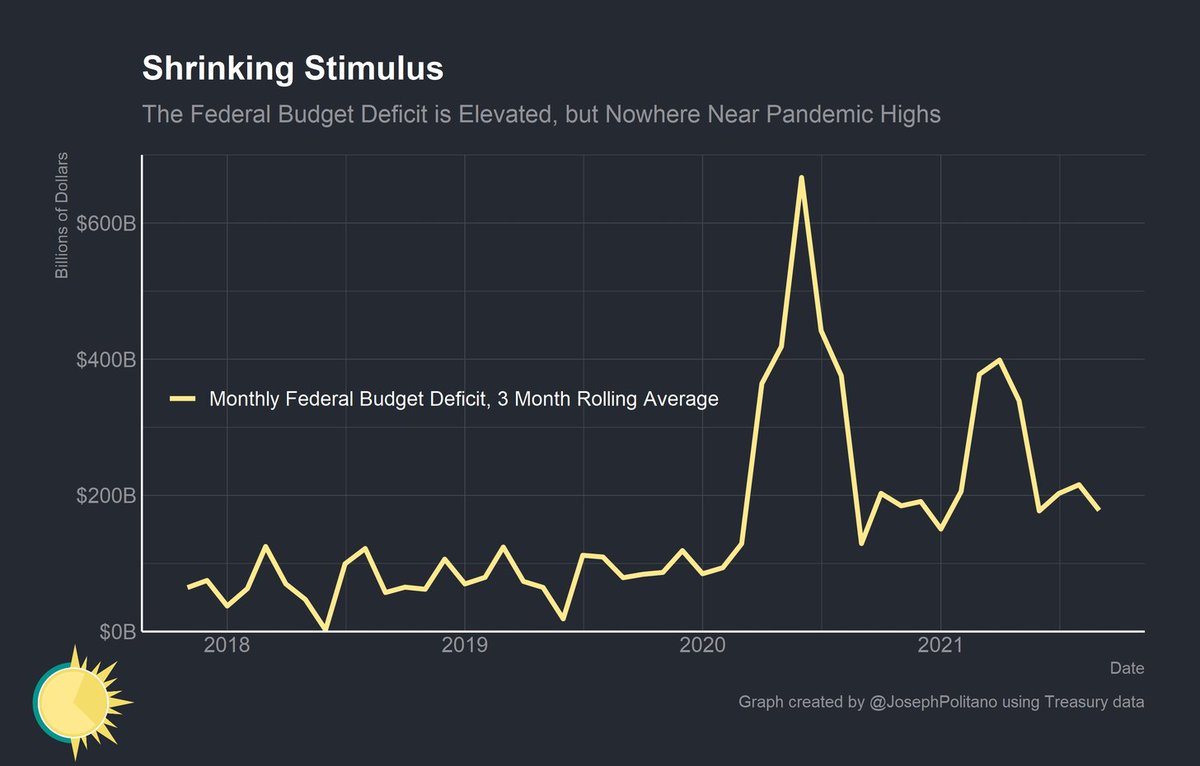

But the Federal Reserve must be forward looking! It should be setting policy based on expectations and future risks. And the primary risk to the future economy is too low nominal income and output. Fiscal stimulus is shrinking, so monetary policy must pick up the slack.

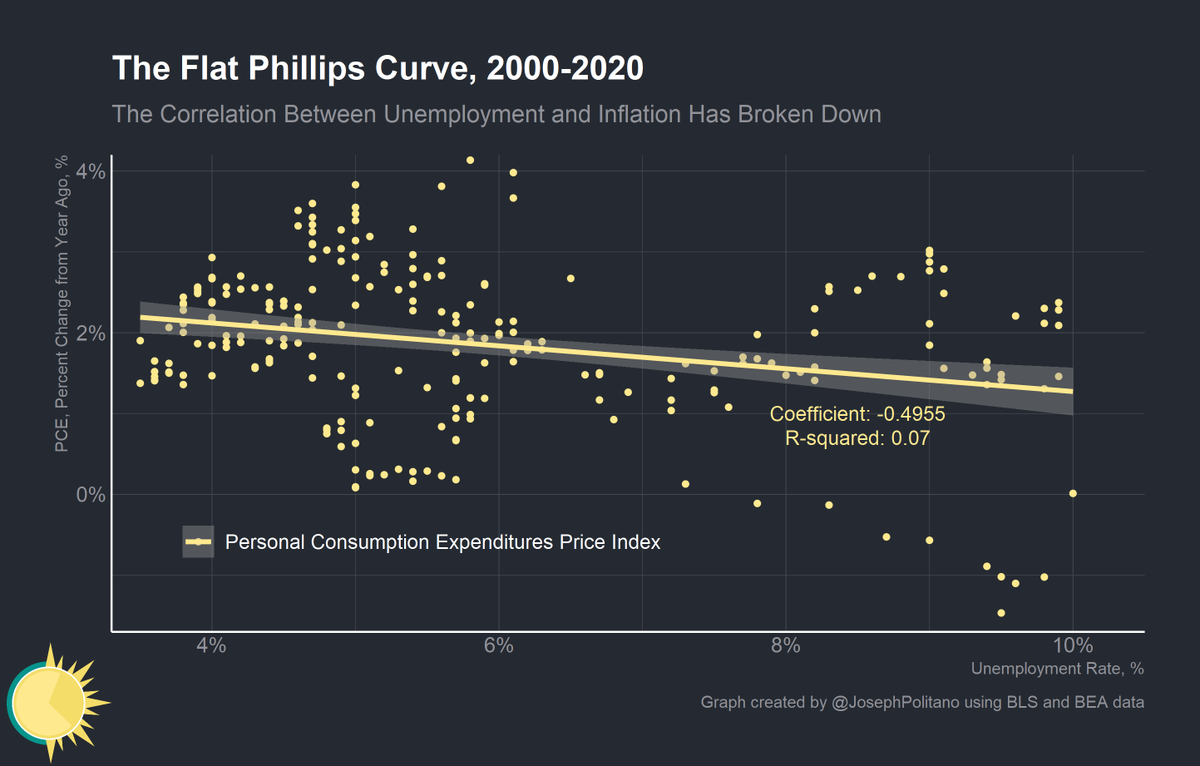

The primary risk of excess nominal incomes is inflation, but the risk of extended inflation is low. Some have warned of a wage-price spiral where rising wages force companies to raise prices. However, current wage increases are in services while price increases are in goods!

More than that, inflation cannot be sustained without long run excess growth in nominal income and NGDP, neither of which we are currently seeing. Current inflation is driven by temporary supply disruptions, most of which are in the goods sector.

apricitas.substack.com/p/yes-inflatio…

apricitas.substack.com/p/yes-inflatio…

So is the Federal Reserve right to taper? I say no—the risks to output are too high and the Fed should be focused on escaping 0% interest rates.

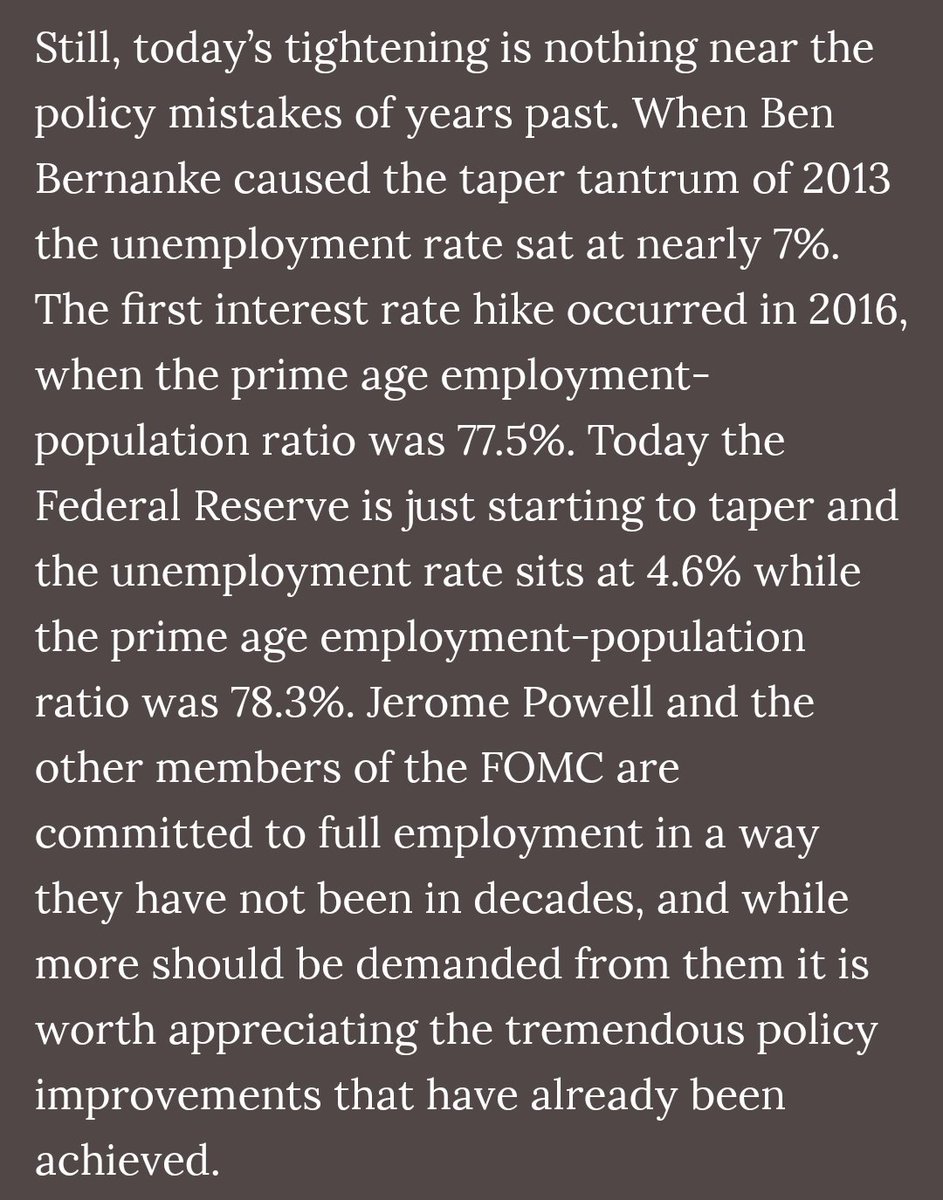

Still, this isn't the mistake of years past. The Fed is more committed to full employment than it has been for decades!

Still, this isn't the mistake of years past. The Fed is more committed to full employment than it has been for decades!

If you like what I do, consider subscribing! It's free, and helps me out a ton.

apricitas.substack.com

apricitas.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh